Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of unsubsidized loans. Understanding the nuances of interest accrual, repayment plans, and eligibility criteria is crucial for making informed financial decisions. This guide provides a clear and concise overview of unsubsidized student loans, empowering you to confidently manage your educational financing.

From exploring the differences between subsidized and unsubsidized loans to outlining effective strategies for managing debt, we’ll cover essential aspects to help you make the best choices for your future. We’ll also examine alternative financing options, ensuring you have a comprehensive understanding of your available resources.

Understanding Unsubsidized Student Loans

Unsubsidized student loans are a crucial financing option for higher education, offering a flexible path to funding your studies. Understanding their key features and how they differ from subsidized loans is essential for making informed borrowing decisions. This section will clarify the mechanics of unsubsidized loans, focusing on interest accrual and scenarios where they prove particularly advantageous.

Key Features of Unsubsidized Student Loans

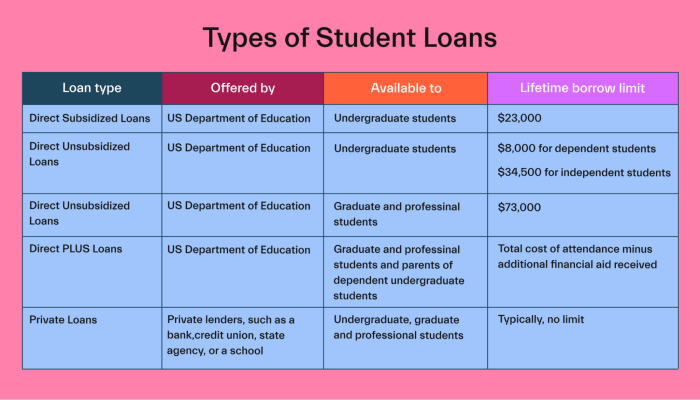

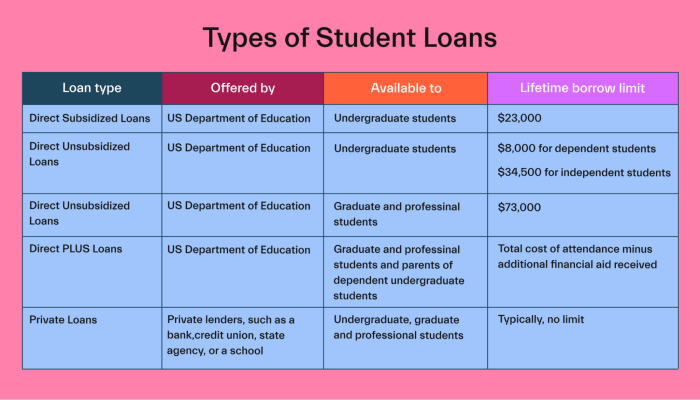

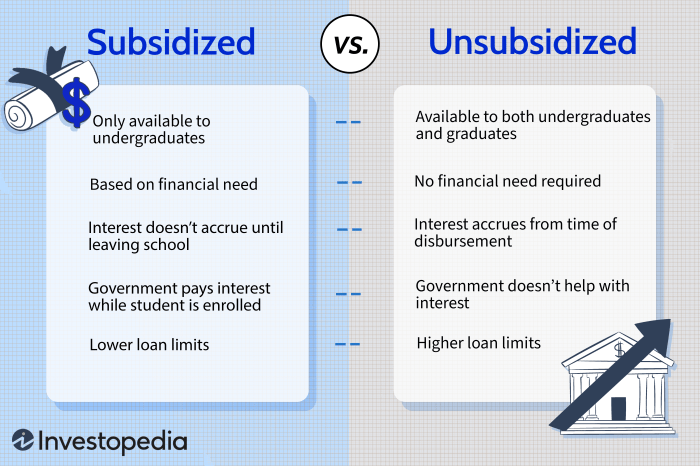

Unsubsidized loans, unlike subsidized loans, begin accruing interest from the moment the loan is disbursed. This means that interest charges accumulate throughout your entire period of study, adding to the total loan amount you’ll eventually need to repay. Borrowers are responsible for paying this accumulated interest. The interest rate is fixed for the life of the loan, offering predictability in repayment planning. Eligibility for unsubsidized loans is generally based on financial need, although the amount you can borrow is often not directly tied to your demonstrated need like subsidized loans. The loan amount is determined by your school’s cost of attendance and your other financial aid. Unsubsidized loans are available to both undergraduate and graduate students.

Differences Between Subsidized and Unsubsidized Loans

The primary difference lies in interest accrual. With subsidized loans, the government pays the interest while you’re enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from disbursement, regardless of your enrollment status. This means that the total amount owed at the end of your studies will be higher for an unsubsidized loan than a comparable subsidized loan. Eligibility criteria may also differ slightly; subsidized loans often have stricter financial need requirements.

Interest Accrual on Unsubsidized Loans During School

Interest on unsubsidized loans begins accruing immediately upon disbursement. This interest is capitalized, meaning it’s added to the principal loan amount. Therefore, you’ll pay interest on the interest, increasing the overall cost of the loan. For example, if you borrow $10,000 and the interest rate is 5%, you’ll accrue $500 in interest during the first year. If you don’t make payments during school, that $500 is added to your principal, and the next year’s interest will be calculated on $10,500. This compounding effect can significantly increase the total repayment amount. To mitigate this, some borrowers choose to make interest-only payments while in school, although this is not mandatory.

Situations Where Unsubsidized Loans Are Beneficial

Unsubsidized loans can be beneficial in situations where subsidized loan limits are insufficient to cover educational expenses. For example, a graduate student pursuing a high-cost program might find that their subsidized loan amount falls short. Unsubsidized loans can fill this gap, providing the necessary funds to complete their education. Additionally, students who are ineligible for subsidized loans due to their income level may rely entirely on unsubsidized loans. Furthermore, students who are already employed and able to make interest payments during their studies may find that unsubsidized loans, with their higher borrowing limits, offer a more efficient financing method. A student with a part-time job, for instance, might be able to make interest-only payments to reduce the overall loan burden after graduation.

Eligibility and Application Process

Securing an unsubsidized federal student loan involves understanding the eligibility requirements and navigating the application process. This section details the criteria you must meet and provides a step-by-step guide to successfully applying for these loans.

Eligibility Criteria for Unsubsidized Federal Student Loans

Eligibility Requirements

To be eligible for an unsubsidized federal student loan, you must meet several criteria. These generally include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, being enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible school, demonstrating financial need (though unsubsidized loans don’t require it in the same way as subsidized loans), and maintaining satisfactory academic progress. Specific requirements may vary slightly depending on the loan program and your institution. It’s crucial to check directly with your school’s financial aid office for the most up-to-date and accurate information.

Step-by-Step Application Guide

Applying for unsubsidized federal student loans involves a series of steps. The process is largely handled online through the Federal Student Aid website (studentaid.gov).

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the first and most crucial step. This application gathers information about your financial situation and determines your eligibility for federal student aid, including unsubsidized loans.

- Receive your Student Aid Report (SAR): After submitting the FAFSA, you’ll receive a SAR summarizing your information and your eligibility for various types of aid.

- Review your school’s financial aid offer: Your school will use your FAFSA information to determine your financial aid package, which may include unsubsidized loans. Carefully review this offer, paying close attention to the loan amounts offered and the terms and conditions.

- Accept your loan offer: If you wish to accept the offered unsubsidized loan, you’ll need to complete the necessary paperwork through your school’s financial aid office. This often involves electronic signatures and acceptance forms.

- Master Promissory Note (MPN): You will likely need to sign a Master Promissory Note (MPN). This legally binds you to repay the loan according to the terms Artikeld.

- Entrance Counseling: Before receiving your first loan disbursement, you’ll typically be required to complete entrance counseling. This is an online tutorial covering responsible borrowing and repayment options.

Required Documentation

The primary document needed is the completed FAFSA. Your school’s financial aid office may request additional documentation to verify your information, such as tax returns, W-2 forms, or proof of enrollment. Providing accurate and complete documentation expedites the application process. Failure to provide necessary documents may delay or prevent the disbursement of your loan.

Pre- and Post-Application Checklist

Before applying:

- Gather all necessary financial information (tax returns, W-2s, etc.).

- Complete the FAFSA accurately and submit it well before deadlines.

- Understand the terms and conditions of the loan, including interest rates and repayment options.

After applying:

- Review your Student Aid Report (SAR) carefully for accuracy.

- Review your school’s financial aid offer thoroughly.

- Sign and return all necessary documents promptly.

- Complete entrance counseling as required.

- Monitor your loan account regularly for updates.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your unsubsidized student loans is crucial for managing your debt effectively. Choosing the right repayment plan can significantly impact your overall borrowing cost and monthly payments. This section will Artikel key considerations for both interest rates and repayment strategies.

Unsubsidized Loan Interest Rates from Different Lenders

Interest rates on unsubsidized federal student loans are set by the government and are typically lower than those offered by private lenders. However, private lenders offer a wider variety of loan options and may be more flexible in their eligibility requirements. The exact interest rate you receive will depend on several factors, including your creditworthiness (for private loans), the loan term, and the prevailing market interest rates. It’s important to shop around and compare offers from multiple lenders before making a decision. Note that rates can fluctuate, so the rates provided here are for illustrative purposes and may not reflect current market conditions. For the most up-to-date information, always consult the lender directly. For example, a hypothetical comparison might show a federal unsubsidized loan with a 5% interest rate, while a private lender might offer a rate of 7% or higher, depending on the borrower’s credit profile.

Repayment Plan Comparison

Choosing the right repayment plan can greatly influence your monthly payments and the total interest paid over the life of your loan. Below is a comparison of common repayment plans. Remember that specific terms and conditions may vary depending on the lender.

| Repayment Plan | Payment Amount | Loan Term | Total Interest Paid (Example) |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment | 10 years | $X |

| Extended Repayment Plan | Lower monthly payment | Up to 25 years | $Y (Higher than Standard) |

| Graduated Repayment Plan | Payments start low and gradually increase | 10 years | $Z (Potentially Higher than Standard) |

| Income-Driven Repayment Plan (IDR) | Payment based on income and family size | Up to 20 or 25 years | Variable, Potentially Lower than others but with possible loan forgiveness after 20 or 25 years |

*Note: The values for X, Y, and Z represent hypothetical total interest paid on a $10,000 loan. Actual amounts will vary significantly based on the loan amount, interest rate, and specific repayment plan terms.*

Examples of Total Loan Cost Under Different Repayment Scenarios

Let’s illustrate the impact of different repayment plans. Suppose you borrow $20,000 at a 6% interest rate. Under a standard 10-year repayment plan, your monthly payments would be higher, but you’d pay less interest overall compared to an extended repayment plan. Conversely, an extended repayment plan would result in lower monthly payments, but significantly higher total interest paid over the longer repayment period. For example, a standard plan might result in a total repayment of $25,000, while an extended plan might result in a total repayment of $32,000.

Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This increases the total amount you owe and can significantly impact the total cost of your loan over time. For example, if you defer payments on your unsubsidized loan during periods like grace periods or school breaks, interest will continue to accrue and then be capitalized. This means the interest becomes part of your principal balance, leading to higher future payments and total interest paid. Let’s say you have a $10,000 unsubsidized loan with a 5% interest rate and defer payments for one year. After one year, the accrued interest would be added to the principal balance, resulting in a larger loan balance and higher total interest paid over the life of the loan. This is why it is advisable to minimize periods of deferment if possible.

Managing Unsubsidized Student Loan Debt

Successfully navigating unsubsidized student loan debt requires proactive planning and a disciplined approach. Understanding your repayment options and developing a realistic budget are crucial steps towards becoming debt-free. Failing to manage your loans effectively can lead to significant financial consequences, so careful consideration of your repayment strategy is essential.

Budgeting and Managing Student Loan Debt

Effective management of student loan debt begins with creating a detailed budget. This budget should accurately reflect your income, expenses, and loan repayment obligations. Tracking your spending allows you to identify areas where you can reduce expenses and allocate more funds towards loan repayment. Consider using budgeting apps or spreadsheets to monitor your financial progress and stay organized. Prioritizing loan repayment within your budget is key to minimizing interest accumulation and accelerating your path to debt freedom. A common strategy is to prioritize higher-interest loans first to minimize overall interest paid.

Repayment Strategies: Benefits and Drawbacks

Several repayment strategies exist, each with its own advantages and disadvantages. The Standard Repayment Plan involves fixed monthly payments over 10 years. While straightforward, it may result in higher monthly payments. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), reducing monthly payments but increasing total interest paid. Income-Driven Repayment Plans (IDR) adjust monthly payments based on your income and family size. While offering lower monthly payments, they typically extend the repayment period and potentially increase total interest paid. Finally, loan consolidation combines multiple loans into a single loan with a potentially lower interest rate and simplified repayment. However, it might extend the repayment period. Choosing the best strategy depends on your individual financial situation and long-term goals.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. It damages your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your income is automatically deducted to repay the loan, is a possibility. The government may also seize tax refunds or Social Security benefits. Furthermore, defaulting can lead to legal action and negatively impact your ability to secure future employment. Avoiding default requires proactive planning, budgeting, and communication with your loan servicer if you encounter financial difficulties.

Sample Budget for Responsible Loan Repayment

This sample budget demonstrates responsible loan repayment. Individual circumstances will vary, requiring adjustments to reflect personal income and expenses.

| Income | Amount |

|---|---|

| Monthly Net Income | $3,000 |

| Expenses | Amount |

| Housing | $1,000 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $500 |

| Other Expenses | $250 |

| Savings | $500 |

Note: This is a sample budget and may not reflect your specific financial situation. Adjust amounts to accurately represent your income and expenses. Prioritize essential expenses and allocate as much as possible towards loan repayment.

Alternatives to Unsubsidized Loans

Securing funding for higher education often involves exploring options beyond unsubsidized federal student loans. A well-rounded financial strategy considers a variety of funding sources to minimize reliance on loans and reduce overall debt. Understanding the strengths and weaknesses of each alternative is crucial for making informed decisions.

Comparison of Financing Options

Unsubsidized federal student loans, while accessible, accrue interest from the moment the loan is disbursed. This contrasts sharply with scholarships and grants, which are forms of free money that don’t need to be repaid. Private loans, offered by banks and credit unions, may offer higher borrowing limits but often come with less favorable terms than federal loans, such as higher interest rates and stricter eligibility requirements. Choosing the right option depends heavily on individual financial circumstances and risk tolerance.

Scholarships and Grants

Scholarships and grants represent the most desirable form of financial aid, as they do not require repayment. Numerous organizations, including colleges and universities, private foundations, and corporations, offer scholarships based on academic merit, athletic ability, community involvement, or financial need. Grants, often awarded based on financial need, are provided by government agencies and private organizations. Finding these opportunities requires proactive searching.

Resources for Finding Scholarships and Grants

Several online resources can assist in locating scholarships and grants. Websites like Fastweb, Scholarships.com, and Peterson’s offer searchable databases of scholarship opportunities. Additionally, contacting the financial aid office at your chosen college or university is crucial, as they often have a comprehensive list of internal and external funding options. State-level government websites may also provide information on grants specific to your state of residence. Remember to carefully review the eligibility requirements for each opportunity.

Private Loans

Private student loans can supplement federal aid, but they generally come with higher interest rates and less flexible repayment options compared to federal loans. Creditworthiness plays a significant role in securing a private loan and determining the interest rate offered. Borrowers should carefully compare interest rates, fees, and repayment terms from multiple lenders before committing to a private loan. It’s advisable to exhaust all other funding options before resorting to private loans, due to the potential for higher long-term costs.

Factors to Consider When Choosing a Financing Option

Several key factors should guide your decision-making process. First, consider the total cost of attendance, including tuition, fees, room and board, and other expenses. Next, assess your financial need and available resources, including savings, family contributions, and potential earnings from part-time employment. Compare the interest rates and repayment terms of different loan options, keeping in mind the long-term implications of debt. Finally, understand the eligibility requirements for each funding source and carefully weigh the advantages and disadvantages before making a commitment. A thorough understanding of all options ensures you choose the most appropriate financial strategy for your educational journey.

Illustrative Examples of Loan Scenarios

Understanding the true cost of unsubsidized student loans requires considering various factors. These examples illustrate how different loan amounts, interest rates, and repayment plans impact the total amount repaid. Remember that these are simplified scenarios and real-world situations may involve additional fees or complexities.

Scenario 1: Low Loan Amount, Low Interest Rate, Standard Repayment

This scenario depicts a student borrowing a relatively small amount at a lower-than-average interest rate, utilizing the standard 10-year repayment plan. Let’s assume a loan of $10,000 with a 5% annual interest rate. Using a standard amortization calculator (widely available online), the monthly payment would be approximately $106.07. Over 10 years (120 months), the total repayment would be approximately $12,728.40, resulting in a total interest paid of $2,728.40. This scenario demonstrates that even with a small loan, interest accrual can significantly increase the overall cost.

Scenario 2: High Loan Amount, High Interest Rate, Extended Repayment

This scenario illustrates the impact of a larger loan amount, a higher interest rate, and a longer repayment period. Consider a loan of $50,000 with a 7% annual interest rate, repaid over 20 years. The monthly payment would be significantly higher, approximately $402.70. Over 20 years (240 months), the total repayment would be approximately $96,648.00, resulting in a substantial total interest paid of $46,648.00. This highlights the considerable cost increase associated with larger loans, higher interest rates, and extended repayment terms.

Scenario 3: Moderate Loan Amount, Average Interest Rate, Income-Driven Repayment

This scenario presents a more nuanced approach, using a moderate loan amount, an average interest rate, and an income-driven repayment plan. Let’s assume a $30,000 loan with a 6% annual interest rate. With an income-driven repayment plan (IDR), monthly payments are adjusted based on income and family size. While the exact monthly payment is difficult to predict without specific income information, IDR plans often extend the repayment period beyond the standard 10 years, potentially up to 20 or 25 years. The total repayment cost will likely be higher than with a standard 10-year plan due to the extended repayment period, but the lower monthly payments may make it more manageable for borrowers with fluctuating incomes. The total interest paid would also be higher than a standard 10-year plan, but the precise amount depends heavily on the individual’s income throughout the repayment period.

Visual Comparison of Total Repayment Costs

A bar graph could effectively represent the total repayment costs across the three scenarios. The x-axis would list the scenarios (Scenario 1, Scenario 2, Scenario 3), and the y-axis would represent the total repayment cost in dollars. Scenario 2’s bar would be significantly taller than the others, visually demonstrating the substantial difference in total cost due to the higher loan amount, interest rate, and longer repayment period. Scenario 1 would have the shortest bar, illustrating the lower total cost associated with a smaller loan amount and lower interest rate. Scenario 3’s bar would fall somewhere in between, reflecting the moderate loan amount and the potentially extended repayment period of an income-driven plan. The visual representation would clearly illustrate the cumulative effect of loan amount, interest rate, and repayment plan on the total cost of repayment over time.

Closing Summary

Securing the best unsubsidized student loan requires careful planning and a thorough understanding of your options. By carefully considering interest rates, repayment plans, and alternative financing sources, you can create a manageable repayment strategy. Remember to proactively manage your debt and seek assistance when needed – responsible financial planning is key to a successful educational journey and a brighter future.

Answers to Common Questions

What is the difference between a subsidized and unsubsidized student loan?

With subsidized loans, the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans accrue interest from the time the loan is disbursed, even while you’re still studying.

Can I refinance my unsubsidized student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers from multiple lenders and consider the implications before refinancing federal loans, as you may lose certain borrower protections.

What happens if I default on my unsubsidized student loan?

Defaulting on a student loan has serious consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. It’s vital to contact your lender immediately if you’re struggling to make payments to explore options like deferment or forbearance.

What are some resources for finding scholarships and grants?

The Federal Student Aid website (studentaid.gov) is an excellent starting point. Additionally, many colleges and universities have their own financial aid offices that can provide information on scholarships and grants, as well as external scholarship databases.