The crushing weight of student loan debt is a reality for millions, often forcing difficult financial decisions. One question frequently arises: can tapping into retirement savings, specifically a 401(k), provide a viable solution? This guide explores the complexities of using your 401(k) to pay off student loans, weighing the potential benefits against the significant long-term financial implications. We’ll delve into the tax consequences, penalties, and alternative strategies to help you make an informed decision.

Understanding the potential ramifications of early 401(k) withdrawal is crucial. While the allure of eliminating student loan debt quickly is strong, prematurely accessing these retirement funds can severely impact your future financial security. This guide will provide a clear framework for evaluating your unique circumstances, considering both the immediate relief and the long-term cost of such a decision. We will examine various scenarios and offer alternative approaches to debt management, empowering you to make the best choice for your financial well-being.

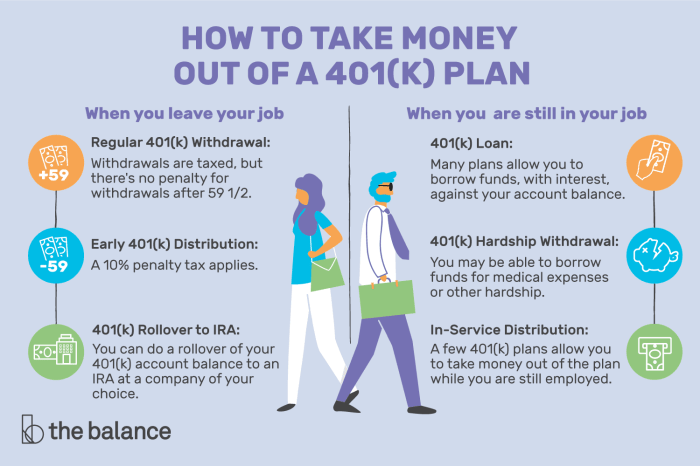

Understanding 401(k) Withdrawal Rules

Accessing your 401(k) before retirement to pay off student loans is a significant financial decision with potentially serious tax and penalty consequences. It’s crucial to understand the rules and implications before taking this step. This section will Artikel the key aspects of 401(k) withdrawal rules, focusing on the tax implications and penalties, and exploring potential exceptions.

Tax Implications of Early 401(k) Withdrawals

Early withdrawals from a 401(k) are generally subject to both income tax and a 10% early withdrawal penalty. The income tax applies to the entire amount withdrawn, and it’s added to your taxable income for the year, potentially pushing you into a higher tax bracket. For example, if you withdraw $10,000 and are in the 22% tax bracket, you’ll owe $2,200 in federal income taxes, in addition to any state income taxes. This significantly reduces the actual amount you receive after taxes. Careful consideration of your current tax bracket is essential before proceeding with a withdrawal.

Penalties Associated with Early Withdrawal Before Age 59 1/2

As mentioned, the Internal Revenue Service (IRS) imposes a 10% additional tax penalty on early 401(k) withdrawals made before age 59 1/2, unless certain exceptions apply. This penalty is in addition to the regular income tax. Using the previous example, the $10,000 withdrawal would incur a $1,000 penalty, leaving you with only $6,800 after taxes and penalties. This substantial reduction highlights the importance of weighing the potential benefits against the significant costs.

Comparison of Withdrawal Penalties Versus Student Loan Interest Rates

Whether withdrawing from your 401(k) to pay off student loans is financially advantageous depends heavily on a comparison of the penalties incurred versus the interest rates on your loans. If your student loan interest rate is significantly higher than the combined tax and penalty rate (which could be over 30% depending on your tax bracket), paying off the loan might still be a beneficial strategy. However, if your student loan interest rate is lower, the penalties from the 401(k) withdrawal could outweigh the benefits of eliminating the debt. A detailed financial analysis comparing these figures is crucial. For instance, if your student loan interest is 7%, but your effective 401k withdrawal cost is 32%, paying down the loan with your 401k may not be financially prudent.

Exceptions to Early Withdrawal Penalties

While the 10% penalty is common, several exceptions exist. These include hardship withdrawals, which are allowed in situations of significant financial need, such as medical expenses, home foreclosure, or, in some cases, unforeseen job loss. However, the definition of “hardship” is strictly defined by the IRS and your 401(k) plan provider. Documentation proving the hardship is usually required. Other exceptions include withdrawals for qualified higher education expenses (under certain conditions) and for certain domestic abuse situations. It’s crucial to thoroughly research these exceptions and confirm eligibility with your plan administrator before proceeding. Each exception has specific requirements, and failing to meet them could result in penalties.

Evaluating the Financial Impact

Using your 401(k) to pay off student loans presents a significant financial decision with long-term implications. Weighing the immediate benefits of debt reduction against the potential loss of future retirement savings requires careful consideration of several factors. This section will explore the financial consequences of both choices, providing a hypothetical scenario to illustrate the potential impact.

The primary trade-off lies between eliminating high-interest student loan debt and preserving the compounding growth potential of your 401(k) contributions. While eliminating student loan debt offers immediate relief and reduces future interest payments, withdrawing from your 401(k) carries significant tax penalties and lost investment opportunities. This analysis will help you understand the potential long-term financial ramifications of each decision.

Long-Term Financial Consequences: 401(k) Withdrawal vs. Continued Loan Payments

Withdrawing from your 401(k) to pay off student loans results in an immediate reduction of debt, but it also means foregoing the potential for significant long-term growth of your retirement savings. Continuing with student loan payments, while potentially requiring more time to become debt-free, allows your 401(k) to grow tax-deferred, benefiting from compound interest over time. The choice depends on individual circumstances, risk tolerance, and long-term financial goals. A lower interest rate on student loans compared to the potential return of a 401(k) might favor continuing loan payments. Conversely, a higher interest rate on student loans might make the 401(k) withdrawal a more appealing option, despite the penalties.

Hypothetical Scenario: Early 401(k) Withdrawal Impact

Let’s consider Sarah, who has $50,000 in student loan debt with a 7% interest rate and $100,000 in her 401(k) earning an average annual return of 7%. If she withdraws $50,000 from her 401(k) to pay off her student loans, she eliminates the debt immediately. However, she loses the potential growth of that $50,000 in her 401(k). Assuming a consistent 7% annual return, that $50,000 could grow to approximately $170,000 in 20 years. By contrast, if Sarah continues to make her student loan payments, she will pay off the debt over time, but her 401(k) will continue to grow, potentially providing a larger retirement nest egg.

Projected 401(k) Growth: With and Without Early Withdrawal

| Year | 401(k) with Withdrawal ($50,000 remaining) | 401(k) without Withdrawal ($100,000 initial) | Difference |

|---|---|---|---|

| 0 | $50,000 | $100,000 | $50,000 |

| 5 | $67,493 | $140,255 | $72,762 |

| 10 | $90,595 | $196,715 | $106,120 |

| 20 | $170,000 (approx.) | $386,970 (approx.) | $216,970 (approx.) |

Note: These figures are approximate and assume a consistent 7% annual return, which is not guaranteed. Actual returns may vary.

Opportunity Cost of Using 401(k) Funds

The opportunity cost represents the potential return lost by withdrawing funds from the 401(k). In Sarah’s example, the opportunity cost is the difference between the projected growth of her 401(k) with and without the withdrawal. This difference highlights the significant long-term financial impact of early withdrawal. This lost potential for growth significantly impacts the overall retirement savings and could lead to a smaller retirement nest egg. The longer the investment horizon, the greater the opportunity cost becomes due to the power of compounding.

Exploring Alternative Solutions

Before considering withdrawing from your 401(k) to pay off student loans, it’s crucial to explore alternative strategies that may offer more financially sound solutions in the long run. These alternatives can help you manage your debt without sacrificing your retirement savings. Weighing the pros and cons of each option will help you make an informed decision.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan, often at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. A lower interest rate directly translates to less money spent on interest and more towards principal, accelerating your repayment journey. However, refinancing might not always be beneficial. For example, if you qualify for income-driven repayment plans or have federal loans with forgiveness programs, refinancing into a private loan could forfeit these benefits. The eligibility criteria for refinancing also vary depending on the lender and your credit score. A strong credit history is often a prerequisite for securing a favorable interest rate.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. Several IDR plans exist, each with different income calculations and forgiveness timelines. These plans can make your monthly payments more manageable, especially during periods of lower income. The potential drawback is that you may end up paying more interest over the life of the loan, and the loan forgiveness might be subject to taxation. Furthermore, the qualification criteria for IDR plans are specific, and not all borrowers are eligible. A thorough understanding of the plan’s terms and conditions is crucial before enrollment.

Resources for Student Loan Debt Management

Understanding your options and navigating the complexities of student loan repayment can be challenging. Fortunately, several resources are available to assist you. The Federal Student Aid website (studentaid.gov) provides comprehensive information on federal student loans, repayment plans, and debt management strategies. Additionally, many non-profit organizations offer free counseling services to help you create a personalized repayment plan. These services often provide guidance on budgeting, exploring repayment options, and negotiating with lenders. Finally, you might find valuable insights and support through online communities and forums dedicated to student loan repayment.

A Step-by-Step Process for Exploring Student Loan Repayment Options

Effectively managing your student loan debt requires a systematic approach. First, gather all your student loan information, including loan balances, interest rates, and repayment terms. Second, carefully analyze your income and expenses to determine your monthly budget and affordability. Third, explore all available repayment options, including standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Fourth, compare the total cost and monthly payments of each option to determine which best suits your financial situation. Fifth, consider seeking professional guidance from a financial advisor or non-profit credit counseling agency. Finally, create a realistic repayment plan and consistently track your progress to stay on track. Regularly reviewing your plan and adjusting it as needed ensures you stay in control of your student loan debt.

Seeking Professional Financial Advice

Before making any decisions about using your 401(k) to pay off student loans, consulting a financial advisor is crucial. This step allows for a comprehensive evaluation of your financial situation, considering both the short-term benefits and long-term consequences of such a significant move. A professional perspective can provide clarity and help you navigate the complexities of this decision.

The potential tax implications, long-term investment growth, and overall financial health are all factors that a financial advisor can help you assess objectively. Their expertise can prevent costly mistakes and guide you towards a financially sound solution tailored to your specific circumstances.

The Importance of Consulting a Financial Advisor

Seeking professional financial advice is paramount because it provides an unbiased and informed perspective on a complex financial decision. A financial advisor can help you understand the potential ramifications of withdrawing from your 401(k), including tax penalties and the loss of potential investment growth. They can also help you evaluate alternative solutions and develop a personalized financial plan that aligns with your goals. For example, an advisor could help someone understand the difference in long-term wealth accumulation between leaving their 401k untouched versus withdrawing early to pay off debt, factoring in interest rates, tax burdens, and projected returns. This comparison, tailored to the individual’s circumstances, is something difficult to accomplish without professional assistance.

Questions to Ask a Financial Advisor

A financial advisor can answer vital questions about the interplay between 401(k) withdrawals and student loan repayment. Discussions should include clarifying the tax implications of early 401(k) withdrawals, exploring alternative repayment plans for student loans, and understanding the long-term impact on retirement savings. For instance, an important discussion point could revolve around comparing the interest rate on the student loan with the potential return on the 401(k) investment over time. This helps determine whether paying off the loan now is truly more financially beneficial than letting the 401(k) continue to grow.

Creating a Personalized Financial Plan

A financial advisor helps create a personalized financial plan by thoroughly analyzing your current financial situation, including assets, liabilities, income, and expenses. This analysis allows for the development of a comprehensive strategy that addresses your short-term needs (like student loan repayment) while safeguarding your long-term financial goals (like retirement). The plan considers your risk tolerance, investment goals, and time horizon, creating a customized roadmap for financial success. This may involve exploring options beyond using the 401(k), such as refinancing student loans at a lower interest rate or seeking income-driven repayment plans.

Evaluating Long-Term Implications

Financial advisors are adept at evaluating the long-term implications of various options. They can model different scenarios, such as the impact of early 401(k) withdrawals on retirement savings, to provide a clear picture of the potential consequences. This foresight is invaluable in making informed decisions. For example, a simulation could demonstrate how a $20,000 withdrawal from a 401(k) today, compounded over 30 years, could result in a significantly smaller retirement nest egg compared to leaving the money invested. This quantitative analysis, based on projections and market data, is crucial for understanding the long-term effects of the decision.

Illustrative Examples

To better understand the complexities of using a 401(k) to pay off student loans, let’s examine two contrasting scenarios. These examples highlight the crucial factors to consider before making such a significant financial decision.

High-Interest Student Loan Debt Scenario

Consider Sarah, a 30-year-old with $75,000 in student loan debt at a 9% interest rate. She has a $50,000 balance in her 401(k). Her monthly student loan payment is substantial, significantly impacting her cash flow and ability to save for other financial goals. Using her 401(k) to pay off the loans would eliminate the high-interest burden immediately. This could free up significant funds each month, allowing her to focus on other financial priorities, such as saving for a down payment on a house or building an emergency fund. However, withdrawing from her 401(k) before retirement age will incur significant tax penalties and lost potential investment growth. The potential long-term financial consequences of depleting her retirement savings must be carefully weighed against the immediate relief from high-interest debt.

Low-Interest Student Loan Debt Scenario

In contrast, consider Mark, a 35-year-old with $50,000 in student loan debt at a 4% interest rate. He has a well-funded 401(k) of $200,000. His monthly student loan payments are manageable, and he is comfortably saving for retirement and other goals. While eliminating the student loan debt would simplify his finances, the opportunity cost of withdrawing from his 401(k) is substantial. The tax penalties and lost potential investment growth would significantly outweigh the modest interest savings on his low-interest student loans. He could likely pay off the loans within a reasonable timeframe through consistent monthly payments without jeopardizing his retirement savings.

Emotional and Psychological Factors

The decision of whether to use a 401(k) to pay off student loans is often fraught with emotional and psychological considerations. The stress and anxiety associated with high-interest debt can be significant, leading individuals to seek immediate relief. This emotional pressure can cloud judgment and lead to rash decisions. Conversely, the fear of depleting retirement savings can be equally paralyzing, preventing individuals from exploring all available options. It is crucial to approach this decision with a clear head, carefully weighing the financial implications alongside the emotional impact. Seeking guidance from a financial advisor can provide a valuable perspective, helping individuals separate their emotions from the purely financial aspects of the decision. A balanced approach, considering both the immediate relief and long-term consequences, is essential.

Last Word

The decision of whether or not to use your 401(k) to pay off student loans is deeply personal and requires careful consideration. While the immediate gratification of debt elimination is tempting, the long-term consequences on your retirement savings can be substantial. By thoroughly evaluating the tax implications, penalties, and alternative solutions, and by seeking professional financial advice, you can make a well-informed decision that aligns with your long-term financial goals. Remember, prioritizing financial health encompasses both present and future well-being.

Clarifying Questions

What constitutes a hardship withdrawal from a 401(k)?

Hardship withdrawals are typically allowed for immediate and heavy expenses like medical bills or preventing foreclosure, but the specific criteria vary by plan. Consult your plan documents or administrator.

Can I repay a 401(k) hardship withdrawal?

Some plans allow for repayment of hardship withdrawals, but this is not always the case. Check your plan documents for details.

Are there any tax advantages to using a 401(k) for student loan repayment?

No, early withdrawals are generally subject to income tax and a 10% penalty unless an exception applies (like a hardship).

What are income-driven repayment plans for student loans?

These plans base your monthly payment on your income and family size, potentially lowering payments and extending the repayment period.