Navigating the world of graduate school funding can feel overwhelming, especially when faced with the complexities of student loans. Securing the best graduate student loan requires careful consideration of various factors, from interest rates and repayment plans to eligibility requirements and potential pitfalls. This guide provides a comprehensive overview, empowering you to make informed decisions and pave the way for a financially sound future.

Understanding the differences between federal and private loans is crucial. Federal loans often offer more favorable terms and protections, while private loans might be necessary to fill funding gaps. This guide will help you weigh the pros and cons of each, analyze your personal financial situation, and select the loan option best suited to your individual needs and circumstances.

Understanding Graduate Student Loan Options

Securing funding for graduate school often necessitates exploring various loan options. A thorough understanding of these options, particularly the differences between federal and private loans, is crucial for making informed financial decisions. Choosing the right loan can significantly impact your repayment burden and overall financial well-being after graduation.

Federal vs. Private Graduate Student Loans

Federal and private graduate student loans differ significantly in their terms, eligibility requirements, and overall benefits. Federal loans are offered by the U.S. government, while private loans are provided by banks, credit unions, and other financial institutions. Understanding these distinctions is paramount for selecting the most suitable financing for your graduate education.

Features of Federal Graduate Student Loans

Federal graduate student loans generally offer several advantages. These loans often come with fixed interest rates, meaning your monthly payments remain predictable throughout the repayment period. They also typically provide flexible repayment options, including income-driven repayment plans that adjust payments based on your income and family size. Eligibility is primarily based on your enrollment status and credit history is usually not a major factor for federal loans. However, borrowing limits exist, and the interest rates may be slightly higher than some private loan options.

Features of Private Graduate Student Loans

Private graduate student loans, while potentially offering lower interest rates than federal loans in some cases, often require a credit check and a co-signer if your credit history is insufficient. Interest rates can be variable, meaning your monthly payment amount could fluctuate over time. Repayment options might be less flexible compared to federal loans, and there may be prepayment penalties if you pay off the loan early. While private loans can offer higher borrowing limits, the lack of government protections can make them riskier.

Comparison of Federal and Private Graduate Student Loans

Federal graduate student loans provide greater borrower protections, including flexible repayment plans and income-driven repayment options, safeguarding against unexpected financial hardships. However, borrowing limits might restrict access to the full funding needed. Private loans can potentially offer lower interest rates and higher borrowing limits but often require better credit and may lack the same borrower protections. The best choice depends on individual financial circumstances and risk tolerance.

Comparison Table of Graduate Student Loan Options

| Lender | Interest Rate Type | Repayment Options | Eligibility Requirements |

|---|---|---|---|

| Federal Grad PLUS Loan | Fixed | Standard, Income-Driven | U.S. citizenship or eligible non-citizen, enrolled at least half-time |

| Federal Direct Unsubsidized Loan | Fixed | Standard, Income-Driven | U.S. citizenship or eligible non-citizen, enrolled at least half-time |

| Sallie Mae Graduate Loan | Fixed or Variable | Standard | Good credit history (or co-signer), enrollment verification |

| Discover Graduate Student Loan | Fixed or Variable | Standard | Good credit history (or co-signer), enrollment verification |

Factors Affecting Loan Eligibility and Interest Rates

Securing a graduate student loan involves a thorough assessment of your financial profile by lenders. Several key factors influence both your eligibility for a loan and the interest rate you’ll receive. Understanding these factors is crucial for navigating the loan application process successfully and obtaining the most favorable terms.

Credit Score’s Influence on Loan Approval and Interest Rates

Your credit score is a critical factor in determining loan eligibility and interest rates. Lenders use your credit score, a three-digit number representing your creditworthiness, to assess your risk as a borrower. A higher credit score generally indicates a lower risk of default, leading to better loan terms. A low credit score might result in loan denial or significantly higher interest rates, making the loan more expensive. For instance, a borrower with a credit score above 750 might qualify for a lower interest rate compared to a borrower with a score below 650. Lenders often use credit scoring models like FICO to evaluate creditworthiness.

Debt-to-Income Ratio’s Impact on Loan Approval

Your debt-to-income (DTI) ratio, calculated by dividing your total monthly debt payments by your gross monthly income, plays a significant role in loan approval. A high DTI ratio suggests you have a considerable amount of existing debt relative to your income, potentially making it harder to manage additional loan payments. Lenders prefer applicants with lower DTI ratios as it indicates a greater capacity to repay the loan. For example, a borrower with a DTI ratio of 30% might be considered a lower risk than a borrower with a DTI ratio of 50%.

Income Verification and its Role in Loan Eligibility

Lenders verify your income to ensure you have the financial capacity to repay the loan. They typically require documentation such as tax returns, pay stubs, or employment verification letters. Sufficient and stable income is essential for loan approval. The type of employment, length of employment, and income stability are all considered. A stable, consistent income stream significantly increases the likelihood of loan approval.

The Role of Co-signers in Securing Graduate Student Loans

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. Co-signers typically have strong credit histories and incomes, mitigating the risk for the lender. Using a co-signer can significantly improve your chances of loan approval, especially if you have limited credit history or a low credit score. However, it’s important to note that a co-signer assumes financial responsibility for the loan, so it’s a significant commitment.

Interest Rate Determination for Graduate Student Loans

Graduate student loan interest rates are determined by a combination of factors, including the lender’s cost of funds, the borrower’s creditworthiness, the loan term, and the prevailing market interest rates. The lender’s cost of funds reflects the interest rate the lender pays to borrow money. A borrower’s creditworthiness, as reflected in their credit score and DTI ratio, significantly influences the interest rate offered. Longer loan terms generally result in higher interest rates due to increased risk for the lender. Finally, prevailing market interest rates influence the overall interest rate environment. The final interest rate is a reflection of these combined factors, creating a unique rate for each borrower.

Managing Graduate Student Loan Debt

Successfully navigating graduate school often involves significant financial planning, particularly concerning student loan debt. Effective management strategies are crucial to minimizing long-term financial strain and ensuring a smooth transition into your professional career. This section Artikels practical approaches to budgeting, repayment planning, and exploring various repayment options available to graduate students.

Budgeting and Managing Student Loan Payments

Creating a comprehensive budget is the cornerstone of effective debt management. This involves carefully tracking income and expenses to understand your financial inflows and outflows. A realistic budget should account for all essential expenses, including tuition, housing, food, transportation, healthcare, and, critically, your student loan payments. Regularly reviewing and adjusting your budget allows for flexibility as your circumstances change throughout your graduate studies and beyond. Consider using budgeting apps or spreadsheets to simplify this process. For example, a student might allocate a specific percentage of their monthly income to loan repayment, ensuring consistency and preventing missed payments.

Creating a Realistic Repayment Plan

Developing a realistic repayment plan is paramount to avoiding financial hardship. This involves assessing your total loan debt, interest rates, and anticipated post-graduation income. A crucial step is to determine the minimum monthly payment required for each loan and then consider whether you can afford higher payments to reduce the principal balance faster and minimize long-term interest costs. Prioritizing high-interest loans for faster repayment can significantly reduce the overall interest paid over the life of the loans. For instance, a graduate student with several loans might prioritize paying off loans with the highest interest rates first, even if the minimum payment amounts are lower.

Graduate Student Loan Repayment Options

Several repayment options exist for graduate student loans, allowing borrowers to tailor their repayment schedules to their financial situations.

Standard Repayment: This involves fixed monthly payments over a set period, typically 10 years. While straightforward, it might lead to higher monthly payments compared to other options.

Extended Repayment: This plan extends the repayment period, resulting in lower monthly payments but potentially higher overall interest paid. It’s suitable for borrowers who need lower monthly payments initially.

Income-Driven Repayment (IDR): IDR plans link monthly payments to your income and family size. Payments are typically lower, and any remaining balance may be forgiven after a specific period (forgiveable amount may vary depending on the specific IDR plan and program). This option provides flexibility for those with lower post-graduation incomes. Examples of IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Sample Graduate Student Budget

This sample budget illustrates a potential financial plan for a graduate student. Note that these figures are illustrative and will vary significantly based on individual circumstances, location, and lifestyle choices.

| Income Source | Monthly Amount |

|---|---|

| Graduate Assistantship/Part-time Job | $2,500 |

| Expense Category | Monthly Amount |

| Rent | $1,200 |

| Groceries | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payments | $500 |

| Books/Supplies | $100 |

| Other Expenses (Entertainment, Personal Care) | $150 |

| Savings | $200 |

Remember: This is a sample budget. Your actual budget will need to be tailored to your specific income and expenses. It is crucial to regularly review and adjust your budget to ensure it aligns with your financial reality.

Exploring Loan Forgiveness and Repayment Assistance Programs

Navigating the complexities of graduate student loan repayment can feel daunting. Fortunately, several federal and, in some cases, state programs offer loan forgiveness or repayment assistance to alleviate this burden. Understanding these options is crucial for effective financial planning after graduation. These programs are designed to support individuals pursuing careers in public service, teaching, or other high-need fields.

Federal Loan Forgiveness and Repayment Programs

Several federal programs offer varying degrees of loan forgiveness or repayment assistance. Eligibility criteria differ based on the specific program and often involve factors such as the type of loan, employment sector, and income level. Careful consideration of each program’s requirements is essential before applying.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent payments. Limitations include strict adherence to repayment plan and employer requirements, and the potential for lengthy repayment periods before forgiveness.

- Teacher Loan Forgiveness: This program offers forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans or Federal Stafford Loans for teachers who have taught full-time for five complete and consecutive academic years in a low-income school or educational service agency. Eligibility hinges on meeting the teaching requirements and maintaining employment in a qualifying institution.

- Income-Driven Repayment (IDR) Plans: These plans, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE), calculate monthly payments based on income and family size. While these plans don’t offer loan forgiveness directly, they can significantly reduce monthly payments, making repayment more manageable and potentially leading to lower overall interest paid. Eligibility depends on loan type and income verification.

State-Specific Loan Repayment Assistance Programs

Beyond federal programs, many states offer their own loan repayment assistance programs, often targeting specific professions like healthcare or education. These programs typically have their own eligibility requirements, including residency restrictions and specific employment criteria. The benefits and limitations vary considerably from state to state. It is essential to research programs available in your specific state of residence.

Comparing Loan Repayment Assistance Options

The choice of loan repayment assistance program depends heavily on individual circumstances, including career goals, income level, and loan type. While some programs offer complete loan forgiveness, others provide more modest payment reductions. Factors such as the length of the program, the amount of forgiveness offered, and the stringent eligibility requirements must be carefully weighed against the potential long-term benefits. For example, PSLF offers complete forgiveness but requires ten years of qualifying employment, while IDR plans offer more immediate relief but may not result in complete loan forgiveness. It’s often beneficial to explore multiple options and seek professional financial advice to determine the best course of action.

Avoiding Predatory Lending Practices

Navigating the graduate student loan market requires vigilance, as predatory lenders exploit the financial vulnerability of students seeking higher education funding. Understanding how to identify and avoid these practices is crucial for securing responsible and affordable loans. This section will equip you with the knowledge to make informed decisions and protect yourself from potentially harmful loan agreements.

Predatory lending practices often target individuals with limited financial literacy or those facing urgent financial needs. These lenders use deceptive tactics to lure borrowers into high-interest, high-fee loans that can create a cycle of debt. Careful review of loan terms and conditions is paramount before signing any agreement, and recognizing red flags is a critical first step in avoiding these harmful practices.

Identifying Predatory Loan Characteristics

Several key characteristics signal a potentially predatory loan. These include excessively high interest rates significantly above market averages, hidden fees or charges not clearly disclosed upfront, and aggressive sales tactics that pressure borrowers into quick decisions without adequate time for review. Loans with balloon payments (a large final payment significantly exceeding other payments), prepayment penalties that discourage early repayment, and loans requiring co-signers despite the borrower’s demonstrable creditworthiness are also major red flags. For example, a loan with an interest rate exceeding 20% when comparable loans are available at 8-10% would be highly suspicious. Similarly, a lender requiring a co-signer for a loan despite the applicant possessing a stable income and good credit history should raise concerns.

Importance of Thoroughly Reviewing Loan Terms

Before signing any loan agreement, meticulously review every clause. Pay close attention to the Annual Percentage Rate (APR), which includes interest and fees, providing a complete picture of the loan’s true cost. Understand the repayment terms, including the loan’s duration, monthly payment amounts, and any potential penalties for late or missed payments. Clearly defined repayment options and a transparent fee schedule are essential indicators of a responsible lender. Failure to thoroughly understand the terms could lead to unexpected costs and financial difficulties down the line. For instance, a seemingly low monthly payment might hide a longer repayment period and ultimately lead to paying significantly more in interest over the life of the loan.

Checklist of Questions to Ask Before Applying

Preparing a checklist of questions is vital to ensuring a responsible borrowing process. This proactive approach empowers you to make informed decisions and avoid potential pitfalls.

Before applying for a graduate student loan, consider asking these questions:

- What is the APR, including all fees and charges?

- What is the total amount I will pay over the life of the loan?

- What are the repayment terms, including the length of the loan and monthly payment amounts?

- Are there any prepayment penalties?

- What are the consequences of late or missed payments?

- What are the lender’s customer service policies and complaint procedures?

- Is the lender licensed and reputable?

- Are all fees and charges clearly disclosed in writing?

- Does the loan require a co-signer, and if so, why?

- What are my options if I experience financial hardship during repayment?

The Impact of Graduate Student Loans on Long-Term Financial Planning

Graduate student loans can significantly impact your long-term financial well-being, extending far beyond the repayment period. Understanding these potential consequences is crucial for making informed decisions about your education and future financial stability. Failing to plan adequately can lead to significant financial strain for years to come, affecting major life goals and overall financial health.

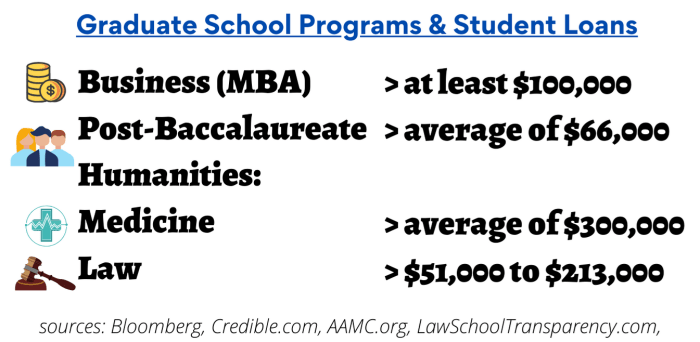

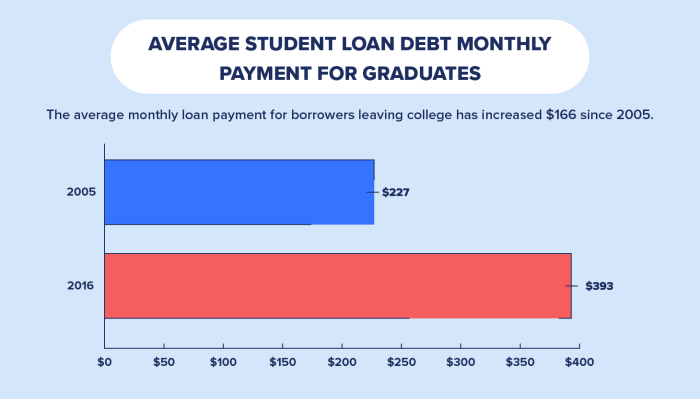

The weight of graduate student loan debt can cast a long shadow over future financial decisions. The monthly payments represent a consistent outflow of funds that can restrict your ability to save, invest, and achieve other financial objectives. This impact is amplified by the often substantial loan amounts taken on to finance graduate studies.

Effects on Major Life Decisions

The burden of student loan debt can significantly influence major life decisions, such as purchasing a home or starting a family. High monthly payments reduce disposable income, making it challenging to save for a down payment on a house or manage the increased expenses associated with raising a family. For example, a recent graduate with $100,000 in student loan debt at a 7% interest rate might face monthly payments exceeding $700, significantly impacting their ability to save for a down payment on a house or other large purchases. This financial constraint can lead to delayed homeownership or family planning, potentially altering life trajectories.

Strategies for Minimizing Long-Term Impact

Several strategies can mitigate the long-term effects of graduate student loan debt. Careful budgeting and financial planning are paramount. Creating a realistic budget that accounts for loan repayments and other essential expenses is crucial. Prioritizing high-interest debt repayment can reduce the overall interest paid over the loan’s lifetime, saving money in the long run. Exploring income-driven repayment plans can adjust monthly payments based on income, offering more manageable repayment schedules. Additionally, actively seeking employment opportunities aligned with your graduate degree can improve your earning potential, enabling faster debt repayment.

Importance of Financial Literacy and Responsible Borrowing

Financial literacy plays a crucial role in responsible borrowing and managing graduate student loan debt. Understanding interest rates, repayment options, and the long-term financial implications of borrowing is essential before taking on significant debt. Responsible borrowing involves only borrowing what is necessary, carefully comparing loan offers, and developing a realistic repayment plan. For instance, understanding the difference between subsidized and unsubsidized loans and the implications of various repayment plans can significantly impact long-term financial health. Graduate students should prioritize developing strong financial literacy skills before and during their studies to navigate the complexities of student loan debt effectively.

Last Recap

Securing the right graduate student loan is a significant step towards achieving your academic goals. By carefully evaluating your options, understanding the associated risks, and developing a robust repayment strategy, you can minimize the long-term financial burden and focus on your studies. Remember, responsible borrowing and financial literacy are key to a successful and stress-free graduate school experience.

FAQ Corner

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How can I improve my chances of loan approval?

Maintain a good credit score, demonstrate a stable income, and keep your debt-to-income ratio low. A co-signer with good credit can also significantly improve your chances.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially lowering your monthly payments but extending your repayment period.

What are some red flags to watch out for with predatory lenders?

Extremely high interest rates, hidden fees, aggressive sales tactics, and a lack of transparency in loan terms are all red flags.