Navigating the complex world of student loans can feel overwhelming. Securing the best interest rate is crucial, impacting your overall repayment burden significantly. This guide provides a comprehensive overview of factors influencing student loan rates, helping you make informed decisions to minimize your long-term financial commitment. We’ll explore federal and private loan options, highlighting key differences and strategies to obtain the most favorable terms.

From understanding the impact of your credit score to comparing offers from various lenders, we’ll equip you with the knowledge and tools necessary to find the best rate for your specific circumstances. We’ll also delve into repayment strategies to ensure a smooth and efficient repayment process, minimizing financial stress throughout your journey.

Understanding Student Loan Rates

Securing a student loan involves understanding the interest rates, as these directly impact the total repayment amount. Interest rates are the cost of borrowing money, expressed as a percentage of the loan principal. Lower rates mean lower overall costs. This section will clarify the factors influencing these rates and the differences between various loan types.

Factors Influencing Student Loan Interest Rates

Several factors determine the interest rate you’ll receive on a student loan. Your creditworthiness is a primary driver; a strong credit history generally leads to lower rates. The loan type (federal or private) also plays a significant role, with federal loans typically offering more favorable terms. The length of the loan repayment term influences the interest rate; longer repayment periods might come with higher rates to compensate the lender for the extended risk. Finally, prevailing market interest rates have a considerable impact; when overall interest rates are high, student loan rates tend to follow suit. These factors interact to determine your individual rate.

Fixed Versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. This predictability makes budgeting easier. In contrast, a variable interest rate fluctuates based on an index rate, such as the prime rate or LIBOR. While a variable rate might start lower than a fixed rate, it can increase over time, leading to higher payments and potentially a larger total repayment amount. The choice depends on individual risk tolerance and financial outlook. A borrower expecting interest rates to remain stable or decline might favor a variable rate, while someone preferring predictability might opt for a fixed rate.

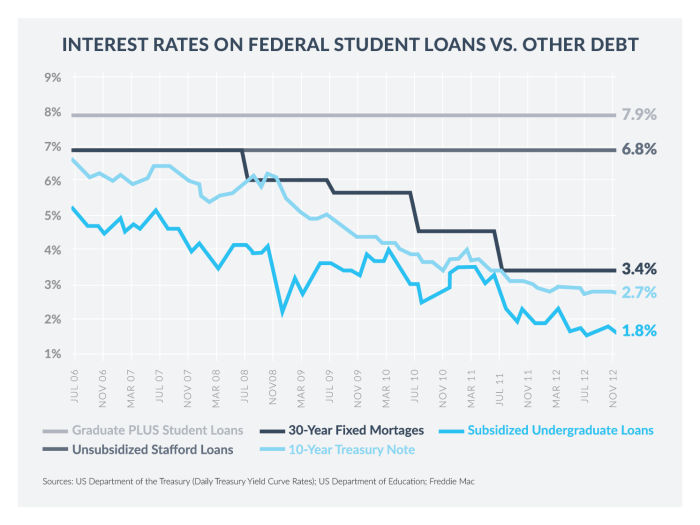

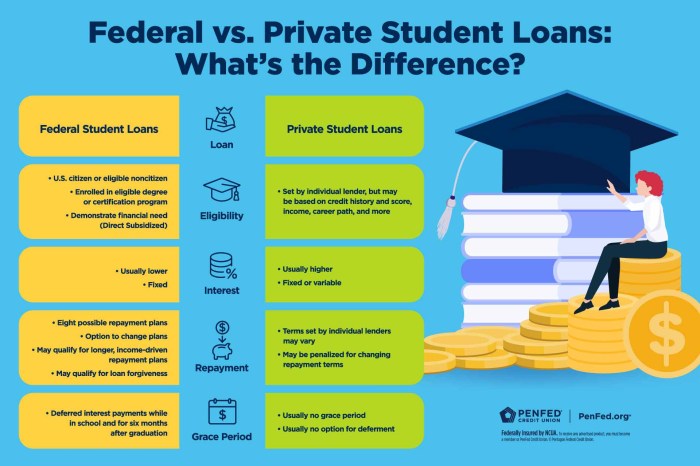

Federal Versus Private Student Loan Interest Rates

Federal student loans generally offer lower interest rates than private loans. This is because the federal government subsidizes these loans and has a lower risk profile. Federal loans also offer various repayment plans and income-driven repayment options, providing more flexibility to borrowers. Private loans, on the other hand, are offered by banks and credit unions, and their rates are influenced by creditworthiness and market conditions. Borrowers with excellent credit might secure competitive rates from private lenders, but those with poor credit may face significantly higher interest rates and less favorable terms. It’s crucial to compare offers from both federal and private lenders before making a decision.

Comparison of Student Loan Interest Rate Types

| Loan Type | Interest Rate Type | Rate Range (Example) | Key Features |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 2-7% | Government-backed, lower rates, potential for subsidized interest during studies |

| Federal Unsubsidized Loan | Fixed | 2-7% | Government-backed, lower rates, interest accrues during studies |

| Private Loan | Fixed or Variable | 3-15% | Higher rates possible, dependent on creditworthiness, less government protection |

| Federal PLUS Loan | Fixed | 7-10% | Loans for parents or graduate students, higher rates than unsubsidized loans |

Finding the Best Rate

Securing the lowest possible interest rate on your student loans can significantly reduce the overall cost of your education. A lower interest rate translates to lower monthly payments and less interest paid over the life of the loan. Understanding the factors that influence your rate and employing effective strategies is crucial to achieving this goal.

The process of finding the best student loan rate involves careful consideration of several key factors and a proactive approach to securing the most favorable terms. This includes understanding your creditworthiness, shopping around for the best offers, and being aware of potential pitfalls that could negatively impact your rate.

Credit Score and Credit History’s Influence on Interest Rates

A strong credit score and a positive credit history are paramount in obtaining favorable student loan interest rates. Lenders use your creditworthiness as a primary indicator of your ability to repay the loan. A higher credit score typically qualifies you for lower interest rates, reflecting a reduced perceived risk for the lender. Conversely, a poor credit history or a low credit score may result in higher interest rates or even loan denial. Building and maintaining a good credit score through responsible credit management—paying bills on time, keeping credit utilization low, and avoiding excessive debt—is a crucial step in securing the best loan terms. For example, a borrower with a credit score of 750 might qualify for a rate of 4%, while a borrower with a score of 600 might face a rate closer to 7%, resulting in thousands of dollars in additional interest paid over the loan’s lifetime.

Avoiding Pitfalls in Student Loan Selection

Several potential pitfalls can hinder your efforts to secure the best student loan rates. Failing to shop around and compare offers from multiple lenders is a common mistake. Relying solely on the first offer received can lead to missing out on potentially more favorable terms. Another pitfall is neglecting to understand the loan terms and conditions thoroughly, including fees, repayment options, and potential penalties for late payments. Finally, taking out more loans than necessary can increase your overall debt burden and negatively impact your credit score.

Comparing Student Loan Offers

A systematic approach to comparing student loan offers is essential to securing the best rate. Follow these steps:

- Gather Multiple Offers: Contact several lenders, including federal and private lenders, to obtain multiple loan offers.

- Compare Interest Rates: Carefully compare the interest rates offered by each lender. Pay attention to both the fixed and variable interest rates, considering the long-term implications of each.

- Analyze Fees: Examine any associated fees, such as origination fees, late payment fees, and prepayment penalties. These fees can significantly impact the overall cost of the loan.

- Review Repayment Terms: Compare the repayment terms, including loan duration, monthly payment amounts, and repayment options (e.g., standard, graduated, income-driven).

- Assess Loan Features: Consider any additional features or benefits offered by the lenders, such as deferment options, forbearance periods, or co-signer release provisions.

- Make an Informed Decision: Based on your comprehensive comparison, choose the loan offer that best aligns with your financial situation and long-term goals.

Federal Student Loan Programs

Navigating the world of federal student loans can seem daunting, but understanding the different programs available is key to securing the best financial aid for your education. Federal student loans offer several advantages over private loans, including potentially lower interest rates and flexible repayment options. This section will Artikel the key features of the major federal student loan programs.

Federal student loan programs are designed to help students finance their education. These loans are offered by the U.S. Department of Education and have various eligibility requirements and interest rate structures. Choosing the right loan depends on your individual financial circumstances and educational goals.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized and unsubsidized Stafford Loans are the most common type of federal student loan. The key difference lies in whether the government pays the interest while you’re in school, during grace periods, or during periods of deferment. Subsidized loans are need-based, meaning your financial need is assessed to determine eligibility. Unsubsidized loans are not need-based; eligibility is based on enrollment status and credit history.

Subsidized Stafford Loans: The government pays the interest on these loans while you’re enrolled at least half-time, during grace periods, and during certain deferment periods. This means your loan balance doesn’t grow during these times. Eligibility is determined by demonstrating financial need through the FAFSA (Free Application for Federal Student Aid).

Unsubsidized Stafford Loans: Interest accrues on these loans from the time the loan is disbursed, regardless of your enrollment status or deferment. You are responsible for paying this interest. Eligibility is primarily based on enrollment status and creditworthiness, although a FAFSA application is still required to determine eligibility for federal student aid in general.

Example: A student receiving a subsidized Stafford loan might find their loan balance unchanged during their summer break, while a student with an unsubsidized loan will see their balance increase due to accrued interest during that same period.

Federal PLUS Loans

Federal PLUS Loans (Parent Loans for Undergraduate Students or Graduate PLUS Loans) are designed to help parents of dependent undergraduate students or graduate students finance their education. These loans are credit-based, meaning the applicant (parent or graduate student) must pass a credit check. Interest rates are typically higher than Stafford loans.

Eligibility: To qualify for a Parent PLUS loan, the parent must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have adverse credit history (although there may be options for borrowers with adverse credit history). Graduate students applying for Graduate PLUS loans must meet similar requirements.

Interest Rates and Repayment: PLUS loan interest rates are fixed, but they tend to be higher than Stafford loan interest rates. Repayment typically begins within 60 days of the final loan disbursement.

Example: A parent might use a Parent PLUS loan to cover the remaining cost of their child’s tuition after exhausting other financial aid options. A graduate student might use a Graduate PLUS loan to cover tuition and living expenses during their graduate studies.

Applying for Federal Student Loans

The application process for federal student loans begins with completing the FAFSA. This application collects information about your financial situation and is used to determine your eligibility for federal student aid, including loans, grants, and work-study programs.

FAFSA Completion: The FAFSA is submitted online and requires information about your income, assets, and family size. Accurate and complete information is crucial for receiving the correct amount of aid. After submission, your FAFSA data is sent to your chosen schools and the Department of Education.

Loan Award Notification: Once your FAFSA is processed, your school’s financial aid office will notify you of your loan eligibility and award amount. You will then need to accept your loan offer and complete a master promissory note (MPN), which is a legally binding agreement outlining the terms of your loan.

Loan Disbursement: Loans are typically disbursed directly to your school to cover tuition and fees. Any remaining funds may be disbursed to you.

Private Student Loans

Private student loans offer an alternative funding source for higher education, supplementing or replacing federal loan options. They are provided by private lenders, such as banks and credit unions, and are subject to varying terms and conditions depending on the lender and the borrower’s creditworthiness. Understanding these differences is crucial for securing the most favorable loan terms.

Private student loans are subject to market interest rates, which fluctuate based on economic conditions. Unlike federal loans, they generally don’t offer income-driven repayment plans or loan forgiveness programs. Careful consideration of the potential advantages and disadvantages is therefore essential before committing to a private loan.

Private Student Loan Terms and Conditions

Private student loan terms and conditions vary significantly across lenders. Interest rates, repayment periods, and fees can differ substantially. Some lenders may offer fixed interest rates, providing predictable monthly payments, while others might offer variable rates, which can change over the life of the loan. Repayment periods typically range from 5 to 20 years, impacting the monthly payment amount. Origination fees, late payment fees, and prepayment penalties are common, adding to the overall cost of the loan. A thorough comparison of offers from multiple lenders is essential to identify the most advantageous terms. For example, Lender A might offer a lower interest rate but a higher origination fee, while Lender B might have a slightly higher rate but no origination fee. Careful calculation of the total cost is necessary to determine which option is truly more cost-effective.

Obtaining a Private Student Loan

Securing a private student loan typically involves completing an application, providing necessary documentation, and undergoing a credit check. Applications usually require personal information, educational details, and financial information, including income and credit history. Supporting documentation may include tax returns, bank statements, and proof of enrollment. The lender will assess the applicant’s creditworthiness and determine the eligibility for a loan and the associated interest rate and terms. A co-signer, typically a parent or other financially responsible individual with good credit, might be required if the applicant lacks a strong credit history. The approval process can vary in length, depending on the lender and the complexity of the application.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer higher loan amounts than federal loans, potentially covering the full cost of education. However, they lack the borrower protections and flexible repayment options often available with federal loans. For example, federal loans may offer income-driven repayment plans, deferment, and forbearance options during periods of financial hardship, while private loans generally do not. Furthermore, federal loans may offer loan forgiveness programs under certain circumstances, which are not usually available with private loans. The interest rates on private student loans are typically higher than those on federal subsidized loans, leading to a greater overall cost over the life of the loan.

Questions to Ask Private Lenders

Before accepting a private student loan offer, it is crucial to ask several key questions to ensure a full understanding of the terms and conditions. This proactive approach helps borrowers make informed decisions and avoid potential pitfalls.

- What is the annual percentage rate (APR) and is it fixed or variable?

- What are the origination fees, late payment fees, and prepayment penalties?

- What is the repayment term, and what will my estimated monthly payment be?

- What are the requirements for deferment or forbearance?

- What happens if I am unable to make my payments?

- Does the lender offer any repayment assistance programs?

- What is the lender’s complaint resolution process?

- What is the lender’s customer service record and reputation?

Repayment Options and Strategies

Choosing the right student loan repayment plan is crucial for minimizing your overall cost and managing your debt effectively. The plan you select significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of your loans. Understanding the various options and developing a sound repayment strategy are key to successful debt management.

Standard Repayment Plan

This is the most common repayment plan, requiring fixed monthly payments over a 10-year period. While it leads to the quickest payoff, resulting in less interest paid overall, the monthly payments can be substantial, potentially straining your budget early in your career. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $320 and total interest paid around $7,000.

Extended Repayment Plan

This plan stretches payments over a longer period, typically 25 years, resulting in lower monthly payments. However, significantly more interest will accrue over the extended repayment period. Using the same $30,000 loan example, the monthly payment would decrease but total interest paid could exceed $18,000.

Graduated Repayment Plan

With this option, monthly payments start low and gradually increase over time, often appealing to recent graduates anticipating higher income in the future. While the initial payments are manageable, they become progressively larger, potentially causing financial stress later on. The total interest paid will generally fall between that of the standard and extended plans.

Income-Driven Repayment Plans

Income-Driven Repayment Plan Benefits and Drawbacks

Income-driven repayment plans (IDR) base your monthly payments on your income and family size. They offer lower monthly payments than standard plans, making them more manageable for borrowers with lower incomes or unexpected financial challenges. However, IDR plans typically extend the repayment period to 20 or 25 years, leading to higher total interest payments compared to standard repayment. Furthermore, any remaining loan balance after the repayment period may be forgiven, but this forgiven amount is considered taxable income.

Effective Strategies for Student Loan Repayment

Creating a budget that prioritizes loan repayment is paramount. This involves tracking income and expenses, identifying areas for savings, and allocating funds specifically towards loan payments. Consider making extra payments whenever possible, even small amounts, to accelerate repayment and reduce overall interest. Automating payments can also help ensure consistent and timely payments, preventing late fees and improving credit scores. Exploring loan refinancing options may reduce your interest rate, leading to lower monthly payments and faster repayment.

Student Loan Repayment Options Flowchart

A flowchart depicting repayment options would visually represent the decision-making process. The flowchart would begin with a central node labeled “Choose Repayment Plan.” Branches would extend from this node to represent the different plans: Standard, Extended, Graduated, and Income-Driven. Each branch would then lead to a smaller node summarizing the key features (payment duration, payment amount, interest paid) of that specific plan. Arrows would clearly indicate the flow of the decision-making process, ultimately guiding the borrower to select the most suitable repayment plan based on their individual financial circumstances.

Illustrative Examples

Let’s examine several scenarios to illustrate the practical application of choosing between different student loan options and how factors like credit scores influence interest rates. These examples highlight the importance of understanding the nuances of various loan types before making a decision.

Federal Loan over Private Loan

Maria, a bright and ambitious student aiming for a degree in nursing, is facing a financial hurdle. She needs $25,000 to cover her tuition and living expenses. While private lenders offer competitive rates, Maria opts for federal student loans. Her reasoning is straightforward: federal loans offer several crucial advantages, including income-driven repayment plans, deferment options during periods of unemployment or financial hardship, and protections against aggressive collection practices. These safeguards provide a safety net that private loans often lack. The potential for lower interest rates on certain federal loan programs, depending on her financial need, also plays a role in her decision. While a private loan might have offered a slightly lower interest rate initially, the long-term security and flexibility of federal loans outweigh this minor difference for Maria.

Variable Rate Loan over Fixed Rate Loan

John, a confident and risk-tolerant student pursuing a lucrative career in software engineering, is considering his financing options. He anticipates high earning potential after graduation and is willing to take on more risk for the potential of lower initial payments. He chooses a variable-rate loan over a fixed-rate loan. His reasoning is based on the current low interest rate environment; a variable rate loan might offer a significantly lower interest rate initially. However, he understands the inherent risks: interest rates could rise unexpectedly, increasing his monthly payments and potentially leading to a higher total cost over the life of the loan. The reward, however, is the potential for significant savings if interest rates remain low or decrease during his repayment period. For example, if the initial interest rate is 3% and rises to 6% after two years, his payments will increase. Conversely, if rates fall to 2%, his payments will decrease. John’s confidence in his future earnings and risk tolerance make this a viable strategy for him, but it’s a gamble that wouldn’t be suitable for everyone.

Impact of a Good Credit Score on Interest Rate

Sarah, a responsible and financially savvy student, has diligently built a strong credit history. She maintains a credit score above 750. When applying for private student loans, lenders recognize her excellent creditworthiness and offer her a significantly lower interest rate compared to applicants with lower scores. For example, a lender might offer Sarah a rate of 5%, while a student with a poor credit history might receive a rate of 10% or even higher. This difference in interest rates can translate into thousands of dollars in savings over the life of the loan, emphasizing the importance of responsible credit management, even during the student years. This favorable interest rate allows Sarah to borrow the necessary funds at a much more manageable cost, showcasing the direct link between a good credit score and access to better financial terms.

Closing Summary

Ultimately, securing the best rate student loan requires careful planning and research. By understanding the nuances of federal and private loan options, leveraging your creditworthiness, and strategically choosing a repayment plan, you can significantly reduce your overall borrowing costs. This guide provides a foundation for making informed decisions, empowering you to navigate the student loan landscape confidently and achieve your financial goals.

Commonly Asked Questions

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can lower your interest rate, but it often involves switching from a federal loan to a private loan, potentially losing federal protections.

How does my credit score affect my student loan interest rate?

A higher credit score generally qualifies you for lower interest rates, especially with private student loans. A poor credit history may lead to higher rates or loan denial.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size. They may result in loan forgiveness after a certain number of years, but you’ll pay more interest overall.