Navigating the complexities of student loan repayment can feel overwhelming, but understanding the student loan interest deduction offers a potential pathway to significant tax savings. This deduction allows eligible taxpayers to reduce their taxable income by the amount of interest they paid on qualified student loans during the tax year. This guide will explore the intricacies of this deduction, helping you determine your eligibility, calculate your potential savings, and avoid common pitfalls.

We’ll cover everything from eligibility requirements and maximum deduction amounts to the impact of different tax brackets and strategies for accurate record-keeping. Through clear explanations, practical examples, and helpful resources, we aim to demystify the process, empowering you to confidently claim this valuable tax benefit.

Understanding the Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. It’s a valuable benefit for those struggling to repay student loans.

Eligibility Requirements for the Student Loan Interest Deduction

To claim the student loan interest deduction, you must meet several criteria. First, the student loans must be taken out by you (or your spouse, if married filing jointly) to pay for qualified education expenses, such as tuition, fees, room, and board. These expenses must be for yourself, your spouse, or a dependent. The loans must be used to pay for higher education at an eligible educational institution. Importantly, you must be legally obligated to repay the loan, and the interest must be paid during the tax year. Finally, your modified adjusted gross income (MAGI) must be below a certain limit (detailed in the table below). If you are claimed as a dependent on someone else’s return, you cannot claim this deduction.

Maximum Deductible Amount of Student Loan Interest

The maximum amount of student loan interest you can deduct is $2,500 per year. This limit applies regardless of how much interest you actually paid. If you paid more than $2,500 in student loan interest, you can only deduct the $2,500 maximum. This deduction is an above-the-line deduction, meaning it’s subtracted from your gross income before calculating your adjusted gross income (AGI). This makes it particularly beneficial as it can lower your taxable income more effectively than some itemized deductions.

Claiming the Student Loan Interest Deduction on Your Tax Return

Claiming the deduction is relatively straightforward. First, gather all your student loan interest statements (Form 1098-E) from your lender(s). These statements detail the amount of interest you paid during the year. Next, complete Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), even if you aren’t claiming an education credit. Section 2 of this form is where you’ll claim the student loan interest deduction. Carefully enter the amount of interest paid on line 20. This amount will then be transferred to your 1040 form. Finally, file your tax return as usual.

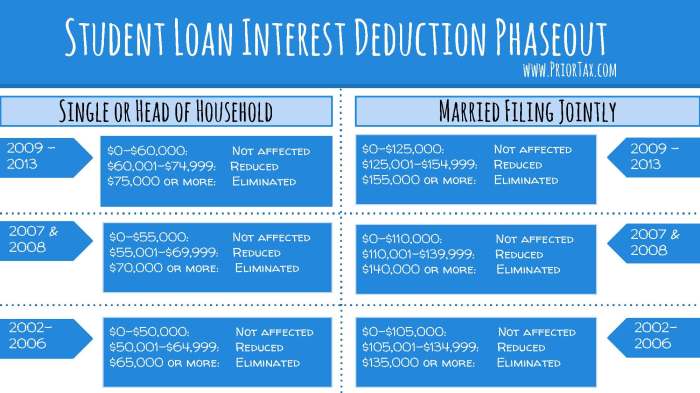

Deduction Limits Based on Filing Status

The deduction is phased out for higher-income taxpayers. The phase-out range varies depending on your filing status. The following table summarizes the modified adjusted gross income (MAGI) thresholds for the 2023 tax year:

| Filing Status | Phase-out Begins | Phase-out Ends |

|---|---|---|

| Single | $70,000 | $85,000 |

| Married Filing Jointly | $140,000 | $170,000 |

| Head of Household | $95,000 | $115,000 |

Note: These are the limits for the 2023 tax year. These limits can change annually, so it’s crucial to consult the most up-to-date IRS guidelines.

Calculating the Deductible Interest

Calculating the student loan interest deduction involves determining the amount of interest you paid during the tax year that’s eligible for the deduction. This deduction can significantly reduce your taxable income, resulting in a lower tax bill. However, understanding the limitations and how to handle multiple loans is crucial for accurate calculation.

Deductible Interest Calculation: A Hypothetical Example

Let’s consider two scenarios to illustrate how to calculate deductible interest. In both, we’ll assume the maximum deduction allowed is $2,500.

Scenario 1: Sarah paid $1,800 in student loan interest on a single loan with a principal balance of $20,000 and an interest rate of 6%. Since her interest payment ($1,800) is less than the maximum deduction ($2,500), she can deduct the full $1,800.

Scenario 2: John paid $3,200 in student loan interest on a single loan. Even though he paid more than the maximum allowed, he can only deduct $2,500. The remaining $700 is not deductible.

Limitations on the Deduction

The student loan interest deduction is subject to several limitations. For instance, the deduction is limited to the actual amount of interest paid during the tax year, and it cannot exceed the maximum deduction amount set by the IRS (which may change yearly). Furthermore, the deduction is only available if you are legally obligated to pay the loan, and you are not claimed as a dependent on someone else’s tax return. Finally, your modified adjusted gross income (MAGI) might affect your eligibility or the amount you can deduct; high-income taxpayers may face reduced or no deduction.

Handling Multiple Student Loans

When you have multiple student loans, calculating the deductible interest involves summing the interest paid on all loans. For example, if you paid $1,200 on one loan and $800 on another, your total interest paid is $2,000. As long as this amount is less than the maximum deduction, you can deduct the full $2,000. If the total exceeds the maximum, you can only deduct the maximum allowed.

Flowchart for Calculating Deductible Student Loan Interest

The following describes a flowchart illustrating the process:

1. Start: Determine the total amount of student loan interest paid during the tax year.

2. Check Maximum Deduction: Compare the total interest paid to the current maximum allowable deduction.

3. Deduction Amount: If the total interest paid is less than or equal to the maximum deduction, the deduction amount is equal to the total interest paid. Otherwise, the deduction amount is equal to the maximum deduction.

4. Check MAGI: Verify if your Modified Adjusted Gross Income (MAGI) meets the requirements for the deduction. If not, the deduction might be reduced or eliminated.

5. Check Eligibility: Confirm you meet all eligibility requirements (e.g., legally obligated to repay, not claimed as a dependent). If not, the deduction is unavailable.

6. End: Report the determined deduction amount on your tax return. The flowchart visually represents the decision-making process, guiding taxpayers through the steps required to accurately calculate their student loan interest deduction. Remember to always consult the latest IRS guidelines for the most up-to-date information.

Impact of Different Tax Brackets

The student loan interest deduction, while beneficial, doesn’t provide the same level of tax savings for everyone. The actual amount you save depends significantly on your tax bracket – the higher your taxable income, the greater the potential benefit. This is because the deduction reduces your taxable income, thereby lowering the overall amount of tax you owe. However, the percentage reduction in tax will vary depending on your marginal tax rate.

The student loan interest deduction reduces your taxable income dollar for dollar. This means that for every dollar of student loan interest you deduct, your taxable income is reduced by one dollar. The resulting tax savings, however, are calculated based on your marginal tax rate – the tax rate applied to your highest income bracket. A higher marginal tax rate translates to greater tax savings from the deduction.

Tax Savings Across Different Tax Brackets

The following table illustrates how the tax savings from a $1,000 student loan interest deduction vary depending on the taxpayer’s marginal tax rate. These are illustrative examples and actual tax brackets and rates can change annually. It is crucial to consult the current IRS guidelines for the most accurate information.

| Taxable Income Range (Example) | Marginal Tax Rate (Example) | Student Loan Interest Deduction | Tax Savings |

|---|---|---|---|

| $20,000 – $40,000 | 12% | $1,000 | $120 ($1,000 x 0.12) |

| $40,000 – $89,075 | 22% | $1,000 | $220 ($1,000 x 0.22) |

| $89,076 – $170,050 | 24% | $1,000 | $240 ($1,000 x 0.24) |

| $170,051 – $215,950 | 32% | $1,000 | $320 ($1,000 x 0.32) |

Comparison with Other Student Tax Benefits

The student loan interest deduction is just one of several tax benefits available to students. Other benefits, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), offer different types of tax relief related to education expenses. The AOTC is a credit that can reduce your tax liability by up to $2,500, while the LLC provides a smaller credit for qualified education expenses. The relative value of these credits versus the deduction depends on individual circumstances, including income level and the amount of qualified education expenses. For example, a higher-income individual might find the student loan interest deduction more beneficial, while a lower-income individual with significant qualified education expenses might benefit more from the AOTC or LLC. It’s important to consider all applicable tax benefits to maximize your savings.

Record Keeping and Documentation

Claiming the student loan interest deduction requires meticulous record-keeping. The IRS needs proof you paid the interest and the amount you paid. Failing to maintain accurate records can result in a denied deduction or even an audit. Proper organization will simplify the tax filing process and ensure you receive the full benefit of this deduction.

Careful record-keeping is crucial for successfully claiming the student loan interest deduction. The IRS requires substantial documentation to verify your claim. Without sufficient evidence, your deduction may be disallowed, leading to a higher tax liability. Proactive organization and storage of relevant documents will minimize stress during tax season and help avoid potential complications.

Necessary Documentation for Student Loan Interest Deduction

To support your student loan interest deduction, gather the following documents. These documents serve as irrefutable evidence to the IRS of your eligible payments. Keep them readily accessible for easy retrieval during tax preparation.

- Form 1098-E, Student Loan Interest Statement: This form, issued by your lender, details the total amount of student loan interest you paid during the tax year. It’s the primary document the IRS uses to verify your deduction.

- Student Loan Payment Records: These records, typically obtained from your lender’s online account or monthly statements, show the payment dates and amounts paid towards your student loans. They corroborate the information on Form 1098-E and provide a detailed history of your payments.

- Copy of Your Tax Return from the Previous Year: In case of discrepancies or audits, having your previous tax return helps establish a consistent history of claiming the deduction (if applicable).

- Supporting Documentation for Unusual Circumstances: If you faced any unusual circumstances affecting your student loan payments (e.g., forbearance, deferment), maintain supporting documentation from your lender to explain any discrepancies between your payments and the amount reported on Form 1098-E.

Best Practices for Organizing and Storing Student Loan Interest Payment Records

Efficiently organizing your student loan interest payment records is essential for a smooth tax filing process. A well-organized system minimizes the time spent searching for documents during tax season and reduces the risk of errors or omissions. Consider implementing these strategies:

- Digital Organization: Create a dedicated folder on your computer or cloud storage service to store digital copies of all relevant documents. This ensures easy access and creates a backup in case of physical loss.

- Physical Filing System: If you prefer physical storage, use a labeled file folder to keep all your student loan documents organized. A clearly labeled folder for each tax year is recommended.

- Regular Updates: Maintain your records regularly throughout the year. As soon as you receive a statement or make a payment, immediately file it in your chosen system.

- Data Backup: For digital records, regularly back up your data to an external hard drive or cloud storage to protect against data loss.

Common Mistakes and Pitfalls

Claiming the student loan interest deduction, while beneficial, can be fraught with potential errors. Understanding these common pitfalls and implementing preventative strategies is crucial to ensure a successful and accurate tax filing. Failure to do so can result in delays, penalties, and ultimately, a smaller refund or a larger tax bill.

Many taxpayers inadvertently make mistakes when claiming this deduction, often due to a lack of understanding of the specific requirements or simply oversight. These errors can range from minor inaccuracies to more significant omissions that invalidate the entire claim. The following sections will detail some of the most frequent mistakes and offer guidance on how to avoid them.

Incorrect Reporting of Interest Paid

Incorrectly reporting the amount of student loan interest paid is a common error. This can stem from misinterpreting your loan statements, failing to account for all interest paid during the year, or including payments that aren’t actually interest. For example, some loan payments might include principal and interest; only the interest portion is deductible. Accurate record-keeping, as previously discussed, is vital to avoid this issue. Using the correct form (Form 1098-E) and double-checking the figures against your loan statements can significantly reduce this risk.

Exceeding the Maximum Deduction Limit

The student loan interest deduction is limited to the actual interest paid, up to a maximum amount set annually by the IRS. Failing to account for this limit is a common mistake. Even if you paid more in student loan interest than the limit, you can only deduct up to the maximum allowed. For example, if the maximum deduction is $2,500 and you paid $3,000 in interest, you can only deduct $2,500. Exceeding this limit will not result in a larger deduction.

Failing to Meet the Modified Adjusted Gross Income (MAGI) Requirements

The student loan interest deduction is subject to income limitations. Taxpayers whose Modified Adjusted Gross Income (MAGI) exceeds a certain threshold are not eligible for the deduction. This threshold changes annually and is based on filing status (single, married filing jointly, etc.). Failing to check your MAGI against the current IRS guidelines is a significant oversight. If your MAGI exceeds the limit, claiming the deduction will result in its disallowance upon audit.

Inaccurate Filing Status

The maximum deduction amount and MAGI thresholds for the student loan interest deduction vary based on filing status. Claiming the deduction using the incorrect filing status will likely result in an incorrect deduction amount. For instance, a married couple filing jointly may have a higher MAGI limit than individuals filing separately, leading to a different deductible amount. Double-checking your filing status and ensuring consistency across all tax forms is crucial.

Strategies to Avoid Common Mistakes

To avoid these pitfalls, consider the following strategies:

- Maintain meticulous records of all student loan payments throughout the year. Keep copies of your loan statements and any other documentation that shows the interest paid.

- Review the IRS guidelines for the student loan interest deduction annually to ensure you understand the current limitations and requirements.

- Use tax preparation software or consult a tax professional to help you accurately complete your tax return and claim the deduction.

- Double-check all figures and ensure consistency between your loan statements and your tax return.

- If unsure about any aspect of the deduction, seek professional tax advice.

Alternatives to the Student Loan Interest Deduction

While the student loan interest deduction offers tax relief, it’s not the only avenue for managing student loan debt. Several other programs and strategies can help reduce the overall cost of repayment. Understanding these alternatives allows borrowers to choose the most effective approach based on their individual circumstances. This section will explore some key options and compare them to the student loan interest deduction.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable, especially during periods of lower income. Several IDR plans exist, each with slightly different eligibility requirements and payment calculation methods. These plans often lead to loan forgiveness after a specified period of qualifying payments, typically 20 or 25 years, though the forgiven amount may be considered taxable income. The benefit lies in affordability; the drawback is the extended repayment period and potential tax liability upon forgiveness.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can reduce your overall interest payments and shorten your repayment timeline. However, refinancing typically removes federal protections, such as income-driven repayment plans and loan forgiveness programs. It’s crucial to carefully compare rates and terms from multiple lenders before refinancing. The benefit is lower interest payments and potentially faster repayment; the drawback is the loss of federal protections.

Public Service Loan Forgiveness (PSLF)

PSLF is a federal program that forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. This program is specifically designed for those pursuing careers in public service. Eligibility requirements are stringent, and the process can be complex. The benefit is potential complete loan forgiveness; the drawback is the lengthy repayment period and strict eligibility criteria.

Comparison of Options

| Option | Monthly Payment Impact | Interest Savings | Eligibility |

|---|---|---|---|

| Student Loan Interest Deduction | Indirectly reduces taxable income, lowering tax liability | Reduces total interest paid through lower taxes | Tax filers with student loan interest |

| Income-Driven Repayment | Significantly lowers monthly payments | Potentially lower total interest paid, but extended repayment | Federal student loan borrowers |

| Student Loan Refinancing | Potentially lower monthly payments depending on new rate | Reduced total interest paid due to lower interest rate | Borrowers with good credit |

| Public Service Loan Forgiveness (PSLF) | Potentially lower monthly payments depending on IDR plan used | Total loan forgiveness after 120 qualifying payments | Federal student loan borrowers working full-time for qualifying employer |

Concluding Remarks

Successfully navigating the student loan interest deduction requires careful planning and accurate record-keeping. By understanding the eligibility criteria, mastering the calculation process, and avoiding common mistakes, you can maximize your tax savings and effectively manage your student loan debt. Remember to consult with a tax professional if you have complex financial situations or require personalized guidance. Taking proactive steps to understand and utilize this deduction can make a substantial difference in your overall financial well-being.

Key Questions Answered

Can I deduct interest on loans used for undergraduate and graduate studies?

Yes, the deduction applies to interest paid on loans for both undergraduate and graduate studies.

What if I paid off my student loans early?

You can still deduct the interest you paid, even if you paid off the loan before the end of the tax year.

What happens if my AGI exceeds the limit for the deduction?

The deduction may be reduced or eliminated depending on your Modified Adjusted Gross Income (MAGI). Consult the IRS guidelines for the current year’s limits.

Do I need to itemize to claim this deduction?

Yes, the student loan interest deduction is an itemized deduction, so you cannot claim it if you use the standard deduction.

Where can I find Form 8863 (Education Credits)?

You can download Form 8863 from the IRS website (irs.gov).