Summer break often presents a unique opportunity for students to accelerate their studies, participate in internships, or pursue enriching experiences. However, the costs associated with summer courses or programs can be significant. This raises a crucial question for many students: can they secure student loan funding to cover these expenses? This exploration delves into the intricacies of obtaining student loans specifically for the summer semester, examining eligibility requirements, available loan types, the application process, and strategies for responsible debt management.

Understanding the nuances of summer student loans is critical for effective financial planning. Unlike the traditional academic year, summer sessions often involve shorter terms and different course loads, potentially impacting loan amounts and repayment schedules. This guide aims to provide clarity and empower students to make informed decisions about financing their summer endeavors.

Eligibility for Summer Semester Loans

Securing funding for your summer semester studies often involves navigating the complexities of student loan eligibility. Understanding the criteria for federal student loans, specifically those applicable during the summer, is crucial for successful financial planning. This section details the requirements, highlighting differences between undergraduate and graduate students and providing examples of situations that might lead to ineligibility.

General Eligibility Criteria for Federal Student Loans

Generally, to be eligible for federal student loans, you must be a U.S. citizen or eligible non-citizen, be enrolled at least half-time in a degree or certificate program at an eligible institution, maintain satisfactory academic progress, and complete the Free Application for Federal Student Aid (FAFSA). Additional requirements may exist depending on the specific loan program. For example, some programs may have income limitations or require demonstration of financial need.

Summer Semester Loan Eligibility Requirements

Eligibility for summer loans largely mirrors the requirements for academic year loans. However, the key difference lies in the enrollment status. You must be enrolled at least half-time during the summer session to qualify. This half-time enrollment is defined by the institution and might vary depending on the number of credit hours required. Furthermore, your school must participate in the federal student aid program. The FAFSA application should reflect your summer enrollment to be considered for summer loans.

Undergraduate vs. Graduate Student Eligibility

The core eligibility requirements remain consistent for both undergraduate and graduate students. However, graduate students might have access to different loan programs with varying borrowing limits and repayment terms. For example, graduate students may be eligible for Grad PLUS loans, which are not available to undergraduates. Both groups must still meet the general eligibility criteria, including maintaining satisfactory academic progress and being enrolled at least half-time.

Examples of Ineligibility for Summer Loans

Several scenarios can lead to ineligibility. Students who are not enrolled at least half-time during the summer session will not qualify. Students who have not completed the FAFSA or who have an unsatisfactory academic record may also be ineligible. Students who are already in default on previous federal student loans are typically barred from receiving further federal aid, including summer loans. Finally, students attending institutions that are not eligible to participate in the federal student aid program will not be able to access federal student loans.

Comparison of Loan Programs and Summer Loan Availability

| Loan Program | Summer Loan Availability | Eligibility Requirements | Notes |

|---|---|---|---|

| Direct Subsidized Loan | Yes | Financial need demonstrated via FAFSA | Interest not accrued while in school at least half-time |

| Direct Unsubsidized Loan | Yes | No demonstrated need required | Interest accrues while in school |

| Direct PLUS Loan (for parents) | Yes (for dependent students) | Credit check required; may be subject to additional requirements | Parents borrow on behalf of the student. |

| Grad PLUS Loan | Yes | Credit check required; may be subject to additional requirements | Available to graduate students. |

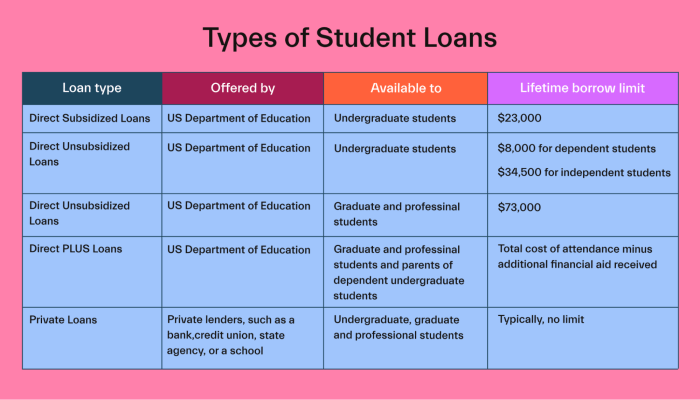

Types of Student Loans Available for Summer

Securing funding for summer coursework can be just as crucial as financing the regular academic year. Understanding the different loan options available is key to making informed financial decisions. This section Artikels the various types of federal and private student loans you might consider for summer study, highlighting their key features and potential benefits and drawbacks.

Federal Student Loan Options for Summer

Federal student loans offer several advantages, including generally lower interest rates and flexible repayment plans. However, eligibility requirements and borrowing limits apply. The most common types of federal student loans are subsidized and unsubsidized loans, along with the Parent PLUS loan.

Subsidized and Unsubsidized Federal Stafford Loans for Summer

Both subsidized and unsubsidized Stafford loans can be used to cover summer coursework expenses. The key difference lies in interest accrual. With subsidized loans, the government pays the interest while you’re enrolled at least half-time, during grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of your enrollment status. For summer, both loan types are available, but the interest implications should be carefully considered when deciding which to prioritize. Interest rates are set annually by the federal government and are generally lower than private loan rates. Repayment typically begins six months after graduation or leaving school.

Parent PLUS Loans for Summer

Parent PLUS loans allow parents of dependent students to borrow funds to cover their child’s educational expenses, including summer courses. These loans are unsubsidized, meaning interest accrues from disbursement. Credit checks are required for approval, and interest rates are generally higher than Stafford loans. Repayment begins within 60 days of the final disbursement.

Private Student Loans for Summer

Private student loans are offered by banks, credit unions, and other financial institutions. These loans often have higher interest rates and less favorable repayment terms than federal loans. Eligibility depends on the lender’s criteria, typically including credit history and co-signer requirements. While private loans can be used for summer study, it’s generally advisable to exhaust federal loan options first due to their more favorable terms.

Pros and Cons of Student Loan Types for Summer Use

Choosing the right loan depends heavily on your individual circumstances and financial situation. Consider these factors carefully:

- Federal Subsidized Loans:

- Pros: No interest accrues while in school; generally lower interest rates than unsubsidized loans or private loans.

- Cons: Borrowing limits may be lower than unsubsidized loans.

- Federal Unsubsidized Loans:

- Pros: Higher borrowing limits than subsidized loans; available to all eligible students.

- Cons: Interest accrues from disbursement; can lead to a larger total repayment amount.

- Federal Parent PLUS Loans:

- Pros: Can cover additional educational expenses; helps reduce the student’s borrowing burden.

- Cons: Higher interest rates than Stafford loans; requires a credit check and may require a co-signer.

- Private Student Loans:

- Pros: May be an option if federal loan limits are insufficient.

- Cons: Typically higher interest rates; stricter eligibility requirements; less flexible repayment options.

Applying for Summer Semester Loans

Securing funding for your summer semester requires a proactive approach to the application process. Understanding the steps involved and the necessary documentation will significantly increase your chances of securing the financial aid you need. This section Artikels the process for applying for federal student loans specifically for the summer term.

Applying for summer semester loans generally follows a similar process to applying for loans for the regular academic year, but with a few key differences in timing and required information. The primary method is through the Free Application for Federal Student Aid (FAFSA).

The FAFSA Application Process for Summer Funding

The FAFSA is the gateway to federal student aid, including summer loans. Completing it accurately and on time is crucial. While the FAFSA itself doesn’t differentiate between summer and regular academic year funding requests, your school uses the information you provide to determine your eligibility for summer aid. The process involves several key steps.

- Gather Necessary Information: Before starting, collect your Social Security number, federal tax returns (yours and your parents’ if you are a dependent student), driver’s license, and bank account information. Also, have your FSA ID ready – this is your unique username and password for accessing the FAFSA website.

- Complete the FAFSA Online: Access the FAFSA website (studentaid.gov) and begin the application. Answer all questions accurately and completely. Inaccuracies can delay or prevent the disbursement of funds.

- Review and Submit: Once you have completed the application, carefully review all the information to ensure accuracy. After reviewing, submit the application electronically.

- Track Your Application: After submitting, monitor your application status through the FAFSA website. You will receive updates on your application progress and any additional information needed from your school.

The Role of the School’s Financial Aid Office

Your school’s financial aid office plays a vital role in processing your summer loan application. They receive your FAFSA data and determine your eligibility based on your financial need, enrollment status, and other factors. They will also notify you of your loan award, if any, and guide you through the loan acceptance and disbursement process. Contacting your financial aid office directly with questions or concerns is highly recommended.

Required Documentation for Summer Loans

The documentation needed for summer loans typically mirrors that required for the regular academic year. This generally includes your completed FAFSA, proof of enrollment for summer courses, and possibly additional documentation requested by your financial aid office based on your individual circumstances. This might include tax returns, bank statements, or other supporting documents to verify the information provided in your FAFSA.

Flowchart Illustrating the Application Steps for Summer Loans

A visual representation of the application process could be depicted as a flowchart. The flowchart would begin with “Start,” then proceed through the steps of gathering information, completing the FAFSA, reviewing and submitting the application, tracking the application status, receiving notification from the financial aid office, and finally, “Loan Disbursement.” Each step would be connected with arrows, illustrating the sequential nature of the process. The flowchart would clearly show the involvement of both the student and the financial aid office at each stage.

Cost of Summer Courses and Loan Amounts

Understanding the cost of summer courses and the loan amounts available is crucial for effective financial planning. Summer courses, while offering flexibility, often come with unique cost considerations compared to regular semesters. This section will clarify how to estimate summer course costs, determine potential loan amounts, and compare these figures to those of traditional academic years.

Estimating the total cost of summer courses involves several factors. First, determine the number of credit hours for each course you plan to take. Next, find the tuition cost per credit hour for your institution’s summer session. This information is usually available on the university’s website, often within the registrar’s office or financial aid section. Add any additional fees, such as technology fees, student activity fees, or health insurance premiums. Finally, factor in living expenses if you’ll be living away from home during the summer. This might include rent, utilities, food, and transportation.

Summer Course Costs Compared to Regular Semesters

Summer courses frequently have a higher cost per credit hour than regular semesters. This is due to several factors, including the condensed timeframe of the courses, potentially smaller class sizes, and increased administrative overhead associated with operating during the summer months. For example, a university might charge $500 per credit hour during the fall semester but increase this to $600 per credit hour during the summer. This increase, while seemingly small, can significantly impact the overall cost, especially for students taking multiple courses. Students should carefully review their university’s summer tuition and fee schedule to understand the specific costs involved.

Loan Amount Determination for Summer Semesters

Loan amounts for summer semesters are typically determined by the same factors that govern loan amounts for regular semesters. Lenders consider the student’s cost of attendance (COA), which includes tuition, fees, room and board, books, and other expenses, minus any financial aid received. However, the COA for summer might be lower than for a full academic year because of fewer courses and potentially lower living expenses if the student remains at home. The number of credit hours taken during the summer also plays a significant role in determining the loan amount. More credit hours generally translate to a higher loan amount, as the overall cost of attendance increases. Furthermore, the student’s credit history and creditworthiness may also affect the loan amount and interest rates offered.

Examples of Loan Amounts Based on Credit Hours and Cost of Attendance

The following table illustrates how loan amounts might vary based on the cost of attendance and the number of credit hours enrolled in. These figures are for illustrative purposes only and should not be considered a guarantee of loan amounts. Actual loan amounts will vary depending on the lender, individual circumstances, and financial aid eligibility.

| Cost of Attendance | Credit Hours | Estimated Loan Amount (Example) | Notes |

|---|---|---|---|

| $3000 | 3 | $2500 | Assumes some financial aid or savings |

| $4500 | 6 | $4000 | Higher COA and credit hours result in a larger loan |

| $2000 | 3 | $1500 | Lower COA and fewer credit hours lead to a smaller loan |

| $6000 | 9 | $5000 | High COA and credit hours necessitate a larger loan amount |

Managing Summer Loan Debt

Taking out student loans for summer courses can significantly impact your overall financial picture. Understanding how to borrow responsibly and manage repayment effectively is crucial to avoiding unnecessary debt burden. This section Artikels strategies for minimizing the financial implications of summer loans and creating a manageable repayment plan.

Responsible Borrowing for Summer Study

Borrowing for summer courses should be approached with the same level of careful planning as borrowing for the academic year. Before taking out any loans, thoroughly research the cost of your summer courses and compare it to your available resources. Only borrow what you absolutely need to cover tuition, fees, and essential living expenses. Avoid unnecessary borrowing for non-essential items. Creating a detailed budget that Artikels all your income and expenses can help you determine the appropriate loan amount. For instance, if your summer courses cost $3,000 and you have $1,000 saved, you should only borrow $2,000.

Implications of Summer Borrowing Versus Academic Year Borrowing

Summer loans, while helpful for accelerating your degree or pursuing specialized courses, often come with unique considerations. Interest accrues on summer loans just as it does on loans taken out during the academic year. However, the repayment period might be shorter, depending on your loan terms. Also, summer employment opportunities might be limited, making repayment more challenging than during the academic year when many students have access to part-time jobs. For example, a student might secure a summer internship paying $10/hour, but the same student could find higher-paying part-time jobs during the regular academic year. This difference in earning potential can significantly affect their ability to manage summer loan repayments.

Summer Loan Repayment Options

Several repayment options exist for summer loans, often mirroring those available for academic year loans. These can include deferment (temporarily postponing payments), forbearance (reducing or suspending payments), and various repayment plans (e.g., standard, graduated, income-driven). It’s vital to understand the terms and conditions of each option and choose the one that best aligns with your financial circumstances. Contacting your loan servicer to discuss available options is crucial. For instance, an income-driven repayment plan could tie your monthly payments to your income, making them more manageable during periods of lower earnings.

Impact of Summer Loans on Overall Student Debt

Summer loans contribute to your overall student loan debt, impacting your post-graduation financial planning. The additional debt can increase your monthly payments and extend the time it takes to pay off your loans. Therefore, careful budgeting and responsible borrowing are essential to minimize the long-term impact. A student who borrows $5,000 for summer courses adds this amount to their existing student loan debt, potentially delaying their ability to achieve financial goals such as buying a home or starting a family.

Creating a Summer Loan Repayment Plan

A well-structured repayment plan is crucial for managing summer loan debt. First, determine your total loan amount, interest rate, and repayment terms. Next, create a realistic budget that incorporates your income and expenses, ensuring you allocate sufficient funds for loan repayments. Consider setting up automatic payments to avoid late fees and maintain a good credit history. Regularly review your plan and adjust it as needed based on changes in your income or expenses. For example, a student might track their expenses using a budgeting app and allocate a specific percentage of their income each month towards loan repayment. They could also explore opportunities for additional income, such as freelancing or part-time jobs, to accelerate their repayment.

Alternatives to Summer Loans

Summer study doesn’t always necessitate student loans. Several alternative funding sources can help cover the costs of summer courses, offering viable alternatives with varying advantages and disadvantages. Exploring these options thoroughly can lead to significant savings and reduce future debt burdens.

Summer Scholarships and Grants

Scholarships and grants represent a significant opportunity to fund summer study without incurring debt. These awards are typically based on merit, financial need, or specific criteria set by the awarding institution or organization. Securing a scholarship or grant can significantly reduce or even eliminate the financial burden of summer courses.

Applying for summer scholarships and grants often involves a similar process to applying for academic year funding. This generally includes completing an application form, providing transcripts and other academic records, and sometimes submitting essays or letters of recommendation. Many scholarships and grants are specific to particular fields of study, institutions, or demographics, so researching relevant opportunities is crucial. Resources such as Fastweb, Scholarships.com, and your college’s financial aid office can be invaluable in locating potential awards.

Part-Time Summer Employment

Working part-time during the summer can provide a direct source of income to offset the cost of summer courses. Many students find summer jobs that allow for flexibility, enabling them to balance work and studies effectively. The income generated can cover tuition fees, books, and other associated expenses, reducing the reliance on loans.

Examples of resources for finding summer employment opportunities include online job boards (Indeed, LinkedIn, Monster), college career services offices, and local businesses. Networking within your community and leveraging personal connections can also uncover valuable job leads. While balancing work and studies requires careful time management, the financial benefits can significantly reduce the need for borrowing.

Comparison of Funding Options

| Funding Option | Pros | Cons | Application Process |

|---|---|---|---|

| Student Loans | Covers tuition and fees; flexible repayment options. | Accumulates debt; interest charges apply; impacts credit score. | Application through the lender; credit check may be required. |

| Scholarships | Free money; does not need to be repaid. | Competitive; specific eligibility criteria; limited availability. | Application through the awarding institution or organization; often requires essays and transcripts. |

| Grants | Free money; does not need to be repaid. | Based on financial need; limited availability; rigorous application process. | Application through the awarding institution or organization; requires documentation of financial need. |

| Part-Time Employment | Direct income; flexible scheduling options (often). | Requires time management; may limit study time; income may not fully cover costs. | Job applications through online platforms, career services, or direct application to employers. |

Wrap-Up

Securing funding for summer studies can significantly enhance a student’s academic journey and career prospects. While federal and private student loans offer viable options, careful consideration of eligibility criteria, loan types, and long-term financial implications is paramount. By understanding the application process, exploring alternative funding sources, and implementing responsible borrowing strategies, students can navigate the complexities of summer financing and achieve their educational goals without undue financial strain. Remember to thoroughly research and compare options before committing to any loan.

FAQ Resource

What is the difference between subsidized and unsubsidized summer loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do, regardless of enrollment status. Both are options for summer study.

Can I use my summer loan for living expenses?

Generally, summer loans are intended to cover tuition and fees for summer courses. Living expenses may be partially covered depending on your school’s cost of attendance calculation.

What happens if I withdraw from my summer classes?

Your loan disbursement may be adjusted, and you may be required to repay a portion of the loan. Contact your financial aid office immediately if you withdraw.

Are there any deadlines for applying for summer loans?

Deadlines vary by institution. Check with your school’s financial aid office for specific deadlines and requirements.