Pursuing higher education abroad is a significant undertaking, and financing it can be a major hurdle. For many international students, the question of securing student loans is paramount. This guide delves into the intricacies of accessing student loans as an international student, exploring eligibility criteria, available loan types, application processes, and potential challenges. We aim to provide a clear and comprehensive overview to empower prospective international students in navigating this crucial aspect of their educational journey.

From understanding the varying eligibility requirements across different countries to navigating the complexities of interest rates and repayment plans, we’ll examine the entire spectrum of student loan options available to international students. We will also explore alternative funding avenues such as scholarships and grants, offering a holistic perspective on financing your international education.

Eligibility Criteria for International Students

Securing student loans as an international student can be a complex process, varying significantly depending on the country you’re studying in. This section Artikels the general eligibility criteria and required documentation, highlighting key differences across several prominent study destinations. Understanding these requirements is crucial for successful loan application.

General Eligibility Requirements for International Students

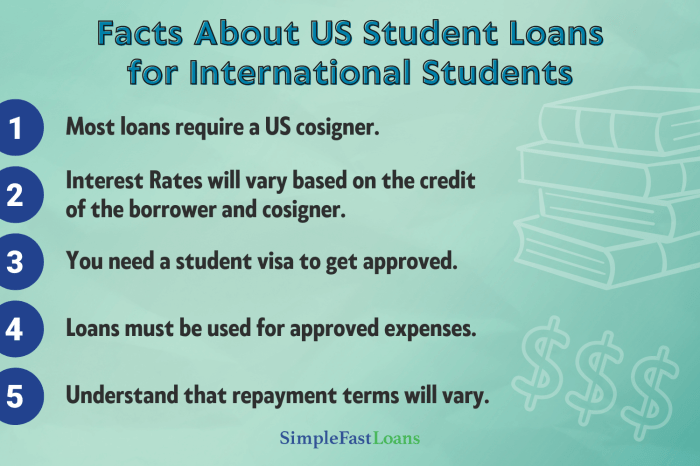

International students typically face a more stringent set of requirements compared to domestic applicants. Lenders assess not only academic merit but also financial stability and immigration status. Common requirements include a valid student visa, proof of enrollment in a recognized institution, a demonstrable need for funding, and a credible plan for repayment. Specific requirements vary considerably across countries and individual lending institutions.

Comparison of Eligibility Criteria Across Countries

The following table compares eligibility criteria for international students seeking student loans in the US, UK, Canada, and Australia. Note that these are general guidelines, and individual lender requirements may differ.

| Country | Credit History Requirement | Minimum GPA | English Proficiency Test |

|---|---|---|---|

| United States | Often required, especially for private loans; co-signer may be necessary. | Varies by lender and program; generally, a strong academic record is advantageous. | TOEFL or IELTS scores often required, depending on the lender and university. |

| United Kingdom | Generally not required for government-backed loans, but private lenders may require a credit check or co-signer. | Varies by university and program; a good academic record is typically expected. | IELTS or TOEFL scores are usually mandatory. |

| Canada | Not typically required for government-backed loans, but private lenders may assess creditworthiness. | Varies by lender and program; a competitive GPA is beneficial. | IELTS or TOEFL scores are commonly required. |

| Australia | Generally not a requirement for government loans; private lenders may have varying requirements. | Varies by university and program; a strong academic record enhances chances of approval. | IELTS or TOEFL scores are often necessary. |

Required Documentation for Proving Eligibility

To successfully apply for a student loan, international students must provide comprehensive documentation proving their eligibility. This typically includes:

- Acceptance Letter from a Recognized Institution: Official documentation confirming enrollment at an accredited university or college.

- Valid Student Visa: Proof of legal permission to study in the chosen country.

- Academic Transcripts: Official records of previous academic performance, demonstrating academic capabilities.

- Proof of Financial Need: Documentation demonstrating the inability to cover tuition and living expenses without financial aid.

- English Language Proficiency Test Scores: TOEFL, IELTS, or other relevant test scores, as required by the lender and institution.

- Passport and other Identification Documents: Valid identification documents are crucial for verification purposes.

- Co-signer Information (if required): Details of a responsible individual who agrees to co-sign the loan and accept responsibility for repayment if the student defaults.

- Bank Statements: Documentation to show financial stability and ability to manage funds.

Types of Student Loans Available to International Students

Securing funding for higher education is a significant undertaking for international students. Unlike domestic students, access to federal loan programs is often limited. However, various other avenues exist to finance their studies, each with its own set of advantages and disadvantages. Understanding these options is crucial for making informed financial decisions.

The landscape of student loans for international students is primarily comprised of private loans and, in some cases, government-sponsored programs specific to certain countries or regions. The availability and terms of these loans can vary significantly depending on the student’s country of origin, chosen institution, and academic program. Careful research is essential to find the most suitable option.

Private Student Loans

Private student loans are offered by various financial institutions, including banks and credit unions, as well as specialized lenders focusing on international students. These loans are not backed by the government, meaning the interest rates and repayment terms are typically determined by the lender based on the applicant’s creditworthiness and other financial factors. This means that securing a loan and obtaining favorable terms often depends on having a strong credit history, a co-signer with good credit, or a demonstrably stable financial background.

- Pros: Widely available, potentially higher loan amounts compared to some government programs, flexible repayment options (sometimes).

- Cons: Higher interest rates than government-backed loans, stricter eligibility requirements, may require a creditworthy co-signer, potential for variable interest rates.

Examples of institutions offering private student loans to international students include Sallie Mae (though they have specific eligibility requirements), Discover Student Loans, and other major banks with international student loan programs. The specific requirements and terms will vary between lenders.

Government-Sponsored Programs

While federal loan programs in the United States (and many other countries) are generally not accessible to international students, some countries have their own government-sponsored programs to support their citizens studying abroad. These programs often come with lower interest rates and more favorable repayment terms than private loans. However, eligibility is strictly limited to citizens of the participating country. The application process and requirements will be unique to each country’s program.

- Pros: Potentially lower interest rates, favorable repayment terms, may offer additional benefits or grants.

- Cons: Limited availability, eligibility restricted to citizens of the sponsoring country, rigorous application processes.

For example, some countries might offer scholarships or grants in conjunction with low-interest loans to students pursuing studies abroad. These programs often have specific criteria related to the field of study or the host country. Information on these programs is usually available through the respective country’s educational or foreign affairs ministries.

Institution-Specific Funding

Many universities and colleges offer their own financial aid packages that may include loans specifically for international students. These loans might be offered directly by the institution or in partnership with a private lender. The terms and conditions of these loans will vary widely based on the institution’s policies and the student’s financial profile.

- Pros: May offer more flexible terms than some private loans, could be integrated with other forms of financial aid.

- Cons: Availability varies significantly between institutions, loan amounts may be limited, terms might not be as favorable as government-backed loans (if available).

It’s crucial to directly contact the financial aid office of the prospective university to inquire about the availability of institutional loans for international students. The institution’s website will often contain details on their financial aid options.

Application Process and Required Documents

Securing a student loan as an international student involves a multi-step process that requires careful planning and preparation. Understanding the requirements and timeline is crucial for a successful application. The process generally begins well before the academic year commences, allowing ample time for processing and potential appeals if necessary.

The application process for international student loans varies depending on the lender and the specific loan program. However, several common steps and required documents are consistent across most applications. Thorough preparation is key to a smooth and efficient application process.

Pre-Application Steps

Before formally applying for a student loan, prospective students should take several crucial steps to increase their chances of approval. These preliminary actions significantly streamline the application process and improve the likelihood of a positive outcome.

- Research Loan Options: Explore various lenders and loan programs available to international students, comparing interest rates, repayment terms, and eligibility criteria.

- Check Eligibility Requirements: Carefully review the eligibility requirements for each loan program, ensuring you meet all the necessary criteria before proceeding with an application.

- Gather Financial Documents: Compile all necessary financial documents, such as bank statements, tax returns, and proof of income, to expedite the application process.

- Secure an Admission Offer: Obtain an official acceptance letter from the chosen educational institution. This is a fundamental requirement for most student loan programs.

Step-by-Step Application Procedure

The application procedure typically follows a sequential order, involving several key steps. It is important to follow each step meticulously to avoid delays or rejection.

- Complete the Application Form: Fill out the loan application form accurately and completely, providing all the required information.

- Submit Supporting Documents: Upload or mail all necessary supporting documents as specified by the lender. Ensure all documents are legible and properly formatted.

- Credit Check (if applicable): Undergo a credit check, if required by the lender. A good credit history can significantly improve your chances of approval.

- Loan Approval/Denial: The lender will review your application and supporting documents and notify you of their decision. This process can take several weeks or months.

- Loan Disbursement: If approved, the loan funds will be disbursed according to the lender’s schedule, often directly to the educational institution.

Flowchart of the Application Process

The following describes a simplified flowchart illustrating the application process. This visual representation helps clarify the sequential nature of the process.

Imagine a flowchart with the following boxes and arrows:

* Start: The starting point of the application process.

* Research Loan Options: An arrow points from “Start” to this box.

* Check Eligibility: An arrow points from “Research Loan Options” to this box.

* Gather Documents: An arrow points from “Check Eligibility” to this box.

* Complete Application: An arrow points from “Gather Documents” to this box.

* Submit Application & Documents: An arrow points from “Complete Application” to this box.

* Credit Check (if applicable): An arrow points from “Submit Application & Documents” to this box.

* Loan Approval/Denial: An arrow points from “Credit Check (if applicable)” to this box. This box has two arrows leading out: one to “Loan Disbursement” and the other to “Application Rejected”.

* Loan Disbursement: The final step of the process.

* Application Rejected: The process ends here if the application is rejected.

Required Documents

Having the necessary documents readily available is essential for a smooth application. Missing or incomplete documentation can significantly delay the process.

- Passport and Visa: Proof of identity and legal residency status.

- Acceptance Letter from University: Confirmation of enrollment at an accredited institution.

- Financial Statements (Bank Statements, Tax Returns): Demonstrates financial capability to repay the loan.

- Proof of Income (if applicable): Supporting documentation for income sources.

- Co-signer Information (if required): Details of a responsible individual willing to co-sign the loan.

- Transcript (if applicable): Academic records from previous institutions.

Interest Rates and Repayment Plans

Securing student loans as an international student often involves navigating a complex landscape of interest rates and repayment schedules. Understanding these factors is crucial for responsible borrowing and long-term financial planning. The costs associated with borrowing, and the terms under which repayment occurs, can vary significantly based on the lender, the loan type, and the student’s country of origin.

Interest rates on student loans for international students are generally higher than those for domestic students. This is due to several factors, including increased risk for lenders and the absence of government-backed loan programs that often offer lower rates to domestic borrowers. The specific interest rate will depend on factors such as the lender’s risk assessment of the borrower, the loan amount, and prevailing market interest rates. Furthermore, the currency in which the loan is denominated can also impact the effective interest rate due to fluctuations in exchange rates.

Interest Rate Comparison Across Loan Types and Countries

The following table offers a hypothetical comparison – actual rates vary considerably depending on the lender, the student’s creditworthiness, and the prevailing economic conditions. It is crucial to contact lenders directly for the most up-to-date information.

| Lender | Interest Rate (Annual Percentage Rate – APR) | Repayment Period (Years) | Deferment Options |

|---|---|---|---|

| Example Private Lender A (US-based) | 7-10% | 5-15 | Interest-only payments during grace period; potential deferment for hardship (requires documentation) |

| Example Private Lender B (UK-based) | 6-9% | 10-20 | Up to 12 months grace period; potential deferment for documented unemployment |

| Example International Lending Institution | 8-12% | 7-12 | Limited deferment options; typically requires significant financial hardship documentation |

Repayment Options After Graduation

After graduation, international students typically have several repayment options available, though these vary depending on the lender and the loan agreement. Common options include:

Standard Repayment: This is the most common repayment plan, where the borrower makes fixed monthly payments over a set period (the repayment period). The length of the repayment period influences the monthly payment amount. A shorter repayment period results in higher monthly payments but lower total interest paid, while a longer repayment period has lower monthly payments but higher total interest paid.

Graduated Repayment: This plan starts with lower monthly payments that gradually increase over time. This can be helpful for recent graduates who may have lower initial incomes.

Income-Driven Repayment (IDR): Some lenders may offer IDR plans, where monthly payments are based on a percentage of the borrower’s income. This can provide flexibility if income fluctuates. However, the availability of IDR plans for international students is often limited compared to domestic borrowers.

Deferment: This allows temporary suspension of payments, usually due to documented hardship, such as unemployment or illness. Interest may still accrue during a deferment period, depending on the loan terms.

Forbearance: This is similar to deferment but offers more flexibility. It allows for temporary reduction of monthly payments or a pause in payments. However, interest usually continues to accrue.

It is crucial to carefully review the loan agreement and discuss repayment options with the lender before graduation to develop a feasible repayment strategy. Failing to manage repayments can lead to serious financial consequences, including damage to credit scores and potential legal action.

Financial Aid and Scholarships for International Students

Securing funding for higher education is a significant hurdle for many international students. While student loans offer a viable option, they come with the burden of repayment. Fortunately, a range of financial aid and scholarship opportunities exist to lessen this burden or even eliminate the need for loans entirely. These options can significantly impact the overall cost of a student’s education.

Exploring alternative funding sources, such as scholarships and grants, is crucial for international students aiming to minimize their financial dependence on loans. These awards often come with fewer strings attached than loans, providing a more manageable path to a degree.

Types of Financial Aid and Scholarships

Many organizations offer financial aid to international students. These range from merit-based scholarships recognizing academic excellence to need-based grants assisting students facing financial hardship. Some scholarships are specific to particular countries, fields of study, or universities, while others have broader eligibility criteria. Examples include scholarships offered by individual universities, government agencies (such as the Fulbright program), private foundations, and international organizations. Many scholarships cover tuition fees, living expenses, or a combination of both. Grants, unlike scholarships, are usually awarded based on financial need and do not require repayment.

The Application Process for Scholarships and Grants

The application process for scholarships and grants varies depending on the awarding organization. Generally, it involves submitting an application form, transcripts, letters of recommendation, and a personal statement outlining the applicant’s academic goals and financial need. Some scholarships require standardized test scores (like the TOEFL or IELTS), while others may emphasize extracurricular activities or community involvement. It’s crucial to carefully review each scholarship’s specific requirements and deadlines to maximize the chances of a successful application. Many applications are submitted online through dedicated portals. Often, multiple applications need to be submitted to increase the chances of securing funding.

Advantages and Disadvantages of Financial Aid versus Student Loans

| Feature | Financial Aid (Scholarships & Grants) | Student Loans |

|---|---|---|

| Repayment | Generally no repayment required | Requires repayment with interest |

| Impact on Future Finances | Minimal to no long-term financial burden | Significant long-term financial burden |

| Application Process | Can be competitive and time-consuming | Relatively straightforward application process |

| Availability | Limited availability; highly competitive | More readily available, but may require a co-signer |

| Eligibility | Based on merit, need, or specific criteria | Based on creditworthiness and ability to repay |

Choosing between financial aid and student loans involves a careful consideration of individual circumstances and long-term financial goals. While loans provide immediate access to funds, financial aid offers a path to education without the burden of future debt.

Potential Challenges and Solutions for International Students

Securing student loans as an international student can present unique hurdles beyond those faced by domestic applicants. Navigating the complexities of the loan process requires careful planning and a proactive approach to overcome potential obstacles. Understanding these challenges and the available solutions is crucial for a successful application.

Credit History and Co-Signer Requirements

Many loan providers require a strong credit history, which international students often lack due to limited credit activity in the loaning country. This lack of established creditworthiness can significantly impact loan approval. Furthermore, the requirement for a co-signer, a US citizen or permanent resident with good credit, adds another layer of complexity. Finding a suitable co-signer who is willing and able to take on this financial responsibility can be challenging.

Language Barriers and Cultural Differences

Language barriers can hinder understanding loan application requirements, terms and conditions, and communication with lenders. Cultural differences in financial practices and expectations can also create misunderstandings and complicate the application process. Misinterpretations of crucial information can lead to delays or even rejection of the loan application.

Solutions for Overcoming Challenges

Addressing these challenges requires a multi-pronged approach. Building credit history, though difficult, can be achieved through secured credit cards or becoming an authorized user on a credit card of a trusted individual with good credit. If a co-signer is required, exploring options such as family members or close friends with strong credit should be considered. Seeking assistance from university international student services or financial aid offices can also prove invaluable. These offices often have staff who are multilingual and culturally sensitive, able to provide guidance and support throughout the process. Finally, thoroughly reviewing all loan documents and seeking clarification when needed is essential to avoid misunderstandings.

Resources for International Students

Accessing relevant resources is vital for a smooth loan application process. A strong support network is crucial for navigating the complexities involved.

- University International Student Services: Most universities offer dedicated support services for international students, including financial aid counseling and guidance on student loans.

- Financial Aid Offices: University financial aid offices are a primary source of information on available loan options, application procedures, and scholarships.

- Governmental Resources: Depending on the student’s country of origin and the lending country, governmental agencies may offer financial aid programs or loan guarantees for international students.

- Non-profit Organizations: Several non-profit organizations provide financial assistance and guidance to international students pursuing higher education.

- Private Loan Providers: While private lenders may have stricter requirements, it’s important to research and compare options from various providers to find the most suitable loan terms.

Legal and Regulatory Aspects

Securing student loans as an international student involves navigating a complex legal landscape that varies significantly across countries. Understanding the legal framework governing these loans is crucial for both borrowers and lenders to ensure transparency and protect the rights of all parties involved. This section Artikels key legal considerations and potential implications.

Legal Frameworks Governing Student Loans for International Students

The legal framework surrounding international student loans differs considerably depending on the country of study and the lender. In the United States, for example, federal student loan programs generally do not extend to international students, leaving them reliant on private lenders whose offerings are governed by state and federal consumer protection laws. These laws often dictate disclosure requirements, interest rate caps, and collection practices. In contrast, some countries may have specific government-backed loan programs for international students, with their own sets of regulations. These regulations often define eligibility criteria, loan terms, and repayment schedules. Understanding the specific legal framework of the country where the student intends to study is paramount. Failure to comply with these regulations can lead to serious consequences.

Implications of Loan Defaults

Loan default, the failure to repay a loan according to the agreed-upon terms, carries significant legal and financial repercussions for international students. These consequences can include damage to credit scores, impacting future borrowing opportunities. Legal action by the lender, potentially involving wage garnishment or the seizure of assets, is also a possibility. Furthermore, a default may affect the student’s immigration status, potentially leading to deportation in some countries. The specific consequences vary based on the country’s legal system and the terms of the loan agreement. For instance, a default on a privately held loan in the UK might lead to court action and debt collection agency involvement, while a similar default on a federally backed loan in Canada might have different procedures and penalties.

Rights and Responsibilities of International Students Regarding Student Loans

International students have specific rights and responsibilities regarding student loans. They have the right to clear and accurate information about loan terms, interest rates, and repayment options. They also have the right to fair treatment from lenders and to dispute any inaccuracies or unfair practices. However, students have the responsibility to thoroughly understand the loan agreement before signing it, make timely payments, and comply with all the terms and conditions. Failure to meet these responsibilities can lead to the consequences Artikeld above. Seeking independent financial advice before taking out a loan is strongly recommended to ensure students are fully aware of their rights and obligations. It is also vital to maintain open communication with the lender throughout the loan repayment period to address any potential issues promptly.

Ending Remarks

Securing funding for higher education as an international student presents unique challenges, but with thorough research and planning, it is entirely achievable. Understanding the various loan options, eligibility criteria, and application processes is crucial. This guide has provided a framework for navigating this process. Remember to explore all available resources, including scholarships and grants, to create a comprehensive financial plan that supports your academic aspirations. By proactively addressing these financial considerations, international students can confidently pursue their educational goals overseas.

Detailed FAQs

What is a co-signer, and why is it often required for international student loans?

A co-signer is a US citizen or permanent resident with good credit who agrees to repay the loan if the student defaults. Lenders often require co-signers because international students may lack a US credit history.

Are there any loan options available without a co-signer?

Some private lenders might offer loans without a co-signer, but these are typically more difficult to obtain and may come with higher interest rates. Strong financial documentation and a high credit score (if applicable) can improve your chances.

What happens if I default on my student loan?

Defaulting on a student loan can have severe consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or visas. It’s crucial to understand your repayment obligations and seek help if you’re struggling to make payments.

Can I use my international credit history to qualify for a loan?

Most US and other Western lenders primarily focus on US credit history. While your international credit history might be considered in some cases, it’s not usually sufficient on its own for loan approval.