Navigating the complexities of student loan repayment can feel overwhelming, but understanding the student loan interest deduction can significantly ease the financial burden. This deduction offers a valuable tax break to eligible borrowers, potentially reducing their overall tax liability. This guide provides a comprehensive overview of the deduction, covering eligibility requirements, calculation methods, relevant tax forms, and potential pitfalls to avoid.

We’ll explore various scenarios, demonstrating how the deduction applies to different income levels and filing statuses. By the end, you’ll possess the knowledge to confidently calculate your deduction and maximize your tax savings. We’ll also address common misconceptions and provide practical advice to ensure a smooth and accurate claim process.

Understanding the Student Loan Interest Deduction

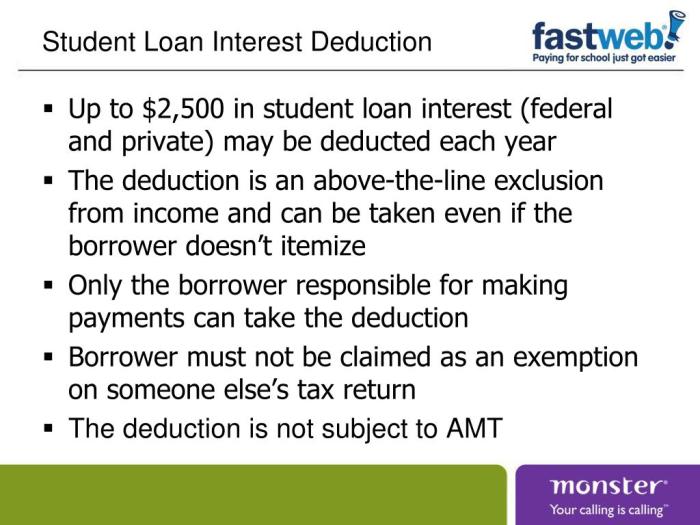

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. It’s a valuable benefit for those struggling to repay student loans, offering some much-needed financial relief.

Eligibility Requirements for the Student Loan Interest Deduction

To claim the student loan interest deduction, you must meet several criteria. First, the student loans must be taken out by you to pay for qualified education expenses—tuition, fees, room and board—for yourself, your spouse, or a dependent. Secondly, you must be legally obligated to repay the loans. This means you can’t deduct interest on loans that have been forgiven or discharged. Thirdly, your modified adjusted gross income (MAGI) must be below a certain threshold. This threshold varies annually and is adjusted for inflation. Finally, you must itemize your deductions on your tax return; the student loan interest deduction cannot be claimed using the standard deduction.

Maximum Deductible Amount of Student Loan Interest

The maximum amount of student loan interest you can deduct is $2,500 per tax year, regardless of how much interest you actually paid. This limit applies even if you paid significantly more in interest. It’s important to note that this is a deduction, not a credit, meaning it reduces your taxable income rather than directly reducing your tax liability by a fixed dollar amount. For example, if you paid $3,000 in student loan interest, you can only deduct $2,500.

Claiming the Student Loan Interest Deduction on Your Tax Return

Claiming the deduction is relatively straightforward. First, gather all your Form 1098-E, Student Loan Interest Statements. This form will list the total amount of student loan interest you paid during the year. Next, complete Schedule 1 (Additional Income and Adjustments to Income) of Form 1040. You’ll enter the amount from Form 1098-E on the appropriate line. Finally, ensure you itemize your deductions on your tax return instead of taking the standard deduction, as the student loan interest deduction is an itemized deduction. If your itemized deductions exceed the standard deduction, you’ll benefit from claiming this deduction.

Comparison of the Student Loan Interest Deduction with Other Education Tax Benefits

The student loan interest deduction is just one of several tax benefits available to help with education expenses. Here’s a comparison:

| Tax Benefit | Description | Maximum Benefit | Eligibility Requirements |

|---|---|---|---|

| Student Loan Interest Deduction | Deduction for student loan interest paid | $2,500 | Must itemize, meet MAGI limits, and pay interest on qualified education loans. |

| American Opportunity Tax Credit (AOTC) | Credit for qualified education expenses | Up to $2,500 | Student must be pursuing a degree or other credential at an eligible educational institution, meet income limits, and be enrolled at least half-time. |

| Lifetime Learning Credit (LLC) | Credit for qualified education expenses | Up to $2,000 | Student can be pursuing an undergraduate or graduate degree, or taking courses to improve job skills, and meet income limits. |

Calculating the Deduction

Determining your student loan interest deduction involves understanding your filing status, adjusted gross income (AGI), and the amount of interest you paid during the tax year. The deduction is limited, and may be phased out entirely for higher earners. This section will walk through several examples to illustrate the calculation process.

Student Loan Interest Deduction Calculation Examples

The student loan interest deduction is calculated by subtracting your student loan interest payments from your gross income, up to a maximum deduction amount. This maximum is dependent on your filing status and AGI. The following examples demonstrate the calculation for various scenarios.

- Example 1: Single Filer, Low Income A single filer paid $1,000 in student loan interest during the tax year and has an AGI below the phaseout threshold. Their student loan interest deduction is $1,000.

- Example 2: Married Filing Jointly, Moderate Income A married couple filing jointly paid $2,500 in student loan interest. Their AGI is within the phaseout range. Let’s assume, for illustrative purposes, that their phaseout begins at $150,000 and their AGI is $160,000. The specific phaseout calculation will reduce their deduction. The exact reduction would depend on the IRS’s phaseout rules for that specific tax year, but it could result in a deduction less than $2,500. Consulting the IRS Publication 970 or a tax professional is crucial for accurate calculation in this scenario.

- Example 3: Single Filer, High Income A single filer paid $1,500 in student loan interest but has an AGI significantly above the phaseout threshold. In this case, their deduction may be reduced or eliminated entirely, depending on the specific phaseout rules and their AGI for that tax year. Again, referring to the IRS Publication 970 is recommended for precise calculation.

- Example 4: Married Filing Jointly, High Interest Paid A married couple filing jointly paid $4,000 in student loan interest. Even if their AGI is below the phaseout threshold, their deduction is limited to a maximum amount (which varies yearly, consult the IRS Publication 970 for the current year’s limit). They can only deduct up to this maximum amount, even if they paid more in interest.

Deduction Limitations and Phase-Outs

The student loan interest deduction is subject to limitations and phase-outs based on your modified adjusted gross income (MAGI) and filing status. The IRS sets annual limits on the amount of interest that can be deducted. Additionally, the deduction is phased out for taxpayers with MAGIs above certain thresholds. These thresholds vary depending on your filing status (single, married filing jointly, etc.) and are adjusted annually for inflation. For instance, a single filer might see their deduction reduced or eliminated entirely if their MAGI exceeds a specified amount. A married couple filing jointly will have a different, higher, MAGI threshold before the phase-out begins. It’s crucial to consult the most recent IRS Publication 970 or a tax professional to determine the current year’s limits and phase-out ranges. Failure to account for these limitations could lead to an inaccurate deduction calculation.

Tax Forms and Documentation

Claiming the student loan interest deduction requires careful attention to the necessary tax forms and supporting documentation. Accurate completion of these forms is crucial to ensure the IRS processes your deduction correctly and avoids potential delays or complications. Failure to provide the correct documentation can result in the rejection of your claim.

The primary tax form used to claim the student loan interest deduction is Form 1040, U.S. Individual Income Tax Return. Specifically, you’ll use Schedule 1 (Additional Income and Adjustments to Income) to report the deduction. Form 1098-E, Student Loan Interest Statement, provides the necessary information to complete this section of your tax return.

Form 1040 and Schedule 1

Form 1040 is the main tax form used to file your income taxes. Schedule 1 is where you’ll report various adjustments to income, including the student loan interest deduction. To claim the deduction, you’ll enter the total amount of student loan interest you paid during the tax year on line 21 of Schedule 1. This amount should match the information reported on your Form 1098-E. The instructions for Form 1040 and Schedule 1 provide detailed guidance on how to accurately complete this section of your tax return. Remember to keep a copy of your completed tax return and all supporting documentation for your records.

Form 1098-E: Student Loan Interest Statement

Form 1098-E is issued by your lender and reports the amount of student loan interest you paid during the tax year. This form is essential for supporting your student loan interest deduction claim. It contains key information, including the payer’s name and tax identification number, the borrower’s name and social security number, and the total amount of interest paid. Carefully review this form to ensure the information is accurate. If you believe there’s an error, contact your lender immediately to resolve it before filing your tax return. Discrepancies between the information on Form 1098-E and the amount you claim on your tax return could lead to delays or rejection of your claim.

Sample Tax Form Section

Let’s imagine a simplified example of how the student loan interest deduction would appear on Schedule 1 of Form 1040. Assume John paid $1,500 in student loan interest during the tax year and received Form 1098-E confirming this amount. On Schedule 1, line 21 (Adjusted Gross Income), he would enter “$1,500” in the space provided for “Student Loan Interest.” This reduces his adjusted gross income, potentially lowering his overall tax liability. This number should precisely match the amount stated on his Form 1098-E.

Necessary Documentation

Beyond Form 1098-E, maintaining accurate records of your student loan payments is crucial. This includes copies of your monthly statements, payment confirmations, and any correspondence with your lender regarding your student loan interest payments. While Form 1098-E is sufficient for most cases, retaining additional documentation serves as valuable backup in case of any discrepancies or audits. These records should be kept for at least three years after filing your tax return, or longer if amended returns are filed.

Impact of the Deduction on Tax Liability

The student loan interest deduction can significantly reduce a taxpayer’s tax liability, but the extent of the reduction depends on several factors, primarily their income and the amount of interest paid. Understanding how this deduction interacts with different income brackets is crucial for accurately assessing its impact.

The deduction lowers taxable income by the amount of student loan interest paid, up to the maximum allowed. This directly translates to a lower tax bill because you’re paying taxes on a smaller income. The magnitude of the savings increases with higher tax brackets, as the marginal tax rate—the tax rate applied to the next dollar earned—is higher. Conversely, individuals in lower tax brackets will see a smaller reduction in their tax liability.

Tax Liability Comparison Across Income Levels

The following table illustrates the potential impact of the student loan interest deduction on tax liability for various income levels, assuming a standard deduction and a $1,000 student loan interest payment. Note that these are simplified examples and do not account for all possible tax situations or deductions. Actual tax liability will vary based on individual circumstances and applicable tax laws.

| Adjusted Gross Income (AGI) | Tax Bracket (Example) | Tax Liability Without Deduction (Example) | Tax Liability With Deduction (Example) | Deduction Savings (Example) |

|---|---|---|---|---|

| $40,000 | 12% | $4,000 | $3,880 | $120 |

| $80,000 | 22% | $12,000 | $11,120 | $880 |

| $120,000 | 24% | $20,000 | $19,040 | $960 |

Consequences of Incorrect Deduction Claiming

Claiming the student loan interest deduction incorrectly can lead to several negative tax implications. For example, claiming an amount exceeding the actual interest paid or exceeding the maximum allowed deduction could result in an amended tax return and potential penalties. The IRS may assess penalties for underpayment of taxes due to an inaccurate deduction, including interest charges on the unpaid tax amount. In severe cases, intentional misrepresentation could lead to more significant penalties and legal repercussions. Accurate record-keeping and a thorough understanding of the deduction’s rules are essential to avoid these potential problems. Consult a tax professional if you are unsure about any aspect of the deduction.

Common Mistakes and Pitfalls

Claiming the student loan interest deduction accurately requires careful attention to detail. Many taxpayers inadvertently make errors that can lead to delays in processing their returns or even disallowance of the deduction. Understanding these common mistakes and implementing preventative strategies is crucial for a smooth tax filing experience.

Incorrectly Reporting Loan Information

Errors in reporting student loan interest paid are frequent. Taxpayers might mistakenly include payments that aren’t qualified student loan interest, such as payments made towards principal, late fees, or prepayment penalties. They might also misreport the total amount paid during the year. To avoid this, meticulously maintain records of all student loan payments, clearly distinguishing between principal and interest. Obtain a Form 1098-E, Student Loan Interest Statement, from your lender; this form provides a summary of the interest paid, which can be used as a cross-reference for your records. Discrepancies between your records and the Form 1098-E should be investigated and resolved before filing your tax return.

Exceeding the Maximum Deduction Limit

The student loan interest deduction is limited to the actual amount of interest paid, up to a maximum amount set by the IRS annually. For the 2023 tax year, this limit is $2,500. Many taxpayers overlook this limitation, attempting to deduct more than the allowed maximum. This error can result in the rejection of the entire deduction or a partial reduction. To prevent this, always check the current IRS guidelines for the annual limit before claiming the deduction. If you paid more than the maximum, only claim the maximum allowable amount.

Failing to Meet Eligibility Requirements

The student loan interest deduction is subject to several eligibility requirements, including modified adjusted gross income (MAGI) limits. These limits vary depending on your filing status. Taxpayers may incorrectly assume they meet the requirements without verifying their MAGI against the IRS thresholds. Furthermore, the deduction is only for interest paid on loans taken out for yourself, your spouse, or your dependent. Interest paid on loans for other individuals cannot be deducted. To avoid disqualification, carefully review the IRS guidelines on eligibility criteria and ensure you meet all requirements before claiming the deduction. If your MAGI exceeds the limit, you won’t qualify for the deduction.

Incorrect Filing Status

The maximum amount of student loan interest you can deduct depends on your filing status (single, married filing jointly, etc.). Using the wrong filing status on your tax return could lead to an incorrect calculation of the deduction. For example, if a married couple files separately, they might each claim a full $2,500 deduction, resulting in a total deduction exceeding the limit. Always accurately report your filing status on your tax return to ensure the correct deduction is applied.

Consequences of Incorrect Claims

Filing an inaccurate student loan interest deduction can result in several negative consequences. The IRS may issue a notice of deficiency, requiring you to pay additional taxes and penalties. These penalties can be significant and include interest charges on the unpaid taxes. In some cases, the IRS might initiate an audit, leading to further investigation and potential legal action. Accurate record-keeping and careful adherence to IRS guidelines are vital to avoid these issues.

Changes and Updates to the Student Loan Interest Deduction

The student loan interest deduction, while a valuable tax break for many, is subject to change. Understanding these potential shifts is crucial for accurate tax planning. Legislation and economic factors can influence the deduction’s availability, limits, and eligibility requirements. Staying informed is key to maximizing its benefit.

The student loan interest deduction, like many aspects of the tax code, is not static. Periodic reviews and potential legislative changes mean that the rules governing this deduction can evolve. These changes may affect the amount of the deduction, who is eligible, or even whether the deduction exists at all. Taxpayers need to be aware of these potential alterations to ensure they are claiming the deduction correctly and receiving the maximum benefit.

Potential Future Changes to the Deduction

Predicting future changes to the student loan interest deduction with certainty is impossible. However, considering historical trends and current economic climates, several scenarios are plausible. For instance, Congress might adjust the maximum deduction amount based on inflation or economic conditions. There could also be discussions about altering eligibility requirements, such as raising or lowering income thresholds. Alternatively, the deduction itself could face elimination as part of broader tax reform efforts. While no specific changes are currently guaranteed, understanding these possibilities allows for proactive tax planning.

Impact of Potential Changes on Taxpayers

Any changes to the student loan interest deduction would directly impact taxpayers’ tax liabilities. For example, a reduction in the maximum deduction amount would lessen the tax savings for eligible individuals. Similarly, increased income thresholds for eligibility could exclude more taxpayers from claiming the deduction. Conversely, an increase in the maximum deduction would provide greater tax relief. Taxpayers should monitor changes closely to assess their personal tax implications.

Resources for Staying Updated on Tax Law Changes

Staying abreast of changes to the tax code requires proactive engagement with reliable sources. Several resources provide timely updates on tax law modifications. These resources offer a variety of formats, from detailed legal analysis to concise summaries tailored for the average taxpayer.

- The Internal Revenue Service (IRS) website: The official source for all tax-related information, including frequent updates on tax law changes.

- Tax professional organizations: Groups such as the American Institute of CPAs (AICPA) and the National Association of Enrolled Agents (NAEA) provide analysis and guidance on tax law changes.

- Reputable financial news outlets: Major news sources often cover significant tax law updates and their implications.

- Tax software and preparation services: Many tax software programs and preparation services include updates reflecting the latest tax law changes.

Visual Representation of the Deduction Process

A flowchart provides a clear and concise way to visualize the steps involved in calculating and claiming the student loan interest deduction. This visual aid simplifies the process, making it easier to understand and follow. By breaking down the process into manageable steps, taxpayers can confidently navigate the deduction.

A flowchart would begin with a decision point: “Did you pay student loan interest?” If no, the process ends. If yes, the process continues. The next step would be to gather necessary documentation, such as Form 1098-E (Student Loan Interest Statement). Following this, the taxpayer would determine their adjusted gross income (AGI). Then, the calculation of the deduction itself would be shown: the actual student loan interest paid (up to the maximum allowed) would be compared to the AGI threshold (which varies yearly). The lesser of the two amounts becomes the deductible amount. This deductible amount is then entered on the appropriate line of Form 1040. The final step is filing the tax return with the supporting documentation.

Flowchart Illustration of Student Loan Interest Deduction Calculation

Imagine a flowchart with boxes and arrows. The first box would read “Did you pay student loan interest in the tax year?”. An arrow pointing to the right leads to a “YES” box, while an arrow pointing downwards leads to a “NO” box. The “NO” box would have an arrow pointing to “End of Process”. The “YES” box would lead to a box labeled “Gather Form 1098-E and other relevant documentation”. This box would connect to a box labeled “Determine your Adjusted Gross Income (AGI)”. This box then connects to a box labeled “Calculate the Deduction: The lesser of actual interest paid (up to the maximum allowed) or the AGI limit”. From here, an arrow leads to “Enter the deduction on Form 1040, Schedule 1 (Additional Income and Adjustments to Income)”. Finally, an arrow leads to a box “File your tax return with supporting documentation”, and then to “End of Process”.

Hypothetical Situation and Deduction Calculation

Let’s consider Sarah, a single taxpayer. In 2023, Sarah paid $2,500 in student loan interest. She received Form 1098-E confirming this amount. Sarah’s adjusted gross income (AGI) for 2023 was $70,000. For the 2023 tax year, the maximum student loan interest deduction was $2,500, and the AGI phaseout range for single filers started above $85,000. Since Sarah’s AGI is below the phaseout range, she can deduct the full amount she paid.

Therefore, Sarah can claim a $2,500 deduction for student loan interest on her 2023 tax return. This will reduce her taxable income by $2,500, resulting in a lower tax liability. The exact tax savings will depend on her applicable tax bracket.

The student loan interest deduction is calculated as the lesser of the actual student loan interest paid or the applicable AGI limit.

Ending Remarks

Successfully claiming the student loan interest deduction requires careful attention to detail and a thorough understanding of the applicable rules and regulations. By following the steps Artikeld in this guide and utilizing the provided resources, taxpayers can confidently navigate the process and reduce their tax burden. Remember to always maintain accurate records and consult with a tax professional if you have any specific questions or concerns regarding your individual circumstances. Understanding this deduction is key to responsible financial planning post-graduation.

FAQ Summary

Can I deduct interest paid on loans for graduate school?

Yes, as long as the loan was taken out for educational expenses.

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest paid during the tax year, regardless of when the loan was repaid.

Is there an income limit for claiming the student loan interest deduction?

Yes, the deduction may be limited or phased out depending on your modified adjusted gross income (MAGI).

Where can I find Form 1098-E?

Your lender should provide you with Form 1098-E, which reports the amount of student loan interest you paid during the year. You can also access it online through the IRS website.

What happens if I make a mistake on my tax return related to this deduction?

You may need to file an amended return to correct any errors. The IRS may also assess penalties and interest if the mistake results in an underpayment of taxes.