Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with private loans. Many borrowers find themselves asking, “Can I refinance my private student loans?” The answer, thankfully, is often yes, but the process requires careful consideration of various factors to ensure you make the most financially sound decision. This guide will walk you through the key aspects of private student loan refinancing, empowering you to make informed choices about your financial future.

Refinancing your private student loans can offer significant advantages, such as lower interest rates leading to substantial savings over the life of the loan, and the simplification of multiple loan payments into a single, more manageable monthly payment. However, it’s crucial to understand the potential drawbacks, including the possible loss of federal student loan protections and the risk of incurring additional fees. This guide will carefully weigh these pros and cons to help you determine if refinancing is the right path for you.

Eligibility Requirements for Refinancing Private Student Loans

Refinancing your private student loans can offer significant benefits, such as lower interest rates and a simplified repayment plan. However, securing approval depends on meeting specific eligibility criteria set by lenders. Understanding these requirements is crucial before applying. This section details common eligibility criteria, highlighting variations among lenders and factors that might lead to rejection.

Common Eligibility Criteria for Private Student Loan Refinancing

Lenders typically assess several key factors to determine your eligibility for refinancing. These commonly include your credit score, debt-to-income ratio, income level, and the type and amount of your existing student loans. A higher credit score generally improves your chances of approval and secures a more favorable interest rate. Your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, is also a significant factor. Lenders prefer applicants with a low DTI, indicating a greater capacity to manage additional debt. Sufficient income is essential to demonstrate your ability to repay the refinanced loan. Finally, the type and amount of your existing private student loans will influence eligibility. Some lenders may prefer to refinance only federal loans or loans from a specific institution. The total amount of your student loan debt may also be a deciding factor in the refinancing process.

Comparison of Eligibility Requirements Across Lenders

Eligibility requirements can vary considerably across different private student loan refinancing lenders. Some lenders may have stricter requirements than others, reflecting their risk assessment models. For instance, one lender might require a minimum credit score of 680, while another might accept applicants with scores as low as 660. Similarly, the acceptable debt-to-income ratio can differ significantly. Some lenders may place a cap on the total loan amount they’re willing to refinance, while others might offer refinancing for larger loan balances. It’s crucial to compare offers from multiple lenders to find the best fit for your individual circumstances. Consider factors beyond just the interest rate, including fees, repayment terms, and lender reputation.

Factors That May Disqualify an Applicant

Several factors can negatively impact your chances of refinancing your private student loans. A low credit score is a major obstacle, often leading to rejection or less favorable terms. A high debt-to-income ratio, indicating financial strain, also reduces your eligibility. An inconsistent employment history or insufficient income can also be detrimental to your application. Furthermore, having a history of late or missed loan payments demonstrates poor credit management, which significantly reduces the likelihood of approval. Finally, certain types of existing debt, or a lack of sufficient private student loan debt to refinance, could lead to disqualification.

Table Comparing Eligibility Requirements

| Lender | Minimum Credit Score | Maximum DTI | Minimum Loan Amount |

|---|---|---|---|

| Lender A | 680 | 43% | $5,000 |

| Lender B | 660 | 50% | $10,000 |

| Lender C | 700 | 40% | $20,000 |

Types of Private Student Loans That Can Be Refinanced

Refinancing your private student loans can simplify your monthly payments and potentially lower your interest rate. However, not all private student loans are created equal, and their eligibility for refinancing varies. Understanding the different types and their refinancing suitability is crucial before you begin the process. This section will clarify which types of private student loans are typically eligible for refinancing and which may present more challenges.

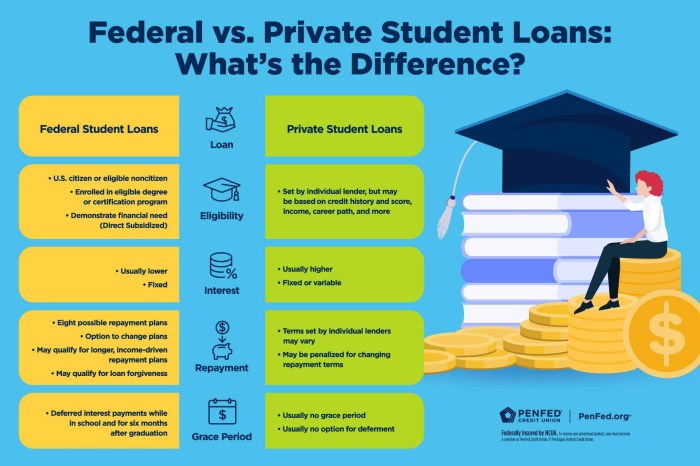

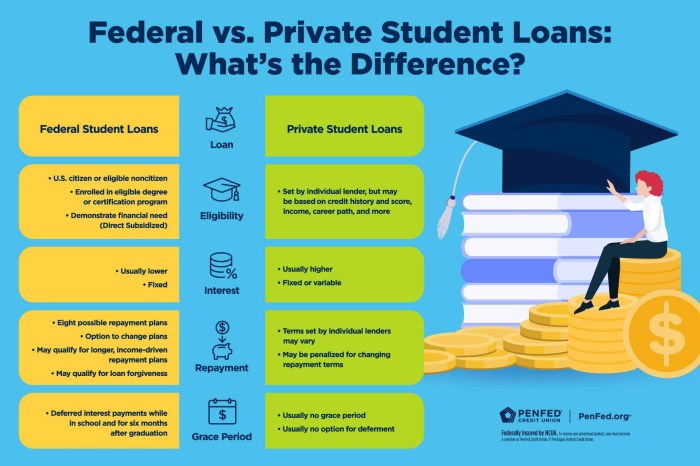

Private student loans differ from federal student loans in several key ways, including eligibility criteria, repayment options, and the refinancing process itself. While federal student loans are backed by the government, private loans are offered by banks, credit unions, and other private lenders. This distinction significantly impacts refinancing opportunities.

Private Student Loan Types and Refinancing Suitability

The eligibility of a private student loan for refinancing hinges on several factors, including the lender, the loan terms, and your creditworthiness. Generally, loans with a longer repayment period or a higher interest rate are more attractive candidates for refinancing. Conversely, loans with shorter terms or already low interest rates might not offer significant advantages through refinancing.

- Unsubsidized Private Loans: These loans accrue interest from the time they’re disbursed, even while you’re still in school. They are generally eligible for refinancing, provided you meet the lender’s credit and income requirements.

- Subsidized Private Loans (Less Common): While less common than unsubsidized private loans, some lenders offer subsidized private loans where interest may not accrue during a grace period. These are typically eligible for refinancing, similar to unsubsidized loans.

- Graduate Student Loans: These loans are specifically designed for graduate-level education and are usually refinanced under the same conditions as undergraduate private student loans. Factors like your credit score and debt-to-income ratio will be key considerations.

- Parent PLUS Loans (Private): Some private lenders offer loans to parents to help finance their children’s education. These loans can often be refinanced, but the parent’s creditworthiness will be the primary determinant of eligibility.

- Loans with Variable Interest Rates: Loans with variable interest rates may be refinanced into loans with fixed rates, offering predictability and protection against interest rate increases. This is often a desirable option for borrowers.

- Loans in Default: Loans currently in default are generally ineligible for refinancing. You’ll need to resolve the default status before considering refinancing options. This typically involves negotiating a repayment plan with the original lender.

- Loans with Co-signers: Loans with co-signers can sometimes be refinanced, but the process may involve the co-signer’s credit history and approval. Refinancing may offer an opportunity to remove the co-signer, depending on your creditworthiness.

Loan Types More Difficult to Refinance

Certain types of private student loans present greater challenges when it comes to refinancing. These often involve unique terms or circumstances that make them less attractive to refinancing lenders.

Loans with very short repayment periods or already exceptionally low interest rates may not offer sufficient incentive for refinancing. The cost and effort of refinancing might outweigh the potential benefits in such cases.

Private student loans with significant delinquencies or negative marks on your credit report will significantly impact your chances of successful refinancing. Improving your credit score is crucial before applying.

Benefits and Drawbacks of Refinancing

Refinancing your private student loans can be a significant financial decision with the potential to offer substantial savings or, conversely, lead to unforeseen complications. Understanding both the advantages and disadvantages is crucial before proceeding. A careful evaluation of your individual circumstances is necessary to determine if refinancing is the right choice for you.

Refinancing involves replacing your existing private student loans with a new loan, typically from a different lender. This new loan may offer more favorable terms, such as a lower interest rate or a more manageable repayment schedule. However, it’s essential to weigh these potential benefits against the potential drawbacks before making a decision.

Lower Interest Rates and Simplified Payments

One of the primary benefits of refinancing is the potential to secure a lower interest rate. A lower interest rate translates directly into lower monthly payments and significantly less interest paid over the life of the loan. For example, refinancing a $50,000 loan from 8% to 6% could save thousands of dollars in interest over the repayment period. Additionally, refinancing can simplify your payments by consolidating multiple loans into a single, easier-to-manage monthly payment. This streamlined approach can improve financial organization and reduce the risk of missed payments.

Loss of Federal Protections and Higher Fees

A key drawback of refinancing private student loans is the potential loss of federal protections. Federal student loans often come with benefits like income-driven repayment plans and loan forgiveness programs. Refinancing with a private lender typically eliminates these protections. Furthermore, refinancing may involve origination fees, prepayment penalties, or other charges that can offset some of the potential savings from a lower interest rate. It’s vital to carefully review all fees associated with the refinancing process before proceeding.

Long-Term Financial Implications

The long-term financial implications of refinancing versus not refinancing depend heavily on individual circumstances and the terms of the new loan. If you can secure a significantly lower interest rate and avoid additional fees, refinancing could lead to substantial long-term savings. However, losing federal protections could prove costly if your financial situation changes unexpectedly. For instance, someone facing unemployment might find the flexibility of income-driven repayment plans invaluable, a benefit lost through refinancing. A thorough comparison of the total interest paid over the life of the loan, factoring in all fees and potential future scenarios, is essential for making an informed decision.

Pros and Cons of Refinancing

| Pros | Cons |

|---|---|

| Lower interest rates | Loss of federal student loan protections |

| Simplified monthly payments | Potential for higher fees (origination fees, prepayment penalties) |

| Longer repayment term (potentially lower monthly payments) | Increased total interest paid over a longer term |

| Potential for better loan terms | Risk of negative impact on credit score if application is denied |

Finding and Comparing Lenders

Refinancing your private student loans can significantly impact your finances, so choosing the right lender is crucial. A thorough comparison of lenders and their offerings is essential to securing the best possible terms for your unique situation. This process involves several key steps to ensure you make an informed decision.

Finding the best private student loan refinance lender requires a systematic approach. This involves identifying potential lenders, gathering information about their offerings, and comparing them across several key factors to determine which best suits your needs. Consider this a crucial step in potentially saving thousands of dollars over the life of your loan.

Reputable Lender Identification

Identifying trustworthy lenders is paramount. Look for lenders with a proven track record, strong online reviews, and transparent lending practices. Check the Better Business Bureau (BBB) for complaints and ratings. Additionally, verify that the lender is licensed and operates legally in your state. Be wary of lenders offering unusually low interest rates or requiring minimal documentation, as these could be red flags. Checking the lender’s website for information on their licensing, accreditation, and customer service policies will provide a degree of assurance.

Factors to Consider When Comparing Lenders

Several key factors must be carefully weighed when comparing different lenders. Interest rates are obviously critical; however, it’s equally important to consider fees, repayment terms, and any additional benefits offered. A slightly higher interest rate might be offset by lower fees or more flexible repayment options. Understanding the total cost of the loan, including all fees and interest, provides a more comprehensive picture than focusing solely on the interest rate.

For instance, consider Lender A offering a 6% interest rate with a $500 origination fee versus Lender B offering a 6.5% interest rate with no origination fee. The lower interest rate initially seems attractive, but calculating the total cost over the loan’s lifetime will reveal which option is ultimately more cost-effective. This calculation requires considering the loan amount, repayment period, and the impact of each fee.

Key Questions to Ask Potential Lenders

Before committing to a refinance, it’s vital to ask potential lenders specific questions. These questions should cover interest rates, fees, repayment options, and the lender’s customer service policies. Asking about the lender’s history of customer satisfaction and their process for handling loan modifications or hardship situations is also crucial. Clarifying the details of any prepayment penalties is important as well, as is understanding the application process and the required documentation.

Examples of crucial questions include: What is your current interest rate for borrowers with my credit score and loan amount? What fees are associated with refinancing my loan? What are my repayment options (e.g., fixed rate, variable rate, repayment term)? What is your process for handling late payments or financial hardship? Does your company have a history of successfully assisting borrowers in similar financial situations?

The Refinancing Application Process

Refinancing your private student loans involves a multi-step process that requires careful preparation and attention to detail. A successful application hinges on providing accurate and complete information to the lender. The entire process, from initial application to loan disbursement, can take several weeks, depending on the lender and the complexity of your application.

The application process typically begins with an online pre-qualification or pre-approval. This initial step allows you to understand your potential interest rate and loan terms without impacting your credit score. Once you’ve chosen a lender and loan terms, you’ll need to submit a formal application, including all the necessary documentation. The lender will then review your application and supporting documents. If approved, the lender will disburse the funds to pay off your existing loans.

Required Documentation and Information

Gathering the necessary documentation is crucial for a smooth and efficient application process. Lenders typically require a range of information to assess your creditworthiness and repayment ability. This typically includes your personal information (name, address, Social Security number), employment history (pay stubs, W-2 forms), income verification (tax returns), and details about your existing student loans (loan balances, interest rates, lenders). You may also need to provide information about your assets and debts. Providing complete and accurate information upfront can significantly reduce processing time and prevent delays. Inaccurate or incomplete information is a frequent cause of application delays or rejection.

Application Processing Timeframe

The time it takes for a lender to process your application can vary. Some lenders may offer quicker processing times, while others may take longer. Factors such as the complexity of your application, the volume of applications the lender is currently processing, and the completeness of your documentation all influence the processing time. Generally, expect the process to take anywhere from a few weeks to several months. Many lenders provide estimated processing timelines on their websites. For example, Lender A might advertise a processing time of 2-4 weeks, while Lender B might state 4-6 weeks. These estimates, however, are not guarantees.

Reasons for Application Rejection and Solutions

Loan applications can be rejected for several reasons, often related to creditworthiness or insufficient income. A low credit score is a common reason for rejection, as lenders view it as an indicator of higher risk. Insufficient income, where your income is not deemed sufficient to cover your monthly loan payments, is another frequent cause. Providing inaccurate information on your application can also lead to rejection. To address these issues, consider improving your credit score by paying down debt and maintaining good credit habits. If your income is insufficient, explore options to increase your income or consolidate your debts to reduce your monthly payments. Ensure all information provided in your application is accurate and complete. If your application is rejected, contact the lender to understand the specific reasons and explore potential solutions. For example, a lender might suggest improving your credit score before reapplying or co-signing the loan with someone who has better credit.

Understanding Repayment Options

Refinancing your private student loans often presents borrowers with a range of repayment options, each impacting the overall cost and repayment schedule. Understanding these options is crucial for making an informed decision that aligns with your financial goals and capabilities. Choosing the right plan depends on your risk tolerance, financial stability, and long-term financial objectives.

Fixed-Rate Repayment

Fixed-rate repayment plans offer predictable monthly payments throughout the loan term. The interest rate remains constant, eliminating the uncertainty associated with fluctuating interest rates. This predictability makes budgeting easier and allows for more accurate long-term financial planning. However, a fixed rate might not always be the lowest rate available, especially if interest rates are expected to fall.

Variable-Rate Repayment

Variable-rate repayment plans offer potentially lower initial monthly payments because the interest rate fluctuates based on a benchmark index, such as the prime rate or LIBOR. This can result in savings during periods of low interest rates. However, the fluctuating interest rate introduces uncertainty into your monthly budget, and your payments could increase significantly if benchmark rates rise. Borrowers should carefully consider their risk tolerance before opting for a variable rate.

Repayment Terms

The loan term, or repayment period, significantly impacts both your monthly payment and the total interest paid. Shorter terms result in higher monthly payments but lower overall interest costs due to less time accruing interest. Longer terms result in lower monthly payments but significantly higher total interest costs over the life of the loan. For example, a $30,000 loan at 6% interest would have a monthly payment of approximately $360 over a 10-year term, totaling approximately $43,200 over the life of the loan. The same loan with a 15-year term would have a monthly payment of approximately $250, but the total cost would be approximately $45,000.

Calculating Total Loan Cost

Calculating the total cost of a loan involves understanding the principal (the original loan amount), the interest rate, and the repayment term. A simple formula isn’t sufficient for precise calculations, as it often involves compounding interest. Most lenders provide amortization schedules that detail the monthly payment breakdown, showing the principal and interest components for each payment. Online loan calculators can also help estimate the total cost under different scenarios. For example, you can input the loan amount, interest rate, and loan term into a calculator to determine the total interest paid and the total amount repaid. Remember to factor in any fees associated with refinancing as well.

Impact on Credit Score

Refinancing your private student loans can have a noticeable impact on your credit score, both positive and negative. The overall effect depends on several factors, including your current creditworthiness, the terms of your new loan, and how you manage the process. Understanding these potential impacts is crucial for making an informed decision.

The primary factor influencing your credit score during refinancing is the hard credit inquiry. Lenders will perform a hard inquiry to assess your creditworthiness before approving your application. This inquiry temporarily lowers your credit score, typically by a few points, but the impact is usually short-lived. However, multiple hard inquiries within a short period can have a more significant negative effect. The positive effects of refinancing, such as improved credit utilization and lower monthly payments, generally outweigh this temporary dip.

Hard Credit Inquiry’s Effect on Credit Score

A hard credit inquiry, conducted by a lender during the loan application process, is recorded on your credit report. Credit scoring models consider these inquiries, and multiple inquiries within a short time frame can negatively affect your score. The impact varies depending on the scoring model used, but a general range is a decrease of 5 to 10 points. This impact is temporary, usually lasting for about 12 months. After that period, the impact on your score diminishes significantly. It’s important to note that the effect is typically less pronounced for individuals with already high credit scores. For example, someone with a 780 credit score might only see a 2-3 point drop, while someone with a 650 score might see a more significant drop of 5-7 points.

Strategies to Mitigate Negative Impacts

Several strategies can help minimize the negative impact on your credit score during the refinancing process. First, shop around and compare offers from multiple lenders within a short timeframe (ideally within 14-45 days, depending on the credit scoring model used). Credit scoring models often treat multiple inquiries within a short window as a single inquiry. Second, ensure you only apply for loans you are genuinely interested in and highly likely to qualify for. Avoid unnecessary applications, as each inquiry impacts your score. Finally, maintaining a strong credit history, with on-time payments and low credit utilization, will help offset the temporary negative impact of a hard inquiry. A solid credit history demonstrates responsible financial behavior, which can outweigh the minor negative effect of a hard inquiry.

Typical Credit Score Changes During and After Refinancing

Let’s illustrate a typical scenario. Suppose an individual has a credit score of 720. Applying for refinancing might result in a temporary drop of 5 points to 715 due to the hard inquiry. If the refinancing is approved and results in a lower debt-to-income ratio and improved credit utilization, their score could subsequently increase over time. For instance, after six months of consistent on-time payments on the refinanced loan, their score might rise to 730 or even higher, surpassing their pre-application score. This positive trend will continue as long as the individual maintains responsible credit behavior. However, if the individual fails to make timely payments on their refinanced loan, their score could decline significantly, regardless of the initial temporary drop from the hard inquiry. This highlights the importance of responsible financial management after refinancing.

Final Summary

Refinancing private student loans presents a powerful opportunity to improve your financial situation, but it’s a decision that demands careful planning and thorough research. By understanding your eligibility, exploring different lenders, and carefully considering the benefits and drawbacks, you can make an informed choice that aligns with your long-term financial goals. Remember to compare lenders diligently, understand the application process, and choose a repayment plan that suits your budget. Taking these steps will empower you to navigate the refinancing process confidently and achieve significant long-term savings.

Frequently Asked Questions

What is the impact of a hard credit inquiry during the refinancing process?

A hard credit inquiry, which occurs when a lender checks your credit report, can temporarily lower your credit score by a few points. However, this impact is usually minor and temporary, and the potential benefits of refinancing often outweigh this short-term effect.

Can I refinance federal student loans with private lenders?

Generally, you cannot directly refinance federal student loans with private lenders. However, you can refinance private student loans separately. If you have both federal and private loans, you may want to consider consolidating your federal loans through the government before refinancing your private loans.

What happens if my refinancing application is rejected?

Rejection often stems from factors like insufficient credit score, high debt-to-income ratio, or incomplete application information. Review your credit report for errors, improve your credit score if needed, and address any shortcomings in your application before reapplying.

How long does the refinancing process typically take?

The timeframe varies among lenders but generally ranges from a few weeks to several months. Factors influencing processing time include application completeness, creditworthiness, and lender workload.