Navigating the world of student loans can feel overwhelming, but understanding the process is key to securing the financial support you need for your education. From federal loans with their government backing to private loans with their varying interest rates, the options can seem endless. This guide will break down the essentials, helping you make informed decisions and avoid common pitfalls.

We’ll explore different loan types, eligibility criteria, the application process, and crucial aspects like interest rates and repayment strategies. Furthermore, we’ll delve into alternative funding sources and responsible borrowing practices to ensure you’re equipped to manage your student loan journey effectively. Ultimately, our aim is to empower you with the knowledge to choose the best path towards financing your education.

Understanding Student Loan Types

Choosing the right student loan is crucial for navigating the costs of higher education. Understanding the differences between federal and private loans, and the various repayment options available, is key to making informed decisions that minimize long-term financial burden. This section will Artikel the key distinctions between these loan types and their associated repayment plans.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government, while private student loans are provided by banks, credit unions, or other private lenders. This fundamental difference impacts numerous aspects of the loan, including interest rates, repayment options, and borrower protections. Federal loans generally offer more borrower protections and flexible repayment plans compared to private loans.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, allowing borrowers to tailor their payments to their financial circumstances. These plans include:

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase over 10 years.

- Extended Repayment: Payments are spread over a longer period (up to 25 years).

- Income-Driven Repayment (IDR): Monthly payments are based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Choosing the right plan depends on your individual financial situation and long-term goals. IDR plans are particularly beneficial for borrowers with low incomes, as they can significantly reduce monthly payments. However, they often result in a higher total amount paid over the life of the loan due to the extended repayment period.

Private Student Loan Repayment Plans

Private student loan repayment plans are typically less flexible than federal loan options. While some lenders may offer options like graduated repayment, the choices are often more limited. Many private loans offer only a standard repayment plan with fixed monthly payments over a set period, usually 10 or 15 years. It’s crucial to review the terms and conditions of your private loan carefully before signing.

Comparison of Federal and Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed or variable depending on the loan type. | Generally higher, fixed or variable; rates depend on creditworthiness. |

| Repayment Plans | Multiple options available, including income-driven plans. | Fewer options, typically standard repayment only. |

| Borrower Protections | Stronger borrower protections, including deferment and forbearance options. | Fewer borrower protections; less flexibility in case of financial hardship. |

| Credit Check | Usually no credit check required for subsidized loans; unsubsidized loans may require a credit check for certain loan amounts. | Credit check required; credit score impacts interest rates and approval. |

Determining Eligibility and Loan Amount

Securing a student loan involves more than just applying; understanding eligibility criteria and determining the appropriate loan amount are crucial steps. Lenders assess applicants based on various factors to determine their creditworthiness and ability to repay the loan. Carefully considering these factors and planning your loan amount can significantly impact your financial future.

Lenders assess several key factors when reviewing student loan applications. These factors help them gauge the risk involved in lending you money.

Factors Affecting Loan Eligibility

Credit history plays a significant role. A strong credit history, demonstrating responsible borrowing and repayment, increases your chances of approval and may result in more favorable interest rates. If you lack a credit history, a co-signer with a good credit score can significantly improve your eligibility. Your income and employment history also matter; consistent income demonstrates your ability to make loan repayments. Finally, your educational background and the program you are applying for are considered; lenders often prefer applicants enrolled in accredited programs. A lender may also review your debt-to-income ratio, comparing your existing debt obligations to your income. A lower ratio generally improves your chances of approval.

Strategies for Maximizing Loan Eligibility

Improving your credit score before applying is a key strategy. This can involve paying bills on time, keeping credit utilization low, and maintaining a diverse credit mix. If you have a limited credit history, consider becoming an authorized user on a credit card with a good payment history. This can help build your credit score over time. Another effective strategy is to secure a co-signer with a strong credit history. This reduces the lender’s risk and increases the likelihood of approval, even if your own credit history is weak. Finally, carefully review your application and ensure all information is accurate and complete to avoid delays or rejection. Errors or omissions can hinder the approval process.

Determining the Appropriate Loan Amount

Determining the appropriate loan amount involves careful consideration of several factors. First, estimate your total educational costs, including tuition, fees, room and board, books, and other expenses. For example, if a four-year program costs $20,000 per year, the total cost is $80,000. Next, consider your personal finances, including savings, grants, scholarships, and any part-time income. If you have $10,000 in savings and expect to receive $5,000 in scholarships, you may only need to borrow $65,000. Finally, create a realistic repayment plan. Consider your expected post-graduation salary and your ability to manage monthly loan payments. Borrowing only what is absolutely necessary minimizes long-term debt burden. For example, if your expected salary is $50,000 annually, you might determine that a monthly payment of $800 is manageable, guiding your loan amount choice accordingly.

The Application Process

Securing student loans involves navigating a specific application process, varying slightly depending on whether you’re applying for federal or private loans. Understanding these processes is crucial for a smooth and successful application. This section details the steps involved in each, providing a clear roadmap for your financial planning.

Applying for Federal Student Loans

The application process for federal student loans primarily revolves around the Free Application for Federal Student Aid (FAFSA). Completing the FAFSA accurately and on time is the cornerstone of receiving federal student aid. The process is generally straightforward but requires careful attention to detail.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is a comprehensive form requesting detailed financial information from both the student and their parents (if applicable). Accurate and complete information is critical for determining your eligibility for federal aid. The steps involved are:

- Gather Necessary Information: Before starting, collect your Social Security number, federal tax returns (yours and your parents’), W-2s, and other relevant financial documents. This preparation significantly streamlines the process.

- Create an FSA ID: You and your parents (if applicable) will need an FSA ID to access and sign the FAFSA. This is a username and password combination that provides secure access to your FAFSA data.

- Complete the FAFSA Form: The online form guides you through various sections, asking for personal information, financial details, and educational plans. Answer each question carefully and accurately.

- Review and Submit: Before submitting, thoroughly review all entered information to ensure accuracy. Errors can delay the processing of your application.

- Track Your Status: After submitting, monitor your FAFSA status online to track its progress and receive updates on your eligibility for aid.

Applying for Private Student Loans

Private student loans are offered by banks and other financial institutions. The application process differs significantly from federal loans and typically involves a more rigorous credit assessment.

- Research Lenders: Begin by researching various private lenders, comparing interest rates, fees, and repayment terms. Consider factors like your credit history and the type of loan you need.

- Pre-qualification: Many lenders offer a pre-qualification process, allowing you to check your eligibility without impacting your credit score. This step provides a preliminary understanding of your loan options.

- Complete the Application: The application process involves providing personal and financial information, including your credit history. Lenders will typically perform a credit check as part of the application process.

- Credit Checks and Co-signers: If your credit history is limited or poor, you may need a co-signer—someone with good credit who agrees to repay the loan if you cannot. A co-signer significantly increases your chances of loan approval.

- Loan Approval and Disbursement: Once your application is approved, the lender will disburse the funds directly to your educational institution. This usually occurs in installments throughout your academic year.

Interest Rates and Fees

Understanding interest rates and fees is crucial for making informed decisions about student loans. These costs significantly impact the total amount you’ll repay, potentially stretching your repayment period and increasing your overall debt. This section will clarify how these costs are determined and how they vary between different loan types.

Interest rates on federal student loans are set by the government and are generally lower than those on private loans. They are influenced by several factors, including the prevailing market interest rates, the type of loan (subsidized or unsubsidized), and the loan’s repayment plan. For example, subsidized loans, which don’t accrue interest while you’re in school, typically have lower rates than unsubsidized loans. Private student loans, on the other hand, are offered by banks and credit unions, and their interest rates are determined by your creditworthiness, the loan amount, and the lender’s own risk assessment. A borrower with a strong credit history will likely secure a more favorable interest rate.

Federal and Private Loan Interest Rate Determination

Federal student loan interest rates are established by Congress and can fluctuate annually. The rate for each loan type (e.g., Direct Subsidized Loan, Direct Unsubsidized Loan, Direct PLUS Loan) is typically fixed for the life of the loan. This means the interest rate doesn’t change over the loan term. Private loan interest rates are variable or fixed, depending on the lender and the terms of the loan agreement. Variable rates adjust periodically based on market conditions, potentially leading to fluctuations in monthly payments. Fixed rates remain consistent throughout the loan term, providing predictability in repayment planning. Lenders consider your credit score, income, and the loan amount when setting your interest rate. A higher credit score generally results in a lower interest rate.

Interest Rate and Fee Comparison Across Loan Types

The table below illustrates a comparison, showing the potential differences in interest rates and fees across various loan types. Note that these are examples and actual rates and fees can vary depending on the lender and the borrower’s individual circumstances. It is essential to check with the lender for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Fees (Example) | Total Repayment Cost (Example – $10,000 Loan, 10-year repayment) |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% | $0 | $12,462 |

| Federal Unsubsidized Loan | 5.5% | $0 | $13,167 |

| Private Loan (Fixed Rate) | 7% | $100 origination fee | $14,890 |

| Private Loan (Variable Rate) | 6-8% (example range) | $200 origination fee + other fees | $14,000 – $16,000 (example range) |

Impact of Interest Rates on Total Repayment Costs

The impact of even small differences in interest rates can be substantial over the life of a loan. The table above demonstrates this impact using example loan amounts and repayment periods. A higher interest rate leads to a higher total repayment cost, meaning you’ll pay significantly more than the original loan amount. For instance, a 1% difference in interest rate on a $10,000 loan over 10 years could result in hundreds or even thousands of dollars in additional interest paid. Careful consideration of interest rates is vital to minimizing the overall cost of borrowing for education.

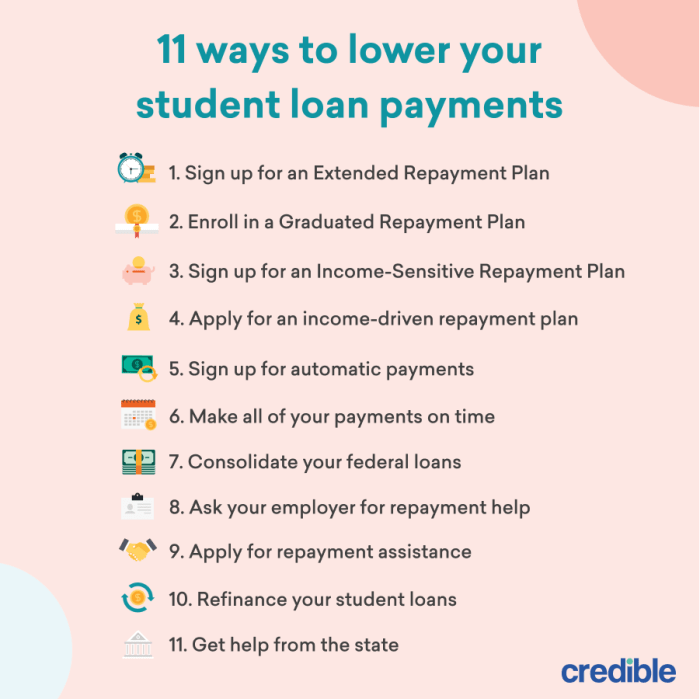

Repayment Strategies

Navigating student loan repayment can feel overwhelming, but understanding your options is key to managing your debt effectively. Choosing the right repayment plan significantly impacts your monthly payments and the total amount of interest you’ll pay over the life of your loan. This section Artikels several common repayment strategies and illustrates how they can affect your financial situation.

Several repayment plans are available, each designed to cater to different financial circumstances and repayment preferences. The best plan for you depends on your income, budget, and long-term financial goals. Careful consideration of these factors is crucial for making an informed decision.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It typically involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, minimizing the total interest paid. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early stages of your career. For example, a $30,000 loan at a 5% interest rate would result in a monthly payment of approximately $317, totaling approximately $38,000 over the 10-year repayment period.

Extended Repayment Plan

An extended repayment plan offers longer repayment terms, typically ranging from 12 to 30 years, depending on the loan type and lender. This leads to lower monthly payments compared to the standard plan, making it more manageable for borrowers with tighter budgets. However, extending the repayment period significantly increases the total interest paid over the life of the loan. Using the same $30,000 loan example at 5% interest, a 20-year repayment plan would result in a monthly payment of roughly $200, but the total cost would rise to approximately $48,000 due to the extended interest accrual.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payments to your income and family size. These plans typically offer lower monthly payments, making them attractive to borrowers with lower incomes or unexpected financial hardships. Several income-driven plans exist, each with its own calculation method and eligibility requirements. These plans often extend the repayment period beyond the standard 10 years, leading to higher total interest paid. However, some plans may offer loan forgiveness after a specific period of repayment, provided you meet certain criteria, such as working in public service. The exact terms and conditions vary significantly depending on the specific income-driven repayment plan selected.

Hypothetical Repayment Schedule: Impact of Early Repayment

| Month | Original Payment (Standard Plan) | Early Repayment (Additional $100/month) | Principal Remaining (Standard Plan) | Principal Remaining (Early Repayment) |

|---|---|---|---|---|

| 0 | $317 | $417 | $30,000 | $30,000 |

| 12 | $317 | $417 | $28,700 (approx.) | $27,500 (approx.) |

| 24 | $317 | $417 | $27,200 (approx.) | $24,500 (approx.) |

| 60 | $317 | $417 | $22,000 (approx.) | $15,000 (approx.) |

| 120 | $317 | $417 | $11,000 (approx.) | $0 (approx.) |

This hypothetical schedule demonstrates how even a modest increase in monthly payments can significantly reduce the loan’s lifespan and total interest paid. The early repayment scenario shows a substantial reduction in the principal balance and an earlier payoff date compared to the standard repayment plan. These figures are approximate and would vary based on the exact interest rate and compounding calculations.

Avoiding Student Loan Debt Traps

Navigating the world of student loans requires careful planning and a keen awareness of potential pitfalls. Many students unintentionally fall into debt traps due to a lack of understanding about loan terms, responsible borrowing practices, and the long-term consequences of default. This section will highlight common mistakes and offer strategies to avoid them.

Understanding the potential consequences of poor financial decisions regarding student loans is crucial for responsible borrowing. Failure to manage student loan debt effectively can have serious repercussions, impacting credit scores, financial stability, and overall well-being.

Common Student Loan Mistakes

Failing to fully understand the terms and conditions of your loan, borrowing more than necessary, and neglecting diligent repayment are among the most frequent mistakes students make. These actions can lead to accumulating substantial debt and facing significant financial challenges later in life. For example, a student might take out the maximum loan amount available without considering their future earning potential, leading to overwhelming debt after graduation. Another common error is choosing a repayment plan without carefully considering its long-term implications on their budget.

Responsible Borrowing and Budgeting Strategies

Creating a realistic budget is paramount. This involves meticulously tracking expenses, identifying areas for potential savings, and prioritizing essential needs. By accurately estimating living expenses and loan repayments, students can determine a responsible borrowing amount that aligns with their financial capabilities. For instance, a student could use budgeting apps or spreadsheets to monitor their income and expenses, ensuring they have sufficient funds for loan repayments while maintaining a comfortable lifestyle. Another crucial strategy is to explore all available financial aid options, including grants and scholarships, before resorting to loans. This reduces the overall loan burden and minimizes the risk of over-borrowing.

Consequences of Student Loan Default

Defaulting on student loans carries severe consequences, including damaged credit scores, wage garnishment, and potential legal action. A damaged credit score makes it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment means a portion of a borrower’s income is directly seized by the lender to repay the debt. In extreme cases, legal action can result in further financial penalties and even legal judgments. For example, a student who defaults on a $50,000 loan might experience a significant drop in their credit score, making it difficult to secure a mortgage or auto loan for years to come. They could also face the legal ramifications of wage garnishment, impacting their ability to meet their basic living expenses. The long-term financial and personal implications of default underscore the importance of proactive loan management.

Alternative Funding Options

Securing funding for higher education often involves more than just student loans. Exploring alternative financing methods can significantly reduce reliance on loans and potentially lessen the long-term financial burden. These options offer diverse avenues to cover educational expenses, minimizing the need for substantial borrowing.

Many students successfully fund their education through a combination of loans and alternative sources. Understanding these alternatives and proactively searching for them can make a substantial difference in your overall financial planning for college. A strategic approach to securing funding, incorporating both loans and alternative options, can create a more manageable financial picture for students.

Scholarships and Grants

Scholarships and grants represent forms of financial aid that don’t require repayment. Scholarships are typically merit-based, awarded to students who demonstrate academic excellence, athletic prowess, or other exceptional talents. Grants, on the other hand, are often need-based, provided to students who demonstrate financial hardship. Both offer significant financial relief, reducing the overall cost of education.

Advantages and Disadvantages of Alternative Funding Compared to Student Loans

Compared to student loans, scholarships and grants offer the clear advantage of not incurring debt. This avoids the long-term financial obligations, interest payments, and potential difficulties associated with loan repayment. However, securing scholarships and grants can be competitive, requiring extensive research and application efforts. The amount awarded may not fully cover the cost of education, potentially requiring supplementary funding through other means. Student loans, while generating debt, provide a more reliable source of funding, though with significant long-term implications.

Resources for Finding Scholarships and Grants

Finding scholarships and grants requires proactive searching and diligent application. Numerous resources are available to assist students in this process.

- Federal Student Aid (FAFSA): The Free Application for Federal Student Aid is the primary gateway to federal grants and loans, often providing a list of potential scholarships based on your eligibility. It’s crucial to complete this application accurately and on time.

- College Websites: Most colleges and universities maintain comprehensive scholarship databases specific to their institution. Reviewing your chosen institution’s financial aid website is a crucial first step.

- Scholarship Search Engines: Several online platforms specialize in compiling and indexing scholarships from various sources. These engines allow students to filter by criteria such as major, academic achievement, and demographic background. Examples include Fastweb, Scholarships.com, and Peterson’s.

- Professional Organizations: Many professional organizations offer scholarships to students pursuing careers in their respective fields. Research organizations related to your intended major for potential opportunities.

- Local and Community Organizations: Local businesses, community groups, and religious organizations frequently offer scholarships to students within their communities. Check with local organizations and community centers for available opportunities.

Financial Literacy and Planning

Navigating the complexities of student loans requires a strong foundation in financial literacy and careful planning. Understanding your personal finances, budgeting effectively, and tracking your income and expenses are crucial steps in managing your debt responsibly and achieving your financial goals. Failing to plan can lead to unforeseen financial difficulties, impacting your academic performance and overall well-being.

Effective budgeting is the cornerstone of sound financial management. A well-structured budget helps you allocate your resources efficiently, ensuring you can cover essential expenses while saving for future needs. Tracking your income and expenses provides a clear picture of your financial situation, enabling you to identify areas where you can save money or adjust your spending habits. This proactive approach allows for informed decision-making regarding loan repayment and overall financial stability.

Creating a Personal Budget

A personal budget is a plan that Artikels your expected income and expenses over a specific period, typically a month. The process involves listing all sources of income, such as part-time jobs, scholarships, grants, and student loan disbursements, and then detailing all anticipated expenses, including tuition, housing, food, transportation, books, and personal items. The goal is to ensure your income exceeds your expenses, creating a positive cash flow. Regularly reviewing and adjusting your budget based on your actual spending habits is crucial for maintaining financial control. Unexpected expenses should be incorporated into contingency planning.

Tracking Income and Expenses Related to Education

Tracking income and expenses related to your education involves meticulously recording every financial transaction. This includes documenting the amount and source of your income, such as scholarship payments, work-study earnings, or financial aid disbursements. Similarly, it requires detailed recording of all educational expenses, such as tuition fees, textbook costs, accommodation charges, and transportation costs. Many budgeting apps and spreadsheets can facilitate this process. By maintaining accurate records, you can gain a clear understanding of your financial inflows and outflows, helping you identify potential areas for cost savings and budget adjustments. This detailed tracking also provides valuable information when applying for financial aid or negotiating repayment plans with lenders.

Sample Budget Template

A simple budget template can be created using a spreadsheet or budgeting app. It should include columns for income sources, dates of receipt, and total income. A separate section should list expenses, categorized for clarity (e.g., tuition, housing, food, transportation, books, entertainment, personal care). Each expense should include a description, date, and amount. The template should also calculate the difference between total income and total expenses to determine the monthly surplus or deficit.

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Tuition | $5,000 | $5,000 | $0 |

| Housing | $1,000 | $950 | $50 |

| Food | $400 | $450 | -$50 |

| Transportation | $200 | $220 | -$20 |

| Books & Supplies | $300 | $280 | $20 |

| Personal Expenses | $200 | $180 | $20 |

| Total Expenses | $7,100 | $7,080 | $20 |

| Income (e.g., Loan Disbursement, Part-time Job) | $8,000 | $8,000 | $0 |

| Net Surplus/Deficit | $900 | $920 | $20 |

Remember to adjust your budget regularly to reflect changes in your income or expenses. Consistent monitoring and adjustments are key to successful budget management.

Understanding Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to incentivize individuals to pursue careers in public service or other high-need fields, often where salaries are lower than those in the private sector. Understanding the eligibility criteria and application processes is crucial for those hoping to benefit from these opportunities.

Public Service Loan Forgiveness (PSLF) Program Criteria

The Public Service Loan Forgiveness (PSLF) program is perhaps the most well-known loan forgiveness program. It forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Crucially, “qualifying” is key here. A qualifying employer includes government organizations at the federal, state, local, or tribal level, as well as certain non-profit organizations. The type of loan must also be a Direct Loan; Federal Family Education Loan (FFEL) Program loans and Perkins Loans are generally ineligible unless consolidated into a Direct Consolidation Loan before the 120 payments begin. Furthermore, the payments must be made on time and under an income-driven repayment plan. Failure to meet any of these criteria can disqualify an applicant from forgiveness.

The PSLF Application Process

The application process for PSLF involves several steps. First, borrowers must consolidate their federal student loans into a Direct Consolidation Loan if they have FFEL Program loans or Perkins Loans. Next, they must complete an Employment Certification Form annually, confirming their employment with a qualifying employer. This form requires the employer’s signature and verification. Finally, after making 120 qualifying monthly payments, borrowers submit a PSLF application to the Department of Education. Thorough documentation is critical throughout the entire process. Incomplete or inaccurate applications can significantly delay or even prevent forgiveness.

Professions Eligible for Loan Forgiveness

Many professions are eligible for loan forgiveness programs, particularly those within the public sector and non-profit organizations. Examples include teachers, nurses, social workers, and members of the military. Specifically, teachers working in low-income schools or districts often qualify for state or federal loan forgiveness programs. Similarly, nurses employed in underserved communities or rural areas might find loan forgiveness opportunities. Social workers serving vulnerable populations, and military personnel fulfilling their service obligations, also frequently benefit from these programs. The specific eligibility criteria vary depending on the program and the employer. It is essential to research the requirements of individual programs to determine eligibility.

Final Thoughts

Securing a student loan is a significant financial undertaking, requiring careful planning and understanding. By carefully considering the various loan types, eligibility requirements, and repayment options, you can make informed decisions that align with your financial situation and educational goals. Remember, responsible borrowing and proactive financial planning are crucial for managing your student loan debt effectively and achieving long-term financial well-being. Don’t hesitate to explore all available resources and seek professional advice when needed.

FAQ Compilation

What is the difference between a subsidized and unsubsidized federal loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout the entire loan period.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payments, but it often involves private lenders and may lose federal protections.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, lead to wage garnishment, and impact your ability to obtain future loans or credit.

How long does it take to get approved for a student loan?

Processing times vary depending on the lender and type of loan. Federal loans generally take a few weeks, while private loans can take longer.

What if I can’t afford my student loan payments?

Contact your lender immediately. They may offer deferment, forbearance, or an income-driven repayment plan.