Navigating the world of student loans can feel overwhelming, a maze of federal programs, private lenders, and repayment options. This guide aims to illuminate the path, offering a clear understanding of the best student loan programs available and how to choose the right one for your individual circumstances. We’ll explore the different types of loans, eligibility criteria, repayment plans, and crucial factors to consider before signing on the dotted line. Understanding these intricacies empowers you to make informed decisions and manage your debt effectively.

From comparing federal and private loan options to deciphering interest rates and fees, we’ll equip you with the knowledge needed to confidently navigate the student loan landscape. We’ll also delve into strategies for managing your debt, including budgeting tips, and importantly, how to avoid common scams. Our goal is to empower you to secure your education without unnecessary financial burdens.

Types of Student Loan Programs

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. This section will detail the key distinctions between federal and private student loans, focusing on their features, eligibility criteria, and potential benefits and drawbacks.

Federal Student Loan Programs

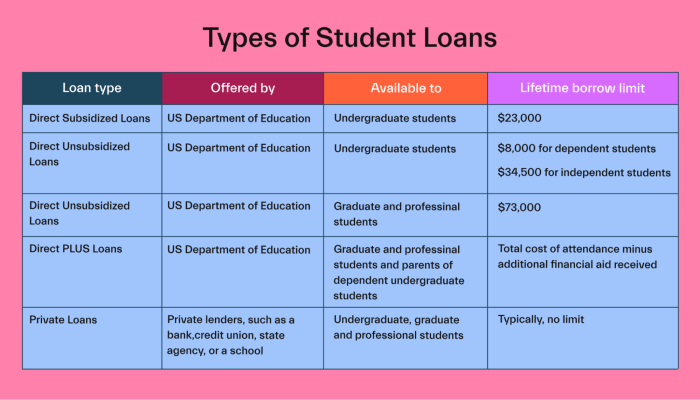

The federal government offers several student loan programs designed to help students finance their education. These programs generally offer more borrower protections and flexible repayment options compared to private loans. The most common types include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans offered to undergraduate students demonstrating financial need. A key feature is that the government pays the interest while the student is in school at least half-time, during grace periods, and during periods of deferment. This means borrowers don’t accrue interest during these times, potentially saving them significant money. Eligibility is determined through the Free Application for Federal Student Aid (FAFSA).

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students, regardless of financial need. Unlike subsidized loans, interest accrues from the time the loan is disbursed, even while the student is in school. Borrowers are responsible for paying this accrued interest, either while in school or after graduation. This can lead to a larger total loan amount owed upon repayment.

Direct PLUS Loans

Direct PLUS Loans are credit-based loans available to graduate or professional students and parents of dependent undergraduate students. Creditworthiness is assessed, and borrowers with adverse credit history may still qualify but might be required to obtain an endorser. These loans can help cover educational expenses not met by other funding sources. Interest rates are typically higher than subsidized and unsubsidized loans.

Federal vs. Private Student Loan Programs

Federal and private student loans differ significantly in their terms and conditions. Federal loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, are offered by banks and credit unions and often have higher interest rates and stricter eligibility requirements. The terms and conditions of private loans vary greatly depending on the lender.

Advantages and Disadvantages of Student Loan Programs

Choosing between federal and private loans requires careful consideration of the advantages and disadvantages of each.

Advantages of Federal Student Loans

Federal student loans often provide lower interest rates, flexible repayment options (including income-driven repayment plans), and borrower protections such as deferment and forbearance options in case of financial hardship. They also offer loan forgiveness programs under specific circumstances, such as for public service.

Disadvantages of Federal Student Loans

The application process can be somewhat complex, requiring completion of the FAFSA. Loan amounts may be limited based on financial need or cost of attendance. Borrowers still need to repay the loan, and failing to do so can result in negative consequences on their credit history.

Advantages of Private Student Loans

Private student loans may offer higher loan amounts compared to federal loans, potentially covering more educational expenses. The application process might be faster and simpler than federal loans.

Disadvantages of Private Student Loans

Private student loans typically have higher interest rates and less flexible repayment options than federal loans. They often lack the borrower protections and forgiveness programs offered by federal loans. Creditworthiness is a key eligibility factor, potentially excluding borrowers with poor credit.

Comparison of Student Loan Programs

| Loan Type | Interest Rate | Repayment Options | Eligibility |

|---|---|---|---|

| Direct Subsidized Loan | Variable; set annually by the government | Standard, graduated, extended, income-driven | Undergraduate students demonstrating financial need |

| Direct Unsubsidized Loan | Variable; set annually by the government | Standard, graduated, extended, income-driven | Undergraduate and graduate students |

| Direct PLUS Loan | Variable; set annually by the government; higher than subsidized/unsubsidized | Standard, graduated, extended | Graduate/professional students and parents of dependent undergraduates; credit check required |

| Private Student Loan | Variable; depends on lender and borrower’s creditworthiness; generally higher than federal loans | Varies by lender; may offer fewer options than federal loans | Varies by lender; good credit history usually required |

Eligibility Criteria and Application Process

Securing student loans involves navigating eligibility requirements and a sometimes complex application process. Understanding these aspects is crucial for a successful application and securing the funding needed for your education. This section details the eligibility criteria for various student loan programs and Artikels the application procedures for both federal and private loans.

Federal Student Loan Eligibility Requirements

Eligibility for federal student loans primarily hinges on your enrollment status, citizenship, and financial need (for some programs). You must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution. U.S. citizenship or eligible non-citizen status is also a requirement. For need-based programs like subsidized loans, your financial need is assessed using the Free Application for Federal Student Aid (FAFSA). Credit history is generally not a factor for federal loans, making them more accessible to students with limited or no credit.

Private Student Loan Eligibility Requirements

Private student loan eligibility is more stringent and often depends heavily on your creditworthiness. Lenders typically assess your credit score, credit history, and debt-to-income ratio. A higher credit score generally increases your chances of approval and can result in more favorable loan terms, such as lower interest rates. Co-signers are often required for students with limited or no credit history, as their creditworthiness helps mitigate the lender’s risk. Income verification may also be necessary. Finally, enrollment at an eligible institution is also a prerequisite for private loans.

Federal Student Loan Application Process

The application process for federal student loans begins with completing the FAFSA. This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including loans, grants, and work-study. After submitting the FAFSA, your school will provide you with a Student Aid Report (SAR) summarizing your aid eligibility. You then select the loans you wish to accept through your school’s financial aid office. The loan funds are usually disbursed directly to your school to cover tuition and fees. Additional funds may be disbursed to you directly, but this is dependent on the type of loan and your school’s policies.

Private Student Loan Application Process

Applying for private student loans typically involves completing an online application with a private lender. You’ll need to provide personal information, educational details, and financial information, including your credit history (if applicable). The lender will review your application and assess your creditworthiness. If approved, you’ll receive a loan offer outlining the terms and conditions. You’ll then need to sign the loan documents to finalize the loan. The disbursement process can vary depending on the lender but typically involves direct deposit to your bank account or disbursement to your school.

Necessary Documentation for Loan Applications

Both federal and private loan applications require specific documentation. For federal loans, the primary document is the completed FAFSA. For private loans, you’ll likely need to provide proof of identity (such as a driver’s license or passport), proof of enrollment, tax returns (or other income documentation), and credit reports. Additionally, you might need to provide information about your existing debts and assets. Some lenders may require additional documentation, depending on your individual circumstances.

Checklist for Maximizing Loan Approval Chances

Before applying for student loans, it is beneficial to prepare a comprehensive checklist to improve your chances of approval. This involves:

- Maintain a good credit score (if applying for private loans): A higher credit score significantly increases your chances of approval and may result in better interest rates. Regularly check your credit report for errors and pay bills on time.

- Complete the FAFSA accurately and promptly (for federal loans): Ensure all information provided is accurate and submitted before the deadlines.

- Limit your existing debt: A lower debt-to-income ratio improves your chances of approval for private loans.

- Have a co-signer (if necessary): A co-signer with good credit can significantly increase your approval chances for private loans.

- Shop around for the best loan terms: Compare offers from multiple lenders to secure the most favorable interest rates and repayment terms.

- Understand the loan terms and conditions thoroughly before signing any documents: Read all the fine print to avoid surprises.

Repayment Plans and Options

Choosing the right repayment plan for your student loans is crucial for managing your debt effectively and avoiding financial strain. Different plans offer varying levels of flexibility and monthly payments, catering to diverse financial situations and income levels. Understanding the nuances of each plan will help you make an informed decision that aligns with your personal circumstances.

Understanding the various repayment options available for your student loans is essential for effective debt management. The best plan depends heavily on your individual financial situation, income, and long-term goals. Failing to choose wisely can lead to unnecessary stress and potential financial difficulties.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. This plan offers predictability and allows for quicker debt payoff, but the monthly payments might be higher than other options.

- Key Feature: Fixed monthly payments over 10 years.

- Benefit: Predictable payments and faster debt repayment.

- Drawback: Higher monthly payments compared to income-driven plans.

- Best For: Borrowers with stable income and a preference for faster repayment.

Graduated Repayment Plan

With a graduated repayment plan, your monthly payments start low and gradually increase over time, typically every two years, for the duration of the repayment period (usually 10 years). This can ease the initial financial burden but leads to significantly higher payments later in the repayment period.

- Key Feature: Payments start low and increase over time.

- Benefit: Lower initial payments, easing the early financial burden.

- Drawback: Payments increase substantially over time, potentially leading to difficulty later on.

- Best For: Borrowers anticipating income growth and who need lower initial payments.

Extended Repayment Plan

An extended repayment plan stretches your repayment period beyond the standard 10 years, usually up to 25 years. This lowers your monthly payments but significantly increases the total interest paid over the life of the loan.

- Key Feature: Longer repayment period (up to 25 years).

- Benefit: Lower monthly payments.

- Drawback: Significantly higher total interest paid.

- Best For: Borrowers with limited current income who need lower monthly payments, even at the cost of higher overall interest.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) tie your monthly payments to your income and family size. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, but the repayment period is often extended, potentially leading to higher overall interest costs. After a specific period (usually 20 or 25 years), any remaining loan balance may be forgiven, though this forgiveness is considered taxable income.

- Key Feature: Monthly payments based on income and family size.

- Benefit: Lower monthly payments, potentially leading to more manageable debt.

- Drawback: Longer repayment periods and potential for higher total interest paid; forgiveness is considered taxable income.

- Best For: Borrowers with low income relative to their debt, or those anticipating fluctuating income.

Interest Rates and Fees

Understanding the financial aspects of student loans is crucial for responsible borrowing and repayment. This section details how interest rates are determined, the various fees associated with loans, and the impact of interest capitalization on your overall loan cost.

Interest rates on student loans are influenced by several factors. The primary factor is the prevailing market interest rates. Government-backed loans, such as federal student loans in the US, typically have lower interest rates than private loans, which are influenced by the lender’s assessment of the borrower’s creditworthiness and the overall economic climate. The loan term also plays a role; longer repayment periods may result in higher interest rates. Finally, the type of loan (e.g., subsidized vs. unsubsidized) can affect the interest rate. Subsidized loans often have lower rates because the government pays the interest while the borrower is in school (under certain conditions).

Determination of Student Loan Interest Rates

Several interconnected factors influence the interest rate assigned to a student loan. These include the type of loan (federal or private), the prevailing market interest rates at the time of loan disbursement, the borrower’s credit history (for private loans), and the length of the repayment term. Government-backed loans usually offer more favorable rates due to the reduced risk for lenders. Private lenders, on the other hand, consider the borrower’s creditworthiness, assessing their ability to repay the loan, which directly impacts the interest rate offered. A longer repayment period generally leads to a higher overall interest rate to compensate the lender for the extended time value of money.

Types of Student Loan Fees

Several fees can be associated with student loans, adding to the overall cost of borrowing. These fees vary depending on the lender and loan type.

- Origination Fees: These are one-time fees charged by the lender when the loan is disbursed. They typically represent a percentage of the loan amount and are deducted from the total loan disbursement. For example, a 1% origination fee on a $10,000 loan would result in a $100 fee.

- Late Payment Fees: These are penalties charged for missed or late loan payments. The amount of the late fee can vary but is usually a percentage of the missed payment or a fixed dollar amount. Consistent on-time payments are crucial to avoid accumulating these fees.

- Prepayment Penalties: While less common with federal student loans, some private lenders may charge a penalty if you pay off your loan early. This fee aims to compensate the lender for lost interest income.

- Default Fees: If a loan goes into default (failure to make payments for a specified period), significant penalties and fees can be incurred. These fees can substantially increase the total loan amount owed.

Interest Capitalization

Interest capitalization occurs when accumulated interest on a loan is added to the principal balance, increasing the total amount owed. This typically happens when the borrower is not making payments, such as during a grace period or deferment. For example, if a student has $10,000 in accrued interest during a deferment period, that $10,000 is added to the principal balance, and future interest calculations will be based on the increased principal amount. This significantly increases the total cost of the loan over time. The effect is compounded the longer the interest is capitalized.

Impact of Different Interest Rates on Total Loan Cost

Imagine two borrowers, each taking out a $20,000 loan. Borrower A has a 5% interest rate, while Borrower B has a 7% interest rate. Both loans have a 10-year repayment period. Over the 10 years, even though the initial loan amounts are identical, the total cost for Borrower B (with the higher interest rate) will be considerably higher than for Borrower A. A simple illustration: If we assume simple interest for ease of understanding (though most loans compound interest), Borrower A will pay approximately $10,000 in interest, while Borrower B will pay approximately $14,000 in interest. This shows a substantial difference solely due to the 2% difference in interest rates. The actual difference would be even greater with compounded interest. This simple example highlights the importance of securing the lowest possible interest rate on student loans.

Managing Student Loan Debt

Successfully navigating student loan debt requires a proactive and organized approach. Understanding your repayment options, creating a realistic budget, and prioritizing your financial literacy are crucial steps to becoming debt-free and achieving your financial goals. Effective management minimizes stress and maximizes your financial well-being.

Practical Tips for Effective Student Loan Debt Management

Managing student loan debt effectively involves several key strategies. Prioritize making on-time payments to avoid late fees and negative impacts on your credit score. Consider exploring options like refinancing to potentially lower your interest rate, thereby reducing your overall repayment amount. Regularly review your loan details and repayment plan to ensure you’re on track and to identify any potential opportunities for savings. Finally, maintain open communication with your loan servicer to address any concerns or questions promptly.

Budgeting and Prioritizing Loan Payments

Creating a comprehensive budget is essential for managing student loan debt. This involves tracking your income and expenses to understand your cash flow. Prioritize essential expenses, such as housing, food, and transportation, before allocating funds towards loan payments. Consider using budgeting apps or spreadsheets to monitor your spending and progress. Allocate a specific amount each month towards your student loan payments and treat it as a non-negotiable expense. By consistently sticking to your budget, you’ll be better positioned to meet your repayment goals.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy plays a vital role in successfully managing student loan debt. Understanding basic financial concepts, such as interest rates, repayment plans, and credit scores, empowers you to make informed decisions about your debt. This knowledge allows you to effectively compare different repayment options, negotiate with lenders, and avoid costly mistakes. Seeking financial advice from reputable sources, such as certified financial planners, can provide valuable guidance and support throughout the repayment process. Investing time in learning about personal finance will ultimately benefit your financial health beyond managing student loans.

Sample Budget Incorporating Student Loan Payments

A well-structured budget is key to successful debt management. The following sample budget illustrates how to incorporate student loan payments while accounting for essential expenses. Remember to adjust this based on your individual income and expenses.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Salary | $3000 | Rent/Mortgage | $1000 |

| Side Hustle Income | $500 | Groceries | $300 |

| Total Income | $3500 | Transportation | $200 |

| Utilities | $150 | ||

| Student Loan Payment | $500 | ||

| Savings | $250 | ||

| Entertainment | $100 | ||

| Total Expenses | $2500 | ||

| Remaining Balance | $1000 |

Avoiding Student Loan Scams

Navigating the world of student loans can be complex, and unfortunately, this complexity makes it easier for scammers to prey on unsuspecting students and families. Understanding common tactics and recognizing warning signs is crucial to protecting yourself from fraudulent schemes that could lead to significant financial hardship.

Scammers employ various deceptive tactics to exploit those seeking financial aid for higher education. These range from offering loans with impossibly low interest rates or requiring upfront fees to impersonating legitimate lenders or government agencies. The consequences of falling victim to these scams can be severe, including accumulating unnecessary debt, damaging your credit score, and facing legal repercussions.

Common Student Loan Scams

Several prevalent scams target students seeking financial aid. These include advance-fee loans, where applicants are asked to pay upfront fees before receiving funds; fake loan forgiveness programs promising immediate debt relief for a fee; and phishing emails or texts mimicking legitimate lenders or government agencies, attempting to steal personal information. Additionally, some scams involve offering loans with incredibly low interest rates that are too good to be true, often leading to hidden fees or predatory terms.

Recognizing and Avoiding Student Loan Scams

Several key strategies can help you avoid student loan scams. Always verify the legitimacy of any lender or organization through official channels. Never pay upfront fees for a student loan; legitimate lenders do not require such payments. Be wary of unsolicited offers that seem too good to be true—extremely low interest rates, guaranteed approval, or promises of immediate debt relief often signal a scam. Protect your personal information and be cautious about sharing sensitive data online or over the phone. If something feels off, trust your instincts and seek advice from a trusted financial advisor or your educational institution’s financial aid office.

Reporting Suspected Student Loan Fraud

If you suspect you’ve been a victim of a student loan scam or have encountered fraudulent practices, reporting it promptly is essential. You can contact the Federal Trade Commission (FTC) to file a complaint. The FTC is a government agency dedicated to protecting consumers from fraud, and they have resources and processes to investigate these types of scams. Additionally, you can contact your state’s attorney general’s office, which may also have resources available to assist you. Reporting suspected fraud helps protect others from becoming victims and allows authorities to investigate and potentially prosecute the perpetrators.

Red Flags to Watch Out For

Several red flags can signal a potential student loan scam. These include unsolicited offers of loans via email or text message, requests for upfront fees or payments before receiving funds, promises of guaranteed loan approval regardless of credit history, unusually low interest rates that seem too good to be true, high-pressure sales tactics, and lenders who are unwilling to provide clear and detailed information about the loan terms and conditions. If you encounter any of these red flags, exercise extreme caution and thoroughly investigate the lender’s legitimacy before proceeding. A legitimate lender will be transparent and readily available to answer your questions.

Summary

Securing a quality education is a significant investment, and understanding student loan options is crucial for responsible financial planning. By carefully considering the various loan types, eligibility requirements, repayment plans, and potential pitfalls, you can make informed choices that align with your financial goals. Remember, proactive planning and informed decision-making are key to managing your student loan debt effectively and achieving long-term financial well-being. This guide serves as a starting point; further research and consultation with financial advisors are always recommended.

Expert Answers

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payments, but it might involve losing federal protections.

What happens if I default on my student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score.

How do I find a reputable student loan provider?

Research thoroughly, check reviews, and verify the lender’s legitimacy with official sources before applying.