Navigating the complexities of higher education often involves the crucial question: can student loans cover living expenses? The answer, while nuanced, is generally yes, but with important considerations. Securing funding for tuition is often the primary focus, but everyday costs like rent, food, and transportation can quickly accumulate. Understanding the various loan types, eligibility criteria, and repayment options is key to making informed financial decisions during your college journey. This guide explores the landscape of student loans and their role in covering living costs, empowering you to make responsible choices.

From federal loans with their varying subsidies and repayment plans to private options with potentially higher interest rates, the choices can seem overwhelming. This guide aims to demystify the process, providing clear explanations and practical advice to help you determine the best approach for your individual circumstances. We will delve into the application process, cost of living estimations, and alternative funding sources, offering a comprehensive overview to aid in your financial planning.

Types of Student Loans for Living Expenses

Securing funding for higher education often involves covering not only tuition and fees but also essential living expenses such as housing, food, and transportation. Student loans can play a crucial role in bridging this financial gap, but understanding the different types available is essential for making informed decisions. This section details the various federal and private loan options, their eligibility requirements, and key differences in interest rates and repayment terms.

Federal Student Loans

Federal student loans are offered by the U.S. Department of Education and generally offer more favorable terms than private loans. These loans are available to eligible students pursuing undergraduate, graduate, or professional degrees. They are often preferred due to their borrower protections and flexible repayment options. Two main types of federal student loans are subsidized and unsubsidized loans.

Eligibility Requirements for Federal Student Loans

To be eligible for federal student loans, applicants must typically meet several criteria. These include: being a U.S. citizen or eligible non-citizen, demonstrating financial need (for subsidized loans), enrolling at least half-time in a degree program at an eligible institution, maintaining satisfactory academic progress, and completing the Free Application for Federal Student Aid (FAFSA). Specific requirements may vary depending on the type of loan and the student’s individual circumstances.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. Unlike federal loans, these loans are not backed by the government. Eligibility requirements for private loans are often stricter, with lenders typically considering factors such as credit history, income, and debt-to-income ratio. This means that students with limited or poor credit history may find it challenging to secure private student loans or may face higher interest rates.

Interest Rates and Repayment Terms

Interest rates and repayment terms vary significantly between federal and private student loans, and even within each category. Federal student loan interest rates are set annually by the government and are generally lower than private loan rates. Repayment plans for federal loans offer several options, including standard, graduated, and income-driven repayment plans. Private loan interest rates are determined by the lender based on the borrower’s creditworthiness and other factors. Repayment terms are typically fixed, and options may be less flexible than those available for federal loans. It’s crucial to compare offers from multiple lenders before selecting a private student loan.

Comparison of Federal Subsidized and Unsubsidized Loans

The following table highlights key differences between federal subsidized and unsubsidized loans:

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest Accrual During School | No interest accrues while enrolled at least half-time. | Interest accrues while enrolled. |

| Grace Period | Six-month grace period before repayment begins. | Six-month grace period before repayment begins. |

| Eligibility | Based on demonstrated financial need. | Based on enrollment and creditworthiness; no need-based requirement. |

| Typical Interest Rate | Generally lower than unsubsidized loans. | Generally higher than subsidized loans. |

Eligibility Criteria and Application Process

Securing student loans to cover living expenses involves navigating specific eligibility requirements and a structured application process. Understanding these aspects is crucial for a successful application. This section details the steps involved, necessary documentation, lender considerations, and a visual representation of the process.

Eligibility criteria for student loans vary depending on the lender (federal or private) and the specific loan program. Generally, lenders assess applicants based on several key factors to determine creditworthiness and repayment ability.

Factors Considered by Lenders

Lenders evaluate several factors when assessing loan applications. These factors help them determine the risk associated with lending money to a student. A strong application demonstrates financial responsibility and a higher likelihood of repayment.

- Credit Score: A good credit score (generally above 670) significantly improves your chances of loan approval and securing favorable interest rates. A low or non-existent credit history might require a co-signer or result in higher interest rates. For example, a student with a credit score of 720 would likely receive better terms than a student with a score of 600.

- Income: While students may not have substantial income, lenders consider any income the student or co-signer may have. This helps assess repayment capacity. Part-time employment or parental income can positively influence the application. For instance, demonstrating a consistent part-time income alongside academic pursuits could strengthen an application.

- Enrollment Status: Lenders verify that the applicant is enrolled at least half-time in a degree or certificate program at an eligible institution. This ensures the loan funds are used for educational purposes. An applicant enrolled full-time will typically be viewed more favorably.

- Debt-to-Income Ratio: Lenders assess the applicant’s existing debt compared to their income. A high debt-to-income ratio indicates a higher risk of default. This ratio is particularly relevant if the student already has other loans or significant financial obligations.

- Co-signer Availability: If a student lacks a strong credit history or income, a co-signer with good credit can significantly improve their chances of approval. The co-signer assumes responsibility for repayment if the student defaults. This is a common strategy for students with limited credit history.

Required Documentation and Verification Process

The application process requires providing various documents to verify your identity, enrollment, and financial information. Failure to provide accurate and complete documentation can delay or even prevent loan approval.

- Proof of Identity: This typically includes a government-issued ID, such as a driver’s license or passport.

- Proof of Enrollment: An official acceptance letter or enrollment verification from the educational institution is required.

- Financial Aid Information: Documents related to other financial aid received, such as grants or scholarships, may be requested.

- Tax Returns (or W-2s): Income verification is often necessary, usually through tax returns or pay stubs.

- Bank Statements: These may be requested to verify financial stability.

The verification process involves lenders confirming the information provided by the applicant. This may involve contacting the applicant’s educational institution or verifying income through third-party sources. A thorough verification process ensures the accuracy and integrity of the application.

Step-by-Step Guide to Applying for Student Loans

Applying for student loans typically follows a structured process. While the specific steps may vary slightly depending on the lender, the overall process is relatively consistent.

- Research and Select a Lender: Compare interest rates, fees, and repayment terms offered by different lenders (federal and private).

- Complete the Application: Fill out the loan application form accurately and completely, providing all required information.

- Gather and Submit Required Documentation: Collect all necessary documents as Artikeld above and submit them to the lender.

- Undergo Credit and Financial Check: The lender will review your application and conduct a credit and financial check.

- Loan Approval or Denial: The lender will notify you of their decision. If approved, you’ll receive loan terms and disbursement information.

- Loan Disbursement: Funds are disbursed according to the lender’s schedule, often directly to the educational institution or to the student’s account.

Student Loan Application Process Flowchart

Imagine a flowchart. It begins with the “Start” box. An arrow leads to “Research and Select Lender.” Another arrow leads to “Complete Application and Submit Documentation.” This leads to “Credit and Financial Check.” From here, two paths diverge: “Approved” leading to “Loan Disbursement” and “Denied” leading to “Revise Application or Explore Other Options.” Finally, both paths converge at the “End” box.

Cost of Living and Loan Amounts

Securing student loans to cover living expenses requires a realistic understanding of the costs involved. The amount you’ll need will significantly vary depending on your location and lifestyle choices. This section will explore these factors to help you better estimate your loan requirements.

Understanding the cost of living is crucial for budgeting and determining the necessary loan amount. Several key factors significantly influence this cost, allowing for a more accurate calculation of your financial needs throughout your studies.

Factors Influencing the Cost of Living

Housing, transportation, and food are the three primary expenses students face. Housing costs, in particular, can vary drastically depending on location and housing type (dorm, apartment, shared housing). Transportation costs include commuting to campus, weekend trips, and potential travel back home. Finally, food expenses depend on dietary habits and access to affordable grocery options. Other factors, such as utilities (electricity, internet), textbooks, and personal spending, should also be considered.

Resources for Estimating Living Expenses

Several resources can assist students in accurately estimating their living expenses. Many universities provide cost-of-living estimates specific to their location, factoring in student-specific expenses. Online calculators and budgeting tools can help personalize estimations based on individual circumstances. Government websites often provide average cost-of-living data by region, while student forums and blogs offer insights from current students. Finally, reaching out to current students at your target university can provide valuable firsthand information on real-world expenses.

Loan Amounts Based on Different Scenarios

The following table illustrates examples of loan amounts needed to cover living expenses, considering various scenarios. These are estimates, and actual costs may vary.

| Location | Lifestyle | Estimated Annual Living Expenses | Estimated Loan Amount (per year) |

|---|---|---|---|

| Small City, Midwest (e.g., Bloomington, Indiana) | Budget-conscious | $12,000 | $12,000 |

| Large City, West Coast (e.g., Los Angeles, California) | Moderate | $25,000 | $25,000 |

| Suburban Area, Northeast (e.g., Boston, Massachusetts) | Comfortable | $30,000 | $30,000 |

| Rural Area, South (e.g., Rural Georgia) | Budget-conscious | $10,000 | $10,000 |

Alternatives to Student Loans for Living Expenses

Securing funding for college living expenses doesn’t solely rely on student loans. Numerous alternatives exist, each with its own advantages and disadvantages. Carefully weighing these options can lead to a more manageable financial path through higher education. Exploring these alternatives can help reduce reliance on loans and minimize future debt burdens.

While student loans provide a readily available lump sum, they come with significant long-term financial obligations. Alternatives such as part-time employment, scholarships, and grants offer a way to finance education without accumulating substantial debt. These methods often require more effort and planning, but the payoff can be considerable, both financially and in terms of reduced stress during your college years.

Part-Time Employment

Finding a part-time job is a practical way to supplement your income during college. Many students work alongside their studies to cover living expenses or a portion thereof. The income generated can be used for rent, groceries, books, transportation, and other necessities. The experience gained from part-time work also benefits students by developing valuable professional skills and building a work history. However, balancing work and studies requires effective time management and prioritization. Too many hours can negatively impact academic performance.

Scholarships and Grants

Scholarships and grants are forms of financial aid that don’t need to be repaid. They are often awarded based on academic merit, financial need, or specific criteria such as extracurricular activities or community involvement. Scholarships are typically competitive, requiring students to submit applications and demonstrate their qualifications. Grants, on the other hand, are often based on financial need and are determined through the Free Application for Federal Student Aid (FAFSA). These can significantly reduce the reliance on loans and minimize overall college costs.

Examples of Scholarships and Grants

Many organizations offer scholarships and grants for students. For instance, the Pell Grant is a federal grant program for students with exceptional financial need. Numerous privately funded scholarships exist, focusing on various fields of study, demographics, or unique talents. The Gates Millennium Scholars program, for example, provides scholarships to outstanding minority students with significant financial need. Many colleges and universities also offer their own institutional scholarships based on academic achievement or demonstrated need. Searching for scholarships requires dedication and research, but the potential rewards are substantial.

Resources for Finding Part-Time Job Opportunities

Several resources can assist students in their search for part-time jobs. University career services offices often post on-campus job openings and provide career counseling. Online job boards like Indeed, LinkedIn, and Monster offer a wide range of part-time positions. Local businesses and community organizations also frequently hire part-time employees. Networking with friends, family, and professors can also uncover hidden job opportunities. Actively seeking and applying for positions increases the chances of securing part-time employment.

Potential Risks and Responsibilities of Borrowing

Taking out student loans to cover living expenses can offer financial flexibility, but it’s crucial to understand the potential downsides before signing on the dotted line. Borrowing involves significant responsibilities and carries inherent risks that can impact your financial well-being for years to come. Careful consideration and planning are essential to navigate this process successfully.

Student loans, while enabling access to education and potentially higher earning potential, represent a substantial financial commitment. Failing to understand the implications of borrowing can lead to overwhelming debt and long-term financial hardship. Responsible borrowing practices, including careful budgeting and a clear understanding of repayment terms, are vital for mitigating these risks.

Debt Burden and Impact on Credit Score

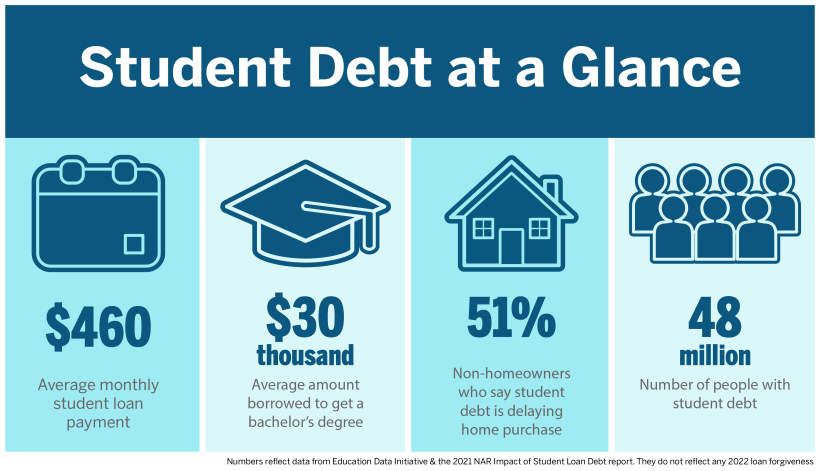

The most significant risk associated with student loans is the accumulation of substantial debt. The total amount borrowed, including interest, can significantly exceed the initial loan amount, especially if repayment is delayed or if high-interest rates are applied. This debt can severely limit financial flexibility, hindering major life decisions such as purchasing a home, investing, or starting a family. Furthermore, missed or late payments can negatively impact your credit score, making it more difficult to secure loans or credit cards in the future, even for essential needs like a car loan or mortgage. A poor credit score can also lead to higher interest rates on future borrowing, further exacerbating the financial burden. For example, a student graduating with $50,000 in loan debt might face monthly payments of several hundred dollars for many years, significantly impacting their disposable income and overall financial health.

Responsible Borrowing and Budgeting

Responsible borrowing starts with a realistic assessment of your financial situation and needs. Before applying for student loans, create a detailed budget that accounts for all expenses, including tuition, fees, housing, food, transportation, and other living costs. Compare the total cost of borrowing with your expected post-graduation earning potential to ensure that you can comfortably manage the loan repayments. Explore options to minimize borrowing, such as scholarships, grants, part-time employment, and savings. Prioritize needs over wants, and avoid unnecessary expenses during your studies. Regularly review your budget and make adjustments as needed. Consider using budgeting apps or spreadsheets to track your spending and monitor your progress.

Avoiding Excessive Debt

Several strategies can help avoid accumulating excessive student loan debt. Firstly, meticulously research and compare loan options from different lenders to secure the most favorable interest rates and repayment terms. Secondly, borrow only the amount absolutely necessary, carefully considering all funding alternatives. Thirdly, prioritize grants and scholarships, which do not need to be repaid. Fourthly, actively pursue part-time employment or summer jobs to offset educational expenses. Finally, consider attending a less expensive institution or pursuing a shorter educational program to reduce overall costs. For instance, choosing a community college for the first two years before transferring to a four-year university can significantly reduce tuition costs.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. It can result in damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Furthermore, it can lead to legal action and even affect your ability to obtain professional licenses in certain fields. The negative impact of defaulting can persist for many years, significantly hindering your financial future. For example, a defaulted loan can remain on your credit report for seven years, making it extremely difficult to secure a mortgage or auto loan during that period. The government can also seize a portion of your tax refund to repay the defaulted loan.

Illustrative Examples of Loan Scenarios

Understanding the nuances of student loan eligibility and repayment requires considering individual circumstances. The following scenarios illustrate how different financial situations impact loan options and repayment strategies. These examples are for illustrative purposes only and do not constitute financial advice. Actual loan amounts and repayment plans will vary depending on lender policies and individual circumstances.

High-Need Student Loan Scenario

This scenario depicts a student, Sarah, pursuing a four-year medical degree. Sarah comes from a low-income family and has limited savings. Her tuition, fees, and living expenses significantly exceed her family’s ability to contribute. Therefore, she requires substantial financial aid to cover her educational costs.

Sarah’s Estimated Costs: Tuition ($250,000), Fees ($10,000), Living Expenses ($60,000). Total: $320,000. She might qualify for federal subsidized and unsubsidized loans, potentially reaching the maximum borrowing limit for her program. Repayment would likely be through an income-driven repayment plan, given her expected relatively low income immediately after graduation. This plan adjusts monthly payments based on her income and family size. The repayment period will likely be extended, reducing monthly payments but increasing the total interest paid over time.

Financial Outcome Visualization: Imagine a bar graph. One bar represents the total cost of education ($320,000). Another bar shows the amount covered by loans (close to $320,000), and a small bar represents any minimal family contribution or scholarships. The repayment plan is visualized as a long, relatively flat line stretching over a considerable time period (potentially 20-25 years), representing the extended repayment schedule.

Moderate-Need Student Loan Scenario

This scenario features David, a student studying engineering at a state university. David’s family can contribute a portion of his educational costs, but he still requires loans to cover a significant portion of his expenses.

David’s Estimated Costs: Tuition ($80,000), Fees ($5,000), Living Expenses ($30,000). Total: $115,000. His family contributes $25,000. David needs approximately $90,000 in student loans. He might utilize a combination of federal and private loans, potentially choosing a standard repayment plan with a 10-year term. His higher earning potential in his field will likely allow him to manage a higher monthly payment.

Financial Outcome Visualization: A bar graph shows the total cost ($115,000). A large portion is covered by loans ($90,000), a smaller portion by family contribution ($25,000). The repayment plan is represented by a moderately sloped line over 10 years, reflecting a shorter repayment period and potentially higher monthly payments.

Low-Need Student Loan Scenario

This scenario involves Maria, a student attending a community college while living at home. Her living expenses are minimal, and her tuition is relatively low. She needs a small student loan to supplement her family’s contribution and part-time job earnings.

Maria’s Estimated Costs: Tuition ($15,000), Fees ($1,000), Living Expenses ($5,000). Total: $21,000. Her family contributes $10,000, and she earns $5,000 through part-time work. She requires only $6,000 in student loans. She could likely repay this loan quickly through a standard repayment plan with a short repayment period (e.g., 3-5 years), minimizing interest accumulation.

Financial Outcome Visualization: A bar graph displays the total cost ($21,000). A small portion is represented by loans ($6,000), a larger portion by family contribution ($10,000), and a noticeable segment by her part-time earnings ($5,000). The repayment plan is depicted as a steeply sloped line over a short period (3-5 years), reflecting rapid repayment and minimal interest accrual.

Epilogue

Successfully managing the financial aspects of higher education requires careful planning and a thorough understanding of available resources. While student loans can provide essential support for covering living expenses, it’s crucial to borrow responsibly and explore alternative funding options whenever possible. By carefully weighing the pros and cons of different loan types and repayment plans, and actively seeking out scholarships and part-time work, students can minimize their debt burden and focus on their academic pursuits. Remember, proactive financial management is key to a successful and less stressful college experience.

FAQ Resource

What happens if I can’t repay my student loans?

Defaulting on student loans can have serious consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans.

Can I use student loans for books and supplies?

Yes, many student loans can be used to cover the cost of textbooks, school supplies, and other educational materials, in addition to living expenses.

Are there any tax benefits associated with student loan interest?

In some countries, you may be able to deduct a portion of the interest you pay on student loans from your taxes. Check with your tax advisor for details.

How long does the loan application process typically take?

The application process can vary depending on the lender and type of loan, but it generally takes several weeks to several months.