The Parent PLUS loan program offers a crucial financial lifeline for many families navigating the high cost of higher education. However, the responsibility for repayment often falls squarely on the parents. This exploration delves into the complexities of student involvement in Parent PLUS loan repayment, examining the legal, ethical, and financial implications for both students and parents. We will explore scenarios where students might contribute, the various methods of contribution, and the long-term impact on everyone’s financial well-being.

Understanding the nuances of Parent PLUS loans and the potential roles students can play is essential for informed decision-making. This guide aims to provide clarity and practical strategies for families to navigate this complex financial landscape responsibly and effectively.

Parent PLUS Loan Basics

Parent PLUS loans are federal loans available to parents of undergraduate students to help pay for their child’s education. These loans offer a significant financial resource, but understanding the program’s intricacies is crucial for responsible borrowing. This section provides a comprehensive overview of Parent PLUS loans, covering eligibility, costs, repayment options, and the application process.

Eligibility Requirements for Parent PLUS Loans

To be eligible for a Parent PLUS loan, a parent must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have an adverse credit history. An adverse credit history typically includes serious delinquencies or defaults on previous loans. The parent must also be the biological or adoptive parent of the dependent undergraduate student, or be a legal guardian. The student must be enrolled at least half-time in a degree or certificate program at a participating institution. Finally, the student must meet the school’s satisfactory academic progress requirements. The Department of Education will conduct a credit check to determine eligibility. If denied due to adverse credit, the parent may be able to obtain an endorser or appeal the decision.

Interest Rates and Fees for Parent PLUS Loans

Parent PLUS loan interest rates are variable and are set annually by the government. These rates are typically higher than those for subsidized and unsubsidized federal student loans. In addition to the interest rate, a loan fee is charged, which is a percentage of the loan amount. This fee is deducted from the loan proceeds before the funds are disbursed to the school. Borrowers should carefully review the interest rate and fee information provided at the time of loan application, as these can fluctuate. For example, a recent year’s interest rate might have been 7.54%, and the loan fee could have been 4.228%. These numbers are illustrative and are subject to change.

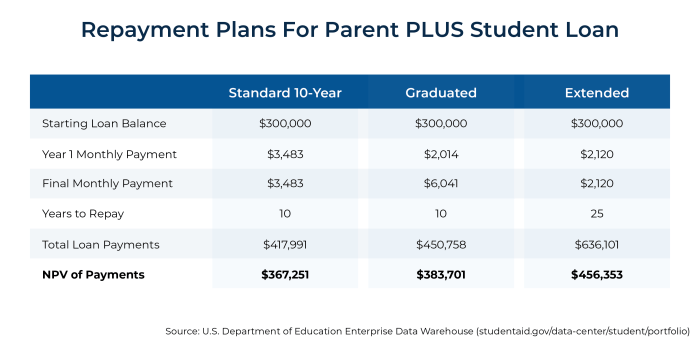

Repayment Options for Parent PLUS Loans

Several repayment options exist for Parent PLUS loans, allowing parents to tailor their repayment plan to their financial situation. These include Standard Repayment, which is typically a 10-year plan with fixed monthly payments; Extended Repayment, offering longer repayment periods and potentially lower monthly payments; Graduated Repayment, starting with lower monthly payments that gradually increase; and Income-Driven Repayment plans, which base monthly payments on income and family size. Each plan has its own advantages and disadvantages concerning total interest paid and repayment duration. It’s advisable to carefully consider each option before selecting a repayment plan.

Applying for a Parent PLUS Loan: A Step-by-Step Guide

Applying for a Parent PLUS loan involves several steps. First, the student must complete the Free Application for Federal Student Aid (FAFSA). The parent then completes the Parent PLUS loan application through the Federal Student Aid website. This application requires providing personal and financial information, including credit history verification. After approval, the loan funds are disbursed to the student’s school to cover educational expenses. It is important to carefully review all loan documents and understand the terms and conditions before accepting the loan. Regular monitoring of the loan account is essential to ensure timely payments and avoid delinquency.

Student’s Role in Repayment

While the Parent PLUS loan is in the parents’ name, a student’s involvement in repayment can significantly impact the family’s financial well-being and the student’s own future. Several scenarios justify a student’s contribution, fostering a sense of shared responsibility and potentially easing the financial burden on the parents.

The student’s role in repayment hinges on several factors, including the student’s financial capacity, the family’s overall financial situation, and the ethical considerations involved in sharing the responsibility for a debt incurred for the student’s education. A collaborative approach to repayment planning, openly discussed between parents and student, is crucial.

Scenarios for Student Contribution

Several situations might encourage a student to contribute to Parent PLUS loan repayment. For example, a student with a high-paying job after graduation might choose to contribute significantly to accelerate repayment and minimize overall interest costs. Alternatively, a student who feels a strong sense of responsibility for their education might contribute even with a more modest income, viewing it as a way to express gratitude to their parents. Finally, families facing financial hardship might collaborate on repayment strategies where the student contributes as much as possible, potentially preventing loan default.

Ethical Considerations of Student Assistance

Contributing to Parent PLUS loan repayment involves ethical considerations. Open communication and mutual agreement between parents and students are essential. The contribution should be voluntary and not create undue financial hardship for the student. The student’s contribution should be viewed as a gesture of support and shared responsibility, not an obligation. It is crucial to avoid situations where the student feels pressured or exploited. A fair and equitable agreement, perhaps documented in writing, can help prevent future misunderstandings.

Methods of Student Financial Contribution

Students can contribute financially in various ways. Direct monthly payments to the loan servicer are the most straightforward approach. Alternatively, the student could contribute a lump sum periodically, perhaps using bonuses or tax refunds. The student might also contribute indirectly by covering other family expenses, freeing up parental funds to allocate toward the loan. The chosen method should align with the student’s financial capacity and the family’s overall financial planning.

Hypothetical Budget Demonstrating Student Contribution

Let’s consider a hypothetical scenario. A student graduates with a starting salary of $50,000 annually. After taxes and essential living expenses (rent, food, transportation, insurance), they have $1,500 per month available. They allocate $300 monthly towards the Parent PLUS loan repayment. This represents 20% of their discretionary income, a significant but manageable contribution.

| Income | Amount |

|---|---|

| Gross Annual Salary | $50,000 |

| Net Monthly Income (after taxes) | $3,000 |

| Expenses | Amount |

| Rent | $1,000 |

| Food | $300 |

| Transportation | $200 |

| Insurance | $200 |

| Other Expenses | $800 |

| Parent PLUS Loan Contribution | $300 |

This budget illustrates how a student can make a substantial contribution while still maintaining a reasonable standard of living. The specific amounts will vary depending on individual circumstances. The key is open communication and a shared understanding of financial responsibilities.

Legal and Financial Implications

Co-signing a Parent PLUS loan carries significant legal and financial responsibilities for the student. Understanding these implications is crucial before agreeing to this arrangement. Failure to understand these implications can lead to severe consequences for both the student and the parent.

Legal Issues Related to Co-signing a Parent PLUS Loan

If a student co-signs a Parent PLUS loan, they become legally obligated to repay the debt should the parent default. This means that even if the parent is unable or unwilling to make payments, the lender can pursue the student for the full amount owed. This legal obligation can impact the student’s credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, collection agencies may pursue aggressive collection methods, including wage garnishment or legal action. The student’s involvement extends beyond simple financial responsibility; it’s a legally binding agreement.

Impact of Student’s Financial Situation on Repayment Options

A student’s financial situation significantly influences their ability to contribute to Parent PLUS loan repayment. For instance, a student with a high income and stable employment may be able to make substantial payments, potentially accelerating the repayment process. Conversely, a student struggling with unemployment or low income may find it challenging to contribute, potentially leading to increased financial stress and default. The availability of income-driven repayment plans can vary depending on the student’s individual financial circumstances. A student’s employment status, existing debts, and overall financial health will all influence their repayment capacity. For example, a student working full-time and earning a comfortable salary might be able to allocate a significant portion of their income towards loan repayment, whereas a student juggling part-time work and additional student loans might only be able to afford minimal payments.

Comparison of Repayment Plan Impacts on Student Finances

The following table compares the impact of different repayment plans on a student’s finances. The examples are illustrative and actual amounts will vary based on loan amount, interest rate, and individual circumstances.

| Repayment Plan | Monthly Payment (Example) | Total Interest Paid (Example) | Impact on Student Finances |

|---|---|---|---|

| Standard Repayment | $300 | $10,000 | High monthly payments; may strain budget; faster payoff. |

| Extended Repayment | $150 | $15,000 | Lower monthly payments; less budget strain; longer payoff; higher total interest. |

| Income-Driven Repayment (IBR) | Variable (based on income) | Variable (potentially high) | Payments adjusted to income; may lead to loan forgiveness after 20-25 years; potential for higher long-term cost. |

| Graduated Repayment | Starts low, increases over time | Variable | Lower initial payments; increases over time; may become challenging later. |

Decision-Making Process for Student Involvement in Loan Repayment

This flowchart illustrates the key considerations a student should make when deciding whether to co-sign a Parent PLUS loan.

[Imagine a flowchart here. The flowchart would begin with a decision box: “Co-sign Parent PLUS Loan?”. If “Yes,” it would lead to a box: “Understand legal obligations and financial implications.” From there, it would branch to boxes assessing the student’s financial stability and ability to contribute to repayment. If “No,” it would lead to a box: “Explore alternative financial aid options.”]

Practical Strategies for Repayment Assistance

Helping parents manage Parent PLUS loan repayments can significantly reduce financial stress for the entire family. Students, while navigating their own financial challenges, can play a crucial role in supporting their parents’ repayment efforts through proactive planning and collaborative strategies. This section Artikels practical approaches to alleviate the burden and foster a shared responsibility.

Strategies for Student Contribution to Loan Repayment

Students can contribute to loan repayment without compromising their own financial stability through several methods. Careful budgeting and prioritizing are key. A realistic approach focuses on consistent, even small, contributions rather than sporadic large payments. This approach fosters a sense of shared responsibility and builds positive financial habits.

One effective method is to create a dedicated savings account specifically for Parent PLUS loan repayments. Regular transfers, even a small percentage of the student’s income, accumulate over time and make a tangible difference. Another strategy is to explore opportunities for increased income, such as part-time jobs, freelance work, or summer employment. These additional funds can be directly applied towards the loan principal, reducing the overall debt and interest accrued.

Financial Literacy Resources for Students and Parents

Access to reliable financial information is crucial for effective loan management. Numerous free resources exist to guide both students and parents through the complexities of loan repayment and financial planning. These resources often provide budgeting tools, debt management strategies, and personalized financial advice.

Government websites, such as the Federal Student Aid website (studentaid.gov), offer comprehensive information on loan repayment plans and options. Many non-profit organizations also provide free financial counseling services, offering personalized guidance tailored to individual circumstances. Additionally, numerous online resources and educational platforms offer courses and workshops on budgeting, saving, and debt management. Utilizing these resources empowers both students and parents to make informed decisions about their financial future.

Examples of Successful Student-Parent Collaboration

Successful collaboration between students and parents in managing Parent PLUS loans often involves open communication, shared responsibility, and a well-defined repayment plan. One example might involve a student contributing a set percentage of their monthly income towards the loan while the parents handle the remaining portion. Another example could be a student taking on additional responsibilities, like reducing household expenses, to free up funds for loan repayment. A family might agree on a specific amount to be paid monthly, dividing the responsibility according to each member’s financial capacity. These collaborative efforts not only reduce the financial strain but also strengthen family bonds.

In some cases, students might help parents explore loan refinancing options to secure lower interest rates, thereby reducing the overall repayment cost. This proactive approach requires careful research and consideration but can yield significant long-term savings. The key is open communication and a willingness to work together towards a shared financial goal. Successful collaboration frequently involves consistent communication, careful budgeting, and a proactive approach to exploring all available options.

Alternative Financial Aid Options

Parent PLUS loans, while helpful, aren’t the only avenue for funding higher education. Exploring alternative financial aid options can significantly impact a family’s overall financial burden and potentially reduce the reliance on Parent PLUS loans, or even eliminate the need entirely. Understanding the nuances of these options is crucial for making informed decisions.

Exploring alternative financial aid options can significantly reduce or even eliminate the need for a Parent PLUS loan. Several alternatives offer different benefits and drawbacks, requiring careful consideration based on individual circumstances. By comparing interest rates, repayment terms, and eligibility requirements, families can create a financial aid strategy that best suits their needs.

Comparison of Parent PLUS Loans with Other Financial Aid

Parent PLUS loans differ substantially from other financial aid options. Unlike federal student loans (subsidized and unsubsidized), which are directly awarded to students based on financial need and academic merit, Parent PLUS loans are credit-based loans taken out by parents. Grants, on the other hand, do not need to be repaid. Scholarships, like grants, are typically awarded based on merit, not financial need. Work-study programs provide part-time employment opportunities, allowing students to earn money while studying. Each option presents a unique set of advantages and disadvantages. Parent PLUS loans offer a large sum of money but come with interest and repayment obligations. Grants and scholarships provide funding without repayment, but they are often competitive and limited in availability. Work-study offers income, but the earnings are typically limited.

Benefits and Drawbacks of Alternative Financial Aid Options

Federal student loans (subsidized and unsubsidized) offer access to funds for tuition, fees, and living expenses, but carry interest rates and repayment obligations. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest immediately. Grants, such as Pell Grants, are need-based and do not require repayment, but the amount is limited and may not cover the full cost of education. Scholarships, awarded based on merit, academic achievement, or specific criteria, also don’t require repayment but are often highly competitive. Work-study programs offer part-time employment opportunities, providing income to help cover educational expenses, but the earnings may not fully cover the costs.

Interest Rates and Repayment Terms of Different Loan Types

Understanding the interest rates and repayment terms is critical for comparing loan options. The interest rates and repayment terms vary depending on the loan type and the lender. The following table provides a general comparison; actual rates may vary depending on current market conditions and the individual’s creditworthiness.

The following table provides a general comparison. Actual rates and terms are subject to change.

| Loan Type | Interest Rate (Approximate) | Repayment Terms |

|---|---|---|

| Parent PLUS Loan | Variable, typically higher than federal student loans | Starts within 60 days of disbursement; various repayment plans available |

| Federal Subsidized Loan | Fixed, determined annually by the government | Starts 6 months after graduation or dropping below half-time enrollment; various repayment plans available |

| Federal Unsubsidized Loan | Fixed, determined annually by the government | Starts 6 months after graduation or dropping below half-time enrollment; various repayment plans available |

| Private Student Loans | Variable or fixed, determined by the lender | Varies depending on the lender; may offer shorter repayment periods |

Hypothetical Scenario: Reducing Parent PLUS Loan Dependency

Let’s imagine the Smith family needs $20,000 for their child’s first year of college. Instead of relying solely on a Parent PLUS loan, they explore other options. Their child receives a $5,000 scholarship and a $2,000 grant. They also secure a work-study position earning $3,000 during the academic year. This reduces their need for a Parent PLUS loan to $10,000 ($20,000 – $5,000 – $2,000 – $3,000 = $10,000). This significantly lessens their borrowing and the subsequent repayment burden. The reduced loan amount also lowers the overall interest accrued over the repayment period.

Impact on Future Financial Planning

Parent PLUS loans, while offering a crucial pathway to higher education, cast a long shadow on the financial futures of both parents and students. The weight of this debt can significantly impact major life decisions, from purchasing a home to saving for retirement, potentially for many years after repayment is complete. Understanding these long-term implications and proactively planning for them is essential for navigating a financially secure future.

The repayment of Parent PLUS loans can strain family budgets for years, potentially delaying major financial goals like saving for retirement or a down payment on a house. For students, the knowledge of their parents’ financial burden can create stress and impact their own financial planning, influencing career choices and delaying major purchases like a car or starting a family. Early and effective financial planning can help mitigate these challenges.

Long-Term Financial Implications

The impact of Parent PLUS loan debt extends far beyond the repayment period. For parents, the debt can reduce their disposable income, limiting opportunities for investments, savings, and other financial goals. This can lead to delayed retirement, reduced retirement savings, and a potentially lower standard of living in later years. For students, the indirect impact can be significant. Witnessing the financial strain on their parents may influence their career choices, pushing them towards higher-paying jobs even if it means compromising personal preferences. The debt can also affect their ability to secure loans for their own future needs, such as mortgages or business ventures. For example, a family struggling with Parent PLUS loan repayments might postpone saving for their child’s college fund, potentially leading to the child needing to take on even more debt in the future.

Mitigating the Impact of Student Loan Debt

Early financial planning is crucial in mitigating the impact of student loan debt. This involves creating a realistic budget that incorporates loan repayments, setting clear financial goals (such as saving for a down payment or retirement), and exploring different repayment strategies. For example, parents can work with a financial advisor to develop a plan that balances loan repayment with other financial goals. Students can start building their credit history early to improve their chances of securing favorable loan terms in the future. Regularly reviewing and adjusting the financial plan is vital to account for unexpected life events and changing financial circumstances.

Impact of Debt on Credit Scores and Future Borrowing Capacity

Student loan debt, especially when managed poorly, can significantly impact credit scores and future borrowing capacity. Missed or late payments can negatively affect credit scores, making it more difficult and expensive to secure loans for major purchases such as a car or a house. A lower credit score can also lead to higher interest rates on future loans, increasing the overall cost of borrowing. Imagine a scenario where a family struggles to manage their Parent PLUS loan repayments. Consistent late payments could drop their credit score substantially, making it significantly harder for them to qualify for a mortgage when they want to buy a house, or even get approved for a car loan at a favorable interest rate. This ripple effect can significantly impact their long-term financial well-being.

Building Good Credit and Financial Habits

Building good credit and healthy financial habits starts early. A step-by-step plan can help students and parents navigate this process effectively.

- Create a budget: Track income and expenses to understand spending habits and identify areas for savings.

- Pay bills on time: Consistent on-time payments are crucial for building a good credit history.

- Open a checking and savings account: Establish a foundation for responsible financial management.

- Obtain a secured credit card: This can help build credit history with lower risk.

- Monitor credit reports: Regularly check for errors and track credit score progress.

- Set financial goals: Define short-term and long-term goals, such as saving for a down payment or paying off debt.

- Seek financial guidance: Consult with a financial advisor for personalized advice and support.

Outcome Summary

Ultimately, the question of whether a student can or should contribute to a Parent PLUS loan is highly nuanced and depends heavily on individual circumstances. While there’s no legal obligation, contributing can alleviate financial strain on parents and foster a stronger family bond. Careful consideration of financial implications, ethical considerations, and open communication between parents and students are crucial for a successful outcome. Proactive financial planning and resource utilization can significantly mitigate the long-term impact of this loan on everyone involved.

Top FAQs

Can a student legally be held responsible for a Parent PLUS loan?

No, unless the student co-signs the loan. Co-signing makes them legally responsible for repayment.

What if the parents can’t repay the loan?

Defaulting on the loan will severely damage the parents’ credit score and may lead to wage garnishment or tax refund offset. The student is generally not directly affected unless they co-signed.

Are there tax implications for student contributions to the loan?

Generally, student contributions are considered gifts and have no direct tax implications for the student, but it’s advisable to consult a tax professional for specific situations.

Can a student use their own savings or earnings to contribute?

Yes, but careful budgeting is essential to ensure it doesn’t compromise the student’s own financial stability and educational goals.