Navigating the complexities of student loan repayment can feel overwhelming, especially when juggling Parent PLUS loans alongside your own student loans. This guide explores the feasibility and financial implications of combining these loan types, offering a clear understanding of the potential benefits and drawbacks. We’ll delve into the intricacies of each loan type, outlining eligibility criteria, interest rates, and repayment options. Ultimately, we aim to empower you with the knowledge needed to make informed decisions about your student loan debt management.

Understanding the nuances of Parent PLUS loans and federal student loans is crucial before considering consolidation. Factors such as interest rates, repayment terms, and potential impacts on your credit score must be carefully weighed. This analysis will provide a framework for comparing the financial implications of combining versus keeping your loans separate, allowing you to choose the strategy best suited to your individual circumstances.

Parent PLUS Loan Basics

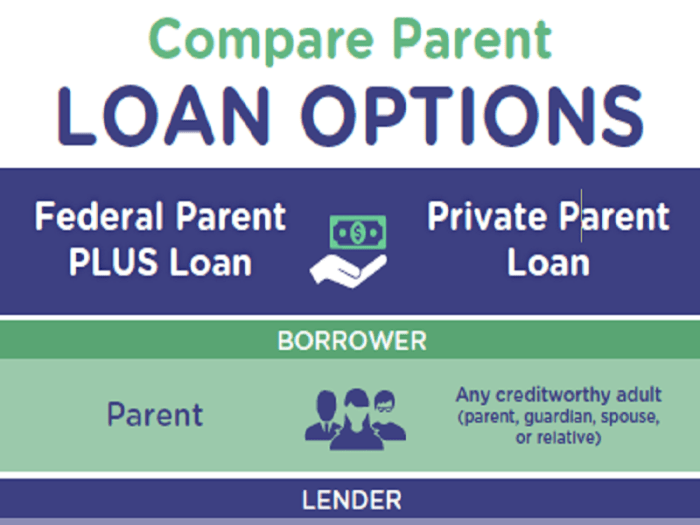

Parent PLUS loans are federal loans available to parents of undergraduate students to help cover their child’s education expenses. These loans offer a significant financial aid option but come with specific requirements and terms that borrowers should understand thoroughly before applying. This section will Artikel the key aspects of Parent PLUS loans, including eligibility, interest rates, repayment options, and a comparison to federal student loans.

Eligibility Requirements for Parent PLUS Loans

To be eligible for a Parent PLUS loan, parents must be a biological or adoptive parent, stepparent, or legal guardian of a dependent undergraduate student enrolled at least half-time in a degree or certificate program at a participating school. The parent must also meet the basic credit requirements, which include having a credit history that doesn’t demonstrate significant financial irresponsibility. The Department of Education will perform a credit check as part of the application process. If a parent is denied due to adverse credit, they may be able to obtain a loan with an eligible co-signer or by demonstrating extenuating circumstances. Finally, the student must be eligible for federal student aid.

Interest Rates and Fees Associated with Parent PLUS Loans

Parent PLUS loan interest rates are variable and are set annually by the government. These rates are typically higher than those for federal student loans. In addition to the interest rate, there’s an origination fee, which is deducted from the loan amount at disbursement. This fee also varies, depending on the loan amount and the year in which the loan was taken out. Both the interest rate and the origination fee contribute to the overall cost of borrowing. It is crucial for parents to carefully consider these costs when deciding whether a Parent PLUS loan is the right choice for their family’s financial situation. For example, a higher interest rate could mean a larger amount paid in interest over the life of the loan.

Repayment Options Available for Parent PLUS Loans

Several repayment plans are available for Parent PLUS loans, offering borrowers flexibility in managing their monthly payments. Standard repayment is a fixed monthly payment over a 10-year period. However, parents may also be eligible for income-driven repayment plans, which adjust payments based on income and family size. These plans generally extend the repayment period beyond 10 years. Additionally, borrowers can explore options like deferment or forbearance if they experience temporary financial hardship. It’s essential to understand the implications of each repayment plan, including the total interest paid over the life of the loan. Choosing a repayment plan that aligns with your budget and financial goals is crucial.

Comparison of Parent PLUS Loan Terms with Federal Student Loans

Parent PLUS loans differ from federal student loans in several key aspects. While both are federal loans, Parent PLUS loans are taken out by the parent, while federal student loans are taken out by the student. Parent PLUS loans typically have higher interest rates and origination fees compared to federal student loans. The creditworthiness of the parent is a determining factor for Parent PLUS loan approval, unlike federal student loans which have different eligibility criteria. Furthermore, repayment options might vary slightly, with income-driven repayment plans often being more readily available for federal student loans. Understanding these differences is critical for making informed decisions about financing a child’s education.

Student Loan Basics

Understanding federal student loans is crucial for navigating the complexities of higher education financing. These loans offer various options, each with its own set of terms and conditions, impacting your borrowing experience and long-term financial health. Careful consideration of these factors is key to making informed decisions about your education funding.

Types of Federal Student Loans

Federal student loans are categorized into several types, each designed to meet different needs and financial situations. The primary distinction lies between subsidized and unsubsidized loans. Subsidized loans offer the benefit of the government paying the interest while you are in school, during grace periods, and under certain deferment situations. Unsubsidized loans, conversely, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. Additionally, there are Parent PLUS loans (already covered), and graduate PLUS loans, which are designed for graduate students and professional degree programs. Finally, Federal Perkins Loans are low-interest loans offered by participating colleges and universities. Eligibility requirements and loan limits vary depending on the type of loan and the student’s financial situation.

Interest Rates and Fees Associated with Federal Student Loans

Interest rates for federal student loans are set annually by the government and are typically fixed for the life of the loan. These rates are generally lower than private loan rates, making them a more attractive option for many borrowers. However, interest does accrue, adding to the total amount you will ultimately repay. Furthermore, there are origination fees associated with federal student loans, which are deducted from the loan disbursement amount. These fees are a small percentage of the loan amount and vary based on the loan type and year of disbursement. For example, in 2023, the origination fee for Direct Subsidized and Unsubsidized Loans was 1.057%. It’s important to factor these fees into your overall borrowing costs.

Federal Student Loan Repayment Options

Once you graduate or leave school, you’ll enter a grace period (typically six months) before repayment begins. After this period, several repayment plans are available to help manage your debt. These include: Standard Repayment (fixed monthly payments over 10 years); Graduated Repayment (payments start low and increase over time); Extended Repayment (payments over 25 years); and Income-Driven Repayment (IDR) plans, which tie monthly payments to your income and family size. The specific repayment plan that best suits your circumstances will depend on factors such as your loan amount, income, and family size. IDR plans, for instance, are often beneficial for borrowers with lower incomes, as they can significantly reduce monthly payments.

Comparison of Student Loan Repayment Plans

The choice of repayment plan significantly impacts your monthly payment amount and the total amount you’ll pay over the life of the loan. A Standard Repayment plan offers the lowest total cost but may result in higher monthly payments. Conversely, an Extended Repayment plan offers lower monthly payments but results in a higher total cost due to the longer repayment period and accrued interest. Income-Driven Repayment plans offer the lowest monthly payments but may result in loan forgiveness after 20 or 25 years, depending on the plan, which can also impact the total amount paid. The optimal plan depends on individual financial circumstances and long-term financial goals. Careful consideration of the trade-offs between monthly payments and total repayment cost is essential when choosing a repayment plan. For example, a borrower with a high income might prefer the Standard Repayment plan to minimize the total interest paid, while a borrower with a lower income might find an IDR plan more manageable.

Combining Loans

Combining Parent PLUS loans and student loans is a strategy some borrowers consider to simplify their repayment process. This involves consolidating multiple loans into a single loan with a single monthly payment. However, it’s crucial to understand both the potential benefits and drawbacks before making a decision.

Parent PLUS and Student Loan Consolidation Process

The process of consolidating Parent PLUS loans and student loans typically involves applying through a federal loan consolidation program, such as the Direct Consolidation Loan program. Borrowers will need to gather necessary documentation, including loan details and income information. The application process will involve a review of the borrower’s credit history, and the terms of the consolidated loan, including the interest rate, will be determined based on a weighted average of the interest rates of the individual loans being consolidated. This process can take several weeks to complete.

Benefits of Combining Loans

Combining Parent PLUS loans and student loans can offer significant advantages. A primary benefit is the simplification of repayment. Instead of managing multiple loan payments with varying due dates and interest rates, borrowers have a single, streamlined payment. This can make budgeting and repayment tracking considerably easier. Furthermore, a longer repayment term might be available, potentially resulting in lower monthly payments.

Drawbacks of Combining Loans

While consolidation simplifies repayment, it’s essential to acknowledge potential drawbacks. A major concern is the potential impact on the interest rate. The interest rate of the consolidated loan is typically a weighted average of the interest rates of the individual loans. If the Parent PLUS loans have a higher interest rate than the student loans, the consolidated loan’s interest rate may be higher than the average interest rate of the student loans. This could lead to paying more interest over the life of the loan. Additionally, some loan forgiveness or repayment assistance programs may not be applicable to a consolidated loan.

Hypothetical Scenario: Combining vs. Separate Loans

Let’s consider a hypothetical scenario to illustrate the financial implications. This example demonstrates the potential impact of consolidation on monthly payments and total interest paid.

| Loan Type | Original Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Parent PLUS Loan 1 | $20,000 | 7.0% | $150 |

| Parent PLUS Loan 2 | $15,000 | 7.5% | $115 |

| Student Loan 1 | $10,000 | 5.0% | $75 |

| Consolidated Loan (Hypothetical) | $45,000 | 6.5% | $300 |

Note: This is a simplified example. Actual interest rates and monthly payments will vary based on several factors, including loan terms and repayment plans. A financial advisor can provide more personalized guidance.

Combining Loans: Financial Implications

Consolidating your Parent PLUS and student loans can have significant financial consequences, impacting your credit score, overall repayment costs, tax liability, and future borrowing capacity. Understanding these implications is crucial before making a decision.

Credit Score Impact

Combining loans can affect your credit score in several ways. A single, consolidated loan replaces multiple accounts on your credit report. While this simplifies your financial picture, it also reduces the length of your credit history. If you had some accounts with longer histories, consolidating might slightly lower your average account age, a factor considered in credit scoring models. Conversely, if you had several accounts with late payments, consolidation could help by showing a consistent, improved payment history on the new loan. The impact on your credit score depends on your individual credit history and the credit scoring model used. For example, a borrower with a history of late payments on multiple loans might see a positive impact on their score after consolidation, as the improved payment history on a single loan outweighs the reduction in average account age. Conversely, a borrower with a consistently excellent payment history might experience a minimal or even slightly negative impact due to the reduction in the average age of accounts.

Comparison of Total Interest Paid

The following table compares the total interest paid over the life of the loans with and without consolidation. These are illustrative examples and actual results will vary based on interest rates, loan terms, and repayment plans.

| Scenario | Initial Loan Amount | Total Interest Paid | Total Repaid |

|---|---|---|---|

| Without Consolidation (Example: Two separate loans with different interest rates and repayment terms) | $50,000 | $20,000 | $70,000 |

| With Consolidation (Example: Single loan with an average interest rate) | $50,000 | $18,000 | $68,000 |

Tax Implications of Loan Consolidation

Generally, the interest paid on student loans, including consolidated loans, is tax deductible up to certain limits. However, the rules can be complex and depend on your income, filing status, and the type of loan. It is advisable to consult a tax professional to determine the specific tax implications of your situation. For example, a high-income borrower might not be eligible for the full student loan interest deduction, while a lower-income borrower might qualify for a larger deduction. Furthermore, the rules regarding tax deductibility might change over time, requiring borrowers to stay updated on current regulations.

Impact on Future Borrowing Opportunities

Consolidating your loans can impact your ability to borrow money in the future. A single, consolidated loan simplifies your financial profile, potentially making it easier to qualify for other loans. However, consolidating high-interest loans into a lower-interest loan can improve your creditworthiness, thus enhancing your borrowing opportunities. Conversely, if you consolidate loans and subsequently struggle with repayments, this negative mark on your credit history could negatively affect your future borrowing prospects. The overall impact on future borrowing depends on your credit history and the terms of the consolidated loan.

Alternative Strategies

Managing Parent PLUS loans and student loans separately offers several advantages, particularly in terms of repayment flexibility and strategic planning. While combining loans can simplify the repayment process, maintaining separate accounts provides greater control over individual loan terms and allows for more targeted repayment approaches. This section explores alternative strategies for managing these loans independently.

Considering the often differing interest rates, repayment terms, and potential for forgiveness programs between Parent PLUS and student loans, maintaining separate accounts can be a beneficial strategy. This approach allows borrowers to prioritize repayment based on individual loan characteristics, focusing resources on loans with higher interest rates or those eligible for income-driven repayment plans. For example, a borrower might prioritize paying down a high-interest Parent PLUS loan while making minimum payments on their student loans, then shifting focus once the higher-interest debt is eliminated.

Strategies for Independent Loan Management

This section details different approaches to managing Parent PLUS and student loans separately. Each strategy presents unique benefits and drawbacks, requiring careful consideration based on individual financial circumstances.

One strategy involves prioritizing the loan with the highest interest rate. This is often a Parent PLUS loan due to its typically higher interest rate compared to subsidized federal student loans. By aggressively paying down this loan first, borrowers minimize the total interest paid over the life of the loans. However, this strategy may require sacrificing payments on other loans, potentially leading to increased overall interest paid if those loans accrue significant interest during the repayment period. Another approach focuses on the loan with the shortest repayment term. This strategy can provide a sense of accomplishment and momentum, but may not be the most financially efficient if other loans have significantly higher interest rates. A third approach involves using available income-driven repayment plans for student loans to lower monthly payments, freeing up more funds to aggressively pay down the Parent PLUS loan. This strategy offers flexibility but may extend the repayment period for student loans, leading to higher total interest paid over time.

Comparing and Contrasting Alternative Strategies

A comparison of these strategies reveals trade-offs between speed of repayment, total interest paid, and short-term financial burden. Prioritizing high-interest loans minimizes long-term costs, but may increase short-term financial strain. Prioritizing shorter-term loans provides psychological satisfaction but may not be the most financially efficient. Using income-driven repayment plans for student loans provides flexibility, but can extend repayment periods and increase total interest paid. The optimal strategy depends on the individual borrower’s financial priorities and risk tolerance.

Resources for Student Loan Management

Understanding your options and accessing available resources is crucial for effective student loan management. The following resources can provide guidance and support:

- Federal Student Aid (FSA): The official website for federal student aid, providing information on repayment plans, loan forgiveness programs, and other resources.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering free and low-cost credit counseling services, including student loan counseling.

- Student Loan Borrower Assistance (SLBA): Provides assistance and information to borrowers struggling with their student loan debt.

- Your Loan Servicer: Contact your loan servicer directly for information about your specific loans and repayment options.

Illustrative Scenarios

Understanding whether combining Parent PLUS loans and student loans is beneficial depends heavily on individual financial circumstances. Let’s examine scenarios where combining is advantageous and where it’s not. We’ll consider factors like interest rates, loan amounts, and repayment options.

Scenario: Combining Loans is Beneficial

Imagine a family with $50,000 in Parent PLUS loans at 7.5% interest and $30,000 in student loans at 5% interest. The higher interest rate on the Parent PLUS loans significantly impacts the total repayment cost over time. By combining these loans into a single loan with a potentially lower interest rate (perhaps 6% through refinancing), the family could save a substantial amount in interest over the life of the loan. For example, a 15-year repayment plan on the combined $80,000 loan at 6% would result in lower monthly payments and significantly less interest paid compared to repaying both loans separately at their original rates. The total interest saved could easily amount to several thousand dollars. This scenario highlights the potential benefit of consolidating high-interest loans with lower-interest ones to reduce the overall borrowing cost.

Scenario: Keeping Loans Separate is Better

Consider a different family with $20,000 in Parent PLUS loans at a fixed 5% interest rate and $40,000 in subsidized federal student loans at 4%. In this case, the interest rate difference is less significant. Furthermore, the student loans may offer income-driven repayment plans or other benefits not available after refinancing into a private loan. Refinancing into a single private loan could eliminate these benefits, potentially leading to higher monthly payments or a longer repayment period. Keeping the loans separate allows the family to leverage the flexible repayment options available for federal student loans while managing the Parent PLUS loan separately. This scenario emphasizes the importance of considering the features and benefits of each loan type before combining them.

Repayment Schedule Comparison

Let’s visually compare the repayment schedules. Imagine a graph with time on the x-axis and cumulative repayment amount on the y-axis. Two lines represent the repayment of the combined and separate loans. The line representing the separate loans would show a steeper initial slope due to higher interest payments, especially for the Parent PLUS loan. The line representing the combined loan would have a shallower slope if a lower interest rate is achieved through refinancing, reflecting lower overall interest paid and a potentially faster payoff. The difference between the two lines visually demonstrates the potential cost savings from combining loans in certain situations, highlighting that while it isn’t always advantageous, it can be a powerful tool for debt management when strategically applied.

Conclusive Thoughts

Successfully managing student loan debt requires a strategic approach. While combining Parent PLUS loans and student loans can simplify repayment, it’s essential to carefully analyze the potential financial implications, including interest rate changes and the long-term cost of borrowing. By understanding the various options and their potential consequences, you can develop a personalized plan that optimizes your repayment strategy and minimizes your overall debt burden. Remember to explore all available resources and consider seeking professional financial advice to ensure you make the best decision for your unique situation.

Quick FAQs

Can I consolidate Parent PLUS loans and student loans with private lenders?

Generally, private lenders offer refinancing options that may include both Parent PLUS and student loans, but the terms and eligibility criteria can vary significantly.

Will combining my loans affect my credit score?

Consolidation itself typically doesn’t negatively impact your credit score, but consistent on-time payments after consolidation will help build or maintain a good credit history.

What happens if I default on a combined loan?

Defaulting on any loan, including a consolidated one, will severely damage your credit score and may lead to wage garnishment or tax refund offset.

Are there any tax implications to consider when consolidating loans?

The tax implications of loan consolidation are complex and depend on your specific circumstances. Consult a tax professional for personalized advice.