Navigating the complex world of student loans can feel overwhelming. The sheer number of options—federal versus private, subsidized versus unsubsidized, and various repayment plans—often leaves prospective borrowers feeling lost. This guide aims to demystify the process, providing a clear understanding of the different types of student loans available and helping you determine which best suits your individual financial circumstances and long-term goals.

We’ll explore the intricacies of federal and private loans, comparing their eligibility requirements, interest rates, and repayment options. We’ll also delve into loan forgiveness programs and strategies for effective debt management, empowering you to make informed decisions and avoid common pitfalls. Ultimately, our goal is to equip you with the knowledge necessary to confidently navigate the path to higher education without being burdened by unnecessary debt.

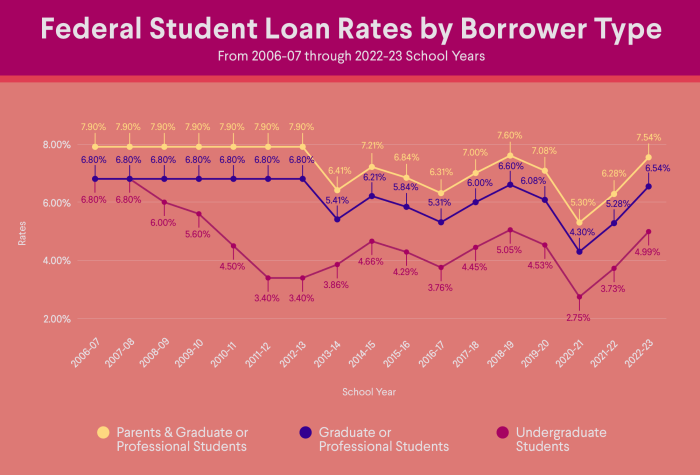

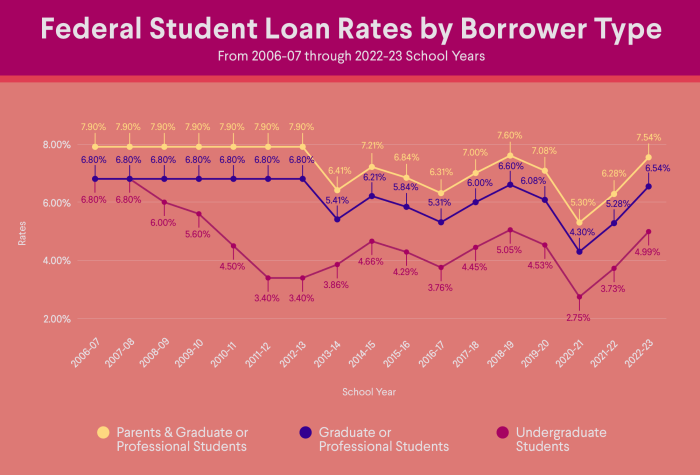

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your student loans is crucial for effective financial planning. Choosing the right repayment plan can significantly impact the total cost and duration of your loan repayment. This section will explore the key factors influencing interest rates and detail the various repayment plan options available to borrowers.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the interest rate you’ll receive on your student loan. These factors are often considered by lenders when assessing the risk associated with lending to a particular borrower. A higher risk profile generally results in a higher interest rate.

- Credit History: A strong credit history, demonstrating responsible borrowing and repayment behavior, often leads to lower interest rates. Lenders view a good credit score as an indicator of lower risk.

- Loan Type: Different types of student loans, such as federal subsidized and unsubsidized loans or private loans, carry varying interest rates. Federal loans generally offer more favorable rates than private loans.

- Market Interest Rates: The prevailing interest rates in the broader financial market significantly influence student loan rates. When overall interest rates rise, student loan rates tend to follow suit.

- Repayment Plan: While not directly affecting the initial interest rate, the chosen repayment plan influences the total interest paid over the life of the loan. Longer repayment periods generally result in higher total interest payments.

Student Loan Repayment Plans

Several repayment plans cater to different financial situations and repayment preferences. Choosing the right plan can significantly impact your monthly payments and the overall cost of your loan.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. It’s the simplest option, but monthly payments can be high.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. This can be helpful initially, but payments become substantially higher in later years.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, leading to lower monthly payments but higher total interest paid over the life of the loan. The maximum repayment period varies depending on the loan type and balance.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly payments to your income and family size. These plans are designed to make repayment more manageable, especially for borrowers with lower incomes.

- Benefits: Lower monthly payments, potential for loan forgiveness after a set period (often 20 or 25 years), and greater affordability during periods of lower income.

- Drawbacks: Longer repayment periods resulting in higher total interest paid, potential for less aggressive debt reduction, and the complexity of the application process and qualification criteria.

Scenario: Comparing Repayment Plan Costs

Let’s consider a $30,000 student loan with a 6% annual interest rate. The total cost will vary significantly depending on the repayment plan chosen.

| Repayment Plan | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Repaid (approx.) |

|---|---|---|---|

| Standard (10 years) | $330 | $11,770 | $41,770 |

| Graduated (10 years) | Varies, starting lower | Similar to Standard | Similar to Standard |

| Extended (20 years) | $200 | $18,000+ | $48,000+ |

| Income-Driven (20-25 years) | Varies greatly based on income | Potentially very high | Potentially very high |

Note: These are approximate figures. Actual payments and total interest paid can vary based on several factors, including the specific loan terms and individual circumstances. Always consult official loan documents for precise calculations.

Loan Forgiveness and Deferment Options

Navigating the complexities of student loan repayment can be challenging. Fortunately, several programs offer loan forgiveness or temporary payment relief through deferment or forbearance. Understanding these options is crucial for borrowers seeking to manage their debt effectively. This section details the criteria for accessing these programs and the processes involved in applying for them.

Loan forgiveness programs and deferment/forbearance options provide crucial support for borrowers facing financial hardship or pursuing careers in public service. These programs can significantly reduce the overall cost of education or offer temporary breathing room during challenging times. Careful consideration of eligibility requirements and application processes is essential to maximize the benefits of these programs.

Public Service Loan Forgiveness (PSLF) Program Criteria

The Public Service Loan Forgiveness (PSLF) program is designed to forgive the remaining balance on federal Direct Loans after 120 qualifying monthly payments are made while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations. Borrowers must be enrolled in an income-driven repayment plan to be eligible. Furthermore, the type of loan must be a Direct Loan; Federal Family Education Loans (FFEL) and Perkins Loans generally require consolidation into a Direct Consolidation Loan before they can qualify. The application process involves meticulous documentation of employment and loan repayment history. Failure to meet all requirements, including consistent on-time payments, can result in ineligibility for forgiveness.

Applying for Loan Deferment or Forbearance

The application process for deferment or forbearance generally involves contacting your loan servicer. You will need to provide documentation to support your request, such as proof of unemployment, medical documentation (for medical deferment), or evidence of economic hardship. Deferment temporarily postpones payments, and in some cases, interest may not accrue. Forbearance also postpones payments, but interest typically continues to accrue, increasing the total loan amount owed. Eligibility requirements vary depending on the type of loan and the reason for requesting deferment or forbearance. Each program has specific documentation requirements that must be met for approval. For example, a borrower facing unemployment would need to provide documentation such as an unemployment benefit statement or a letter from their employer confirming their job loss.

Examples of When Loan Forgiveness or Deferment Might Be Beneficial

Loan forgiveness can be particularly beneficial for individuals working in public service, such as teachers, nurses, and social workers, who often face lower salaries compared to other professions. Deferment or forbearance can provide temporary relief for borrowers experiencing unexpected financial hardship, such as job loss, illness, or a family emergency. For instance, a teacher working for a qualifying non-profit organization might find PSLF beneficial after 10 years of consistent payments. A borrower experiencing a period of unemployment might benefit from a deferment to avoid falling behind on payments.

Resources for Borrowers

Several resources are available to assist borrowers in navigating the complexities of loan forgiveness and deferment options. These resources offer guidance, support, and information to help borrowers make informed decisions about their student loan repayment.

- Federal Student Aid (FSA): The official website for federal student aid provides comprehensive information on loan programs, repayment options, and forgiveness programs. It offers detailed guidance on eligibility requirements, application procedures, and contact information for loan servicers.

- StudentAid.gov: This website offers a wealth of resources, including calculators to estimate monthly payments and loan forgiveness timelines. It also provides access to online tools and applications for managing student loans.

- Your Loan Servicer: Your loan servicer is your primary point of contact for all matters related to your student loans. They can provide personalized information regarding your loan terms, repayment options, and eligibility for deferment or forgiveness programs.

- National Student Loan Data System (NSLDS): NSLDS is a central database that allows borrowers to access information about their federal student loans. This database provides a comprehensive overview of loan balances, repayment history, and other pertinent details.

Choosing the Right Loan

Selecting the appropriate student loan requires a careful assessment of your individual financial situation and a thorough understanding of the loan market. The best loan for one student might not be the best for another, emphasizing the need for personalized decision-making. This process involves considering your creditworthiness, repayment capacity, and the overall cost of borrowing.

Assessing Individual Financial Circumstances

Determining your ideal loan type begins with a realistic evaluation of your current and projected financial situation. This includes analyzing your expected income after graduation, existing debt obligations, and living expenses. Consider creating a detailed budget that projects your income and expenses for at least the first year after graduation. This budget should account for loan repayments. For instance, if you anticipate a lower-paying job after graduation, a loan with a longer repayment period and potentially a lower monthly payment might be more manageable than a loan with a shorter repayment term and higher monthly payments. Conversely, if you anticipate a higher-paying job, a shorter repayment term could save you money on interest in the long run. A thorough financial self-assessment is crucial for making informed decisions about loan amounts and repayment plans.

The Importance of Credit Scores

Your credit score significantly impacts your loan approval and the interest rate you’ll receive. Lenders use credit scores to assess your creditworthiness—your ability to repay borrowed money. A higher credit score generally translates to more favorable loan terms, including lower interest rates and potentially more favorable repayment options. For example, a student with an excellent credit score might qualify for a federal student loan with a subsidized interest rate, while a student with a poor credit score might only qualify for a private loan with a significantly higher interest rate and less favorable terms. Improving your credit score before applying for loans can lead to substantial savings over the life of the loan. Strategies for improving your credit score include paying bills on time, maintaining low credit utilization, and avoiding opening multiple new credit accounts in a short period.

Researching and Comparing Loan Offers

Researching and comparing loan offers from various lenders is essential for securing the best possible terms. Begin by comparing interest rates, fees, and repayment options offered by different lenders. This involves checking both federal and private loan options. Federal student loans often offer lower interest rates and more flexible repayment plans than private loans, but they also have eligibility requirements. Private loans are available to students who don’t qualify for federal loans or need additional funding, but typically come with higher interest rates. A systematic approach is key: create a spreadsheet to compare interest rates, fees, and repayment terms from different lenders. Don’t hesitate to contact lenders directly with questions; understanding the details is crucial for making an informed decision.

Checklist Before Signing a Student Loan Agreement

Before committing to a student loan, carefully review the loan agreement and ensure you fully understand its terms. This checklist will help you avoid potential pitfalls:

- Interest Rate: Understand the interest rate (fixed or variable) and how it will affect your total repayment cost.

- Fees: Identify any origination fees, late payment fees, or other charges.

- Repayment Terms: Review the repayment schedule, including the length of the repayment period and the monthly payment amount.

- Deferment and Forbearance Options: Check if the loan offers deferment or forbearance options in case of financial hardship.

- Loan Forgiveness Programs: Inquire about any potential loan forgiveness programs you might qualify for based on your career path.

- Total Loan Cost: Calculate the total cost of the loan, including interest and fees, to get a complete picture of your financial obligation.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options, budgeting effectively, and cultivating responsible financial habits are crucial for minimizing stress and achieving long-term financial well-being. This section provides practical strategies to manage your student loan debt effectively.

Effective management of student loan debt hinges on a combination of strategic budgeting, responsible financial practices, and a keen awareness of potential pitfalls. By proactively addressing these areas, borrowers can significantly improve their chances of timely repayment and avoid the negative consequences associated with default.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is paramount. This involves meticulously tracking income and expenses to identify areas where savings can be made. Prioritize your student loan payments by incorporating them into your monthly budget as a non-negotiable expense, similar to housing or utilities. Consider using budgeting apps or spreadsheets to simplify this process and monitor progress. Explore different repayment plans to find one that aligns with your current financial capacity, while still aiming for timely payments to minimize interest accrual. For example, an income-driven repayment plan might offer lower monthly payments initially, but it’s important to understand the long-term implications, such as potentially higher total interest paid over the life of the loan.

Financial Literacy and Responsible Borrowing Habits

Financial literacy is the cornerstone of effective debt management. Understanding interest rates, repayment terms, and the long-term implications of borrowing is crucial before taking out student loans. Before applying for loans, research different lenders and compare interest rates, fees, and repayment options. Avoid borrowing more than necessary; only borrow what you truly need for education-related expenses. Building good credit is also important, as it can impact your ability to secure favorable loan terms in the future. Regularly reviewing your credit report and addressing any errors can positively influence your financial standing.

Avoiding Common Student Loan Debt Pitfalls

Several common pitfalls can exacerbate student loan debt. One significant risk is failing to understand your repayment options. Explore income-driven repayment plans, deferment, or forbearance options if you face temporary financial hardship. However, be aware that these options might delay repayment and increase the total interest paid over the loan’s lifetime. Another common mistake is ignoring your loans or failing to communicate with your lender. Proactive communication is key; if you anticipate difficulty making payments, contact your lender immediately to discuss possible solutions before defaulting. Finally, avoid the temptation to consolidate high-interest loans into a new loan with a lower interest rate without carefully evaluating the overall costs and implications. While consolidating might seem attractive, it could potentially extend the repayment period and lead to higher total interest paid over the life of the loan.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe and long-lasting consequences. The following infographic visually represents these repercussions.

Infographic: Consequences of Student Loan Default

The infographic is a visual representation of a flowchart. It begins with a central box labeled “Student Loan Default.” From this central box, three main branches extend, each representing a major consequence:

Branch 1: Damaged Credit Score: This branch depicts a downward-pointing arrow leading to a box illustrating a severely damaged credit score, represented by a low numerical score (e.g., below 500) and a visual representation of a torn credit report. Smaller boxes branching off from this could include difficulty securing loans, renting an apartment, or getting a job.

Branch 2: Wage Garnishment: This branch uses an arrow pointing to a box showing a portion of wages being deducted, visually represented by a paycheck with a significant portion shaded to indicate the garnished amount. A smaller box could detail the potential impact on living expenses and overall financial stability.

Branch 3: Legal Action: This branch leads to a box depicting a gavel and a court document, representing legal proceedings and potential lawsuits. Smaller boxes could illustrate the costs associated with legal fees, potential judgments, and the impact on future financial opportunities.

The infographic concludes with a large box at the bottom summarizing the overall long-term negative impacts of defaulting on student loans, emphasizing the importance of responsible repayment.

Last Point

Choosing the right student loan is a crucial step in your educational journey. By carefully considering your financial situation, understanding the various loan types and their associated costs, and exploring available repayment and forgiveness options, you can significantly reduce the financial burden of higher education. Remember, proactive planning and responsible borrowing habits are key to successfully managing student loan debt and achieving your academic aspirations without compromising your future financial well-being.

Frequently Asked Questions

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while in deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves switching from federal to private loans, potentially losing federal protections.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, leading to wage garnishment, tax refund offset, and difficulty obtaining future loans or credit.

How can I improve my chances of loan approval?

Maintain a good credit score, have a co-signer if needed, and accurately complete the loan application.