Navigating the complexities of graduate school funding can feel overwhelming. Securing financial aid is crucial for many aspiring graduate students, and understanding the nuances of subsidized loans is paramount. This exploration delves into the eligibility criteria, available loan types, and alternative funding options to help graduate students make informed decisions about their financial future.

This guide clarifies the process of applying for federal student aid, including the Free Application for Federal Student Aid (FAFSA), and explores how factors like financial need and program type influence loan availability. We’ll also examine the differences between subsidized and unsubsidized loans, and discuss effective strategies for managing and repaying graduate student loan debt to ensure a smooth transition from student to professional.

Eligibility for Subsidized Loans

Graduate students seeking financial aid often explore federal student loan programs. Understanding the eligibility criteria and differences between subsidized and unsubsidized loans is crucial for responsible borrowing. This section clarifies the requirements and options available.

Federal Student Loan Programs for Graduate Students

The primary federal student loan programs available to graduate students are the Direct Unsubsidized Loan and the Direct PLUS Loan. Direct Unsubsidized Loans are generally available to graduate students who meet basic eligibility requirements, while Direct PLUS Loans are credit-based loans available to parents and graduate students. Both loan types offer different interest rates and repayment options. The specific terms and conditions are subject to change and are determined annually by the U.S. Department of Education.

Credit History Requirements for Graduate Student Loan Applications

For Direct Unsubsidized Loans, a credit check is not typically required. However, for Direct PLUS Loans, a credit check is mandatory. Applicants with adverse credit history, such as bankruptcies, foreclosures, or a history of late payments, may be denied a Direct PLUS Loan. In such cases, a creditworthy co-signer might be required to secure the loan. The specific credit history requirements for Direct PLUS Loans are set by the Department of Education and can be subject to change.

Comparison of Subsidized and Unsubsidized Loan Options for Graduate Students

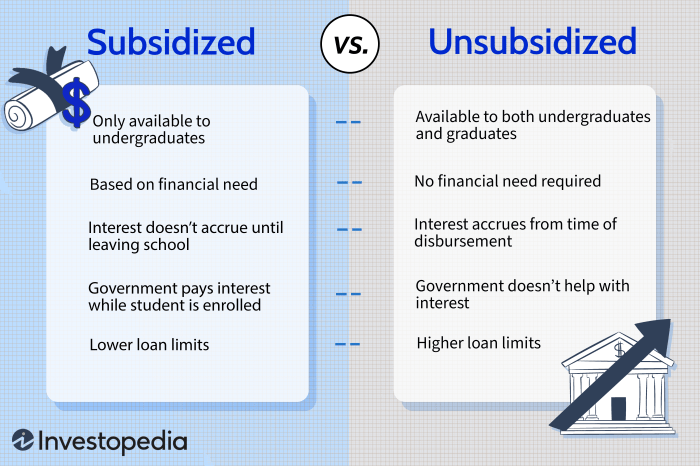

It’s important to understand that graduate students are generally not eligible for subsidized federal loans. Subsidized loans are only available for undergraduate students who meet specific need-based requirements. Unsubsidized loans, on the other hand, are available to both undergraduate and graduate students. The key difference lies in interest accrual. With unsubsidized loans, interest begins accruing immediately, while with subsidized loans, interest accrual is deferred until after graduation. This means that borrowing an unsubsidized loan will result in a higher total repayment amount compared to a subsidized loan (if available).

Examples of Qualification and Disqualification for Subsidized Loans

A graduate student pursuing a Master’s degree in Engineering would not qualify for a subsidized loan because these are not available to graduate students. Conversely, an undergraduate student demonstrating financial need through the FAFSA might qualify for a subsidized loan. Another example: A graduate student with a strong credit history might qualify for a Direct PLUS Loan, but this is not a subsidized loan. A graduate student with poor credit history might be denied a Direct PLUS Loan, leaving them to explore alternative financing options.

Summary of Loan Types and Eligibility

| Loan Type | Eligibility Requirements | Interest Accrual | Repayment Options |

|---|---|---|---|

| Direct Unsubsidized Loan (Graduate) | U.S. citizenship or eligible non-citizen status; enrollment at least half-time in a degree program | Begins accruing immediately | Standard repayment, graduated repayment, extended repayment, income-driven repayment |

| Direct PLUS Loan (Graduate) | U.S. citizenship or eligible non-citizen status; enrollment at least half-time in a degree program; satisfactory credit history (or a creditworthy co-signer) | Begins accruing immediately | Standard repayment, graduated repayment, extended repayment |

Types of Graduate Programs and Loan Availability

Federal student loan programs, including subsidized loans, are generally available to graduate students pursuing a variety of degree programs. However, the specifics of eligibility and loan amounts can vary depending on several factors. Understanding these factors is crucial for prospective graduate students planning their financing.

The availability of subsidized federal loans for graduate study is generally less extensive than for undergraduate programs. While unsubsidized loans are readily available to most graduate students, the availability of subsidized loans is more limited and often depends on the student’s financial need, as determined by the Free Application for Federal Student Aid (FAFSA).

Subsidized Loan Availability by Degree Program

Subsidized federal Stafford Loans are typically not available to graduate students. Instead, graduate students primarily rely on unsubsidized Stafford Loans. This distinction is important because interest begins to accrue on unsubsidized loans immediately, whereas with subsidized loans, the government pays the interest while the student is enrolled at least half-time. This applies regardless of the specific type of graduate program—Master’s, PhD, or professional degrees like law, medicine, or business. While the *type* of degree doesn’t directly affect eligibility for unsubsidized loans, the program length and the cost of attendance will significantly influence the total loan amount a student can borrow.

Program Length and Loan Disbursement

The length of a graduate program directly impacts the total amount a student can borrow and the disbursement schedule. A longer program, such as a PhD, will allow for a larger cumulative loan amount over the course of the program compared to a shorter Master’s program. Loans are typically disbursed in installments each academic year or semester, based on the student’s demonstrated need and cost of attendance. For example, a student in a two-year Master’s program might receive loan disbursements for each year, while a five-year PhD student would receive disbursements annually for the duration of their program.

Loan Availability: Public vs. Private Institutions

While the federal loan programs are available to students at both public and private institutions, there can be differences in the overall cost of attendance. Private institutions often have higher tuition rates, potentially leading to a higher overall loan need for graduate students. However, both public and private institutions participate in the federal student aid programs, meaning students at either type of institution can access the same federal loan options, albeit potentially needing to borrow larger sums at private institutions.

Loan Amounts for Different Graduate Programs

The maximum loan amounts for graduate students are generally higher than for undergraduates, reflecting the typically higher costs associated with graduate-level education. However, the specific amount a student can borrow depends on their financial need, cost of attendance, and the type of loan. For example, a student in a high-cost professional program like medicine might be eligible for significantly higher loan amounts compared to a student in a lower-cost Master’s program in the humanities. The federal government sets annual and aggregate loan limits, which vary based on the student’s dependency status and year in school.

Applying for Federal Student Aid

Applying for federal student aid involves several key steps:

- Complete the Free Application for Federal Student Aid (FAFSA): This form collects necessary financial information to determine eligibility for federal aid.

- Receive your Student Aid Report (SAR): This report summarizes the information you provided on the FAFSA and your initial eligibility for aid.

- Apply for federal student loans through your school’s financial aid office: Your school will use your FAFSA information to determine your eligibility for loans and your loan amount.

- Accept or decline your loan offer: Once you receive your loan offer, you’ll need to accept or decline the offered amount.

- Complete loan entrance counseling: This is a requirement for federal student loans, providing important information about borrowing responsibly.

- Master Promissory Note (MPN): This note signifies your agreement to repay your loan(s).

Impact of Financial Need on Loan Eligibility

Financial need plays a significant role in determining the amount of subsidized federal graduate student loans a student may receive. The more significant the demonstrated financial need, the greater the potential for receiving subsidized loans, which don’t accrue interest while the student is enrolled at least half-time. Conversely, students with less demonstrated need may receive smaller subsidized loan amounts or none at all, relying more heavily on unsubsidized loans.

Demonstrated financial need is calculated by comparing the student’s Expected Family Contribution (EFC) to the Cost of Attendance (COA). The difference between these two figures represents the student’s financial need. The EFC is determined based on information provided on the FAFSA, while the COA is established by the individual graduate program and institution.

Documentation Required to Demonstrate Financial Need

To accurately determine financial need, graduate students must provide comprehensive financial documentation through the FAFSA. This typically includes tax returns (both federal and state, if applicable) for the student and their parents (if claimed as a dependent), W-2 forms, pay stubs, bank statements, and documentation of any other income or assets. Providing complete and accurate information is crucial for an accurate financial need assessment. Incomplete or inaccurate information can lead to delays or denial of financial aid.

Completing the FAFSA for Graduate Students

The FAFSA process for graduate students is similar to that for undergraduates, although some questions may be tailored to the graduate student’s circumstances. Students will need to create an FSA ID, gather the necessary financial documentation, and carefully complete the online application. The FAFSA requires accurate reporting of income, assets, family size, and dependency status. Graduate students should ensure they select the correct academic year and their intended program of study. Submitting the FAFSA by the priority deadline set by their institution is recommended to avoid potential processing delays.

Cost of Attendance (COA) Calculation and its Role in Loan Eligibility

The Cost of Attendance (COA) is a comprehensive estimate of the total cost of attending a graduate program for one academic year. It includes tuition and fees, room and board (if applicable), books and supplies, transportation, and other miscellaneous expenses. The institution determines the COA based on various factors, including the program’s tuition rates, local living costs, and institutional policies. The COA is a critical component in determining financial need. A higher COA, coupled with a lower EFC, will result in a greater demonstrated need and potentially a larger subsidized loan amount. The formula for calculating financial need is generally:

Financial Need = Cost of Attendance (COA) – Expected Family Contribution (EFC)

Federal Student Aid Application Process Flowchart

A flowchart illustrating the application process would visually represent the steps:

1. Start: The process begins with the student’s decision to apply for federal student aid.

2. Gather Documentation: The student collects all necessary financial documents (tax returns, W-2s, bank statements, etc.).

3. Complete FAFSA: The student completes the Free Application for Federal Student Aid (FAFSA) online, accurately providing all required information.

4. FAFSA Processing: The FAFSA is processed, and the student’s Expected Family Contribution (EFC) is calculated.

5. Financial Need Assessment: The institution’s financial aid office compares the student’s EFC to their Cost of Attendance (COA) to determine their financial need.

6. Loan Eligibility Determination: Based on the financial need assessment, the institution determines the student’s eligibility for subsidized and unsubsidized federal student loans.

7. Loan Offer: The institution offers the student a loan package based on their eligibility.

8. Acceptance/Rejection: The student accepts or rejects the loan offer.

9. Loan Disbursement: If accepted, the loan is disbursed according to the institution’s disbursement schedule.

10. End: The process concludes with the student receiving the loan funds.

Alternatives to Subsidized Loans for Graduate Students

Securing funding for graduate school can be challenging, even with federal subsidized loans. Fortunately, numerous alternative funding sources exist to help offset the costs of higher education. Exploring these options thoroughly can significantly reduce reliance on loans and potentially lead to better financial outcomes after graduation. This section will examine various alternatives, their application processes, eligibility requirements, and the advantages and disadvantages of each.

Scholarships and Grants

Scholarships and grants represent a significant source of non-repayable funding for graduate students. These awards are often merit-based, need-based, or a combination of both. They can cover tuition, fees, living expenses, and even research-related costs. The application processes vary widely depending on the awarding institution or organization.

Assistantships

Many graduate programs offer assistantships, which provide financial support in exchange for part-time work. These assistantships can take various forms, including teaching assistantships (TAs), research assistantships (RAs), and administrative assistantships. TAs typically assist professors with teaching duties, such as grading papers and leading discussion sections. RAs assist professors with research projects, conducting literature reviews, collecting data, and analyzing results. Administrative assistantships involve supporting the department’s administrative staff. The stipend provided through an assistantship often covers tuition and provides a living allowance.

Private Loans

Private loans offer an alternative to federal loans, but they typically come with higher interest rates and less favorable repayment terms. Borrowers should carefully compare interest rates, fees, and repayment options before taking out a private loan. Understanding the total cost of borrowing is crucial, as private loans often lack the same consumer protections as federal loans. While private loans can bridge funding gaps, they should be considered only after exploring other options.

Comparison of Funding Sources

The following table summarizes the key characteristics of various funding sources for graduate students:

| Funding Source | Application Process | Eligibility Criteria | Advantages/Disadvantages |

|---|---|---|---|

| Federal Subsidized Loans | Apply through the Free Application for Federal Student Aid (FAFSA) | U.S. citizenship or eligible non-citizen status, enrollment in an eligible program, demonstrated financial need (for subsidized loans) | Advantages: Low interest rates, flexible repayment options, government protections. Disadvantages: Requires demonstrated financial need (for subsidized loans), may still result in significant debt. |

| Scholarships | Varies widely depending on the awarding institution or organization; typically involves completing an application and submitting supporting documents. | Varies widely; may be merit-based, need-based, or field-specific. | Advantages: Non-repayable funding. Disadvantages: Competitive application process, limited availability. |

| Grants | Similar to scholarships; often requires completion of a grant application and supporting documentation. | Varies widely; often based on financial need or specific criteria set by the granting institution or organization. | Advantages: Non-repayable funding. Disadvantages: Competitive application process, limited availability. |

| Assistantships | Typically applied for through the graduate program; often requires a strong academic record and relevant skills. | Enrollment in a graduate program, strong academic standing, relevant skills or experience. | Advantages: Provides both financial support and valuable work experience. Disadvantages: Requires part-time work commitment, may limit time for other activities. |

| Private Loans | Apply directly with a private lender; typically involves a credit check and financial documentation. | Creditworthiness (often requires a co-signer if credit history is limited), enrollment in an eligible program. | Advantages: Can fill funding gaps. Disadvantages: Higher interest rates than federal loans, less favorable repayment terms, may require a co-signer. |

Resources for Researching Funding Opportunities

Graduate students can utilize several resources to identify potential funding opportunities. These include their university’s financial aid office, professional organizations related to their field of study, and online databases such as Peterson’s and Fastweb. Many funding opportunities are specific to particular fields of study or demographics, so targeted searches are often more effective. Networking with faculty members and fellow graduate students can also uncover hidden opportunities.

Managing Graduate Student Loan Debt

Navigating graduate school often requires significant financial investment, and managing the resulting loan debt effectively is crucial for long-term financial well-being. Understanding repayment options, budgeting strategies, and the consequences of default are essential steps in developing a responsible plan.

Effective strategies for managing and repaying graduate student loans involve a multifaceted approach encompassing careful budgeting, exploring different repayment plans, and proactive engagement with loan servicers. Failure to manage debt effectively can lead to significant financial hardship, impacting credit scores and future financial opportunities.

Repayment Plans Available to Graduate Students

Several repayment plans are designed to help graduate students manage their loan debt. These plans vary in terms of monthly payments, interest accrual, and loan forgiveness possibilities. The most common options include standard repayment, extended repayment, graduated repayment, and income-driven repayment (IDR) plans. Standard repayment involves fixed monthly payments over a 10-year period. Extended repayment offers longer repayment terms, reducing monthly payments but increasing the total interest paid. Graduated repayment starts with lower monthly payments that increase over time. IDR plans, such as the Income-Driven Repayment (IDR) plan, tie monthly payments to your income and family size, potentially leading to loan forgiveness after 20 or 25 years of payments, depending on the specific plan. Choosing the right plan depends on individual financial circumstances and long-term goals.

Implications of Defaulting on Graduate Student Loans

Defaulting on graduate student loans has severe consequences. It can result in damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and even legal action are all potential outcomes. Furthermore, defaulting can impact your ability to secure future employment, particularly in fields requiring security clearances or professional licenses. The long-term financial and personal repercussions of defaulting significantly outweigh the short-term benefits of avoiding payments.

Budgeting Tools and Resources for Managing Student Loan Debt

Effective budgeting is paramount in managing student loan debt. Numerous tools and resources are available to assist in this process. Free budgeting apps, such as Mint or YNAB (You Need A Budget), allow users to track income and expenses, categorize spending, and create customized budgets. Online calculators can help estimate monthly payments under different repayment plans. Many universities and financial institutions offer free financial counseling services to provide personalized guidance and support in developing a debt management strategy. These resources can be invaluable in creating a realistic and sustainable budget tailored to individual needs.

Tips for Responsible Borrowing and Repayment Planning

Careful planning and responsible borrowing are crucial for minimizing the burden of graduate student loan debt.

- Borrow only what you need: Avoid taking out more loans than necessary for tuition, fees, and living expenses.

- Understand loan terms: Carefully review the terms and conditions of each loan before signing, paying close attention to interest rates, repayment periods, and fees.

- Create a realistic budget: Develop a detailed budget that accounts for all income and expenses, including loan payments.

- Explore repayment options: Research and compare different repayment plans to determine the most suitable option based on your financial situation.

- Stay organized: Keep accurate records of all loan-related documents and communications.

- Seek professional advice: Consult with a financial advisor or student loan counselor for personalized guidance.

- Prioritize repayment: Make timely payments to avoid late fees and negative impacts on your credit score.

Final Conclusion

Successfully financing graduate education requires careful planning and a comprehensive understanding of the available options. While subsidized federal loans offer a valuable pathway, remember to explore all avenues, including grants, scholarships, and assistantships, to minimize reliance on loans. Proactive debt management strategies, starting from the application process, are key to mitigating long-term financial burdens and ensuring a positive post-graduate experience. Remember to research and compare all options carefully before committing to any loan.

General Inquiries

What is the difference between subsidized and unsubsidized graduate loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans do.

Can I get a subsidized loan for a Master’s in Fine Arts?

The availability depends on your financial need and program specifics. Check with your school’s financial aid office.

What happens if I default on my graduate student loans?

Defaulting can severely damage your credit score, and the government may take legal action to recover the debt.

Are there income-driven repayment plans for graduate loans?

Yes, several income-driven repayment plans are available to help manage monthly payments based on your income and family size.