Summer classes offer a chance to accelerate your degree or explore new subjects, but financing them can be a concern. Many students wonder if they can secure student loans specifically for summer coursework. This guide delves into the intricacies of obtaining financial aid for summer studies, covering eligibility, loan types, application processes, and alternative funding options. Understanding these aspects is crucial for effectively managing your summer education expenses.

We’ll explore both federal and private loan options, highlighting the differences in interest rates, repayment plans, and application requirements. We’ll also discuss strategies for budgeting, estimating costs, and creating a realistic financial plan that considers both your academic goals and your financial well-being. The information provided aims to empower you to make informed decisions about financing your summer education.

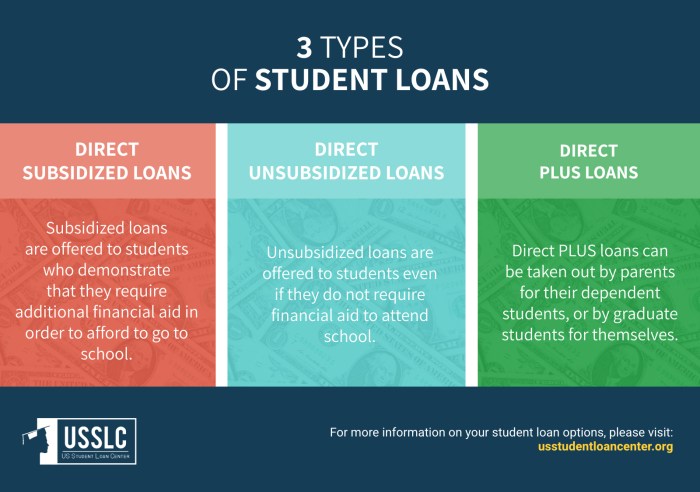

Types of Student Loans for Summer Classes

Securing funding for summer classes can significantly impact a student’s ability to progress towards their degree. Understanding the different types of student loans available and their implications is crucial for making informed financial decisions. This section details the various federal and private loan options and their relevance to summer coursework.

Federal Student Loans for Summer Classes

Federal student loans offer a range of options for students pursuing summer courses. These loans are generally preferred due to their borrower protections and often lower interest rates compared to private loans. The main types are subsidized and unsubsidized loans, along with PLUS loans for parents.

Subsidized and Unsubsidized Federal Stafford Loans

Both subsidized and unsubsidized Stafford loans are available for summer classes. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, including during the summer, while unsubsidized loans accrue interest from the time the loan is disbursed. Interest rates for both are set annually by the federal government and are generally lower than private loan rates. Repayment typically begins six months after graduation or leaving school, regardless of whether summer classes were included in the overall educational plan. The loan amount is determined by financial need for subsidized loans and by cost of attendance minus other financial aid for unsubsidized loans.

Federal PLUS Loans

Parent PLUS loans allow parents of dependent students to borrow funds to cover their child’s educational expenses, including summer classes. These loans are credit-based, meaning the parent must meet specific credit requirements to qualify. Interest rates are typically higher than Stafford loans, and interest begins accruing immediately upon disbursement. Repayment options include standard repayment plans, extended repayment plans, and graduated repayment plans. The parent is responsible for repaying the loan, regardless of the student’s academic progress or financial situation.

Private Student Loans for Summer Classes

Private student loans are offered by banks and credit unions. They can be used to cover summer classes, but often come with higher interest rates and less favorable repayment terms compared to federal loans. Eligibility often depends on the applicant’s credit history and co-signer availability. Private loan providers may offer different repayment plans, including fixed or variable interest rates. The benefits of private loans might include larger loan amounts or faster disbursement, but the drawbacks can outweigh these advantages due to potentially high interest rates and lack of federal borrower protections. For example, a private loan might offer a higher loan amount than a federal loan, allowing students to cover all expenses. However, this might come with a higher interest rate making the total repayment significantly more expensive.

Federal vs. Private Loan Options for Summer Study

The following comparison highlights key differences between federal and private loan options for summer classes:

- Interest Rates: Federal loans generally have lower, fixed interest rates compared to private loans, which often have higher, variable rates.

- Repayment Options: Federal loans offer a wider range of repayment plans and income-driven repayment options, providing more flexibility. Private loan options are often more limited.

- Borrower Protections: Federal loans include borrower protections, such as deferment and forbearance options during financial hardship, which are not always available with private loans.

- Credit Check: Federal loans typically do not require a credit check, while private loans usually do, often requiring a co-signer if the borrower lacks sufficient credit history.

- Loan Amount: Federal loans have limits based on cost of attendance and financial need, whereas private loans might offer larger amounts, but this comes with the risk of higher debt.

Loan Amount and Cost of Summer Courses

Planning to finance your summer classes with a student loan requires careful consideration of the total cost and the appropriate loan amount. Understanding these factors is crucial for responsible borrowing and effective financial management during and after your studies. This section will guide you through estimating costs, calculating loan needs, and understanding the long-term implications of your borrowing decisions.

Estimating the total cost of summer classes involves more than just tuition. You need to account for all associated expenses to accurately determine your loan requirements.

Estimating Total Costs for Summer Courses

To accurately estimate your total costs, gather information on tuition fees, other course-related fees (like lab fees or technology fees), books and materials, and living expenses. Let’s illustrate with an example: Suppose tuition for a three-credit summer course is $1,500, and there’s a $50 lab fee. Textbooks cost $100, and you estimate $500 for living expenses (housing, food, transportation) for the duration of the summer course. Therefore, your total estimated cost is $1,500 + $50 + $100 + $500 = $2,150.

Calculating Potential Loan Amount

Once you’ve estimated your total costs, you can determine the potential loan amount needed. Subtracting any available funds (savings, grants, scholarships) from your total cost will give you the remaining amount to borrow. In our example, if you have $500 in savings, you would need a loan of $2,150 – $500 = $1,650. Remember to factor in any potential additional expenses that might arise.

Applying for a Loan Amount

The application process for a student loan will vary depending on the lender (federal or private). Generally, you’ll need to complete an application, provide documentation (like proof of enrollment and financial need), and undergo a credit check (if applicable for private loans). Be sure to carefully review the loan terms, including interest rates and repayment options, before accepting the loan. When applying, specify the exact amount you need to cover your estimated expenses, avoiding borrowing more than necessary.

Impact of Loan Amount on Repayment

Borrowing a larger loan amount will lead to higher monthly payments and a greater total amount paid over the life of the loan due to accumulated interest. Conversely, borrowing a smaller amount will result in lower monthly payments and less overall interest paid. Carefully weigh your financial situation and repayment capabilities when deciding on the loan amount. For example, borrowing $2,000 instead of $1,650 will likely result in significantly higher interest payments over the long term. Responsible borrowing involves taking only what you need.

Step-by-Step Guide to Budgeting and Determining Loan Needs

- Gather Cost Information: Collect detailed information on tuition, fees, books, materials, and living expenses.

- Estimate Total Costs: Sum up all estimated expenses to determine your total cost for summer classes.

- Assess Available Funds: Identify any savings, grants, scholarships, or other financial aid you have available.

- Calculate Loan Amount: Subtract your available funds from your total estimated cost to determine the amount you need to borrow.

- Research Loan Options: Compare loan terms from different lenders (federal and private) to find the best option.

- Apply for the Loan: Complete the loan application process, providing all required documentation.

- Review Loan Terms: Carefully review the loan agreement before accepting it.

Application Process and Required Documents

Securing a student loan for summer classes involves navigating the application process for either federal or private loans. Understanding the requirements and steps involved is crucial for a smooth and successful application. This section details the necessary steps and documents for both federal and private loan options.

Federal Student Loan Application Process

The application process for federal student loans for summer classes begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers information about your financial situation and is used to determine your eligibility for federal student aid, including loans. The FAFSA data is then sent to your chosen school(s), which will then determine your financial aid package. This package might include grants, scholarships, and loans. After your school processes your FAFSA, you will receive an award letter outlining your financial aid options. You then accept the loan offer through your school’s financial aid portal.

Required Documents for Federal Student Loans

To complete the FAFSA, you will need several key documents. These typically include your Social Security number, your federal tax returns (yours and your parents’ if you are a dependent student), your driver’s license or state ID, and your financial records (bank statements, investment accounts). You will also need your school’s Federal School Code (you can find this on your school’s website). Additionally, proof of enrollment for summer classes will be required before the loan is disbursed. This is usually a copy of your course schedule or acceptance letter from your institution.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is an online application. You will need to create an FSA ID, a username and password used to access and manage your FAFSA information. The application will ask for detailed information about your income, assets, family size, and other relevant financial data. It’s crucial to accurately and completely fill out the FAFSA, as inaccuracies can delay or prevent your loan approval. You should review all information carefully before submitting the form. After submission, you will receive a confirmation number. It is important to keep this number safe.

Private Student Loan Application Process

Applying for private student loans for summer courses generally involves a more streamlined process compared to federal loans. You will typically apply directly through the lender’s website. You will need to provide personal information, including your Social Security number, address, and school information. The lender will then assess your creditworthiness and financial situation. A co-signer may be required if you lack a strong credit history. The loan approval process may involve a credit check, and you will need to provide proof of enrollment, similar to the federal loan process.

Summer Student Loan Application Process Flowchart

The following describes a flowchart illustrating the application process. Imagine a flowchart with boxes and arrows.

Box 1: Determine Loan Need (Federal or Private)

Arrow: Points to Box 2 or Box 5

Box 2: Complete FAFSA

Arrow: Points to Box 3

Box 3: Receive Financial Aid Award Letter

Arrow: Points to Box 4

Box 4: Accept Loan Offer (Federal)

Arrow: Points to Box 6

Box 5: Apply to Private Lender

Arrow: Points to Box 7

Box 6: Loan Disbursement (Federal)

Arrow: Points to Box 8

Box 7: Loan Approval (Private)

Arrow: Points to Box 8

Box 8: Loan Funds Received

Repayment and Financial Planning for Summer Loans

Securing a student loan for summer courses can provide valuable financial flexibility, but careful planning for repayment is crucial to avoid future financial strain. Understanding repayment options, budgeting effectively, and knowing the consequences of default are essential steps in responsible borrowing.

Repayment Options for Summer Loans

Student loan repayment options generally mirror those for academic year loans. The most common is a standard repayment plan, where you make fixed monthly payments over a set period (typically 10-20 years). However, income-driven repayment plans are also available, adjusting your monthly payments based on your income and family size. These plans often extend the repayment period, leading to higher overall interest payments but lower monthly burdens. Deferment or forbearance may be options if you experience temporary financial hardship, allowing you to temporarily postpone or reduce payments. It’s vital to contact your loan servicer to understand the specifics of your loan and available repayment options.

Managing Loan Repayment and Summer Expenses

Balancing summer employment, living expenses, and loan repayments requires a well-structured budget. Creating a realistic budget that Artikels all income and expenses is the first step. This includes tracking summer earnings, rent or housing costs, transportation, food, and loan payments. Prioritizing essential expenses and identifying areas for potential savings can free up funds for loan repayment. Exploring opportunities for additional income, such as part-time jobs or freelance work, can further alleviate financial pressure.

Examples of Repayment Plans and Interest Implications

Consider two scenarios: Scenario A: A student borrows $2,000 at a 5% interest rate with a standard 10-year repayment plan. Their monthly payment would be approximately $21. The total interest paid over 10 years would be approximately $500. Scenario B: The same student opts for an income-driven repayment plan with a 20-year repayment period. Their monthly payment might be lower, perhaps $12, due to lower income during summer months, but the total interest paid would be significantly higher, potentially exceeding $1000. These examples highlight the trade-off between lower monthly payments and increased total interest costs. The best option depends on individual financial circumstances and priorities.

Consequences of Student Loan Default

Defaulting on a student loan has severe consequences. Your credit score will suffer significantly, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and difficulty obtaining federal financial aid are all potential outcomes. In some cases, the debt may be referred to collections agencies, leading to further fees and legal action. Avoiding default requires proactive planning and consistent communication with your loan servicer.

Resources for Financial Planning and Loan Repayment Assistance

Numerous resources are available to assist with financial planning and student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, including student loan repayment guidance. Your college or university’s financial aid office may also provide resources and workshops on financial literacy and debt management. The Federal Student Aid website (studentaid.gov) offers comprehensive information on repayment plans, loan forgiveness programs, and other assistance options. Finally, many non-profit organizations provide free financial counseling and support.

Alternatives to Student Loans for Summer Classes

Summer classes can significantly boost your academic progress, but the associated costs can be daunting. While student loans are a common option, exploring alternatives can lead to more manageable finances and potentially avoid accumulating debt. This section Artikels several viable alternatives to student loans for funding your summer coursework.

Scholarships and Grants for Summer Study

Numerous scholarships and grants are available specifically for summer study, often overlooked by students primarily focused on academic year funding. These awards can significantly reduce or even eliminate the need for loans. Many institutions offer internal summer scholarships for their currently enrolled students. Additionally, numerous external organizations and foundations provide grants based on merit, financial need, or specific academic fields. A diligent search is crucial to uncover these opportunities.

Locating and Applying for Summer Scholarships and Grants

To find suitable scholarships and grants, utilize online scholarship search engines, consult your college’s financial aid office, and explore professional organizations related to your field of study. Pay close attention to eligibility criteria, deadlines, and required documentation. Thoroughly complete each application, highlighting relevant experiences and achievements. Many applications require essays showcasing your academic goals and financial need. Remember to start your search early, as the application process can be time-consuming.

Part-Time Employment and Summer Jobs

Earning income through part-time employment during the summer can provide a significant contribution towards your tuition costs. Numerous summer jobs are available, ranging from internships in your field to retail or hospitality positions. Careful budgeting and planning are key to balancing work and studies effectively. Consider your academic schedule when searching for work, ensuring the job doesn’t interfere with class attendance or study time.

Balancing Work and Studies During the Summer

Successfully managing a part-time job while attending summer classes requires careful planning and prioritization. Create a realistic schedule that allocates sufficient time for both work and academic responsibilities. Utilize time management techniques like to-do lists and prioritization matrices. Effective communication with your employer about your academic commitments can help prevent scheduling conflicts. Consider using your study breaks to complete short tasks related to your work.

Comparison of Funding Options

| Funding Option | Benefits | Drawbacks | Application Process |

|---|---|---|---|

| Student Loans | Covers full tuition costs; flexible repayment options. | Accumulates debt with interest; impacts credit score. | Application through lender; credit check required. |

| Scholarships | Free money; doesn’t need repayment. | Competitive; requires strong application. | Application varies; essays, transcripts, recommendations. |

| Grants | Free money; doesn’t need repayment. | Limited availability; based on need or merit. | Application through institution or organization. |

| Part-time Employment | Earns income; flexible scheduling options. | Limited earnings; may impact study time. | Job application; interview process. |

Ultimate Conclusion

Securing funding for summer classes doesn’t have to be daunting. By understanding the various loan options available, carefully estimating your costs, and exploring alternative funding sources, you can create a manageable financial plan. Remember to thoroughly research each option, compare interest rates and repayment terms, and prioritize responsible borrowing to avoid future financial strain. With careful planning and preparation, you can successfully navigate the financial aspects of your summer academic pursuits.

FAQ Compilation

Can I use my existing student loan for summer classes?

It depends on your loan type and lender. Check your loan terms or contact your lender to confirm eligibility for summer disbursement.

What if my summer classes cost less than my loan amount?

You may not receive the full loan amount. Some lenders disburse funds based on demonstrated need and actual costs. Contact your lender to confirm their disbursement policy.

Are there any grants or scholarships specifically for summer classes?

Yes, many institutions and organizations offer summer-specific grants and scholarships. Check with your school’s financial aid office and search online databases for relevant opportunities.

How does taking out a summer loan impact my overall loan repayment?

It will increase your total loan amount and, consequently, your monthly payments and overall interest paid. Consider the long-term implications before borrowing.