Navigating the world of student loans can be daunting, especially for parents eager to support their children’s higher education. This guide offers a comprehensive overview of the best parent student loan options, exploring federal and private loans, eligibility requirements, repayment strategies, and alternative financing methods. We’ll delve into the intricacies of interest rates, fees, and repayment plans, empowering you to make informed decisions that align with your family’s financial goals.

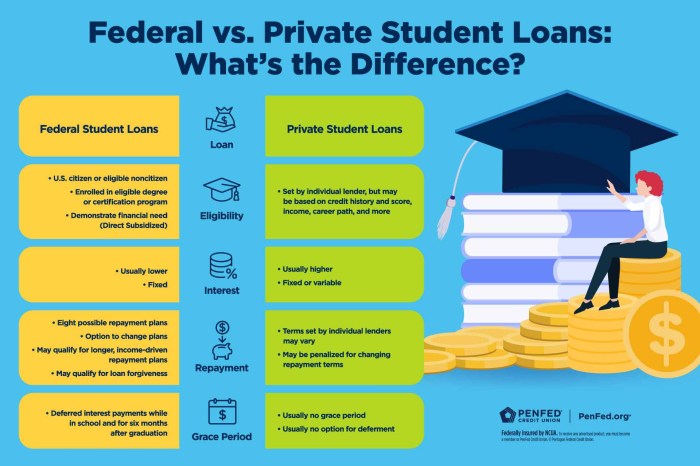

Understanding the differences between federal and private loans is crucial. Federal loans often offer more borrower protections, while private loans may have varying interest rates and eligibility criteria. This guide will help you weigh the pros and cons of each, considering factors like your credit score and financial stability. We’ll also explore alternative funding sources, such as 529 plans and scholarships, providing a holistic approach to financing your child’s education.

Understanding Parent Student Loan Options

Navigating the world of student loans can be daunting, especially for parents eager to support their children’s education. Choosing the right loan involves understanding the key differences between federal and private options, as well as the specific features of each loan type. This section will clarify the various options available to parents, enabling informed decision-making.

Federal vs. Private Parent Student Loans

Federal and private parent loans differ significantly in their terms and conditions. Federal parent loans, such as Parent PLUS loans, are offered by the government and generally offer more borrower protections and potentially more favorable repayment options. Private loans, on the other hand, are provided by banks and credit unions, and their terms are determined by the lender’s policies and the borrower’s creditworthiness. Interest rates on federal loans are typically fixed and are usually lower than those offered by private lenders. Federal loans also offer various repayment plans, including income-driven repayment, which can significantly impact monthly payments. Private loans may have variable interest rates, potentially leading to fluctuating monthly payments, and repayment options may be less flexible. Eligibility for federal loans is based on the student’s eligibility for federal student aid, while eligibility for private loans depends heavily on the parent’s credit history and income. A strong credit score is usually required to qualify for a private loan at a competitive interest rate.

Types of Federal Parent Loans

The primary federal parent loan is the Parent PLUS Loan. This loan allows parents to borrow up to the total cost of attendance, minus other financial aid received by the student. Creditworthiness is a key factor in eligibility for a Parent PLUS Loan; parents with adverse credit history may be denied. However, there may be options for obtaining a PLUS loan with an endorser or by demonstrating extenuating circumstances. Unlike some private loans, Parent PLUS loans typically come with fixed interest rates, offering predictability in monthly payments. Furthermore, federal loans offer various repayment options and borrower protections not always available with private loans. For example, deferment or forbearance may be available under certain circumstances, allowing for temporary suspension of payments.

Comparison of Parent Loan Providers

The interest rates, fees, and repayment options offered by various parent loan providers can differ significantly. It is crucial to compare offers from multiple lenders before making a decision. The following table compares four hypothetical providers, illustrating the potential variations:

| Loan Provider | Interest Rate (Example) | Origination Fee (Example) | Repayment Options (Example) |

|---|---|---|---|

| Provider A (Federal) | 6.00% fixed | 4.228% of loan amount | Standard, Extended, Income-Driven |

| Provider B (Private) | 7.50% variable | 1% of loan amount | Standard, 10-year fixed |

| Provider C (Private) | 8.25% fixed | 0% | Standard, 15-year fixed |

| Provider D (Private) | 6.75% fixed | 2% of loan amount | Standard, Graduated |

*Note: These are example rates and fees and may not reflect current market conditions. Always check with the individual lender for the most up-to-date information.*

Eligibility and Application Process

Securing parent student loans involves navigating specific eligibility criteria and a multi-step application process. Understanding these requirements is crucial for a smooth and successful application. Both federal and private loan options have unique processes and demands.

The eligibility and application process for parent student loans differs depending on whether you’re applying for a federal Parent PLUS loan or a private parent loan. Federal loans generally have more lenient requirements but also come with fixed interest rates and government-set terms. Private loans often have stricter eligibility criteria but may offer more flexible terms, potentially at a higher interest rate. It’s essential to compare both options carefully before making a decision.

Federal Parent PLUS Loan Eligibility and Application

To be eligible for a Parent PLUS loan, you must be the parent of a dependent student enrolled at least half-time in an eligible degree or certificate program at a participating school. You must also meet specific credit and financial requirements. The Department of Education will perform a credit check to assess your creditworthiness. While a negative credit history doesn’t automatically disqualify you, it might lead to increased interest rates or the requirement for a creditworthy co-signer. Income verification may be required, and this usually involves providing tax returns or other documentation to demonstrate your ability to repay the loan.

The application process begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers information about your financial situation and your student’s educational goals. Once the FAFSA is processed, you can apply for a Parent PLUS loan directly through the Federal Student Aid website. You will need your FAFSA Student Aid Report (SAR) and other identifying information. The application involves providing details about your income, credit history, and the amount you wish to borrow. The application will also require you to acknowledge and agree to the loan terms and conditions.

Private Parent Loan Eligibility and Application

Private parent loans are offered by various banks and financial institutions. Eligibility criteria vary significantly between lenders. Generally, private lenders require a good to excellent credit score, stable income, and a demonstrable ability to repay the loan. They will conduct a thorough credit check and review your income documentation, including tax returns, pay stubs, and bank statements. Some lenders may also require a co-signer, especially if your credit history is less than perfect or your income is insufficient.

The application process typically involves completing an online application through the lender’s website. You’ll need to provide personal and financial information, including your Social Security number, date of birth, employment history, and income details. Supporting documentation may include tax returns, pay stubs, bank statements, and proof of enrollment for your student. You’ll need to carefully review the loan terms and conditions, including interest rates, repayment schedules, and any associated fees, before accepting the loan. Lenders will then review your application and inform you of their decision. Approval may depend on a variety of factors, including your creditworthiness and the amount you are requesting.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for parent student loans is crucial for effective financial planning. Choosing the right loan and repayment plan can significantly impact the total cost and the monthly burden. This section will clarify the intricacies of these aspects.

Parent PLUS loans and private parent loans each have their own interest rate structures. Interest rates for federal Parent PLUS loans are fixed and determined by the U.S. Department of Education, typically based on the 10-year Treasury note index and adjusted periodically. Private parent loans, offered by banks and credit unions, have variable or fixed interest rates that depend on several factors, including the borrower’s credit score, loan amount, and the prevailing market interest rates. A higher credit score generally leads to a lower interest rate. It’s essential to compare rates from multiple lenders before committing to a private loan.

Parent Loan Interest Rate Determination

The interest rate on a federal Parent PLUS loan is set by the government and is fixed for the life of the loan. This means your monthly payments will remain consistent. In contrast, private parent loans often have variable interest rates, meaning the rate can fluctuate over time, potentially leading to changes in your monthly payment amount. Factors influencing private loan interest rates include the borrower’s creditworthiness (credit score, debt-to-income ratio, length of credit history), the loan amount, and prevailing market conditions. A borrower with excellent credit is more likely to secure a lower interest rate.

Repayment Plan Options

Several repayment plans are available for parent loans, allowing borrowers to tailor their payments to their financial circumstances. Understanding the differences between these plans is crucial for responsible debt management.

Standard Repayment

The standard repayment plan involves fixed monthly payments over a 10-year period. This is generally the shortest repayment term and results in the lowest total interest paid but may lead to higher monthly payments. This option is ideal for borrowers with a strong financial standing and the ability to handle higher monthly payments.

Extended Repayment

The extended repayment plan stretches payments over a longer period, typically 25 years. This results in lower monthly payments but leads to higher total interest paid over the life of the loan. This is a suitable option for borrowers with a tighter budget who prefer smaller monthly payments, even if it means paying more in interest over the long term.

Income-Driven Repayment (IDR) Plans

Income-driven repayment plans are generally not available for Parent PLUS loans, though some private lenders may offer similar options. These plans link monthly payments to the borrower’s income and family size. Payments are typically lower than under standard repayment plans, and any remaining loan balance may be forgiven after a specific period (e.g., 20 or 25 years). Eligibility criteria for IDR plans vary, and the forgiveness provision is subject to certain tax implications.

Example Monthly Payment Amounts

The following table illustrates estimated monthly payment amounts for various loan amounts and interest rates, assuming different repayment plans. These are illustrative examples only and actual payments may vary based on individual lender terms and conditions.

| Loan Amount | Interest Rate (Fixed) | Standard Repayment (10 years) | Extended Repayment (25 years) |

|---|---|---|---|

| $20,000 | 7% | $239 | $126 |

| $30,000 | 7% | $359 | $189 |

| $40,000 | 7% | $478 | $252 |

| $20,000 | 9% | $257 | $141 |

Managing and Reducing Loan Debt

Successfully navigating parent student loan debt requires a proactive and strategic approach. Effective management involves careful budgeting, prioritizing payments, and exploring options to reduce the overall cost of borrowing. Understanding your options and avoiding common pitfalls can significantly impact your long-term financial health.

Budgeting and Prioritizing Payments

Creating a realistic budget is crucial for managing parent student loan debt. This involves tracking all income and expenses to identify areas where spending can be reduced. Prioritizing loan payments, particularly those with higher interest rates, can help minimize the total interest paid over the life of the loan. Consider using budgeting apps or spreadsheets to track your finances and visualize your progress. For example, a family might allocate a specific portion of their monthly income towards loan repayment, perhaps using automatic payments to ensure consistency. This disciplined approach can accelerate debt reduction and prevent missed payments.

Refinancing Parent Student Loans

Refinancing involves replacing your existing parent student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce the total interest paid over the life of the loan and potentially shorten the repayment period. However, it’s important to carefully compare offers from multiple lenders to find the best terms and ensure the new loan aligns with your financial situation. For instance, a family with excellent credit might qualify for a significantly lower interest rate through refinancing, saving them thousands of dollars over the loan’s lifespan. Factors such as credit score, debt-to-income ratio, and loan amount all influence the eligibility and terms offered.

Avoiding Common Pitfalls

Late payments and default are serious consequences of poor loan management. Late payments negatively impact your credit score, potentially making it harder to secure future loans or even rent an apartment. Defaulting on a loan can result in wage garnishment, tax refund offset, and damage to your credit history. To avoid these issues, set up automatic payments, create reminders for due dates, and communicate with your lender immediately if you anticipate difficulty making a payment. Consider exploring options like deferment or forbearance if facing temporary financial hardship, as these can provide temporary relief without causing immediate default. Open communication with the lender is vital in preventing negative consequences.

Alternatives to Parent Loans

Securing funding for higher education doesn’t solely rely on parent loans. A range of alternative financing options exist, each with its own set of advantages and disadvantages. Carefully considering these alternatives can lead to a more financially sound approach to college funding. This section explores several key options and compares them to traditional parent loans.

Exploring alternative financing options can significantly impact the overall cost of higher education and reduce reliance on loans with potentially high interest rates. Understanding the nuances of each option empowers families to make informed decisions that best suit their individual circumstances.

529 Education Savings Plans

529 plans are tax-advantaged savings plans designed specifically for education expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free. These plans can be established by parents, grandparents, or other family members. Different states offer varying 529 plan options, each with its own investment choices and fee structures. While contributions aren’t tax-deductible at the federal level, some states offer state income tax deductions for contributions made to their own state’s 529 plan. The flexibility of investment options allows for tailoring the plan to the investor’s risk tolerance and time horizon. However, contributions are limited, and penalties may apply for withdrawals not used for qualified education expenses.

Scholarships and Grants

Scholarships and grants represent forms of financial aid that don’t require repayment. Scholarships are typically merit-based, awarded based on academic achievement, athletic ability, or other talents and characteristics. Grants are often need-based, awarded to students demonstrating financial need as determined by the Free Application for Federal Student Aid (FAFSA). A significant advantage is the absence of debt accumulation. However, securing scholarships and grants can be competitive, requiring diligent research and application efforts. The availability of funding also varies widely depending on the institution and specific criteria.

Federal Student Loans (Direct Loans)

While often associated with the student, parents can also borrow directly from the federal government through the Parent PLUS Loan program. These loans offer fixed interest rates and repayment options, and the interest may be tax-deductible. However, they typically carry higher interest rates than other loan options. The repayment schedule can stretch for several years, potentially impacting the parent’s long-term financial goals. Credit checks are conducted, and approval isn’t guaranteed.

Comparison of Financing Methods

The following table compares parent loans, 529 plans, scholarships/grants, and federal student loans (Direct Loans).

| Financing Method | Advantages | Disadvantages |

|---|---|---|

| Parent Loans | Relatively easy access to funds; fixed repayment terms. | High interest rates; adds to parental debt; impacts credit score. |

| 529 Plans | Tax-advantaged growth; flexible investment options; tax-free withdrawals for qualified expenses. | Limited contribution limits; penalties for non-qualified withdrawals. |

| Scholarships/Grants | No repayment required; can significantly reduce overall education costs. | Competitive application process; limited availability; requires extensive research. |

| Federal Student Loans (Direct Loans) | Fixed interest rates; flexible repayment options; interest may be tax-deductible. | Interest rates may be higher than other options; adds to student debt. |

The Impact of Parent Loans on Family Finances

Taking out parent loans to fund a child’s education can significantly impact a family’s financial well-being, both in the short-term and long-term. Careful consideration of the potential consequences is crucial before committing to this significant financial obligation. Understanding the full implications will help families make informed decisions and navigate the challenges effectively.

Parent loans, like any other debt, can affect a family’s financial stability and future opportunities. The monthly payments add to existing household expenses, potentially straining the budget and limiting spending on other necessities or desired items. Furthermore, the long-term implications, such as decreased borrowing capacity and potential impact on credit scores, need careful assessment. Effective budgeting and financial planning are essential to mitigate these potential negative effects.

Long-Term Financial Implications of Parent Loans

Parent loans can have a lasting impact on family finances. The most significant effect is often felt through the reduction in disposable income due to monthly loan repayments. This can limit the family’s ability to save for retirement, purchase a home, or fund other important financial goals. For example, a family might delay saving for their children’s future education or their own retirement due to the burden of student loan repayments. Furthermore, late or missed payments can negatively affect credit scores, potentially making it more difficult to secure loans or credit cards in the future with favorable interest rates. A lower credit score can also impact insurance premiums and even employment opportunities in some cases. The potential long-term cost of these impacts should be carefully weighed against the benefits of higher education.

Incorporating Parent Loan Payments into a Family Budget

Successfully integrating parent loan payments into a family budget requires careful planning and prioritization. The first step involves creating a detailed budget that Artikels all income and expenses. This allows families to identify areas where they can potentially reduce spending to accommodate the loan payments. This could involve cutting back on non-essential expenses, such as dining out or entertainment, or exploring ways to increase income through part-time work or freelance opportunities. Prioritizing loan payments and building an emergency fund are also crucial to avoid falling behind on payments and incurring additional fees. Budgeting apps and financial planning tools can assist in this process, providing a clear picture of the family’s financial situation and facilitating better financial decision-making.

Calculating the Total Cost of a Parent Loan

Accurately calculating the total cost of a parent loan is essential for understanding the true financial commitment. This calculation involves considering not only the principal loan amount but also the interest that will accrue over the loan’s life. The total cost can be significantly higher than the initial loan amount, especially with loans that have higher interest rates or longer repayment periods. For example, a $50,000 loan with a 7% interest rate over 10 years could result in a total repayment of significantly more than $50,000 due to accumulated interest and fees. Many online loan calculators are available to help families estimate the total cost, allowing them to make more informed borrowing decisions. It’s crucial to factor in all associated fees, such as origination fees or late payment penalties, when calculating the total cost. Understanding this total cost helps families make informed decisions about whether the benefits of the loan outweigh the financial burden.

Total Cost = Principal Loan Amount + (Principal Loan Amount * Interest Rate * Loan Term) + Fees

Illustrative Examples of Loan Scenarios

Understanding the potential impact of parent student loans requires examining both positive and negative scenarios. Careful planning can lead to manageable debt, while poor management can result in significant financial strain. The following examples illustrate these contrasting outcomes.

Successful Parent Loan Management

This scenario depicts a family meticulously planning for their child’s education. The parents, John and Mary, anticipate needing $40,000 in parent PLUS loans to cover their daughter Sarah’s four-year college education. Before applying, they carefully review their budget, cutting unnecessary expenses to ensure they can comfortably afford the monthly payments. They choose a 10-year repayment plan with a fixed interest rate of 7%. They also establish an emergency fund to cover unexpected expenses and maintain a healthy credit score. Over the 10 years, their total repayment, including interest, is approximately $51,000. While a significant expense, their proactive planning ensures they remain financially stable throughout the repayment period. Their consistent on-time payments contribute positively to their credit history.

Consequences of Poor Parent Loan Management

In contrast, consider the Smiths. They took out $60,000 in parent PLUS loans for their son, Michael’s, college education without adequately considering their repayment capacity. They made minimum payments for the first five years, resulting in significantly higher interest accumulation. Facing unexpected job losses and medical expenses, they fell behind on payments, leading to late fees and a damaged credit score. After five years, they owe over $75,000. They are now struggling to manage their debt, impacting their ability to save for retirement and other important financial goals. Their credit score significantly suffers, affecting their ability to secure future loans or even rent an apartment.

Comparison of Loan Repayment Costs

A bar graph would visually represent the total repayment costs of two loan scenarios. The first bar, representing the “Careful Planning” scenario, would show a total repayment cost of approximately $51,000 over 10 years. The second bar, representing the “Poor Management” scenario, would be significantly taller, illustrating a total repayment cost exceeding $75,000, reflecting the impact of accrued interest and late fees. The difference in height clearly demonstrates the financial advantage of careful planning and timely payments. The x-axis would label each bar with the corresponding scenario, while the y-axis would represent the total repayment amount in dollars. The difference in bar heights would visually emphasize the substantial financial implications of poor loan management.

Closing Summary

Securing the best parent student loan requires careful planning and a thorough understanding of the available options. By carefully comparing interest rates, repayment terms, and eligibility requirements, you can make an informed decision that minimizes long-term financial burdens. Remember to factor in alternative funding sources and create a comprehensive budget to manage loan repayments effectively. With diligent planning and a clear understanding of your financial landscape, you can support your child’s education while safeguarding your family’s financial future.

Common Queries

What is the difference between Parent PLUS loans and private parent loans?

Parent PLUS loans are federal loans with fixed interest rates and borrower protections. Private loans are offered by banks and credit unions, often with variable interest rates and potentially less favorable terms.

Can I refinance my parent student loan?

Yes, you may be able to refinance your parent student loan with a private lender to potentially lower your interest rate. However, this often requires a good credit score.

What happens if I default on a parent student loan?

Defaulting on a student loan can severely damage your credit score, leading to difficulty obtaining future loans and impacting your financial standing.

How do I choose the best repayment plan for my parent student loan?

Consider your budget and financial goals when choosing a repayment plan. Options include standard, extended, and income-driven repayment plans.