Securing higher education can be transformative, but for individuals with felony convictions, the path to student loans often presents unique challenges. Navigating the complexities of federal and state aid programs, along with private loan options, requires a thorough understanding of eligibility criteria and potential hurdles. This exploration delves into the realities of accessing student financial aid with a criminal record, examining the varying policies and practices that affect access to education.

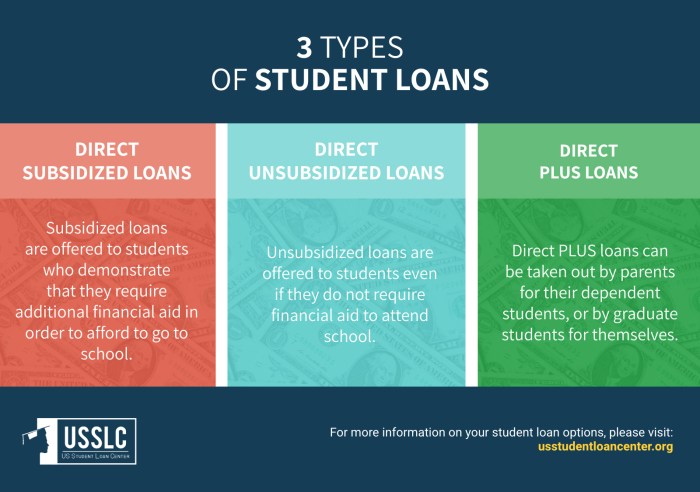

The journey to higher education for felons involves more than just academic preparation; it necessitates understanding the legal landscape surrounding financial aid. This includes differentiating between federal and state loan programs, each with its own set of eligibility requirements and potential restrictions for individuals with criminal histories. Furthermore, the role of private lenders and the impact of credit history and criminal records on loan approval are critical considerations.

State-Specific Student Loan Programs and Felons

Navigating the complexities of higher education financing can be challenging for anyone, but individuals with criminal records often face additional hurdles. While federal student aid programs have specific criteria that may exclude or limit eligibility for those with convictions, several states have implemented programs designed to be more inclusive. These programs recognize the importance of rehabilitation and second chances, offering pathways to education for individuals striving to improve their lives. Understanding the nuances of these state-specific initiatives is crucial for felons seeking financial assistance for their education.

State-sponsored student loan programs for felons vary significantly in their eligibility requirements and the types of aid offered. Some programs may focus on specific types of convictions or prioritize individuals who have completed rehabilitation programs. Others might have less stringent criteria, focusing more on the applicant’s demonstrated commitment to academic success and future contributions to society. The differences highlight the evolving landscape of criminal justice reform and its intersection with educational opportunities.

Eligibility Criteria Variations Across State Programs

Eligibility criteria for state-sponsored student loan programs differ significantly. Some states may only consider the severity and nature of the conviction, while others may also assess factors such as the applicant’s rehabilitation efforts, time elapsed since the conviction, and overall academic record. For instance, a state might prioritize applicants who have completed a drug rehabilitation program or participated in community service, demonstrating a genuine commitment to positive change. Conversely, another state’s program may focus solely on the type of crime, potentially excluding applicants with certain felony convictions regardless of their rehabilitation efforts. These variations underscore the need for careful research into each state’s specific requirements.

Unique Aspects of State Programs Compared to Federal Programs

State programs often offer a more flexible and individualized approach compared to their federal counterparts. Federal programs, while aiming for broad accessibility, often have stricter guidelines and may automatically disqualify applicants with certain criminal records. State programs, in contrast, can tailor their criteria to reflect the specific needs and priorities of their respective populations. This allows for a more nuanced assessment of individual circumstances and a greater focus on rehabilitation and reintegration. For example, a state program might offer mentoring or support services alongside financial aid, providing a more holistic approach to student success.

Application Processes: Felons vs. Non-Felons

The application process for state-sponsored programs may or may not differ significantly for felons compared to non-felons. While the basic application forms might be similar, felons may be required to provide additional documentation, such as court records, proof of completion of rehabilitation programs, or letters of recommendation attesting to their character and commitment to education. This extra documentation is intended to provide a more comprehensive understanding of the applicant’s background and their suitability for the program. However, some states streamline the process to avoid unnecessary barriers to access. It’s crucial to check each state’s specific guidelines for complete clarity.

States with More Inclusive Financial Aid Programs for Students with Criminal Backgrounds

The landscape of state-level support for students with criminal records is constantly evolving. However, several states have demonstrated a commitment to providing more inclusive access to higher education financing. It’s important to note that program details and eligibility requirements can change, so always consult the relevant state agency for the most up-to-date information.

- California: California has demonstrated a commitment to providing educational opportunities for formerly incarcerated individuals through various initiatives.

- New York: New York offers several programs aimed at supporting individuals returning to society, including those seeking higher education.

- Illinois: Illinois has programs designed to assist individuals with criminal records in accessing educational resources.

- Texas: Texas has various initiatives that support re-entry and educational opportunities, though specifics regarding financial aid for felons may vary.

- Michigan: Michigan has implemented several programs aimed at reducing recidivism, including access to education.

Private Student Loan Options for Felons

Securing funding for higher education can be challenging for anyone, but individuals with felony convictions often face additional hurdles. While federal student loan programs have limitations for those with criminal records, private student loan options may still be available, albeit with a more rigorous application process. Understanding the factors that private lenders consider is crucial for felons seeking to finance their education.

Private lenders assess applications from felons based on a range of factors, not solely focusing on the criminal record. The overall financial profile of the applicant plays a significant role. This includes credit history, income, existing debts, and the overall financial stability of the applicant. A strong financial profile can mitigate the impact of a felony conviction.

Factors Considered by Private Lenders

Private lenders employ a multifaceted approach to evaluating loan applications from individuals with felony convictions. They carefully examine several key aspects of the applicant’s financial standing and history. The weight given to each factor varies among lenders, reflecting their individual risk assessment models.

- Credit History: A strong credit history, demonstrating responsible financial management, is highly advantageous. This includes consistent on-time payments, low credit utilization, and the absence of significant negative marks. A good credit score significantly improves the chances of loan approval and can potentially lead to more favorable interest rates.

- Criminal Record: The nature and severity of the felony conviction are important considerations. Lenders typically review the specifics of the crime, the date of conviction, and any subsequent legal actions or rehabilitation efforts. Older convictions with no recent offenses may have less impact than recent or serious crimes.

- Income and Employment History: A stable income and consistent employment history demonstrate the applicant’s ability to repay the loan. Lenders will often require proof of income and employment, such as pay stubs or tax returns.

- Debt-to-Income Ratio: This ratio indicates the proportion of an applicant’s income dedicated to debt repayment. A lower debt-to-income ratio suggests a greater capacity to manage additional debt, improving the likelihood of loan approval.

- Co-signer Availability: Having a co-signer with a strong credit history can significantly enhance the chances of loan approval. The co-signer assumes responsibility for repayment if the primary borrower defaults.

Impact of Credit History and Criminal Records

Credit history and criminal records significantly influence the approval process for private student loans for felons. A poor credit history can lead to loan rejection or less favorable terms, such as higher interest rates and stricter repayment conditions. Similarly, a serious or recent felony conviction can negatively impact the applicant’s creditworthiness and increase the perceived risk for the lender. However, a positive credit history and a demonstrable commitment to rehabilitation can mitigate the negative impact of a criminal record.

Applying for a Private Student Loan as a Felon: A Flowchart

The process for a felon applying for a private student loan is similar to that of a non-felon, but requires more meticulous preparation.

[A textual description of a flowchart follows. Imagine a flowchart with the following boxes and connecting arrows:]

Start –> Research Private Lenders –> Gather Required Documents (Credit Report, Income Verification, Criminal Record) –> Complete Application –> Lender Review (Credit Check, Criminal Background Check, Financial Assessment) –> Approval/Rejection –> Loan Disbursement (if approved) –> End

Examples of Successful Loan Applications

While each case is unique, several scenarios illustrate how felons might successfully obtain private student loans. For instance, an individual with an older, non-violent felony conviction, a strong credit history, stable employment, and a co-signer with excellent credit could significantly increase their chances of approval. Another example might be an individual who has demonstrated rehabilitation through consistent employment, community involvement, and completion of relevant programs, showcasing a commitment to positive change. These factors can help offset the negative impact of a criminal record.

Impact of Criminal Records on Financial Aid Applications

Applying for financial aid, including student loans and grants, can be complex for individuals with criminal records. The presence of a felony conviction can significantly influence the application process, impacting both eligibility and the amount of aid received. Understanding the nuances of how criminal history is considered is crucial for navigating this challenging aspect of higher education financing.

Background checks are a common component of the student loan application process. While the specifics vary among lenders and funding sources (federal, state, or private), most institutions will review applicants’ background information as part of their risk assessment. This review aims to gauge the applicant’s creditworthiness and overall reliability in repaying the loan. The depth and scope of these checks can differ; some may simply involve a credit report check, while others might delve into more extensive background information, including criminal records.

Types of Felonies and Application Outcomes

The impact of a felony conviction on a student loan application is not uniform. The severity of the crime, its relevance to financial responsibility, and the time elapsed since the conviction all play a role. For instance, a felony conviction related to fraud or embezzlement might pose a greater obstacle to loan approval than a non-violent offense. Lenders might perceive a higher risk of default with applicants convicted of financially related crimes. Similarly, more recent convictions often carry more weight than older ones, reflecting a perceived greater risk of future misconduct. The absence of any financial-related crimes and a long period of time since the conviction can often mitigate the negative impact.

Rehabilitation Efforts and Loan Eligibility

Demonstrating successful rehabilitation after a felony conviction can significantly improve an applicant’s chances of securing student loan approval. This might involve providing evidence of stable employment, positive community involvement, participation in rehabilitation programs, and letters of recommendation attesting to positive character changes. These actions showcase a commitment to personal growth and responsibility, lessening the lender’s perceived risk. A strong application emphasizing successful rehabilitation can counterbalance the negative impact of a criminal record.

Grants versus Loans: Impact of Felony Convictions

The impact of a felony conviction can differ between grants and loans. While grants are generally based on financial need and academic merit, some grant programs might have specific eligibility criteria that exclude individuals with certain criminal convictions. Loans, on the other hand, primarily assess creditworthiness and risk of default. While a felony conviction can negatively affect loan approval, it doesn’t automatically disqualify applicants. The applicant’s overall profile, including their rehabilitation efforts and financial history, are still significant factors.

Addressing Criminal Records in Application Materials

Applicants should be transparent and proactive in addressing their criminal record. Rather than attempting to conceal it, it’s often better to acknowledge the conviction directly and present a compelling narrative of rehabilitation and personal growth. This approach allows the applicant to control the narrative and demonstrate their commitment to responsibility. A well-written personal statement explaining the circumstances surrounding the conviction, outlining the steps taken toward rehabilitation, and expressing a strong commitment to future success can positively influence the application outcome. Supporting documentation, such as letters of recommendation, employment history, and participation in rehabilitation programs, further strengthens the applicant’s case.

Resources and Support for Felons Seeking Student Loans

Securing higher education funding after a felony conviction can present significant challenges. Many felons face obstacles related to their criminal record, impacting their eligibility for federal aid and creating difficulties in accessing private loans. However, several organizations and resources are dedicated to assisting individuals with criminal backgrounds in navigating the complexities of the student loan application process and pursuing their educational goals. This section details those resources and offers guidance for overcoming common hurdles.

The journey to higher education for individuals with felony convictions often requires more than just academic preparation. It demands proactive engagement with support systems that address both financial and logistical barriers. Understanding the available resources and effectively utilizing them can significantly increase the chances of securing funding and successfully completing a degree program.

Organizations Offering Assistance to Felons Seeking Higher Education Funding

Several non-profit organizations and government programs provide crucial support to individuals with criminal records seeking higher education. These organizations often offer a range of services, including financial counseling, assistance with completing the FAFSA (Free Application for Federal Student Aid), and guidance on navigating the complexities of loan applications and repayment. They act as advocates, helping to overcome the stigma and prejudice often associated with a criminal record. Many also provide mentorship and career counseling, extending support beyond the financial aspects of education.

Types of Support Offered by These Organizations

Support services vary depending on the organization but commonly include:

- Financial Counseling: Organizations provide guidance on budgeting, managing debt, and exploring various funding options beyond student loans.

- Application Assistance: Staff assist with completing the FAFSA and other financial aid applications, ensuring accuracy and maximizing the applicant’s chances of approval.

- Mentorship Programs: Connecting felons with mentors who have successfully navigated similar challenges can provide invaluable guidance and support.

- Legal Aid: Some organizations offer legal assistance to address issues related to expungement or record sealing, which can improve loan eligibility.

- Scholarship Search Assistance: Staff help identify and apply for scholarships specifically designed for students with criminal records or those facing socioeconomic challenges.

Websites and Resources Providing Relevant Information

Accessing reliable information is critical for felons navigating the student loan process. The following resources offer valuable guidance and support:

- The National Association for the Advancement of Colored People (NAACP): The NAACP offers resources and support for African Americans facing barriers to education, including those with criminal records.

- The Prison Policy Initiative: This organization provides data and analysis on mass incarceration and its impact on education and employment, offering insights into the challenges faced by formerly incarcerated individuals.

- The U.S. Department of Education: The Department’s website contains information on federal student aid programs and eligibility requirements.

- State-Specific Resources: Many states have programs specifically designed to assist individuals with criminal records in accessing education and employment opportunities. It is crucial to research state-specific resources.

A Brief Guide for Felons Navigating the Student Loan Application Process

Applying for student loans with a criminal record requires careful planning and proactive engagement.

- Understand Your Eligibility: Research federal and private loan options, understanding the impact of your criminal record on eligibility.

- Complete the FAFSA: Be honest and thorough in completing the FAFSA. Address your criminal record truthfully and seek assistance if needed.

- Explore Alternative Funding Options: Consider scholarships, grants, and vocational training programs as alternative or supplemental funding sources.

- Seek Professional Assistance: Consult with financial aid counselors and organizations specializing in assisting formerly incarcerated individuals.

- Develop a Strong Repayment Plan: Plan for loan repayment from the outset, considering your potential income and expenses after graduation.

Examples of Successful Strategies Felons Have Used to Overcome Obstacles in Obtaining Student Loans

Success stories often involve proactive planning and the utilization of available support systems. For instance, some individuals have successfully secured loans by highlighting their rehabilitation efforts, demonstrating a commitment to education, and obtaining strong letters of recommendation from mentors or employers. Others have leveraged scholarships and grants to reduce their reliance on loans, thereby minimizing the financial risk. In some cases, expungement of criminal records has significantly improved loan eligibility. These strategies demonstrate the importance of persistence and resourcefulness in overcoming obstacles.

Final Summary

Obtaining student loans with a felony conviction presents significant obstacles, but it’s not insurmountable. By carefully understanding the eligibility criteria for federal and state programs, exploring private loan options, and proactively addressing criminal history in applications, individuals can increase their chances of securing funding for higher education. The availability of resources and support organizations further underscores the possibility of overcoming these challenges and pursuing educational goals.

Answers to Common Questions

What types of felonies most significantly impact loan eligibility?

Violent felonies and drug-related offenses often pose the greatest challenges, but the impact varies depending on the specific crime, the lender, and the applicant’s rehabilitation efforts.

Can I improve my chances of loan approval after serving my sentence?

Yes, demonstrating rehabilitation through positive actions like maintaining employment, completing educational programs, and engaging in community service can significantly improve your chances.

What if my application is denied? What are my options?

Explore appealing the decision, seeking assistance from support organizations, and considering alternative funding sources like scholarships or grants.

Are there any specific documents I should prepare when applying for student loans with a felony?

You should gather all relevant documentation related to your conviction, rehabilitation efforts, and financial stability. Consult with a financial aid advisor for specific guidance.