Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with private loans. Many borrowers find themselves questioning, “Can I refinance private student loans?” This comprehensive guide explores the intricacies of refinancing, providing you with the knowledge to make informed decisions about your financial future. We’ll delve into eligibility requirements, interest rates, the refinancing process, and ultimately, help you determine if refinancing is the right choice for your specific circumstances.

Understanding the nuances of private student loan refinancing is crucial for managing your debt effectively. This guide will cover key aspects, from determining your eligibility based on credit score and income to comparing offers from various lenders and weighing the potential benefits against the risks. We aim to equip you with the tools and information needed to confidently navigate the refinancing landscape.

Eligibility Requirements for Refinancing

Refinancing your private student loans can offer significant benefits, such as lower interest rates and a simplified repayment plan. However, accessing these benefits hinges on meeting specific eligibility criteria set by lenders. Understanding these requirements is crucial before applying. This section details the common factors lenders consider when assessing your eligibility for refinancing.

Credit Score Requirements

A high credit score is typically the most significant factor influencing your eligibility for private student loan refinancing. Lenders use your credit score to assess your creditworthiness and predict your likelihood of repaying the loan. Generally, a higher credit score indicates a lower risk to the lender, leading to more favorable terms and a greater chance of approval. Scores below a certain threshold (often around 660-700, but this varies by lender) often result in rejection or significantly less attractive interest rates. Improving your credit score before applying can greatly increase your chances of approval and secure a better interest rate. Consistent on-time payments on existing debts, maintaining low credit utilization, and avoiding new credit applications are effective strategies for credit score improvement.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio, calculated by dividing your total monthly debt payments by your gross monthly income, is another key factor. A lower DTI ratio demonstrates your ability to manage existing debt while taking on additional financial responsibility. Lenders generally prefer borrowers with lower DTI ratios, as it signals a reduced risk of default. High DTI ratios often lead to rejection or less favorable loan terms. Strategies to improve your DTI ratio include paying down existing debts, increasing your income, or consolidating high-interest debts.

Income Verification

Lenders require verification of your income to assess your repayment capacity. This typically involves providing documentation such as pay stubs, tax returns, or bank statements. The specific documentation required and the verification process may vary depending on the lender and the borrower’s income source. Self-employment or irregular income sources can sometimes make the verification process more challenging. Accurate and complete documentation is essential for a smooth and efficient application process. Providing insufficient or inaccurate documentation can delay or even prevent approval.

Examples of Ineligibility

Several situations might render a borrower ineligible for refinancing. These include having a very low credit score (below the lender’s minimum threshold), an excessively high DTI ratio, a history of late payments or defaults on existing loans, insufficient income to support the loan repayment, or a lack of verifiable income. Furthermore, some lenders may not refinance certain types of private student loans, such as those with co-signers or those in default. It’s crucial to check the specific eligibility requirements of each lender before applying.

Comparison of Eligibility Requirements Across Lenders

| Lender | Minimum Credit Score | Debt-to-Income Ratio Requirement | Income Verification Method |

|---|---|---|---|

| Lender A (Example) | 680 | 43% | Pay stubs, tax returns |

| Lender B (Example) | 660 | 40% | Pay stubs, bank statements |

| Lender C (Example) | 700 | 35% | Tax returns, W-2 forms |

Interest Rates and Loan Terms

Refinancing your private student loans offers the potential to lower your monthly payments and save money on interest over the life of the loan. However, understanding the factors that influence interest rates and the various loan terms available is crucial to making an informed decision. This section will clarify these key aspects to help you navigate the refinancing process effectively.

Factors Influencing Interest Rates

Several factors contribute to the interest rate you’ll receive on a refinanced private student loan. Your credit score is a primary determinant; a higher credit score generally translates to a lower interest rate. Your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, also plays a significant role. A lower DTI indicates a lower risk to the lender, potentially leading to a better interest rate. The loan amount itself can also influence the rate; larger loan amounts might come with slightly higher rates. Finally, the lender’s current market conditions and their specific lending policies contribute to the final interest rate offered.

Fixed vs. Variable Interest Rates

Refinanced private student loans typically offer either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability and stability in your monthly payments. This offers peace of mind, as your payment amount won’t fluctuate due to changes in market interest rates. Conversely, a variable interest rate fluctuates based on market indices, such as the LIBOR or SOFR. While a variable rate might start lower than a fixed rate, it carries the risk of increasing over time, potentially leading to higher monthly payments. The advantage of a variable rate is the possibility of lower initial payments, but this comes with the uncertainty of future payment amounts.

Repayment Terms

Repayment terms encompass the loan’s tenure (the total repayment period) and payment frequency. Common loan tenures range from 5 to 15 years, with longer tenures resulting in lower monthly payments but higher total interest paid over the loan’s life. Payment frequency typically involves monthly payments, though some lenders might offer bi-weekly or even weekly payment options. Choosing a shorter loan tenure can lead to significant long-term savings on interest, despite higher monthly payments. Conversely, a longer tenure allows for smaller monthly payments, potentially making the loan more manageable in the short term.

Hypothetical Interest Paid Scenario

Let’s consider a hypothetical scenario to illustrate the impact of interest rates and repayment terms. Suppose you refinance a $30,000 loan.

| Scenario | Interest Rate | Loan Tenure (Years) | Approximate Monthly Payment | Total Interest Paid (Approximate) |

|---|---|---|---|---|

| A | 6% Fixed | 10 | $330 | $9,600 |

| B | 7% Fixed | 10 | $350 | $12,000 |

| C | 6% Fixed | 15 | $240 | $14,400 |

This table demonstrates that even a small difference in interest rate or loan tenure can significantly impact the total interest paid over the life of the loan. Scenario A, with a lower interest rate and shorter tenure, results in the lowest total interest paid. Scenario C, with a longer tenure, has lower monthly payments but significantly higher total interest. Choosing the right combination depends on your individual financial circumstances and priorities. Remember that these are approximate figures, and actual payments may vary slightly depending on the lender and specific loan terms.

Types of Private Student Loans That Can Be Refinanced

Refinancing your private student loans can simplify your repayment process and potentially lower your interest rate. However, not all private student loans are created equal, and eligibility for refinancing varies depending on the loan type and lender. Understanding which loans are eligible is crucial before you begin the refinancing process.

Understanding which private student loans qualify for refinancing is essential for streamlining your debt and potentially saving money. Different lenders have varying eligibility criteria, so it’s always advisable to check with your potential refinancing provider directly. However, a general understanding of common loan types and their refinancing suitability will help you navigate the process.

Eligible Private Student Loan Types for Refinancing

Many common types of private student loans are typically eligible for refinancing. These often include undergraduate and graduate student loans, as well as loans taken out for specific professional programs or certifications. The key factor is that the loan must be a private loan, not a federal loan. Many lenders offer refinancing options for various loan types, but specific eligibility criteria may still apply. For example, some lenders might require a minimum loan balance or a certain credit score.

- Undergraduate Loans: Loans taken out to finance a bachelor’s degree are generally refinanced.

- Graduate Loans: Loans used for master’s, doctoral, or professional degrees (like law or medical school) are usually eligible.

- Professional School Loans: Loans specifically for programs like medical, dental, or law school often qualify for refinancing.

- Consolidation Loans (Private): If you already consolidated multiple private student loans, you may be able to refinance that consolidated loan into a single, potentially lower-interest loan.

Ineligible Loan Types for Refinancing

It’s important to note that certain loans are typically not eligible for private student loan refinancing. These include federal student loans and some types of parent loans.

- Federal Student Loans: Federal loans (like Stafford, Perkins, or PLUS loans) cannot be refinanced through private lenders. Federal loan consolidation is a separate process handled by the federal government.

- Parent PLUS Loans: These loans, taken out by parents to finance their children’s education, are typically not eligible for private refinancing.

- Certain Private Loans with Specific Terms: Some private loans may have clauses or stipulations that prevent refinancing. This might include loans with deferred interest or those in default.

Refinancing Multiple Private Student Loans

Many borrowers have multiple private student loans with different interest rates and repayment terms. Refinancing these into a single loan can simplify the repayment process. The process typically involves applying to a lender with your combined loan information. The lender will then assess your creditworthiness and offer a new loan with a potentially lower interest rate and a single monthly payment. This streamlined approach can make budgeting and tracking repayments much easier. It’s crucial to compare offers from multiple lenders to secure the most favorable terms.

The Refinancing Process

Refinancing your private student loans can be a complex but potentially rewarding process. Understanding the steps involved and the necessary documentation will significantly increase your chances of a successful application and securing a better loan. This section details the refinancing process, highlighting key considerations along the way.

Steps in the Refinancing Process

The refinancing process typically involves several key steps. A clear understanding of each step will streamline the application and help you manage expectations.

- Check Your Credit Report: Before applying, review your credit report for any inaccuracies. A strong credit score is crucial for securing favorable terms.

- Shop Around for Lenders: Compare interest rates, fees, and repayment terms from multiple lenders. Consider factors such as loan amounts, repayment periods, and lender reputation.

- Pre-qualify for a Loan: Many lenders offer a pre-qualification process, which allows you to check your eligibility without impacting your credit score significantly. This provides a clearer picture of your potential loan terms.

- Gather Required Documentation: Collect all necessary documents, including your student loan statements, tax returns, pay stubs, and proof of employment. Having everything ready will expedite the application process.

- Complete the Application: Fill out the lender’s application accurately and completely. Ensure all information is up-to-date and consistent with the supporting documentation.

- Provide Documentation: Submit the required documentation to the lender for review. The lender will verify the information you provided.

- Loan Approval/Denial: The lender will review your application and supporting documentation. You will receive notification of approval or denial.

- Loan Closing: If approved, you will need to sign the loan documents and finalize the refinancing process. This typically involves electronic signatures and transferring funds.

Required Documentation

Lenders typically require various documents to verify your identity, income, and the details of your existing student loans. Providing complete and accurate documentation is critical for a smooth and timely application process.

- Government-Issued Photo ID: This is usually required for identity verification purposes.

- Proof of Income: Pay stubs, tax returns, or W-2 forms are commonly used to demonstrate your income stability.

- Student Loan Statements: These statements provide details about your existing student loan balances, interest rates, and lenders.

- Employment Verification: Some lenders may require verification of your employment status directly from your employer.

- Bank Statements: These may be requested to assess your financial stability and ability to repay the loan.

Impact on Credit Score

Applying for a loan, including refinancing, will result in a hard inquiry on your credit report. This inquiry can temporarily lower your credit score by a few points. However, the impact is usually minimal and temporary. A significantly improved interest rate and streamlined repayment plan can ultimately outweigh the short-term dip in your credit score, especially if your existing debt-to-income ratio is high. For example, a successful refinance that lowers your monthly payment by $200 could significantly improve your financial situation, outweighing a minor, temporary credit score reduction.

Flowchart of the Refinancing Process

A visual representation of the refinancing process can be helpful. Imagine a flowchart beginning with “Initiate Refinancing,” branching to “Check Credit Report” and “Research Lenders.” These then lead to “Pre-qualification,” followed by “Gather Documentation” and “Complete Application.” The application process branches to “Approval” or “Denial.” Approval leads to “Loan Closing” and finally, “Refinanced Loan.” Denial may lead to “Revise Application” or “Explore Other Options.” The flowchart visually demonstrates the sequential nature of the process and potential branching paths.

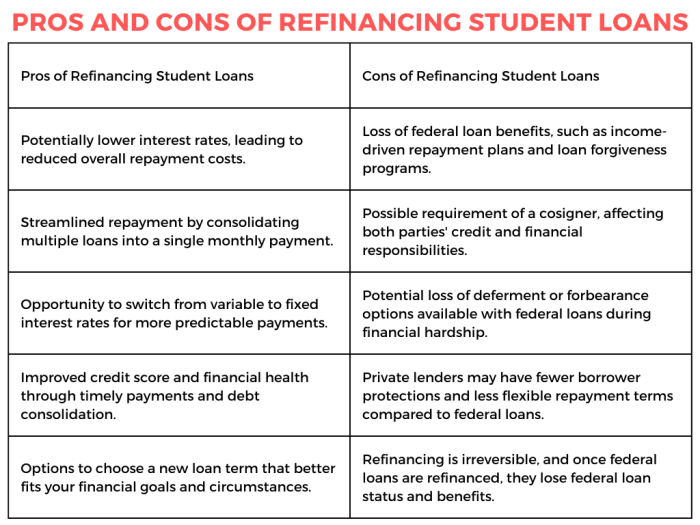

Final Review

Refinancing private student loans can offer significant advantages, such as lower interest rates and simplified repayment plans. However, it’s essential to carefully weigh the potential benefits against the risks, considering factors like the loss of federal loan protections. By understanding the eligibility requirements, comparing lender offers, and considering alternatives, you can make an informed decision that aligns with your financial goals. Remember to thoroughly research and compare options before committing to a refinancing plan.

Question & Answer Hub

What happens to my loan if I refinance and then miss payments?

Missing payments after refinancing will negatively impact your credit score and could lead to default, resulting in potential legal action from the lender.

Can I refinance federal student loans with private student loans?

Generally, you cannot directly refinance federal student loans with private lenders. However, you can refinance private loans separately.

How long does the refinancing process typically take?

The timeframe varies depending on the lender and the complexity of your application, but it typically ranges from a few weeks to a couple of months.

Will refinancing affect my taxes?

The tax implications of refinancing depend on your specific situation and may vary by jurisdiction. Consult a tax professional for personalized advice.