Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected financial hardships arise. One common question many borrowers grapple with is: “Can I defer my private student loans?” This guide delves into the intricacies of deferment for private student loans, exploring the various options available, the application process, and the long-term implications of this crucial decision. Understanding the nuances of deferment will empower you to make informed choices about managing your student loan debt effectively.

This comprehensive resource will equip you with the knowledge necessary to confidently approach your lender, understand the potential benefits and drawbacks of deferment, and ultimately, create a sustainable repayment plan tailored to your unique circumstances. We’ll cover everything from eligibility criteria and application procedures to the financial ramifications and viable alternatives.

The Deferment Application Process

Applying for a deferment on your private student loans involves several steps and requires careful attention to detail. The specific process may vary slightly depending on your lender, so it’s crucial to consult your loan agreement and the lender’s website for the most accurate and up-to-date information. Generally, however, the process follows a similar pattern.

The application process for deferment typically involves submitting a formal request to your lender, along with supporting documentation to substantiate your eligibility. Failure to provide the necessary documentation can delay or even deny your deferment request.

Required Documentation for Deferment

Lenders require documentation to verify your eligibility for a deferment. This evidence helps them assess your situation and determine whether you qualify for the requested relief. Commonly requested documents include proof of unemployment, enrollment in school, or evidence of a medical hardship. Specific requirements are Artikeld in your loan agreement and on your lender’s website.

- Proof of Unemployment: This could include a layoff notice, unemployment benefits statement, or a letter from your employer confirming your unemployment status.

- Enrollment Verification: A copy of your student ID, an acceptance letter from your educational institution, or a transcript showing current enrollment will generally suffice.

- Medical Documentation: For medical deferments, you’ll likely need a doctor’s statement detailing your condition, its impact on your ability to work, and anticipated duration.

- Other Supporting Documents: Depending on the reason for your deferment request, additional documentation might be required. This could include legal documentation, military orders, or other evidence supporting your claim.

Step-by-Step Deferment Application Guide

The application process typically involves these steps. However, always refer to your lender’s specific instructions, as variations exist. Be prepared for potential delays and challenges, such as incomplete applications or requests for additional information.

- Review Your Loan Agreement and Lender’s Website: Familiarize yourself with the specific requirements and procedures for applying for a deferment with your lender.

- Gather Necessary Documentation: Collect all required documents to support your deferment request. Ensure these are clear, legible, and complete.

- Complete the Deferment Application: Fill out the application form accurately and completely. Double-check all information for accuracy before submission.

- Submit Your Application: Submit your completed application and supporting documents via the method specified by your lender (e.g., mail, online portal, fax).

- Follow Up: After submitting your application, keep a record of your submission and follow up with your lender if you haven’t received an update within the timeframe indicated on their website or in your loan agreement.

Potential Challenges in the Deferment Application Process

Applicants may encounter several challenges during the deferment application process. These can range from gathering the required documentation to dealing with lengthy processing times. Proactive planning and communication with the lender can help mitigate these challenges.

- Incomplete Applications: Submitting an incomplete application can lead to delays and requests for additional information, prolonging the process.

- Missing Documentation: Failure to provide all necessary documentation can result in the rejection of your deferment request.

- Lengthy Processing Times: Lenders may take several weeks or even months to process deferment applications, depending on their workload and the complexity of the request.

- Communication Difficulties: Difficulties in communicating with your lender can create further delays and frustration.

Financial Implications of Deferment

Deferring your private student loans can offer temporary relief, but it’s crucial to understand the long-term financial consequences. While pausing payments provides short-term breathing room, it significantly impacts the overall cost of your loan. Understanding these implications is vital for making informed decisions about your repayment strategy.

Interest Accrual During Deferment

Interest Accrual During Deferment

During a deferment period, your loan continues to accrue interest. This means that even though you’re not making payments, the principal loan amount increases over time. The interest rate applied during deferment is typically the same as the rate during repayment. This accumulated interest is usually capitalized at the end of the deferment period, meaning it’s added to your principal balance, increasing the amount you ultimately owe. This capitalization effect can substantially increase the total repayment amount. For example, if you defer a $10,000 loan with a 7% interest rate for one year, you will owe significantly more than $10,000 at the end of that year. The exact amount will depend on the loan’s compounding frequency.

Impact on Total Loan Repayment Amount

The longer your loan is deferred, the more interest accrues, leading to a larger total repayment amount. This increased total cost directly results from the capitalization of interest. To illustrate, consider a $20,000 loan with a 6% interest rate over a 10-year repayment period. If this loan is deferred for two years, the total interest paid will be substantially higher compared to a scenario without deferment. The increased principal amount due to capitalized interest will result in larger monthly payments or an extended repayment timeline. The exact increase depends on the interest rate, loan amount, and deferment period.

Scenario: Total Cost Comparison

Let’s compare two scenarios to illustrate the financial impact:

| Scenario | Initial Loan Amount | Interest Rate | Deferment Period | Total Repayment Amount (Estimate) |

|---|---|---|---|---|

| Scenario A (No Deferment) | $20,000 | 6% | 0 years | $27,150 |

| Scenario B (2-Year Deferment) | $20,000 | 6% | 2 years | $29,500 (Estimate) |

Note: These figures are estimates and the actual amounts will vary based on the specific loan terms and compounding frequency. Scenario B demonstrates the increase in the total cost due to the deferment period. The difference reflects the cost of the interest accrued during the two-year deferment period.

Alternatives to Deferment

Deferring your private student loan payments can provide temporary relief, but it’s not always the best solution. Understanding the alternatives is crucial for making informed financial decisions. Exploring options like forbearance and income-driven repayment plans can help you navigate challenging financial periods without solely relying on deferment.

Forbearance

Forbearance is another option for temporarily suspending or reducing your private student loan payments. Unlike deferment, forbearance typically doesn’t require demonstrating financial hardship, although lenders may have their own criteria. However, interest usually continues to accrue during a forbearance period, leading to a larger overall loan balance. This means you’ll end up paying more in the long run. The length of a forbearance period varies depending on the lender and your circumstances, often ranging from a few months to a year. Some lenders may allow multiple forbearance periods, but this should be carefully considered due to the accumulating interest.

Income-Driven Repayment Plans

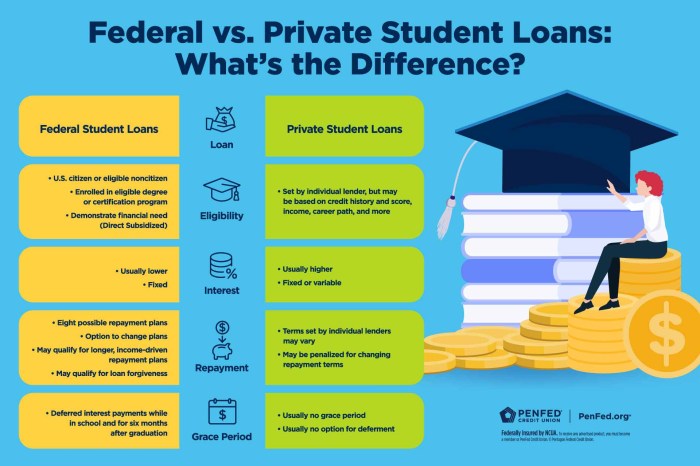

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable based on your income and family size. These plans are typically available for federal student loans, but some private lenders may offer similar programs. IDR plans calculate your monthly payment based on a percentage of your discretionary income. If your income is low, your monthly payment may be significantly reduced or even $0. However, it’s important to note that IDR plans typically extend the repayment period, meaning you’ll pay more interest over the life of the loan. The longer repayment period can result in a higher total repayment amount compared to a standard repayment plan. Several types of IDR plans exist, each with its own specific calculation methods and eligibility requirements. For example, a common IDR plan is the Revised Pay As You Earn (REPAYE) plan.

Comparison of Deferment, Forbearance, and Income-Driven Repayment

| Feature | Deferment | Forbearance | Income-Driven Repayment |

|---|---|---|---|

| Payment Suspension | Yes | Yes (or reduced) | Potentially reduced or $0 |

| Interest Accrual | Typically Yes (for private loans) | Typically Yes | Typically Yes |

| Financial Hardship Requirement | Often Required | Often Not Required | Based on income and family size |

| Impact on Credit Score | Potentially Negative | Potentially Negative | Potentially Negative if payments are missed |

| Loan Balance at End of Term | Higher due to accrued interest | Higher due to accrued interest | Potentially Higher due to extended repayment period |

Advantages and Disadvantages of Each Option

Choosing the best option depends entirely on your individual financial situation and goals. Carefully weighing the advantages and disadvantages is essential before making a decision. For instance, while deferment offers immediate relief, the accumulating interest could significantly increase the total loan cost. Similarly, forbearance provides flexibility but also leads to higher long-term costs due to accumulated interest. IDR plans offer affordability but may result in a longer repayment timeline and increased total interest paid. Consulting with a financial advisor can help you determine the most suitable option for your specific circumstances.

Communicating with Your Lender

Open and proactive communication with your student loan lender is crucial throughout the deferment process. Effective communication ensures a smoother experience, minimizes misunderstandings, and helps you navigate any potential challenges. Maintaining a clear record of your interactions will also prove beneficial.

Effective communication requires a strategic approach. This includes planning your contact, formulating clear questions, and understanding the best methods to reach your lender. Remember to always maintain a professional and respectful tone in all your communications.

Sample Communication Plan

A well-structured communication plan ensures you address all necessary aspects of your deferment request efficiently. This plan should include identifying the appropriate contact method (phone, email, or mail), preparing all necessary documentation beforehand, and scheduling a time to contact the lender when you are least likely to be interrupted. Following up on your initial contact within a reasonable timeframe is also important. For example, you might plan to email your request with supporting documentation, follow up with a phone call if you don’t hear back within a week, and maintain a written record of all communications and their dates.

Examples of Information to Obtain from Your Lender

Before initiating the deferment process, it is advisable to gather specific information from your lender. This might include clarifying the specific requirements for deferment, understanding the documentation needed to support your application, and obtaining details about the length of the deferment period and any associated fees or interest accrual implications. Additionally, inquire about the lender’s preferred method of communication and their typical response times. Confirming the status of your application after submission is also vital.

Strategies for Effective Communication

Effective communication with your lender involves several key strategies. Maintain a clear and concise communication style, avoiding jargon or overly technical language. Be organized and prepared, having all necessary documents and information readily available. Always keep a record of all correspondence, including dates, times, and the content of your conversations. If you encounter difficulties, politely but firmly reiterate your request and seek clarification on any unclear points. Remember to remain respectful and professional throughout the entire process. For example, if you have trouble understanding a particular aspect of the deferment process, you might request a follow-up call to clarify the information rather than sending a series of emails that might become difficult to track.

Long-Term Effects of Deferment

Deferring your private student loans can offer temporary relief, but it’s crucial to understand the potential long-term consequences. While deferment provides a break from payments, it doesn’t erase the debt; instead, it can significantly impact your financial future in several ways, affecting your creditworthiness and future borrowing capabilities. Careful consideration of these effects is essential before choosing this option.

Deferment’s impact extends beyond the immediate relief it offers. Understanding these long-term implications is key to making informed financial decisions. Failing to consider these factors can lead to unforeseen difficulties down the line, potentially hindering your financial progress.

Credit Score Impact

Deferment is typically reported to credit bureaus as a “payment not made,” even though it’s a legally sanctioned forbearance. This can negatively affect your credit score, making it harder to secure loans, rent an apartment, or even get certain jobs in the future. The severity of the impact depends on factors such as your existing credit score, the length of the deferment period, and your overall credit history. For instance, a short deferment period for a borrower with a strong credit history might have a minimal effect, while a longer deferment for someone with a weak credit history could significantly lower their score, potentially impacting their ability to secure favorable interest rates on future loans or credit cards. The longer the deferment, the more significant the negative impact. A substantial drop in credit score can persist for years after the deferment period ends, highlighting the importance of careful planning.

Future Borrowing Opportunities

A lower credit score resulting from deferment can directly influence your future borrowing opportunities. Lenders often use credit scores to assess risk. A lower score suggests a higher risk to the lender, potentially resulting in higher interest rates or even loan denials. This can make it more challenging to obtain loans for significant purchases, such as a car or a house, or even to refinance your existing student loans at a more favorable rate. The increased cost of borrowing due to a lower credit score can have substantial long-term financial consequences, significantly increasing the overall cost of the loan over its lifespan. Securing a mortgage, for example, could become significantly more difficult, or require a larger down payment.

Developing a Long-Term Repayment Strategy

Creating a comprehensive repayment strategy *after* the deferment period is crucial to avoid further financial setbacks. This involves understanding your post-deferment monthly payment amount, creating a realistic budget that accommodates this payment, and exploring options to accelerate repayment, such as making extra payments or refinancing at a lower interest rate if your credit score allows. Failing to plan for repayment can lead to delinquency and further damage to your credit score. A well-structured repayment plan should consider potential income changes, unexpected expenses, and other life events that might affect repayment ability. For example, a borrower might consider establishing an emergency fund to cover unexpected expenses, preventing the need for additional deferments or defaults.

Illustrative Scenarios

Understanding the impact of deferring private student loans requires considering various situations. The decision to defer isn’t universally beneficial; its effectiveness hinges on individual circumstances and financial planning. The following scenarios illustrate both positive and negative outcomes associated with deferment, as well as situations where alternative solutions prove more advantageous.

Beneficial Deferment Scenario

Imagine Sarah, a recent graduate facing unexpected medical expenses after a car accident. She’s secured a job but the initial salary is modest, and the medical bills are significantly impacting her ability to manage her monthly student loan payments. In this case, deferring her private student loans for six months provides crucial breathing room. The deferment allows her to focus on recovering her health and managing her immediate financial crisis without jeopardizing her credit score due to missed payments. Once the emergency subsides, she can resume payments with a more stable financial foundation.

Detrimental Deferment Scenario

Consider Mark, a recent graduate with a comfortable salary who chooses to defer his loans simply to delay repayment. He uses the extra funds for leisure activities and discretionary spending. While the deferment provides temporary relief from payments, it ultimately increases the total amount he owes due to accrued interest. Over time, this accumulated interest significantly increases his overall debt burden, potentially hindering his long-term financial goals such as saving for a down payment on a house or investing. His decision, while seemingly advantageous in the short-term, proves detrimental in the long run due to the lack of financial discipline.

Alternative to Deferment Scenario

Let’s look at David, a graduate with manageable student loan payments but facing a period of temporary unemployment. He’s actively seeking employment and anticipates securing a new position within a few months. Instead of deferring his loans, he negotiates with his lender for an income-driven repayment plan. This allows him to reduce his monthly payments based on his current income, preventing missed payments while he searches for a job. Once he secures new employment, he can adjust his repayment plan to reflect his increased income, minimizing the long-term financial impact of the temporary unemployment. This proactive approach allows him to avoid the negative consequences of deferment, such as increased interest charges and potential damage to his credit score.

Final Wrap-Up

Successfully navigating the process of deferring private student loans requires careful consideration of various factors. While deferment can offer temporary relief from repayment obligations, it’s crucial to weigh the potential impact on interest accrual and long-term repayment costs. By understanding the available options, thoroughly researching the application process, and maintaining open communication with your lender, you can make informed decisions that best serve your financial well-being. Remember, proactive planning and a well-defined repayment strategy are key to achieving long-term financial success after your deferment period.

Question & Answer Hub

What happens to interest during a private student loan deferment?

Interest typically continues to accrue on your loan balance during a deferment period, increasing your overall debt. The specifics depend on your loan agreement.

Can I defer my private student loans indefinitely?

No, deferment periods are typically limited in duration. The maximum deferment length varies by lender and loan terms. Repeated deferments might negatively impact your credit score.

What if my lender denies my deferment request?

If your request is denied, explore alternative options like forbearance or income-driven repayment plans. Contact your lender to understand the reasons for denial and discuss other possibilities.

How does deferment affect my credit score?

While not always immediate, prolonged deferments can negatively impact your credit score. Lenders view deferment as a potential indicator of financial difficulty.

What documentation do I need to apply for a deferment?

Required documentation varies by lender but often includes proof of hardship (e.g., unemployment documentation, medical bills) and your loan agreement details.