The weight of student loan debt can feel overwhelming, but the possibility of paying it off entirely offers a significant sense of relief and financial freedom. This guide explores the practical steps involved in paying off your student loans in full, from understanding your repayment options and calculating your payoff amount to developing a sound financial plan and navigating the payment process itself. We’ll examine the advantages and disadvantages of early repayment, consider alternative options like refinancing, and provide answers to frequently asked questions to help you make informed decisions about your financial future.

Navigating the complexities of student loan repayment can be challenging. This comprehensive guide will equip you with the knowledge and strategies necessary to determine if paying your student loans in full is the right choice for you and, if so, how to achieve it effectively. We’ll cover everything from understanding your loan balance and available repayment plans to creating a budget and exploring various payment methods. Let’s explore the path to financial independence.

Understanding Student Loan Repayment Options

Choosing the right repayment plan for your student loans is crucial for managing your debt effectively and minimizing long-term costs. Different plans offer varying monthly payments and overall repayment periods, impacting your budget and the total interest you’ll pay. Understanding the nuances of each plan will help you make an informed decision.

Federal Student Loan Repayment Plans

Federal student loans offer several repayment plans designed to accommodate various financial situations. These plans differ significantly in their monthly payment amounts and total repayment times. Choosing the right plan depends on your income, budget, and long-term financial goals.

Standard Repayment

Standard repayment is the most straightforward plan. It involves fixed monthly payments over a 10-year period. While offering a relatively short repayment term, the monthly payments can be substantial, potentially straining your budget.

Extended Repayment

Extended repayment offers lower monthly payments than standard repayment, but stretches the repayment period to up to 25 years. This reduces the immediate financial burden but increases the total interest paid over the life of the loan.

Graduated Repayment

Graduated repayment starts with lower monthly payments that gradually increase over time. This can be appealing initially, but the payments become progressively higher, potentially becoming difficult to manage later on.

Income-Driven Repayment (IDR) Plans

IDR plans link your monthly payment to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, but repayment periods can extend beyond 20 years, potentially leading to higher overall interest costs. Forgiveness may be possible after a specified period of payments, depending on the plan and loan type.

Private Student Loan Repayment Options

Private student loans generally offer fewer repayment options compared to federal loans. Common options include:

Standard Repayment (Private)

Similar to federal standard repayment, private loan standard repayment involves fixed monthly payments over a set period (often 5-15 years). The terms and conditions are determined by the lender.

Extended Repayment (Private)

Some private lenders may offer extended repayment plans, allowing for longer repayment periods with lower monthly payments. However, the total interest paid will likely be higher.

Comparison of Repayment Plans

| Repayment Plan | Minimum Monthly Payment | Total Repayment Time | Pros | Cons |

|---|---|---|---|---|

| Standard Repayment (Federal) | Varies based on loan amount and interest rate | 10 years | Shortest repayment period, lowest total interest paid | Highest monthly payments |

| Extended Repayment (Federal) | Lower than Standard Repayment | Up to 25 years | Lower monthly payments | Longest repayment period, highest total interest paid |

| Graduated Repayment (Federal) | Starts low, increases over time | 10 years | Lower initial payments | Payments increase significantly over time |

| Income-Driven Repayment (Federal) | Based on income and family size | Up to 20+ years, potential forgiveness | Lowest monthly payments, potential loan forgiveness | Longest repayment period, potentially high total interest paid |

| Standard Repayment (Private) | Varies based on lender and loan terms | 5-15 years | Potentially shorter repayment periods than federal options | Less flexibility, higher interest rates possible |

| Extended Repayment (Private) | Lower than Standard Repayment (Private) | Varies based on lender | Lower monthly payments | Longer repayment period, higher total interest paid |

Determining Loan Balance and Payoff Amount

Paying off your student loans in full can be a significant financial achievement. Understanding your current loan balance and the total amount required for payoff is the crucial first step. This involves obtaining accurate information from your loan servicer and performing a straightforward calculation.

Accurately determining your loan balance and the total payoff amount requires careful attention to detail. Failing to account for accrued interest or potential prepayment penalties can lead to unexpected costs and delays in your payoff process.

Obtaining an Accurate Statement of the Current Student Loan Balance

To obtain an accurate statement of your current student loan balance, including accrued interest, you should log into your online account with your loan servicer. Most servicers provide online portals offering detailed account information, including current balance, payment history, and interest accrual. Alternatively, you can contact your servicer directly via phone or mail to request a statement. Be sure to clearly state your request and provide any necessary identifying information, such as your loan ID number or Social Security number. This statement will clearly show the principal balance, the accrued interest, and any other fees associated with your loan. Remember to check the statement date to ensure the information is current.

Calculating the Total Payoff Amount

Calculating the total payoff amount involves adding the current principal balance and the accrued interest. This figure represents the minimum amount needed to fully settle your loan. However, it is crucial to check if your loan has any prepayment penalties. Some loans may charge a fee for early repayment. This information is usually Artikeld in your loan documents or can be confirmed by contacting your loan servicer. If a prepayment penalty applies, you must add this fee to the total payoff amount.

Total Payoff Amount = Current Principal Balance + Accrued Interest + Prepayment Penalty (if applicable)

For example, if your current principal balance is $20,000, your accrued interest is $2,000, and there is no prepayment penalty, your total payoff amount would be $22,000.

Requesting a Payoff Quote from Your Loan Servicer

A payoff quote provides an official statement of the exact amount needed to pay off your loan in full on a specific date. This is essential to ensure you have the precise amount ready and avoid any discrepancies. Here’s a step-by-step guide:

- Locate your loan servicer’s contact information: This information can typically be found on your monthly statement or your online loan account.

- Contact your loan servicer: You can contact them via phone, mail, or through their online portal. Many servicers have a dedicated section for payoff requests.

- Request a payoff quote: Clearly state that you are requesting a payoff quote and provide all necessary identifying information, including your loan ID number and Social Security number.

- Specify the date: Indicate the date you intend to make the full payment. The payoff amount may slightly vary depending on the date due to ongoing interest accrual.

- Receive and review the quote: The servicer will provide a written quote outlining the exact amount required to pay off your loan on the specified date. Carefully review this quote to ensure accuracy before proceeding with the payment.

Financial Planning for Full Loan Payoff

Paying off your student loans in one lump sum can significantly reduce the overall interest paid and provide financial freedom sooner. This requires careful financial planning, budgeting, and a commitment to saving aggressively. This section will Artikel strategies to achieve this goal.

Sample Budget for Lump-Sum Student Loan Payment

A successful lump-sum payment strategy begins with a realistic budget. This budget should allocate sufficient funds for both essential living expenses and the targeted loan payoff. The following is a sample budget, and specific allocations will need to be adjusted based on individual circumstances and income.

| Category | Monthly Allocation |

|---|---|

| Housing (Rent/Mortgage) | $1000 |

| Food | $500 |

| Transportation | $200 |

| Utilities | $150 |

| Healthcare | $100 |

| Student Loan Payoff (Savings) | $1000 |

| Other Expenses (Entertainment, Clothing, etc.) | $150 |

| Total Monthly Expenses | $3100 |

This example shows a significant portion of the monthly income ($1000) dedicated to student loan repayment. Remember that this is just a sample, and your budget should reflect your unique financial situation. Tracking expenses meticulously is crucial to identify areas where spending can be reduced.

Strategies for Saving and Accumulating Funds

Saving for a substantial lump-sum payment requires dedication and strategic planning. Creating a dedicated high-yield savings account specifically for this purpose is highly recommended. This account will help you visualize your progress and avoid the temptation to use the money for other expenses. Additionally, regularly reviewing and adjusting spending habits is essential. This might involve identifying areas of unnecessary spending (e.g., subscriptions, eating out) and cutting back to redirect those funds towards loan repayment. Consider using budgeting apps to track spending and identify areas for improvement. Automating savings transfers from your checking account to your dedicated savings account each month ensures consistent contributions.

Potential Financial Resources for Loan Payoff

Several resources can assist in accelerating student loan payoff. Emergency funds, if available, can be partially or entirely allocated towards this goal, providing a significant boost to your savings. However, it’s crucial to maintain an emergency fund for unexpected expenses. Exploring government-sponsored financial assistance programs, such as income-driven repayment plans or loan forgiveness programs (based on profession or public service), can also help manage or reduce loan balances. It’s important to research and understand the eligibility criteria and implications of each program before applying. Finally, consider consulting a financial advisor to discuss personalized strategies for loan repayment and overall financial planning.

The Process of Making a Full Loan Payment

Paying off your student loans in full can be a significant financial achievement. This process involves several key steps, from gathering necessary information to confirming your payment has been processed. Understanding these steps will ensure a smooth and efficient payoff experience.

The first step is to determine the exact payoff amount. This often involves contacting your loan servicer to request a payoff quote, which will specify the total amount needed to settle your loan(s) completely. This quote will include the principal balance, any accrued interest, and any applicable fees. It’s crucial to obtain this quote shortly before making your payment to ensure accuracy, as balances can change daily due to accruing interest.

Gathering Required Documentation

Before initiating the payment process, gather all necessary documentation. This typically includes your loan servicer’s contact information, your loan account number(s), and the payoff quote. Having this information readily available streamlines the process and minimizes potential delays. In some cases, additional identification may be required, depending on the payment method chosen.

Available Payment Methods and Their Comparison

Several methods exist for making a full student loan payment. Each has its own advantages and disadvantages.

The following table summarizes the common payment methods:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Online Payment Portal | Convenient, fast, secure, often provides immediate confirmation. | Requires internet access and a registered account with the loan servicer. |

| Mail (Check or Money Order) | No need for internet access; a physical record of payment is maintained. | Slower processing time, risk of lost mail, requires sufficient mailing time for timely processing. |

| Phone Payment | Convenient for those without online access; allows for immediate confirmation in some cases. | May incur additional fees; requires calling during business hours and potentially waiting on hold. |

Verifying Loan Payoff and Obtaining Confirmation

Once you’ve made your payment, it’s crucial to verify its successful processing and obtain official confirmation from your loan servicer. This typically involves requesting a payoff confirmation letter or checking your online account for updated balance information. This letter serves as official proof that your loan has been paid in full, which is essential for your personal records. Allow sufficient processing time (often several business days) before contacting your servicer to inquire about the status of your payment. The timeframe will vary depending on the payment method used. For example, online payments often provide quicker confirmation than mailed payments.

Potential Benefits and Drawbacks of Early Loan Payoff

Paying off your student loans early can significantly impact your financial future, offering substantial benefits but also presenting potential drawbacks. Weighing these carefully is crucial to making an informed decision aligned with your overall financial goals. This section will explore the advantages and disadvantages to help you understand the implications of accelerating your loan repayment.

The primary advantage of early repayment lies in minimizing the total interest paid over the life of the loan. Student loans often accrue significant interest, especially those with high interest rates. By paying them off early, you reduce the amount of money spent on interest, freeing up funds for other financial priorities. Additionally, a faster payoff can positively affect your credit score, demonstrating responsible financial behavior to lenders. However, there are also downsides to consider. Prematurely paying off student loans might mean delaying other important financial goals, such as saving for a down payment on a house or investing for retirement. Furthermore, aggressively paying down student loans could leave you with insufficient funds to handle unexpected financial emergencies.

Advantages of Early Student Loan Payoff

Early payoff offers tangible financial advantages. Reduced interest payments translate directly into more money available for other purposes. A higher credit score can lead to better interest rates on future loans and potentially even better terms on insurance policies.

Disadvantages of Early Student Loan Payoff

While the benefits are appealing, early repayment isn’t always the best strategy. Sacrificing other financial goals, such as retirement savings or emergency funds, can have long-term consequences. Unexpected expenses can also create financial hardship if a significant portion of your income is dedicated to student loan repayment.

Long-Term Financial Implications of Early Loan Payoff

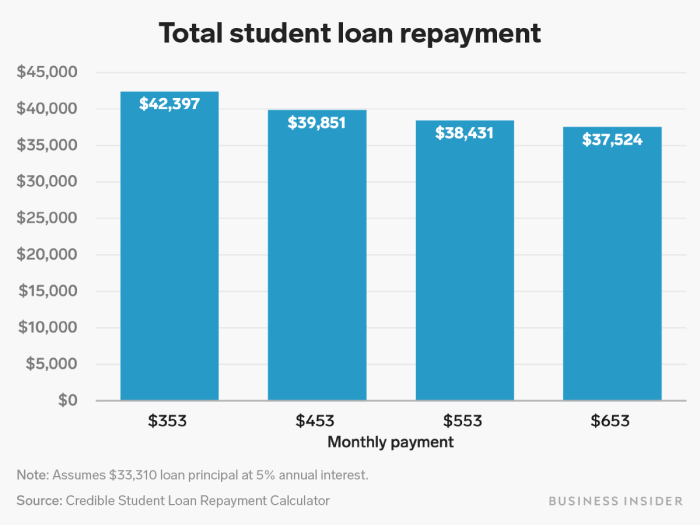

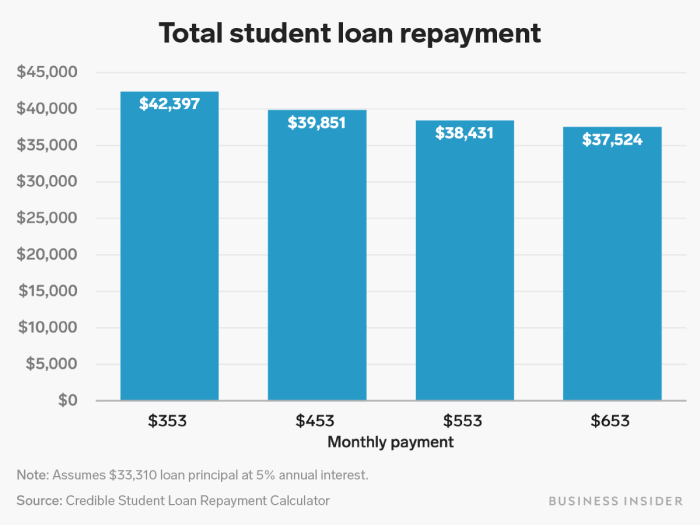

The decision to pay off student loans early involves considering the long-term financial implications. The following scenarios illustrate the impact of different interest rates and loan amounts:

To effectively illustrate the long-term financial implications, let’s consider hypothetical scenarios. These examples demonstrate how different interest rates and loan amounts affect the total cost and the potential benefits of early repayment.

- Scenario 1: High Interest Rate, High Loan Amount Imagine a $50,000 loan with a 7% interest rate. Paying it off over the standard 10-year repayment period could cost you significantly more in interest than paying it off aggressively within 5 years. The accelerated repayment would save a substantial amount on interest, though it requires a significant upfront financial commitment.

- Scenario 2: Low Interest Rate, Low Loan Amount Consider a $10,000 loan with a 3% interest rate. While paying it off early still reduces interest, the savings might be less substantial compared to the high-interest, high-amount scenario. The potential benefits of investing that extra money elsewhere might outweigh the modest interest savings.

- Scenario 3: Average Interest Rate, Average Loan Amount A $30,000 loan with a 5% interest rate represents a more common situation. Early repayment would result in moderate interest savings, and the decision to prioritize early payoff should be weighed against other financial priorities, such as building an emergency fund or investing for retirement.

Considering Alternative Payment Options

Paying off your student loans in full might not always be the most financially advantageous strategy. Several alternative options exist, each with its own set of benefits and drawbacks. Carefully weighing these alternatives against your individual financial circumstances is crucial before making a decision.

Exploring alternative repayment strategies can lead to significant savings or provide more manageable monthly payments. These options offer flexibility and can be particularly helpful for individuals facing financial constraints or those seeking to optimize their long-term financial health.

Loan Refinancing

Loan refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce the total amount you pay over the life of the loan. The lower interest rate is achieved by leveraging your improved credit score or shopping around for better loan terms. For example, someone with a high credit score might refinance their federal student loans with a private lender at a substantially lower interest rate, leading to lower monthly payments and a reduced total interest paid. However, refinancing federal student loans means losing access to federal repayment programs like income-driven repayment plans and potential forgiveness programs. Careful consideration of this trade-off is essential.

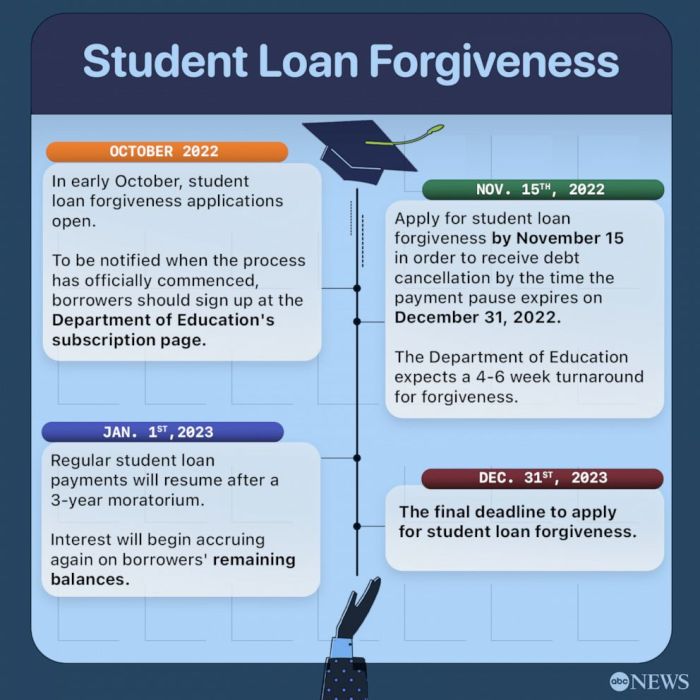

Student Loan Forgiveness Programs

Several student loan forgiveness programs exist, offering the possibility of having a portion or all of your student loan debt discharged. These programs typically target specific professions, such as teaching or public service, or individuals who meet certain income requirements. Eligibility criteria vary significantly depending on the specific program. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying employer. However, meeting the stringent requirements for these programs can be challenging. Thorough research and careful documentation are necessary to successfully apply and qualify for these programs.

Comparison of Loan Refinancing and Full Payoff

The decision between refinancing and full payoff hinges on individual financial situations and long-term goals. The following table illustrates key differences:

| Feature | Loan Refinancing | Full Payoff | Notes |

|---|---|---|---|

| Interest Rate | Potentially lower than original rate | Original interest rate (unchanged) | Depends on credit score and market rates. |

| Monthly Payment | Potentially lower | Potentially higher (depending on payoff timeline) | Refinancing can extend loan term, potentially lowering monthly payments. |

| Total Cost | Potentially lower due to lower interest | Higher due to paying the full principal and accumulated interest | Full payoff eliminates future interest accrual. |

Closure

Successfully paying off your student loans in full represents a significant financial achievement. By understanding your repayment options, developing a robust financial plan, and carefully navigating the payment process, you can significantly reduce your long-term financial burden and improve your creditworthiness. Remember to carefully weigh the pros and cons, considering your overall financial situation and long-term goals. This guide provides a solid foundation for making informed decisions about your student loan repayment journey, empowering you to take control of your financial future.

Top FAQs

What if I can’t afford to pay my student loans in full?

Explore alternative repayment plans like income-driven repayment or refinancing to find a more manageable payment schedule. Contact your loan servicer to discuss options.

Will paying my student loans early affect my credit score?

Generally, paying down debt positively impacts your credit score, but the effect depends on your overall credit history. Paying off your loans in full will likely have a positive impact over time.

What happens if I make a payment and the loan servicer doesn’t receive it?

Always retain proof of payment (e.g., bank statement, confirmation number). Contact your loan servicer immediately if you suspect a payment issue.

Can I pay off my student loans with a credit card?

Some loan servicers may allow this, but it’s usually not recommended due to potential high interest charges on credit cards. Check with your servicer and carefully weigh the pros and cons.