Navigating the complexities of student loan debt can feel overwhelming, especially when faced with high interest rates. Many borrowers find themselves wondering, “Can I refinance my private student loan?” This question opens the door to a world of possibilities, from significantly reducing monthly payments to shortening the repayment timeline. However, understanding the nuances of refinancing is crucial to making an informed decision that aligns with your financial goals.

This guide delves into the intricacies of private student loan refinancing, providing a clear and concise overview of eligibility requirements, the various types of loans eligible for refinancing, the potential benefits and drawbacks, and a step-by-step approach to finding the best refinancing options. We’ll also explore potential risks and offer illustrative examples to help you better understand the process and its implications.

Eligibility Requirements for Refinancing

Refinancing your private student loans can offer significant benefits, such as lower interest rates and a simplified repayment plan. However, eligibility depends on several factors that lenders carefully assess. Understanding these requirements is crucial before you begin the application process. This section details the key criteria you’ll need to meet to successfully refinance your private student loans.

Credit Score Requirements

A strong credit score is typically the most significant factor in determining your eligibility for private student loan refinancing. Lenders use your credit score as an indicator of your creditworthiness and repayment ability. Generally, a credit score of 670 or higher is considered favorable for refinancing, although some lenders may have slightly lower or higher thresholds. Scores below this range may make it difficult to secure a favorable interest rate or even qualify for refinancing at all. The higher your credit score, the better interest rates and loan terms you can expect. Factors like payment history, credit utilization, and length of credit history all contribute to your overall credit score.

Income Verification Methods

Lenders require verification of your income to ensure you have the capacity to repay the refinanced loan. Common methods include providing pay stubs, tax returns (W-2s and 1099s), or bank statements showing consistent income deposits. Some lenders may use automated income verification services that access your information directly from your employer or bank. The specific documents required will vary depending on the lender and the complexity of your income situation. Providing accurate and complete documentation is essential for a smooth and timely application process.

Comparison of Eligibility Criteria Across Lenders

Eligibility criteria can vary significantly across different private student loan refinancing lenders. Some lenders may prioritize credit score, while others might place more emphasis on your debt-to-income ratio (DTI) or the type of student loans you’re looking to refinance. For example, one lender might accept borrowers with a lower credit score but require a lower DTI, while another might have a higher credit score requirement but be more flexible with DTI. It’s crucial to compare offers from multiple lenders to find the best terms and conditions based on your individual financial profile. Shopping around and comparing rates is strongly advised before committing to a refinance.

Debt-to-Income Ratio’s Impact on Approval Chances

Your debt-to-income ratio (DTI) – the percentage of your gross monthly income that goes towards debt payments – plays a crucial role in your eligibility for refinancing. A lower DTI generally increases your chances of approval. Lenders prefer borrowers with a manageable debt load, indicating a lower risk of default.

| Debt-to-Income Ratio (DTI) | Approval Chances | Example Scenario | Lender Considerations |

|---|---|---|---|

| Below 30% | High | Monthly income of $5,000, total monthly debt payments of $1,000 (20% DTI). | Strong likelihood of approval due to low risk. |

| 30-40% | Moderate | Monthly income of $5,000, total monthly debt payments of $1,800 (36% DTI). | Approval possible, but may require a higher credit score or additional documentation. |

| 40-50% | Low | Monthly income of $5,000, total monthly debt payments of $2,500 (50% DTI). | Approval less likely; lender may require significant improvements in financial situation. |

| Above 50% | Very Low | Monthly income of $5,000, total monthly debt payments of $3,000 (60% DTI). | Approval highly unlikely without substantial changes to debt or income. |

Types of Private Student Loans Eligible for Refinancing

Refinancing your private student loans can simplify your repayment process and potentially lower your monthly payments. However, not all private student loans are created equal, and eligibility for refinancing can vary depending on the type of loan you have. Understanding the types of loans eligible for refinancing is crucial before you begin the process.

Many lenders offer refinancing options for a wide range of private student loans. These typically include loans issued by banks, credit unions, and online lenders. The specific types of loans accepted often depend on the lender’s policies.

Private Student Loan Types Typically Eligible for Refinancing

Various types of private student loans are commonly refinanced. These frequently include undergraduate and graduate student loans, as well as loans taken out for specific educational programs, such as medical school or law school. Some lenders may also refinance loans used for other educational expenses, such as tuition, fees, room and board, and books. It’s important to check directly with the refinancing lender for their specific eligibility criteria. For example, lender A might accept loans from multiple institutions, while lender B may only accept loans originated through their own network.

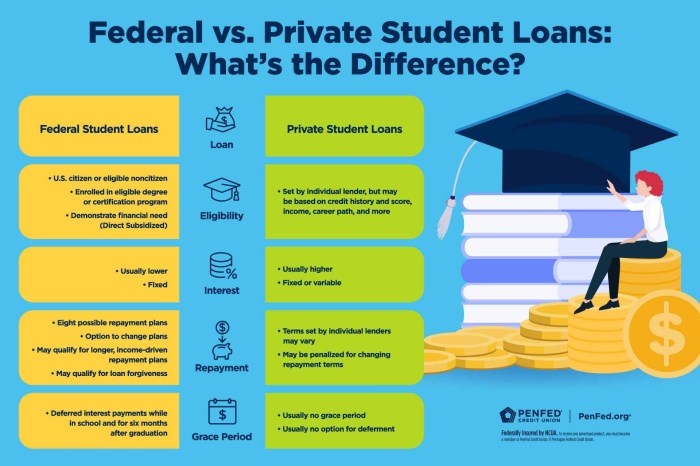

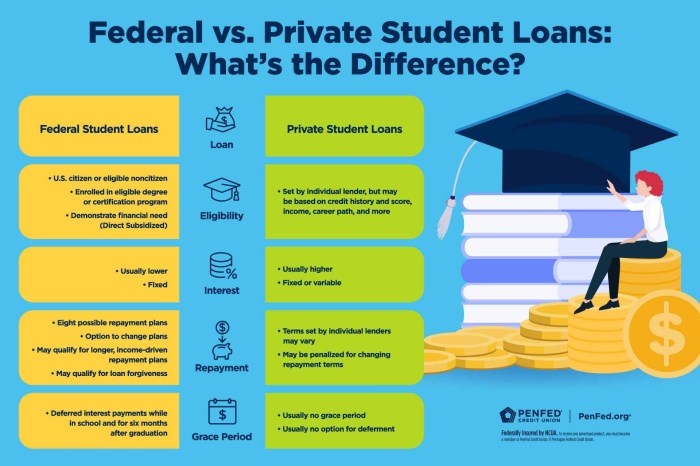

Refinancing Federal Student Loans Consolidated into Private Loans

Federal student loans are generally not eligible for private refinancing. However, if you have consolidated your federal student loans into a private loan, refinancing that consolidated private loan *may* be possible. This consolidated private loan would then be treated like any other private student loan for refinancing purposes. The terms and conditions, including interest rates and repayment options, will depend on the refinancing lender’s assessment of your creditworthiness. It’s essential to carefully compare offers from different lenders before making a decision. Keep in mind that refinancing federal loans into a private loan relinquishes the borrower protections afforded by federal loan programs.

Implications of Refinancing Different Loan Types Simultaneously

Refinancing multiple private student loans simultaneously can streamline your payments into a single monthly payment. However, the interest rate offered on a consolidated loan will depend on your overall credit profile, taking into account the interest rates and repayment histories of all the individual loans being refinanced. A borrower with a mix of high-interest and low-interest loans might receive a blended interest rate that reflects this mix. For example, someone with a strong credit history and a mix of loans with a 7% and 10% interest rate might receive an overall interest rate between these two, while a borrower with a weaker credit profile might receive a higher rate. Carefully reviewing the terms of the refinanced loan is crucial to ensure it aligns with your financial goals.

Benefits and Drawbacks of Refinancing

Refinancing your private student loans can be a strategic financial move, but it’s crucial to carefully weigh the potential advantages against the risks involved. Understanding both the benefits and drawbacks will help you make an informed decision that aligns with your long-term financial goals. A thorough assessment of your current financial situation and future plans is essential before proceeding.

Refinancing offers the potential to significantly reduce your monthly payments and overall interest costs. However, this comes with the trade-off of potentially losing certain federal loan protections. The decision hinges on a careful comparison of these competing factors.

Lower Interest Rates and Monthly Payments

Refinancing can unlock lower interest rates, especially if your credit score has improved since you initially took out your loans. A lower interest rate translates directly into lower monthly payments, freeing up cash flow for other financial priorities. For example, someone with a 7% interest rate on a $50,000 loan might see their monthly payment drop considerably by refinancing to a 4% rate. This could mean hundreds of dollars saved each month, allowing for faster debt repayment or investments in other areas.

Shorter Repayment Terms

While a lower interest rate is often the primary motivator, refinancing also allows you to potentially shorten your repayment term. This means paying off your loan faster, reducing the total interest paid over the life of the loan. However, shorter repayment terms usually result in higher monthly payments. It’s essential to find a balance that suits your budget and financial goals. A shorter repayment term could be advantageous if you anticipate a significant increase in income in the near future.

Loss of Federal Student Loan Protections

A significant drawback of refinancing private student loans is the potential loss of federal student loan protections. Federal loans often come with benefits like income-driven repayment plans, deferment options during periods of financial hardship, and forgiveness programs. Refinancing a federal loan into a private loan typically eliminates these protections. This is a critical consideration, especially if you anticipate facing financial difficulties in the future. The trade-off between potentially lower payments and the loss of these safety nets needs careful evaluation.

Long-Term Financial Implications: Refinancing vs. Not Refinancing

The decision to refinance carries significant long-term financial implications. Consider the following comparison:

- Refinancing: Potentially lower monthly payments and total interest paid, but loss of federal loan protections, and risk of higher payments if interest rates rise unexpectedly. This strategy works best for borrowers with strong credit scores and stable financial situations who are confident in their ability to manage higher monthly payments if necessary.

- Not Refinancing: Retention of federal loan protections, but potentially higher monthly payments and total interest paid over the life of the loan. This approach offers greater financial security, particularly for borrowers with unpredictable income or those who anticipate needing access to federal loan benefits in the future.

Finding the Best Refinancing Options

Refinancing your private student loans can significantly impact your finances, potentially saving you thousands of dollars over the life of your loan. However, navigating the numerous lenders and offers can be overwhelming. A systematic approach to comparing options is crucial to securing the best possible terms. This section provides a step-by-step guide to help you find the most advantageous refinancing plan.

To find the best refinancing option, a multi-step process involving careful comparison and consideration of various factors is essential. This ensures you select a loan that aligns with your financial goals and circumstances.

Comparing Offers from Multiple Lenders

Before you begin comparing offers, gather your financial information, including your credit score, debt-to-income ratio, and current student loan details. This will allow lenders to provide you with personalized quotes. Then, use online comparison tools or contact several lenders directly to obtain multiple refinancing offers. It’s advisable to obtain at least three to five offers to ensure a broad comparison.

Once you have multiple offers, organize them in a spreadsheet or table. This will make comparing key features much easier. Consider using columns for lender name, interest rate, fees, repayment terms, and any other relevant information.

Key Factors to Consider When Selecting a Refinancing Lender

Several key factors significantly influence the overall cost and suitability of a refinanced loan. Careful consideration of these elements is paramount to making an informed decision.

A structured approach to evaluating these factors is essential for making an informed decision.

- Interest Rate: This is the most crucial factor. A lower interest rate translates to lower monthly payments and significant savings over the life of the loan. Compare both fixed and variable interest rates, considering your risk tolerance and financial outlook.

- Fees: Lenders may charge origination fees, prepayment penalties, or other fees. These fees can add to the overall cost of the loan, so carefully compare the total fees across different offers. A lower interest rate might be offset by higher fees.

- Repayment Terms: Consider the loan term length. Shorter terms lead to higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but higher total interest paid. Choose a term that aligns with your budget and financial goals.

- Loan Type: Understand the type of loan being offered (e.g., fixed-rate, variable-rate). Fixed-rate loans offer predictable payments, while variable-rate loans may fluctuate based on market conditions.

- Customer Service and Reputation: Research the lender’s reputation and customer service record. Look for reviews and ratings from other borrowers.

Calculating the Total Cost of Refinancing

Accurately calculating the total cost of refinancing is crucial for a comprehensive comparison. This involves considering not only the interest rate but also any fees and the length of the repayment period.

A simple calculation will not suffice; a more detailed approach is needed to accurately assess the overall cost.

Total Cost = (Monthly Payment x Number of Months) + Total Fees

For example, let’s say Lender A offers a $20,000 loan at 6% interest over 10 years with a $200 origination fee, resulting in a monthly payment of $210. The total cost would be ($210 x 120 months) + $200 = $25,400. Compare this to Lender B’s offer to determine which is more cost-effective.

The Refinancing Process

Refinancing your private student loans can seem daunting, but understanding the process can make it significantly less stressful. The application process generally involves several key steps, from initial research to final loan disbursement. Careful preparation and attention to detail are crucial for a smooth and successful refinancing experience.

The steps involved in refinancing your private student loans typically follow a structured path. This process, while varying slightly between lenders, generally includes similar stages. Understanding these steps allows you to anticipate what to expect and better manage your expectations throughout the process.

Application Steps

The application process usually begins with completing an online application form. This form will request personal information, including your employment history, income, and details about your existing student loans. After submitting the application, the lender will review your information and may request additional documentation to verify the details provided. Following a credit check and verification of your information, the lender will provide a loan offer outlining the terms and conditions of the refinanced loan. Finally, upon acceptance of the offer, the lender will disburse the funds, paying off your existing loans. This process can take several weeks, depending on the lender and the complexity of your application.

Required Documentation

Lenders typically require various documents to verify your identity, income, and the details of your existing student loans. Commonly requested documents include government-issued identification, proof of income (such as pay stubs or tax returns), and details of your current student loans, including loan amounts, interest rates, and outstanding balances. You may also be asked to provide proof of your education, such as transcripts or degree verification. Providing all necessary documentation promptly can expedite the application process. Failure to provide the requested documentation can significantly delay the approval and disbursement of your refinanced loan.

Timeline from Application to Disbursement

The time it takes to refinance your student loans can vary depending on several factors, including the lender’s processing time, the complexity of your application, and the completeness of your documentation. While some lenders may process applications quickly, others may take several weeks or even months. A realistic expectation is to allow for a timeline of several weeks from application submission to loan disbursement. For example, a lender might take two to four weeks to review the application and verify the information, followed by another week or two for final approval and loan disbursement. It’s advisable to check with your chosen lender for an estimated timeline.

Potential Risks and Considerations

Refinancing your private student loans can offer significant benefits, but it’s crucial to understand the potential downsides before making a decision. While refinancing can lower your monthly payments and interest rate, several factors could negatively impact your financial situation. Careful consideration of these risks is essential to ensure refinancing aligns with your overall financial goals.

Interest rates are not static; they fluctuate based on various economic factors. A seemingly attractive interest rate at the time of refinancing could increase if market conditions change during the loan’s term. This could lead to higher overall interest paid compared to your original loan. For example, if you refinance at a 6% rate and rates rise to 8% shortly after, your monthly payments could increase substantially, potentially negating the initial benefits of refinancing.

Impact on Credit Score

The refinancing process involves a hard inquiry on your credit report, which can temporarily lower your credit score. The extent of the decrease depends on your existing credit history and the number of recent inquiries. Furthermore, your credit score will be assessed again by the new lender, and a lower score could result in a higher interest rate or even loan denial. It’s important to understand that while a temporary dip is common, consistently applying for credit can negatively affect your creditworthiness in the long term. Consider your credit score before applying for refinancing to avoid further complications.

Scenarios Where Refinancing May Not Be Beneficial

There are situations where refinancing might not be the best financial strategy. For instance, if you have multiple private student loans with significantly different interest rates, refinancing might not lower your overall interest rate. This could happen if the weighted average interest rate of your existing loans is lower than the rate offered by a refinancing lender. Another scenario is if you are close to paying off your loans. The fees and closing costs associated with refinancing might outweigh the benefits of a slightly lower interest rate, especially if the remaining loan balance is small. Finally, if your credit score is low, you might qualify only for a high-interest rate loan, negating the benefits of refinancing.

Illustrative Examples

Understanding the potential benefits and drawbacks of refinancing private student loans requires examining real-world scenarios. The following examples illustrate both positive and negative outcomes, highlighting the importance of careful consideration before proceeding.

Successful Refinancing Scenario

Sarah, a recent graduate with $40,000 in private student loans carrying a 7.5% interest rate, successfully refinanced her loans with a reputable lender. She secured a new loan with a 4.5% interest rate, reducing her monthly payment by approximately $150. This lower interest rate saved her over $10,000 in interest over the life of the loan, allowing her to pay off her debt faster and free up funds for other financial goals, such as investing or purchasing a home. The streamlined process with her chosen lender was also a positive aspect, making the entire refinancing experience relatively stress-free. She carefully compared offers from multiple lenders before selecting the one that best suited her financial situation.

Unsuccessful Refinancing Scenario

Mark, also burdened with private student loans totaling $35,000, rushed into refinancing without thoroughly researching lenders and loan terms. He opted for a lender offering an attractively low initial interest rate, but failed to notice the loan’s variable interest rate structure. Within a year, interest rates rose significantly, increasing his monthly payment substantially and ultimately extending his repayment period. Additionally, he overlooked prepayment penalties, which prevented him from making extra payments to accelerate his debt repayment. The result was higher overall interest payments and a longer repayment timeline compared to his original loan terms. This situation highlights the importance of understanding all aspects of a loan agreement before signing.

Ultimate Conclusion

Refinancing your private student loans can be a powerful tool for managing your debt, but it’s not a one-size-fits-all solution. By carefully considering your eligibility, comparing offers from multiple lenders, and understanding the potential risks, you can make an informed decision that best suits your individual financial circumstances. Remember to weigh the long-term implications against your short-term needs. Ultimately, the goal is to create a sustainable repayment plan that allows you to achieve financial freedom.

Query Resolution

What is the impact of refinancing on my credit score?

The impact on your credit score is temporary. A hard inquiry will slightly lower your score initially, but a lower interest rate and responsible repayment can positively affect your credit score over time. The overall effect depends on your credit history and the lender’s evaluation.

Can I refinance if I have missed payments in the past?

Missing payments can significantly affect your eligibility. Lenders generally prefer borrowers with a strong payment history. However, some lenders may consider applications with minor past delinquencies. It’s crucial to thoroughly check your credit report and explore lenders with more lenient criteria.

What are the common fees associated with refinancing?

Common fees include origination fees, which are a percentage of the loan amount, and prepayment penalties, though these are less common in refinancing. Carefully review all fees before committing to a refinance.

How long does the refinancing process typically take?

The timeline varies depending on the lender and the complexity of your application. It can range from a few weeks to several months. Expect a thorough review of your financial documents.