Navigating the complexities of student loan repayment can feel overwhelming, especially with a major lender like Sallie Mae. This guide provides a clear and concise overview of Sallie Mae student loans, from application to repayment strategies and long-term financial planning. We’ll explore various loan types, interest rates, repayment options, and potential challenges, equipping you with the knowledge to manage your student loan debt effectively.

Understanding your Sallie Mae loan is crucial for your financial future. This guide aims to demystify the process, providing practical advice and resources to help you make informed decisions and achieve your financial goals. Whether you’re a prospective borrower or already managing your loans, this comprehensive resource offers valuable insights and actionable steps.

Understanding Sallie Mae Student Loans

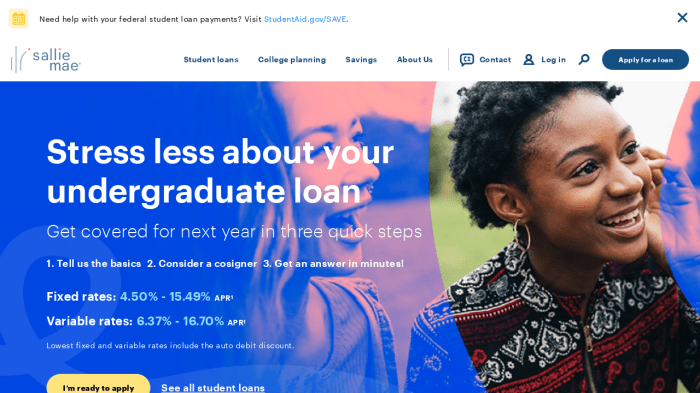

Sallie Mae, originally a government-sponsored entity, is now a private company offering a range of student loan products. Understanding the nuances of these loans is crucial for prospective borrowers to make informed decisions about financing their education. This section will detail the various loan types, interest rates, repayment options, and provide a comparison with federal loan programs.

Sallie Mae Loan Types

Sallie Mae offers several student loan products catering to different needs and financial situations. These loans typically fall under two main categories: private student loans and refinancing options. Private student loans are available to both undergraduate and graduate students, while refinancing options are geared towards those who already have existing student loan debt. The specific terms and conditions of each loan will vary depending on the applicant’s creditworthiness and other financial factors.

Interest Rates and Repayment Options

Interest rates for Sallie Mae loans are variable and depend on several factors, including the borrower’s credit score, the loan amount, and the loan term. Generally, borrowers with higher credit scores will qualify for lower interest rates. Repayment options typically include standard repayment plans (fixed monthly payments over a set period), graduated repayment plans (payments increase over time), and extended repayment plans (longer repayment periods leading to lower monthly payments but higher overall interest paid). Specific repayment options and their associated terms should be reviewed carefully on the Sallie Mae website or through a loan counselor.

Comparison with Federal Student Loan Programs

Sallie Mae private student loans differ significantly from federal student loan programs like those offered through the Department of Education. Federal loans often come with more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Federal loans also typically have lower interest rates than private loans, especially for borrowers with less-than-perfect credit. However, federal loans may have stricter eligibility requirements and may not cover the full cost of tuition. Choosing between federal and private loans depends heavily on individual circumstances and financial needs. Careful consideration of the pros and cons of each is crucial before making a decision.

Comparison of Sallie Mae Loan Products

| Loan Type | Interest Rate | Repayment Options | Borrower Protections |

|---|---|---|---|

| Private Student Loan (Undergraduate) | Variable, based on creditworthiness | Standard, Graduated, Extended | Limited; check specific loan terms |

| Private Student Loan (Graduate) | Variable, based on creditworthiness | Standard, Graduated, Extended | Limited; check specific loan terms |

| Refinancing Loan | Variable, based on creditworthiness and existing debt | Standard, potentially others depending on the loan | Limited; check specific loan terms |

| Parent Loan | Variable, based on parent’s creditworthiness | Standard, Graduated, Extended | Limited; check specific loan terms |

The Application Process

Applying for a Sallie Mae student loan involves several key steps, requiring careful attention to detail and accurate information. A successful application hinges on providing complete and verifiable documentation, understanding the credit check process, and diligently following the application instructions. This section Artikels the process to help prospective borrowers navigate it smoothly.

Required Documentation and Information

To complete your Sallie Mae student loan application, you’ll need to gather several essential documents and pieces of information. This ensures a timely and efficient processing of your application. Missing information can lead to delays. Generally, you will need to provide personal identification, such as your Social Security number and driver’s license. You’ll also need details about your enrollment at your chosen school, including your acceptance letter and details about your program of study. Finally, you’ll need to provide financial information, such as your income and assets, to help Sallie Mae assess your ability to repay the loan. The specific requirements may vary depending on the type of loan you’re applying for.

The Credit Check Process and Its Impact

Sallie Mae, like most lenders, conducts a credit check as part of the loan application process. This assessment helps determine your creditworthiness and influences the terms of your loan, including the interest rate offered. A strong credit history typically results in more favorable loan terms. A poor credit history may result in a higher interest rate or even loan denial. However, even with a less-than-perfect credit history, there may still be loan options available, though they may come with less favorable terms. Sallie Mae considers various factors in the credit check, including payment history, credit utilization, and the length of your credit history.

Step-by-Step Guide to Completing the Sallie Mae Loan Application

The Sallie Mae loan application process generally follows these steps: First, you’ll need to create an online account. This will allow you to track your application’s progress and manage your loan once it’s approved. Next, you’ll complete the application form, providing all the required personal, academic, and financial information accurately and completely. After submitting your application, you will likely need to provide additional documentation to verify the information you’ve provided. Sallie Mae will then review your application and conduct a credit check. Finally, you’ll receive a decision on your loan application. If approved, you’ll receive loan terms and details regarding disbursement.

Repayment Options and Strategies

Successfully navigating student loan repayment requires understanding the available options and developing a robust strategy. Sallie Mae offers several repayment plans, each with its own set of advantages and disadvantages. Choosing the right plan and implementing effective management strategies are crucial for timely repayment and minimizing long-term financial strain.

Sallie Mae Repayment Plan Options

Sallie Mae provides various repayment plans to cater to different financial situations and borrower needs. These plans typically include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. The Standard Repayment plan involves fixed monthly payments over a 10-year period. The Extended Repayment plan stretches payments over a longer period, reducing the monthly payment amount but increasing the total interest paid. Graduated Repayment starts with lower monthly payments that gradually increase over time. IDR plans, while not directly offered by Sallie Mae, often involve partnerships with the federal government programs and adjust payments based on income and family size. It’s crucial to carefully compare the terms and conditions of each plan before making a decision.

Advantages and Disadvantages of Repayment Plans

| Repayment Plan | Advantages | Disadvantages |

|---|---|---|

| Standard Repayment | Lower total interest paid, quicker loan payoff | Higher monthly payments |

| Extended Repayment | Lower monthly payments | Higher total interest paid, longer repayment period |

| Graduated Repayment | Lower initial payments, manageable for early career stages | Payments increase significantly over time, potentially causing financial strain later |

| Income-Driven Repayment (IDR) | Payments adjusted based on income, more manageable during periods of low income | Potentially longer repayment periods, may lead to higher overall interest paid |

Effective Student Loan Debt Management Strategies

Creating a budget is fundamental to effective student loan repayment. This involves tracking income and expenses to identify areas where savings can be made. Prioritizing high-interest loans for repayment is another effective strategy, minimizing the total interest paid over the life of the loans. Automating loan payments helps ensure timely payments and avoids late fees. Exploring loan refinancing options, if available and advantageous, can potentially lower interest rates and reduce the overall cost of repayment. Finally, maintaining open communication with Sallie Mae is crucial to address any issues or changes in circumstances promptly.

Resources for Borrowers Struggling with Repayment

Borrowers facing repayment difficulties can utilize several resources. Sallie Mae offers dedicated customer support channels to answer questions and provide guidance. Independent financial advisors can offer personalized advice on managing student loan debt. Non-profit organizations focused on financial literacy often provide free resources and workshops on budgeting and debt management. Government websites, such as the Federal Student Aid website, offer information on repayment options and potential hardship programs. Utilizing these resources can provide valuable support and guidance during challenging financial times.

Managing Your Sallie Mae Account

Effectively managing your Sallie Mae student loan account is crucial for maintaining a positive credit history and avoiding potential financial difficulties. Understanding the various account management tools and communication strategies available can significantly simplify the loan repayment process and ensure a smooth experience. This section details the key aspects of managing your Sallie Mae account.

Making Loan Payments

Sallie Mae offers several convenient methods for making your loan payments. You can make payments online through your Sallie Mae account, a process that typically involves logging in, selecting the loan, and entering your payment information. This method is generally the quickest and most efficient. Alternatively, you can mail a check or money order to the address provided on your billing statement. Remember to include your loan number for proper processing. For those who prefer automated payments, Sallie Mae also allows you to set up automatic debit payments from your checking or savings account. This ensures timely payments and eliminates the need for manual intervention each month. Finally, some employers offer payroll deduction options, allowing direct payments from your paycheck. Contact your employer’s human resources department for more information on this possibility.

Accessing and Understanding Account Statements

Your Sallie Mae account statements provide a comprehensive overview of your loan activity. You can access these statements online through your account dashboard. These statements typically detail your loan balance, payment history, interest accrued, and any upcoming payments. Understanding these statements is key to tracking your progress and ensuring you’re on track with your repayment plan. Each statement will clearly indicate the minimum payment due, the due date, and any late payment fees that may apply. Reviewing your statements regularly helps you identify any discrepancies and address them promptly. If you have difficulty understanding any information on your statement, contact Sallie Mae’s customer service for clarification.

Updating Personal Information

Keeping your personal information up-to-date with Sallie Mae is essential for receiving important communications and ensuring your payments are processed correctly. You can update your address, phone number, and email address directly through your online account. Access your profile settings, locate the relevant fields, and enter the updated information. It is crucial to update your information promptly whenever changes occur to prevent delays or issues with your payments or correspondence. Failure to update your contact information may result in missed payment reminders or important notices regarding your loan.

Maintaining Good Communication with Sallie Mae

Proactive communication with Sallie Mae is crucial for a positive loan management experience. If you anticipate any difficulty making a payment, contact Sallie Mae immediately to explore options like deferment or forbearance. Regularly reviewing your account statements and proactively addressing any questions or concerns will help you avoid potential problems. Utilize Sallie Mae’s online resources, including FAQs and help articles, to find answers to common questions. If you need to contact customer service, utilize the phone number or online chat feature provided on their website. Document all communication with Sallie Mae, including dates, times, and the outcome of each interaction. This documentation can be invaluable if any disputes arise.

Potential Issues and Solutions

Navigating the world of student loans can sometimes present challenges. Understanding common problems and knowing how to address them proactively is crucial for a positive borrowing experience. This section will Artikel potential issues Sallie Mae borrowers may encounter, along with effective strategies for resolving them. We will cover loan denials, billing discrepancies, and effective communication methods with Sallie Mae’s customer service department.

Loan Denial Appeals

A loan application denial can be disheartening. Sallie Mae assesses applications based on credit history, income, and other factors. If your application is denied, you’ll receive a notification explaining the reasons. You can then review this explanation carefully and gather any additional documentation that might strengthen your application. This could include updated credit reports showing improved scores, evidence of increased income, or clarification on any information previously provided. You can then submit a formal appeal through Sallie Mae’s online portal or by contacting their customer service department, providing the supporting documentation. Sallie Mae will review your appeal and notify you of their decision.

Dispute Resolution for Billing Errors

Billing errors, such as incorrect interest calculations or inaccurate payment postings, can occur. If you identify a discrepancy on your statement, gather all relevant documentation, including your statement showing the error and any supporting evidence, such as payment confirmations. Contact Sallie Mae’s customer service immediately to report the error. They will investigate the issue and provide a resolution, which may involve correcting the billing error and adjusting your account accordingly. Maintain detailed records of all communication with Sallie Mae throughout the dispute process.

Contacting Sallie Mae Customer Service

Sallie Mae offers various avenues for contacting customer service. You can access their website for FAQs, online account management tools, and contact information. They provide phone support, allowing you to speak directly with a representative. Alternatively, you can submit inquiries through their secure online messaging system. When contacting Sallie Mae, have your loan information readily available, including your loan number and account details, to expedite the process. Keep records of all interactions, including dates, times, and summaries of conversations.

Problem Resolution Flowchart

The following flowchart Artikels the steps to take when facing a problem with your Sallie Mae loan:

[Imagine a flowchart here. The flowchart would begin with a “Problem with Sallie Mae Loan?” box. A “Yes” branch would lead to a “Identify the Problem” box, followed by a “Gather Supporting Documentation” box. From there, two branches would emerge: one leading to “Contact Sallie Mae Customer Service (Phone, Online, Mail)” and the other to “Review Sallie Mae’s Response”. If the response is unsatisfactory, a branch would lead to “Escalate the Issue (Follow Sallie Mae’s Appeal Process)”. A “No” branch from the initial question would lead to a “No Action Needed” box.]

For example, let’s say a borrower discovers an incorrect interest charge. They would first identify the problem (incorrect interest charge), gather their statement showing the error, and then contact Sallie Mae customer service. Sallie Mae would investigate and either correct the error or explain the discrepancy. If the explanation is unsatisfactory, the borrower can follow Sallie Mae’s appeal process to further address the issue.

Long-Term Financial Planning

Successfully navigating student loan debt is crucial for achieving long-term financial goals. The weight of these loans can significantly impact your ability to save for retirement, buy a home, or even comfortably manage everyday expenses. Understanding how to integrate loan repayment into your overall financial strategy is key to building a secure future.

Student loan debt’s impact on long-term financial goals is multifaceted. High monthly payments can reduce disposable income, limiting savings for investments like retirement accounts (401(k)s or IRAs) and hindering the accumulation of wealth over time. A large debt burden can also negatively affect credit scores, making it more difficult and expensive to secure loans for major purchases like a house or car. This can lead to delayed milestones in achieving significant life goals, potentially impacting financial stability in the long run. For example, a significant portion of a young professional’s income dedicated to student loan repayment might delay homeownership by several years, impacting the ability to build equity and potentially miss out on appreciating property values.

Budgeting and Financial Planning While Repaying Student Loans

Creating a realistic budget is essential for managing student loan repayments effectively. This involves carefully tracking income and expenses, prioritizing loan payments, and identifying areas where spending can be reduced. Consider using budgeting apps or spreadsheets to monitor your finances and ensure you’re staying on track. A crucial aspect of this is prioritizing high-interest debt to minimize overall interest paid over time. A sample budget might allocate 20% of monthly income to student loan payments, 10% to savings (emergency fund and retirement), and the remaining 70% to living expenses, ensuring a balance between debt repayment and future financial security.

Building Credit After Graduation and Loan Repayment

Establishing and maintaining good credit is paramount after graduation. Consistent and on-time student loan payments significantly contribute to a positive credit history. Consider exploring credit-building strategies such as obtaining a secured credit card with a small credit limit, using it responsibly, and paying off the balance in full each month. Monitoring your credit report regularly and addressing any errors promptly can also help you build and maintain a strong credit score. A good credit score can unlock access to better interest rates on future loans, credit cards, and even insurance, making significant financial decisions more affordable.

Sample Budget Incorporating Student Loan Repayment

The following is a sample budget illustrating the integration of student loan repayment. This is a simplified example, and individual budgets should be tailored to specific circumstances.

| Income | Amount |

|---|---|

| Monthly Salary | $3,000 |

| Expenses | Amount |

| Student Loan Payment | $600 (20%) |

| Rent/Mortgage | $800 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Savings (Emergency Fund & Retirement) | $300 (10%) |

| Other Expenses | $600 |

Remember, this is a sample budget. Adjust categories and amounts to reflect your individual financial situation and goals. Regularly review and adjust your budget as needed.

Illustrative Examples

Understanding the impact of Sallie Mae student loans requires examining concrete examples. This section provides hypothetical scenarios to illustrate the loan repayment process and the long-term financial consequences of different repayment plan choices. These examples are for illustrative purposes only and should not be considered financial advice. Individual circumstances will vary.

A Hypothetical Borrower’s Repayment Journey

Let’s consider Sarah, a recent graduate with $30,000 in Sallie Mae student loans at a 7% annual interest rate. We’ll examine her repayment journey under different scenarios. This example uses simplified calculations for clarity; actual repayment schedules may vary slightly.

Sarah’s initial loan amount is $30,000. If she chooses a standard 10-year repayment plan, her monthly payment would be approximately $350. Over the 10 years, she would pay approximately $42,000, with $12,000 representing the accumulated interest. A visual representation could show a graph with the initial loan balance decreasing over time, alongside a line representing the accumulating interest. The graph would clearly show how the interest payment portion dominates during the early years and gradually decreases as the principal balance is reduced. The steepest portion of the interest line would be at the beginning of the repayment period.

If Sarah opts for a 15-year repayment plan, her monthly payment would be reduced to roughly $250. However, the total interest paid over the 15 years would increase significantly, potentially exceeding $18,000. A comparative bar graph showcasing the total interest paid under the 10-year and 15-year plans would vividly illustrate this difference. The bar representing the 15-year plan would be noticeably taller than the bar representing the 10-year plan.

Financial Impact of Different Repayment Plans

The choice between a 10-year and 15-year repayment plan significantly impacts Sarah’s long-term finances. While the lower monthly payment of the 15-year plan provides short-term relief, it results in considerably higher total interest payments. This increased interest expense could limit her ability to save for other financial goals, such as a down payment on a house or investing for retirement.

Conversely, the higher monthly payments of the 10-year plan, while more demanding in the short term, lead to significant long-term savings on interest. This could free up more financial resources for other priorities over the long term. A table comparing the total interest paid, total amount repaid, and monthly payments for both repayment plans would clearly demonstrate the trade-off between short-term affordability and long-term financial gain. This table would visually represent the cumulative financial impact of each choice. For instance, it might show that the 10-year plan, while demanding higher monthly payments, saves Sarah approximately $6,000 in interest compared to the 15-year plan.

End of Discussion

Successfully managing Sallie Mae student loans requires proactive planning and a thorough understanding of your repayment options. By utilizing the strategies and resources Artikeld in this guide, you can effectively navigate the complexities of student loan debt and build a strong financial foundation for the future. Remember, open communication with Sallie Mae and consistent financial planning are key to long-term success.

Helpful Answers

What happens if I miss a Sallie Mae loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially impact your future borrowing ability. Contact Sallie Mae immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I consolidate my Sallie Mae loans?

Sallie Mae offers consolidation options, potentially simplifying repayment by combining multiple loans into one. Check their website or contact customer service to determine eligibility and explore the benefits and drawbacks.

How can I contact Sallie Mae customer service?

Sallie Mae provides various contact methods, including phone, email, and online chat. Their website usually lists contact information and hours of operation.

What is the difference between a deferment and a forbearance?

A deferment temporarily postpones your payments, often due to specific circumstances like unemployment or enrollment in school. A forbearance also postpones payments, but typically doesn’t require specific qualifying reasons, though it might have stricter requirements.