The allure of a new car often clashes with the reality of student loan debt. Many students grapple with the question: can funds intended for education be diverted to purchase a vehicle? This exploration delves into the complexities of using student loans for car purchases, examining the financial implications, legal considerations, and viable alternatives.

Navigating this decision requires a thorough understanding of loan regulations, interest rates, and the potential long-term consequences. We will explore the permissible uses of student loans, compare them to traditional auto loans, and guide you toward making an informed and responsible financial choice. Understanding the potential pitfalls and exploring alternative financing options are crucial steps in this process.

Eligibility for Using Student Loans for Car Purchases

Student loans are designed to finance education-related expenses, and their use for purchasing a car is generally discouraged and often prohibited. While technically possible in some very limited circumstances, attempting to use student loan funds for a vehicle purchase is almost always a financially unwise decision. The high interest rates and potential long-term consequences far outweigh any perceived short-term benefits.

General Rules and Regulations Surrounding Student Loan Usage

Federal student loan programs, such as those offered through the Department of Education, explicitly prohibit the use of loan funds for anything other than qualified education expenses. These expenses typically include tuition, fees, books, supplies, and room and board. Any attempt to misrepresent the use of these funds for a car purchase can lead to serious repercussions, including loan default and potential legal action. Private student loans may have slightly more flexible terms, but most lenders also strictly enforce restrictions on how the borrowed funds can be utilized. These restrictions are typically detailed in the loan agreement. Borrowers should carefully review their loan documents to fully understand the terms and conditions.

Specific Restrictions Imposed by Various Loan Providers

Most loan providers, whether federal or private, have robust verification processes in place to ensure funds are used for their intended purpose. They often require borrowers to submit documentation supporting their educational expenses. For instance, a borrower might need to provide tuition bills, receipts for textbooks, or proof of on-campus housing. Submitting falsified documents to acquire funds for non-educational purposes is a serious offense with potentially severe consequences. Private lenders may have slightly varying policies, but the general principle of using the funds solely for education remains consistent. Even a small deviation from the stated purpose can result in loan default or penalties.

Examples of Permissible and Prohibited Uses of Student Loans

A permissible use would be paying for tuition and fees at an accredited college or university. Another acceptable use could be covering the cost of required textbooks and other educational materials. Conversely, using student loan funds to purchase a car is a strictly prohibited use. Similarly, using the funds for personal expenses like vacations, entertainment, or other non-educational items is also against the terms of the loan agreement. Attempting to circumvent these restrictions by creating false documentation or making misleading statements could lead to serious financial penalties.

Comparison of Loan Types and Suitability for Car Purchases

| Loan Type | Eligibility Criteria | Interest Rates | Restrictions |

|---|---|---|---|

| Federal Student Loan (e.g., Direct Subsidized/Unsubsidized Loans) | Enrollment in an eligible educational program | Variable, generally lower than private loans | Strictly prohibits use for non-educational purposes |

| Private Student Loan | Creditworthiness, co-signer may be required | Variable, generally higher than federal loans | Restrictions vary by lender, but generally prohibit or strongly discourage non-educational use |

| Auto Loan | Creditworthiness, income verification | Variable, depends on credit score and loan terms | Specifically for vehicle purchase |

| Personal Loan | Creditworthiness, income verification | Variable, depends on credit score and loan terms | Can be used for various purposes, including car purchase |

Financial Implications of Using Student Loans for Cars

Using student loans to purchase a car, while seemingly convenient, carries significant long-term financial consequences. Unlike educational loans intended for investments in future earning potential, using them for a depreciating asset like a car can lead to substantial debt and hinder your financial well-being. This section will explore the key financial implications of this decision.

Interest Rate Comparisons

Student loan interest rates and auto loan interest rates often differ significantly. Student loan interest rates can vary depending on the type of loan (subsidized, unsubsidized, PLUS), your creditworthiness, and the lender. However, they are frequently higher than rates offered for auto loans, especially for borrowers with good credit. For example, a student loan might carry an interest rate of 7% or higher, while a well-qualified borrower could secure an auto loan at 4% or 5%. This difference in interest rates can dramatically increase the total cost of borrowing over the loan term. The higher interest on student loans will compound the debt faster, resulting in significantly more interest paid over the life of the loan compared to an auto loan.

Calculating the Total Cost of Borrowing

Accurately calculating the total cost of borrowing with a student loan for a car requires careful consideration of several factors. You need to know the principal loan amount (the car’s price), the interest rate, and the loan term (repayment period). The total interest paid can be estimated using an online loan calculator or a simple formula, although the formula will not account for any changes in the interest rate. For example, let’s assume a $15,000 car purchase with a 7% student loan over 5 years. A loan calculator would provide the precise total interest paid, but a rough estimate can be calculated by multiplying the principal by the interest rate, multiplied by the loan term in years: $15,000 x 0.07 x 5 = $5250 (This is a simplified calculation and does not reflect the compounding effect of interest). The total cost of the car would then be $15,000 + $5250 = $20,250. This illustrates the significant extra cost associated with using a higher-interest student loan. Using a dedicated loan calculator will give a more accurate picture.

Impact on Credit Scores and Future Borrowing

Taking on significant debt, especially high-interest debt like a student loan for a car, can negatively impact your credit score. Late payments or defaulting on the loan will severely damage your credit, making it difficult to secure loans in the future, such as a mortgage for a house or even a lower-interest auto loan. A lower credit score can also lead to higher interest rates on other loans, further compounding the financial burden. A poor credit history created by mishandling a student loan used for a car purchase can have long-lasting negative consequences, affecting your financial opportunities for years to come. Maintaining a good credit score requires responsible debt management and timely payments.

Alternative Financing Options for Car Purchases

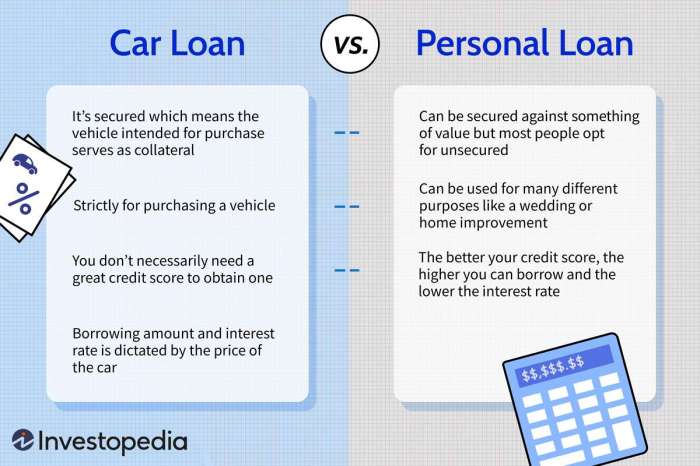

Securing financing for a car purchase offers various avenues beyond student loans. Understanding these alternatives is crucial for making an informed decision that aligns with your financial situation and long-term goals. This section will explore different auto loan options, the application process, and a comparison of leasing versus buying.

Types of Auto Loans

Several types of auto loans cater to different needs and credit profiles. These loans typically come with varying interest rates and repayment terms, influencing the overall cost of the vehicle. The most common types include loans from banks, credit unions, and dealerships. Banks and credit unions often offer more competitive rates than dealerships, especially for borrowers with good credit. Dealerships may provide financing options, but their rates tend to be higher. Another type is an indirect auto loan, where the dealership acts as an intermediary between the borrower and the lender.

Auto Loan Application Process (Banks and Credit Unions)

Applying for an auto loan from a bank or credit union typically involves these steps: First, you’ll need to pre-qualify for a loan to understand your potential borrowing power and interest rate. This often requires providing basic personal and financial information. Next, you’ll need to submit a formal application, including detailed financial documents like pay stubs, tax returns, and bank statements. The lender will then review your application and credit score to determine your eligibility and the loan terms. Upon approval, you’ll receive a loan agreement outlining the terms and conditions, including the interest rate, loan amount, and repayment schedule. Finally, the loan funds will be disbursed once you complete the necessary paperwork and finalize the car purchase.

Leasing vs. Buying a Car

Leasing and buying represent distinct approaches to car ownership. Leasing involves making monthly payments for the right to use a vehicle for a predetermined period (typically two to four years), after which you return the vehicle. Buying, on the other hand, involves securing financing (like an auto loan) to purchase the car outright, building equity over time. Leasing usually requires lower monthly payments and allows access to newer vehicles more frequently. However, you don’t own the car at the end of the lease, and mileage restrictions and wear-and-tear charges can apply. Buying offers ownership, equity building, and the ability to customize and modify the vehicle, but generally involves higher monthly payments and a larger initial investment.

Decision-Making Flowchart: Student Loan vs. Auto Loan

The following flowchart visually represents the decision-making process for choosing between using a student loan or an auto loan for a car purchase.

[Illustrative Flowchart Description:] The flowchart would begin with a central question: “Do you have sufficient savings for a down payment and monthly car payments without impacting student loan repayment?” A “Yes” branch would lead to “Consider an auto loan.” A “No” branch would lead to “Evaluate the financial implications of using a student loan for a car.” This branch would then split into “Can you manage both student loan and car loan repayments?” A “Yes” branch would lead to “Carefully consider the higher interest rates and long-term costs of using a student loan for a car, but it might be feasible.” A “No” branch would lead to “Explore alternative solutions, such as delaying the car purchase, finding a less expensive vehicle, or seeking additional income.” All branches eventually converge at “Final Decision: Student Loan or Auto Loan or Alternative Solution.”

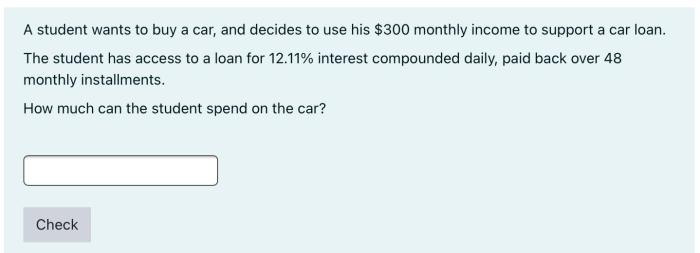

Responsible Borrowing Practices and Budgeting

Before considering any loan, including a student loan for a car purchase, a realistic budget is crucial. Failing to plan effectively can lead to overwhelming debt and significant financial strain. A well-structured budget provides a clear picture of your income and expenses, allowing you to determine your affordability and repayment capacity. This proactive approach minimizes the risk of defaulting on your loan and protects your long-term financial health.

Creating a comprehensive financial plan that incorporates loan repayments involves several key steps. Understanding your current financial situation is the foundation of this process. This includes calculating your monthly income, identifying all your existing expenses (housing, food, utilities, transportation, etc.), and assessing your current debt levels. Subtracting your total expenses from your income reveals your disposable income – the amount available for loan repayments and other discretionary spending. This figure is critical in determining the maximum loan amount you can comfortably afford without jeopardizing your financial stability. It’s important to remember that this disposable income should not be completely allocated to loan repayments; you must account for unexpected expenses and savings goals.

Creating a Realistic Budget

Budgeting involves carefully tracking income and expenses to ensure that spending remains within the limits of available funds. Effective budgeting methods range from simple spreadsheets to sophisticated budgeting apps. Regardless of the method used, the core principles remain the same: accurate record-keeping, regular monitoring, and timely adjustments. For example, a student might track their income from part-time jobs and any financial aid received. They would then list their monthly expenses, including rent, groceries, tuition fees, and entertainment. By subtracting their total expenses from their income, they can determine their disposable income and whether they can comfortably afford loan repayments. If the disposable income is insufficient, adjustments must be made, such as reducing non-essential spending or seeking additional income sources. It is crucial to include a buffer in the budget for unforeseen expenses, such as car repairs or medical bills.

Developing a Comprehensive Financial Plan

A robust financial plan integrates budgeting with long-term financial goals. This involves setting financial targets, such as saving for a down payment on a house or investing for retirement. A realistic plan incorporates loan repayments into this larger framework, ensuring they don’t overshadow other essential financial priorities. For instance, a student might aim to repay their student loan within a specified timeframe while also saving a portion of their income for future education or a down payment on a house. The financial plan would need to balance these competing goals and adjust accordingly. This holistic approach helps individuals manage their finances responsibly and achieve their long-term aspirations.

Practical Tips for Effective Debt Management

Managing debt effectively requires discipline and a proactive approach. Prioritizing high-interest debts, such as credit card debt, is crucial. Exploring debt consolidation options, which involve combining multiple debts into a single loan with potentially lower interest rates, can simplify repayment and reduce overall costs. Regularly reviewing and adjusting the budget as circumstances change is essential to prevent debt from spiraling out of control. For example, if a student experiences a reduction in income, they should immediately review their budget and explore options to reduce spending or increase income. This proactive approach is vital in maintaining financial stability. Additionally, maintaining open communication with lenders is important to address any difficulties promptly and avoid defaulting on loan repayments.

Resources for Financial Literacy and Debt Management

Accessing reliable resources for financial literacy and debt management is essential for informed decision-making. These resources provide valuable guidance on budgeting, debt management, and financial planning.

- National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services.

- Consumer Financial Protection Bureau (CFPB): Provides information and resources on various financial topics, including debt management.

- Your university’s financial aid office: Often provides workshops and individual counseling on financial planning.

- Online financial literacy websites and apps: Many reputable websites and apps offer budgeting tools, financial education resources, and debt management strategies.

Potential Legal and Ethical Considerations

Using student loan funds for purposes other than education carries significant legal and ethical implications. Misrepresenting the use of these funds can lead to serious consequences, impacting your creditworthiness and potentially resulting in legal action. Understanding these implications is crucial before considering such a financial decision.

Legal Ramifications of Misusing Student Loan Funds

The misuse of student loan funds is a serious offense. Federal student loans, in particular, are subject to strict regulations. Borrowers are required to use the funds for qualified education expenses, including tuition, fees, books, supplies, and room and board. Diverting these funds to purchase a car constitutes a breach of the loan agreement. This breach can result in the loan being declared immediately due and payable, leading to significant financial hardship. Furthermore, the lender may pursue legal action, potentially including lawsuits and collection efforts. In extreme cases, the borrower could face criminal charges for fraud. The specific penalties vary depending on the loan type, the amount misused, and the lender’s policies. For instance, a borrower might face fines, wage garnishment, or even damage to their credit score, severely impacting their ability to secure future loans or credit cards.

Fraudulent Use of Student Loans for Car Purchases

Using student loans to buy a car can be considered fraudulent if the borrower intentionally misrepresents the purpose of the funds to the lender. This typically involves submitting false documentation or making misleading statements on loan applications. For example, a borrower might claim the funds are for tuition when they actually intend to use them for a car down payment. Such actions constitute a deliberate attempt to deceive the lender and obtain funds under false pretenses. This is a serious crime with potentially severe penalties, including hefty fines, imprisonment, and a severely damaged credit history. The consequences can extend beyond the immediate financial penalties, impacting future opportunities for employment and financial stability. A conviction for student loan fraud would be a significant impediment to securing future loans or credit.

Ethical Implications of Prioritizing a Car Purchase Over Educational Expenses

From an ethical standpoint, prioritizing a car purchase over educational expenses raises significant concerns. Student loans are intended to facilitate access to education, which is widely considered an investment in one’s future. Using these funds for a non-essential purchase like a car diverts resources away from this crucial investment. This decision could negatively impact the borrower’s long-term career prospects and earning potential. It may also create a sense of financial instability and stress, potentially leading to further poor financial decisions. Ethically, responsible use of student loan funds aligns with the intended purpose – supporting educational goals and building a future based on education and skill development. Borrowing money for education with the intention of using it for something else undermines the very purpose of the loan and is not a responsible or ethical approach to personal finance.

Importance of Transparency and Responsible Borrowing Practices

Transparency and responsible borrowing are paramount when dealing with student loans. Borrowers have a moral and legal obligation to use the funds as intended. This includes maintaining accurate records of expenses, providing truthful information to lenders, and carefully budgeting for educational costs. Open communication with lenders regarding any unforeseen circumstances is also crucial. A responsible borrower would fully understand the terms and conditions of their loan agreement before accepting the funds. They would meticulously track their spending to ensure compliance with the loan agreement’s stipulations and avoid any potential legal or ethical breaches. This proactive approach protects the borrower from potential legal repercussions and fosters a sense of financial responsibility.

Ending Remarks

Ultimately, the decision of whether to use a student loan for a car purchase is a deeply personal one with significant financial ramifications. While seemingly convenient, it often proves a costly and potentially risky endeavor. By carefully weighing the pros and cons, exploring alternative financing, and prioritizing responsible budgeting, individuals can make informed decisions that align with their long-term financial well-being and avoid the pitfalls of misusing student loan funds.

FAQ Overview

Can I use my student loan for a car down payment?

Generally, no. Most student loan providers explicitly prohibit using funds for non-educational purposes. Attempting to do so could lead to loan default and legal consequences.

What happens if I use my student loan for a car and get caught?

Consequences can range from repayment demands for the misused funds to legal action, including potential fines and damage to your credit score.

Are there any exceptions to using student loans for car purchases?

Exceptions are extremely rare and typically involve specific extenuating circumstances, such as documented emergencies directly impacting education. These require significant documentation and approval from the loan provider.

What’s the best way to finance a car if I have student loan debt?

Prioritize paying down high-interest debt first. Then, explore auto loans from banks or credit unions, comparing interest rates and terms. Consider a used car to reduce the overall loan amount.