Navigating the complex world of student loan debt can feel overwhelming, but understanding your refinancing options is a crucial step towards financial freedom. This guide explores the intricacies of student loan refinancing, helping you determine if it’s the right choice for your unique circumstances. We’ll examine eligibility requirements, compare different lenders and loan types, and delve into the potential benefits and risks involved. Ultimately, we aim to empower you with the knowledge needed to make informed decisions about your financial future.

From understanding eligibility criteria based on your credit score and debt-to-income ratio to comparing interest rates and loan terms across various lenders, we’ll break down the process step-by-step. We’ll also explore alternatives to refinancing, ensuring you have a comprehensive understanding of your options before making any significant financial commitments. This guide provides a clear path to navigate the complexities of student loan refinancing, empowering you to make the best decision for your financial well-being.

Eligibility Requirements for Refinancing

Refinancing your student loans can significantly reduce your monthly payments and overall interest costs, but it’s crucial to understand the eligibility requirements before applying. These requirements vary depending on the lender and the type of loan you’re refinancing. Generally, lenders assess your financial health to determine your risk level.

Credit Score Requirements

A strong credit score is a cornerstone of student loan refinancing eligibility. Most lenders prefer applicants with a credit score of 660 or higher, although some may accept scores as low as 600, but at potentially higher interest rates. A higher credit score indicates a lower risk to the lender, leading to more favorable terms. Lenders use credit reports from agencies like Experian, Equifax, and TransUnion to assess your creditworthiness. A lower credit score may lead to rejection or less attractive loan options. Improving your credit score before applying is advisable.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio, calculated by dividing your total monthly debt payments by your gross monthly income, is another key factor. A lower DTI ratio signifies your ability to manage your debt effectively. Lenders generally prefer applicants with a DTI ratio below 43%, although this can vary depending on the lender and other factors like your credit score and income. A high DTI ratio may indicate a higher risk of default, potentially resulting in loan rejection or less favorable interest rates.

Income Requirements

Sufficient income is essential to demonstrate your ability to repay the refinanced loan. Lenders typically require a stable income stream from employment or self-employment. The specific income requirements vary widely depending on the lender and loan amount. Some lenders may request documentation like pay stubs or tax returns to verify income. Having a consistent and verifiable income history greatly increases your chances of approval.

Comparison of Eligibility Requirements Across Loan Types

The eligibility requirements for refinancing federal student loans differ significantly from those for refinancing private student loans. Federal loans often have stricter requirements, while private lenders offer more flexibility but may demand higher credit scores.

| Lender | Minimum Credit Score | Debt-to-Income Ratio | Loan Types Accepted |

|---|---|---|---|

| Example Lender A (Private) | 660 | 43% or less | Federal and Private |

| Example Lender B (Private) | 680 | 36% or less | Private only |

| Example Lender C (Private) | 600 (Higher rates likely) | 50% or less (Higher rates likely) | Federal and Private |

| Federal Loan Consolidation (Direct Consolidation Loan) | N/A (No credit check) | N/A (Not a primary factor) | Federal loans only |

Types of Student Loans that Can Be Refinanced

Refinancing student loans can be a strategic move to potentially lower your monthly payments and interest rate, but it’s crucial to understand which loan types are eligible and the implications involved. The process differs depending on whether your loans are federal or private, each carrying unique benefits and drawbacks.

Refinancing options vary depending on the lender and your individual financial profile. Careful consideration of the advantages and disadvantages specific to your loan type is essential before making a decision.

Federal Student Loan Refinancing

Federal student loans, issued by the government, offer various repayment plans and protections not always available with private loans. However, refinancing federal loans into private loans means losing these federal benefits.

Federal student loans eligible for refinancing typically include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for both parents and graduate students), and Federal Stafford Loans. However, it’s important to note that refinancing federal loans eliminates access to income-driven repayment plans (IDR), loan forgiveness programs (like Public Service Loan Forgiveness – PSLF), and deferment or forbearance options offered by the federal government.

Advantages and Disadvantages of Refinancing Federal Student Loans

The primary advantage of refinancing federal loans lies in the potential for a lower interest rate and a simplified repayment process, consolidating multiple loans into one. However, the significant disadvantage is the loss of federal protections and benefits. For example, a borrower struggling with repayments might find themselves without the safety net of IDR plans or loan forgiveness programs after refinancing.

Example Scenario: Federal Loan Refinancing

Imagine a borrower with $50,000 in federal student loans at a 6% interest rate. By refinancing, they might secure a new loan with a 4% interest rate, resulting in lower monthly payments and reduced total interest paid over the life of the loan. However, if this borrower later experiences financial hardship, they’ve forfeited the flexibility of federal repayment programs.

Private Student Loan Refinancing

Private student loans are issued by banks and credit unions, and their terms and conditions vary significantly among lenders. Refinancing private loans can simplify repayment and potentially lower your interest rate, but it’s important to shop around for the best rates and terms.

Most private student loans are eligible for refinancing, regardless of the lender. However, the eligibility criteria for refinancing can be stricter than for federal loans, often requiring a good credit score and stable income.

Advantages and Disadvantages of Refinancing Private Student Loans

The main advantage of refinancing private student loans is the potential for a lower interest rate and monthly payment. Consolidation into a single loan simplifies repayment management. However, refinancing private loans doesn’t offer the same level of borrower protections as federal loans. If you encounter financial difficulties, there are fewer options for repayment assistance.

Example Scenario: Private Loan Refinancing

A borrower with several private student loans totaling $30,000 at various interest rates (averaging 7%) might refinance into a single loan with a 5% interest rate. This would reduce their monthly payment and the total interest paid over the life of the loan, streamlining their repayment process. However, they must ensure they can maintain consistent payments as there are fewer options available if they face financial challenges.

Impact of Refinancing on Federal Loan Benefits

Refinancing federal student loans into private loans results in the complete loss of all federal loan benefits. This includes access to income-driven repayment plans (IDR), which base monthly payments on your income and family size; deferment and forbearance options, which allow temporary pauses or reductions in payments; and loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which can forgive remaining loan balances after a certain period of qualifying employment. Careful consideration of these potential trade-offs is essential before proceeding with refinancing federal loans.

Interest Rates and Loan Terms

Refinancing your student loans can significantly impact your monthly payments and overall cost. Understanding the interest rates and loan terms offered by various lenders is crucial to making an informed decision. This section will explore how interest rates are determined and the different repayment options available.

Interest rates offered by different lenders vary considerably. Factors such as your credit score, loan amount, and the lender’s current market conditions all play a role in the rate you’ll receive. Generally, borrowers with higher credit scores and smaller loan amounts qualify for lower interest rates. Conversely, those with lower credit scores or larger loan amounts may face higher rates. It’s essential to compare offers from multiple lenders to find the most favorable terms.

Factors Influencing Interest Rates

Several factors influence the interest rate you’ll receive on a refinanced student loan. A higher credit score generally translates to a lower interest rate because it signals lower risk to the lender. Similarly, a smaller loan amount also tends to result in a lower interest rate because it represents a lower risk to the lender. Conversely, a lower credit score or a larger loan amount increases the perceived risk, leading to higher interest rates. Other factors such as your income, debt-to-income ratio, and the type of loan being refinanced can also play a role.

Loan Terms and Their Implications

Loan terms, also known as repayment periods, represent the length of time you have to repay your refinanced loan. Common repayment periods range from 5 to 20 years. Shorter loan terms typically result in higher monthly payments but lower overall interest paid due to less time accruing interest. Longer loan terms lead to lower monthly payments but result in higher overall interest paid due to the extended repayment period. The choice depends on your financial situation and priorities. Choosing a longer term might offer short-term relief, but it will cost you more in the long run.

Sample Interest Rates and Loan Terms

The following table provides sample interest rates and loan terms for different credit scores and loan amounts. These are illustrative examples and actual rates may vary depending on the lender and individual circumstances. Always check with individual lenders for their current rates.

| Credit Score | Loan Amount | Interest Rate | Loan Term (Years) |

|---|---|---|---|

| 750+ | $20,000 | 4.5% | 10 |

| 750+ | $50,000 | 5.0% | 15 |

| 680-749 | $20,000 | 6.0% | 10 |

| 680-749 | $50,000 | 6.5% | 15 |

| Below 680 | $20,000 | 7.5% | 10 |

| Below 680 | $50,000 | 8.0% | 15 |

The Refinancing Process

Refinancing your student loans can be a complex but potentially rewarding process. It involves securing a new loan from a different lender to pay off your existing student loan debt, often at a lower interest rate or with more favorable terms. Understanding the steps involved and gathering the necessary documentation beforehand will streamline the process and increase your chances of success.

The refinancing process typically involves several key steps, from initial research to final loan disbursement. Careful planning and attention to detail at each stage are crucial for securing the best possible terms.

Required Documents and Information

Before you begin the application process, gather all the necessary documents. This will significantly expedite the process and prevent delays. Lenders typically require documentation verifying your identity, income, and existing student loan debt. Failing to provide complete and accurate information can lead to application rejection or processing delays.

- Government-issued photo identification: This is essential for verifying your identity. Examples include a driver’s license, passport, or state-issued ID card.

- Social Security number: Your Social Security number is required for credit checks and loan processing.

- Proof of income: This might include pay stubs, tax returns, or bank statements, demonstrating your ability to repay the loan.

- Student loan statements: You’ll need to provide statements showing the balance, interest rate, and loan servicer for each loan you wish to refinance.

- Degree information: Some lenders may require verification of your degree or educational attainment.

Comparing Offers from Different Lenders

Once you’ve gathered the necessary documents, you can begin comparing offers from multiple lenders. This is a crucial step, as interest rates, fees, and repayment terms can vary significantly between lenders. Don’t settle for the first offer you receive; shop around to find the best deal. Consider factors beyond the interest rate, such as loan fees, repayment terms, and customer service.

To effectively compare offers, create a spreadsheet or use a loan comparison tool. List each lender’s offered interest rate, fees, repayment terms (loan length and monthly payment), and any other relevant conditions. This allows for a clear and objective comparison, helping you make an informed decision.

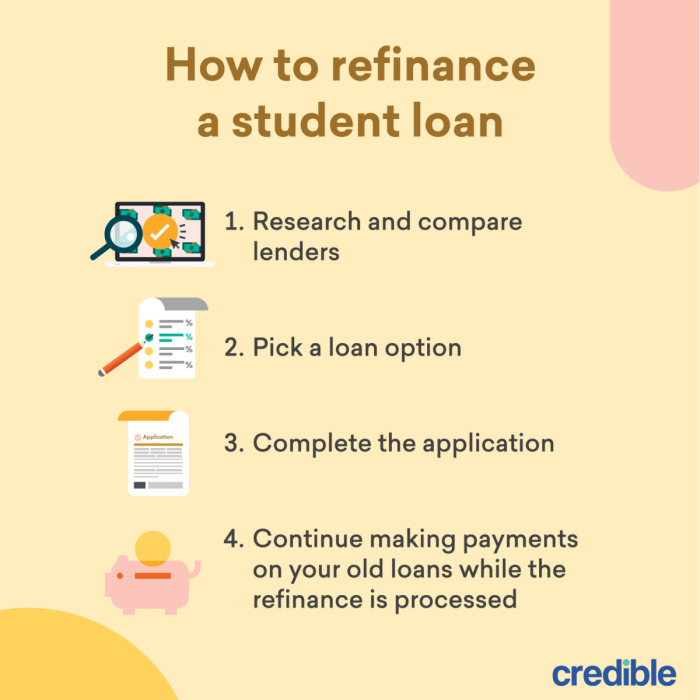

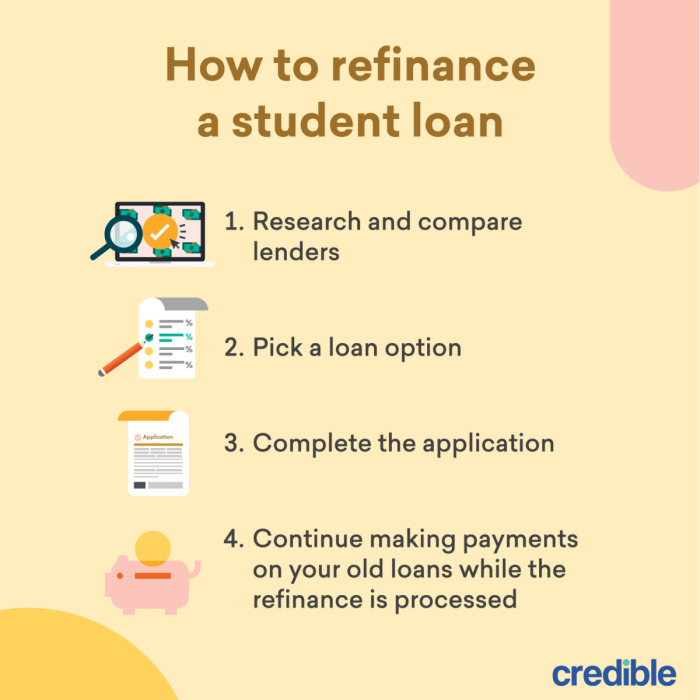

Step-by-Step Refinancing Guide

The refinancing process is typically straightforward, but each lender may have slight variations. This general guide Artikels the common steps.

- Check your credit score: Knowing your credit score before applying helps you understand your eligibility and anticipate the interest rates you might qualify for. A higher credit score typically leads to better loan terms.

- Research and compare lenders: Use online comparison tools or visit lender websites to compare interest rates, fees, and repayment options.

- Pre-qualify: Many lenders offer pre-qualification options that allow you to see potential rates and terms without impacting your credit score. This gives you a clearer picture of what you can expect.

- Complete the application: Once you’ve chosen a lender, complete the application form online, providing all the required documentation.

- Review and sign loan documents: Carefully review the loan documents before signing to ensure you understand all terms and conditions.

- Loan disbursement: Once approved, the lender will disburse the funds to pay off your existing student loans.

Potential Benefits and Risks of Refinancing

Refinancing your student loans can be a significant financial decision with the potential to save you money or, conversely, to lead to unforeseen challenges. Understanding both the advantages and disadvantages is crucial before proceeding. This section will Artikel the potential benefits and risks associated with refinancing, allowing you to make an informed choice.

Refinancing essentially involves replacing your existing student loans with a new loan from a private lender. This new loan may offer different terms, such as a lower interest rate or a shorter repayment period. However, it’s important to weigh these potential benefits against the risks involved, which can significantly impact your long-term financial health.

Lower Interest Rates and Shorter Repayment Terms

Lower interest rates are a primary motivator for refinancing. By securing a lower rate, you’ll pay less interest over the life of the loan, leading to significant savings. A shorter repayment term, while potentially increasing monthly payments, can help you become debt-free faster. For example, someone with $50,000 in loans at 7% interest could save thousands of dollars over the life of the loan by refinancing to a 4% interest rate. Similarly, shortening the repayment period from 10 years to 5 years, even with higher monthly payments, results in less total interest paid.

Loss of Federal Loan Benefits and Increased Monthly Payments

A key risk of refinancing is the potential loss of federal student loan benefits. Federal loans often come with income-driven repayment plans, loan forgiveness programs (for specific professions), and deferment options during periods of financial hardship. Refinancing with a private lender typically eliminates these protections. Furthermore, while a shorter repayment term can lead to quicker debt elimination, it also means higher monthly payments. This could strain your budget if not carefully planned. For instance, reducing a 10-year loan to a 5-year loan will roughly double your monthly payments.

Long-Term Financial Implications of Refinancing Versus Not Refinancing

The long-term financial implications depend heavily on individual circumstances and the specific terms of the refinancing offer. Refinancing can lead to substantial savings if you secure a significantly lower interest rate and can comfortably manage the increased monthly payments. However, if you lose valuable federal loan benefits or face unforeseen financial difficulties, refinancing could prove detrimental. Careful comparison of total interest paid over the life of both the original and refinanced loans, factoring in any lost benefits, is crucial for determining the best long-term strategy. For example, someone with a stable income and high credit score might benefit greatly from refinancing, while someone with fluctuating income or a lower credit score might be better off sticking with their federal loans and their associated protections.

Potential Benefits and Risks of Refinancing

The decision to refinance should be made after carefully considering the following:

- Potential Benefits: Lower interest rates, shorter repayment terms, potentially lower monthly payments (if extending the loan term), simplification of multiple loans into one.

- Potential Risks: Loss of federal student loan benefits (e.g., income-driven repayment, loan forgiveness programs), higher monthly payments (if shortening the loan term), potential for increased total interest paid if the new interest rate is not significantly lower, increased risk if your credit score worsens.

Alternatives to Refinancing

Refinancing your student loans isn’t the only path to managing your debt. Several alternative strategies can significantly impact your monthly payments and overall repayment burden, potentially offering more suitable solutions depending on your individual financial circumstances. Understanding these options allows for a more informed decision about your best course of action.

Exploring alternatives to refinancing is crucial because refinancing might not always be the best choice. Factors like your credit score, interest rates, and loan type can influence the feasibility and benefits of refinancing. Understanding alternative options empowers you to make a decision that aligns with your financial situation and long-term goals.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. These plans are designed to make student loan repayment more manageable, especially during periods of lower income or unexpected financial hardship. Several IDR plans exist, each with its own eligibility criteria and payment calculation method. For example, the Revised Pay As You Earn (REPAYE) plan caps your monthly payment at 10% of your discretionary income. The advantage of IDR plans is the lower monthly payments; however, a potential disadvantage is that you may end up paying more interest over the life of the loan, extending the repayment period significantly. This could also lead to a larger final payment if the remaining balance isn’t forgiven under the plan’s terms.

Loan Forgiveness Programs

Certain professions, like teaching or public service, may qualify for loan forgiveness programs. These programs partially or completely forgive your student loan debt after meeting specific requirements, such as working a certain number of years in a qualifying position. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit employer. The benefit is obvious: potential complete loan forgiveness. However, eligibility requirements are stringent, and the process can be lengthy and complex. There’s also no guarantee of forgiveness, and the program’s rules can change.

Comparison of Options

The following table compares refinancing with income-driven repayment plans and loan forgiveness programs:

| Option | Description | Advantages/Disadvantages |

|---|---|---|

| Refinancing | Consolidating multiple student loans into a single loan with a new interest rate and repayment term. | Advantages: Potentially lower interest rates, simplified repayment, shorter repayment term. Disadvantages: May not be available to everyone, higher interest rates possible with poor credit, loss of federal loan benefits. |

| Income-Driven Repayment Plans | Adjusts monthly payments based on income and family size. | Advantages: Lower monthly payments, more manageable repayment. Disadvantages: Longer repayment period, potentially higher total interest paid, no loan forgiveness guarantee. |

| Loan Forgiveness Programs | Forgives a portion or all of your student loan debt after meeting specific requirements. | Advantages: Potential for complete loan forgiveness. Disadvantages: Strict eligibility requirements, lengthy process, no guarantee of forgiveness, may require specific employment. |

Illustrative Example

Let’s consider the case of Sarah, a recent graduate with $50,000 in federal student loans at a 6% interest rate and $10,000 in private student loans at a 9% interest rate. She’s looking to refinance to potentially lower her monthly payments and save money on interest over the life of her loans. Her credit score is a strong 750, which will be beneficial in securing favorable refinancing terms.

Sarah’s Refinancing Exploration

Sarah begins by researching different student loan refinancing companies online. She compares interest rates, fees, and repayment terms offered by various lenders. She carefully reviews customer reviews and ratings to gauge the reputation and reliability of each lender. She also checks the lenders’ websites for information on eligibility requirements and the refinancing application process. Understanding the importance of pre-qualification, she utilizes several lenders’ online tools to obtain pre-qualification offers without impacting her credit score. This allows her to compare multiple offers side-by-side before formally applying.

The Refinancing Application and Approval

Based on her research and pre-qualification offers, Sarah selects a lender offering a competitive interest rate of 4.5% for a 10-year repayment term. This rate is significantly lower than her current interest rates on both her federal and private loans. She gathers the necessary documents, including her loan details, pay stubs, and tax returns, and submits her formal application. The lender reviews her application and credit history. Within a week, Sarah receives notification that her application has been approved.

Post-Refinancing Outcome

After the refinancing is complete, Sarah’s monthly payments decrease considerably, freeing up a significant portion of her monthly budget. While her total repayment period increases slightly to 10 years, the lower interest rate means she will pay substantially less in interest over the life of the loan compared to her previous payment schedule. The lower monthly payment improves her cash flow, allowing her to save more and potentially accelerate other financial goals such as investing or paying down other debts. This positive outcome underscores the potential benefits of refinancing, although it’s crucial to remember that individual results can vary based on several factors.

Final Conclusion

Refinancing student loans can be a powerful tool for managing debt, but it’s crucial to carefully weigh the potential benefits against the risks. By understanding your eligibility, comparing lender offers, and considering alternative options, you can make an informed decision that aligns with your long-term financial goals. Remember to thoroughly research each lender and carefully review the terms and conditions before signing any agreements. Taking a proactive approach to managing your student loan debt empowers you to achieve financial stability and pursue your future aspirations with confidence.

Questions and Answers

What is the impact of refinancing on my federal student loan benefits?

Refinancing federal student loans into private loans typically means losing access to federal benefits like income-driven repayment plans and loan forgiveness programs.

How long does the refinancing process usually take?

The timeframe varies by lender, but generally expect the process to take several weeks from application to loan disbursement.

Can I refinance only a portion of my student loans?

Some lenders allow partial refinancing, while others require refinancing the entire loan balance. Check individual lender policies.

What happens if I miss payments after refinancing?

Missing payments after refinancing will negatively impact your credit score and could lead to default, similar to other loan types.