The prospect of eliminating student loan debt ahead of schedule is alluring, but the reality is nuanced. Understanding the intricacies of your loan agreement—whether federal or private—is paramount. Early repayment can offer significant long-term financial benefits, such as reduced interest payments and faster debt freedom, but it’s crucial to navigate potential penalties and unforeseen consequences. This guide explores the complexities of early student loan repayment, providing insights into various loan types, repayment strategies, and the importance of careful financial planning.

We’ll delve into the specific terms and conditions of both federal and private student loans, highlighting key differences in early repayment policies. We’ll also examine effective strategies for accelerating repayment, considering factors such as your overall financial health and risk tolerance. The goal is to equip you with the knowledge needed to make informed decisions about your student loan repayment journey.

Understanding Loan Terms and Agreements

Paying off your student loans early can be a financially savvy move, but understanding your loan agreements is crucial. Different loan types have varying terms and conditions, and some may include penalties for early repayment. This section will clarify the key aspects of various student loan agreements to help you make informed decisions.

Types of Student Loans and Repayment Terms

Student loans are broadly categorized into federal and private loans. Federal loans, offered by the U.S. government, generally have more borrower-friendly terms and repayment options than private loans, which are offered by banks and other private lenders. Federal loans often include options like income-driven repayment plans and loan forgiveness programs, while private loans typically have fixed repayment terms and may lack such flexibility. Repayment terms for both types vary depending on the loan type (e.g., subsidized vs. unsubsidized federal loans), the loan amount, and the lender’s policies. For example, a 10-year repayment plan is common for federal loans, but private loans might have shorter or longer terms.

Penalties for Early Repayment

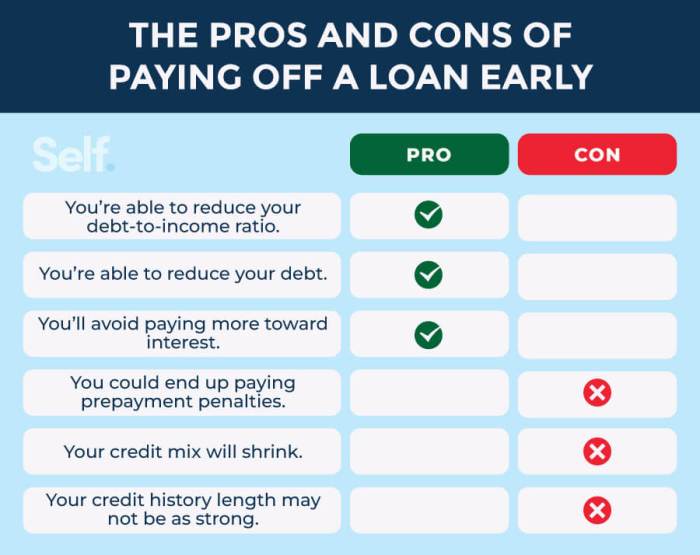

While many student loans do not charge a penalty for early repayment, some private loans may include prepayment penalties. These penalties are typically a percentage of the principal amount repaid early and are designed to compensate the lender for lost interest income. The penalty amount and the duration for which it applies will vary depending on the loan agreement. For instance, a loan agreement might stipulate a 1% penalty on the outstanding principal if the loan is repaid within the first three years. Federal student loans, however, generally do not have prepayment penalties.

Examples of Loan Agreements and Early Repayment Policies

A typical loan agreement will clearly Artikel the terms of repayment, including any prepayment penalties. For example, a section titled “Prepayment” or “Early Repayment” might state something like: “Borrower may repay the loan in full or in part at any time without penalty.” Conversely, another agreement could stipulate: “Prepayment penalty: A 2% penalty will be applied to the principal balance if the loan is repaid within the first two years of the loan term.” These clauses are legally binding and should be carefully reviewed before signing the loan agreement. It’s important to note that the specific wording will vary depending on the lender and the type of loan.

Comparison of Federal and Private Student Loan Terms Regarding Early Payoff

The key difference lies in the presence or absence of prepayment penalties. Federal student loans typically do not impose penalties for early repayment, offering borrowers flexibility. Private student loans, however, may include prepayment penalties, which should be carefully considered before making an early payment. Additionally, federal loans often provide more flexible repayment options, such as income-driven repayment plans, that may indirectly impact the feasibility and desirability of early repayment. Private loans tend to offer less flexibility in repayment options. Therefore, a borrower with federal loans might find early repayment more straightforward than someone with private loans.

Federal Student Loan Repayment

Paying off federal student loans early can offer significant financial advantages, but it’s crucial to understand the implications before making a decision. This section details the benefits, drawbacks, and practical steps involved in accelerating your repayment journey.

Early repayment of federal student loans presents a compelling opportunity to save money on interest and achieve financial freedom sooner. However, it’s important to weigh the potential benefits against any drawbacks related to your overall financial strategy.

Benefits and Drawbacks of Early Federal Student Loan Repayment

The primary benefit of early repayment is the reduction of total interest paid. Interest accrues over the life of the loan, so paying down the principal faster minimizes the amount you ultimately pay. This can translate into thousands of dollars saved, depending on the loan amount, interest rate, and repayment plan. A drawback, however, could be the loss of liquidity. Aggressively paying down student loans might limit access to funds for emergencies or other important investments. Carefully consider your financial situation and risk tolerance before prioritizing early repayment. For example, someone with a high-interest loan and a stable income might find early repayment beneficial, while someone facing financial instability might prioritize building an emergency fund.

Making Extra Payments on Federal Student Loans

Making extra payments on your federal student loans is straightforward. You can typically make these payments online through your loan servicer’s website, by phone, or by mail. Most servicers allow you to designate extra payments as going directly towards your principal balance, thus accelerating repayment. Be sure to clearly indicate your intention to apply the extra payment to the principal when making your payment. Many servicers provide tools on their websites to calculate the impact of extra payments on your loan repayment timeline.

Requesting an Early Payoff Statement

To obtain an early payoff statement, contact your loan servicer. This statement will detail the exact amount needed to pay off your loan in full, including any accrued interest. This is crucial to ensure you pay the correct amount and avoid any discrepancies. The process typically involves submitting a request through your online account or by phone. The servicer will then generate and provide you with the statement, usually within a few business days. It’s advisable to request this statement a few days before your intended payoff date to allow sufficient processing time.

Step-by-Step Guide for Paying Off Federal Student Loans Early

- Determine your available funds: Assess your budget and identify how much extra you can afford to allocate towards your student loans each month.

- Contact your loan servicer: Confirm your payment options and inquire about applying extra payments to your principal.

- Set up automatic payments: Automate your regular payments and schedule additional payments at regular intervals to maintain consistency.

- Consider a lump-sum payment: If possible, utilize bonuses, tax refunds, or other windfalls to make larger, one-time payments.

- Track your progress: Monitor your loan balance regularly to stay motivated and ensure you’re on track to meet your early repayment goal.

- Request an early payoff statement: A few days before your intended payoff date, request a final payoff statement from your servicer to confirm the exact amount owed.

- Make the final payment: Submit your final payment to pay off your loan in full.

Private Student Loan Repayment

Unlike federal student loans, private student loans are offered by banks, credit unions, and other financial institutions. Their repayment terms and policies can vary significantly, and understanding these differences is crucial before signing a loan agreement. This section will explore the potential penalties associated with early repayment of private student loans, compare the policies of different lenders, and provide examples of relevant loan agreement clauses.

Prepayment Penalties for Private Student Loans

Many private student loan lenders do not impose prepayment penalties. However, some may charge a fee for paying off your loan early. These penalties can vary widely depending on the lender and the specific loan agreement. The penalty might be a percentage of the outstanding loan balance or a flat fee. It’s crucial to carefully review your loan documents to determine if such a penalty exists. Failing to do so could result in unexpected costs.

Comparison of Early Repayment Policies Among Private Student Loan Lenders

The early repayment policies of private student loan lenders differ substantially. Some lenders explicitly state that there are no prepayment penalties, while others may have fees tied to specific loan products or repayment plans. It is essential to compare offers from multiple lenders before choosing a loan, paying close attention to the fine print regarding early repayment. Shopping around can save you significant money in the long run.

Prepayment Penalty Comparison Table

| Lender | Prepayment Penalty | Penalty Details | Notes |

|---|---|---|---|

| Example Lender A | None | No penalty for early repayment. | Check specific loan terms as policies may change. |

| Example Lender B | Possible | May charge a percentage of the outstanding balance, depending on the loan type and terms. Consult the loan agreement for specifics. | Contact the lender directly to clarify. |

| Example Lender C | None | Explicitly states no prepayment penalties in their loan agreements. | Verify this information on their official website. |

| Example Lender D | Variable | Penalty varies based on the loan’s age and outstanding balance. Specifics are detailed in the loan agreement. | Review the loan agreement carefully for details. |

*Note: This table provides examples and should not be considered exhaustive. Always refer to the specific loan agreement for the most accurate information.*

Examples of Private Loan Agreement Clauses Related to Early Repayment

Private loan agreements often contain clauses explicitly addressing early repayment. These clauses may specify whether a prepayment penalty applies, the calculation method for any penalty, and the process for making an early payment. For example, a clause might state: “Borrower may prepay the loan in full or in part at any time without penalty.” Alternatively, another clause might state: “A prepayment penalty of X% of the outstanding principal balance will be applied if the loan is repaid within Y years of the loan origination date.” It is critical to carefully review these clauses to understand your rights and obligations. Failure to understand these clauses could lead to unexpected financial consequences.

Strategies for Early Repayment

Paying off student loans early can significantly reduce the total interest paid and free up your finances sooner. Several strategies can help you achieve this goal, each with its own advantages and disadvantages. Choosing the right approach depends on your individual financial situation, risk tolerance, and repayment preferences. Understanding these strategies and their potential impact is crucial for effective debt management.

Debt Snowball Method

The debt snowball method focuses on paying off your smallest loan first, regardless of its interest rate. This approach provides psychological momentum by quickly achieving small wins, which can boost motivation to continue the repayment process. The satisfaction of eliminating a loan entirely can be highly motivating, encouraging consistent repayment efforts on the remaining loans.

- Pros: Motivational, provides a sense of accomplishment early on.

- Cons: May not be the most financially efficient method as it ignores interest rates; you might pay more interest overall.

Debt Avalanche Method

The debt avalanche method prioritizes paying off the loan with the highest interest rate first, regardless of the loan balance. This approach minimizes the total interest paid over the life of the loans, resulting in significant long-term savings. While it may not offer the same immediate psychological gratification as the snowball method, the financial benefits are substantial.

- Pros: Most financially efficient method, minimizes total interest paid.

- Cons: Can be less motivating initially, as the largest payoff may take longer.

Calculating Potential Savings

Calculating potential savings requires understanding the interest rates and remaining balances on your loans. Let’s illustrate with an example. Suppose you have two loans: Loan A ($5,000, 7% interest) and Loan B ($2,000, 5% interest).

Using the debt avalanche method, you’d focus on Loan A first. By making extra payments, you can significantly reduce the time it takes to pay off the loan and the total interest accrued. Using a loan amortization calculator (easily found online), you can input the loan details and extra payments to determine the total interest saved and the new repayment timeline. For example, by adding $100 per month to Loan A’s payments, you could potentially save hundreds of dollars in interest and pay it off several months earlier.

Using the debt snowball method, you would tackle Loan B first. While quicker to pay off, the interest savings will be less significant compared to the avalanche method. The same loan amortization calculator can be used to compare the two approaches.

Total Interest Saved = Total Interest Paid (Original Plan) – Total Interest Paid (Accelerated Plan)

Budgeting for Early Repayment

A realistic budget is essential for allocating extra funds towards early loan repayment. Consider this example budget:

| Category | Amount |

|---|---|

| Housing | $1000 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Other Expenses | $300 |

| Student Loan Payment (Original) | $500 |

| Extra Loan Payment | $200 |

| Savings | $200 |

This budget demonstrates allocating $200 of extra funds towards early loan repayment, while still maintaining savings. Adjusting expenses or increasing income can free up additional funds for faster repayment. Regularly reviewing and adjusting your budget is crucial to ensure its effectiveness.

Financial Considerations and Planning

Paying off student loans early can be a rewarding financial goal, but it’s crucial to approach it strategically within the context of your broader financial picture. A well-structured financial plan acts as a roadmap, ensuring that aggressive loan repayment doesn’t jeopardize other essential financial aspects. Ignoring this planning phase can lead to unforeseen difficulties and hinder your overall financial well-being.

Early student loan repayment significantly impacts your financial health, both positively and negatively. While reducing debt is undeniably beneficial, a poorly planned approach can have unintended consequences. It’s vital to weigh the advantages against the potential drawbacks before committing to a rapid repayment strategy.

Impact of Early Repayment on Credit Score and Overall Financial Health

Accelerated student loan repayment can indirectly boost your credit score. Lowering your debt-to-income ratio, a key factor in credit scoring models, improves your creditworthiness. However, if early repayment involves neglecting other financial obligations, like credit card payments, this can negatively affect your credit score, potentially outweighing the benefits of the early loan payoff. A balanced approach, prioritizing responsible debt management across all accounts, is key to maintaining a healthy credit profile. For example, aggressively paying down a high-interest credit card while simultaneously paying extra on student loans could be a more effective strategy than solely focusing on the student loans.

Factors to Consider Before Early Repayment

Before committing to early student loan repayment, several critical factors require careful consideration. Failing to assess these factors can lead to financial strain and potentially derail your overall financial goals.

- Emergency Fund: Having a robust emergency fund (ideally 3-6 months of living expenses) is paramount. Unexpected events, like job loss or medical emergencies, can quickly derail even the most well-intentioned financial plans. Draining your emergency fund to pay down loans prematurely leaves you vulnerable to further financial hardship.

- High-Interest Debt: Prioritize paying off high-interest debt, such as credit cards or payday loans, before aggressively attacking student loans. The interest accruing on high-interest debt often far exceeds that of federal student loans, making it a more financially prudent target for rapid repayment. For instance, paying off a credit card with a 20% interest rate will save you significantly more money in the long run than paying down a student loan with a 5% interest rate.

- Other Financial Obligations: Consider all financial obligations, including rent, utilities, and insurance, before accelerating loan repayment. Neglecting these essential expenses to focus solely on student loans can lead to late payments, penalties, and damage to your credit score. A balanced budget that addresses all financial responsibilities is essential for long-term financial stability.

Consequences of Neglecting Other Financial Obligations

Focusing solely on early loan repayment while neglecting other financial obligations can have severe consequences. This can lead to late payments, resulting in penalties and negatively impacting your credit score. For example, if you consistently miss credit card payments to prioritize student loan repayment, your credit score could drop significantly, making it more difficult to secure loans or even rent an apartment in the future. Furthermore, neglecting essential expenses like rent or utilities can lead to eviction or service disruptions, causing significant stress and financial setbacks. A holistic approach to debt management is crucial to prevent such negative outcomes.

Seeking Professional Advice

Navigating the complexities of student loan repayment, especially when aiming for early payoff, can be challenging. A financial advisor can provide invaluable guidance and support throughout this process, offering personalized strategies and helping you make informed decisions. Their expertise can significantly impact your financial well-being and help you achieve your goals more efficiently.

Financial advisors offer a holistic perspective on your finances, considering your student loans alongside other financial goals such as saving for retirement, purchasing a home, or investing. They can help you create a comprehensive financial plan that integrates your student loan repayment strategy with your broader financial objectives. This integrated approach ensures that your efforts to pay off your loans don’t compromise other important aspects of your financial future.

The Role of a Financial Advisor in Student Loan Repayment

A financial advisor acts as a trusted guide, helping you understand your loan terms, explore repayment options, and develop a personalized repayment plan. They can analyze your income, expenses, and debt to determine the most effective strategy for early repayment, considering factors such as your risk tolerance and financial priorities. They may also help you identify potential tax benefits related to student loan repayment. Furthermore, a financial advisor can provide ongoing support and accountability, helping you stay on track with your repayment goals and make adjustments as needed.

Benefits of Consulting a Financial Advisor Before Making Significant Financial Decisions

Seeking professional financial advice before making significant decisions, such as aggressive student loan repayment strategies, offers several key benefits. It mitigates the risk of making impulsive or uninformed choices that could negatively impact your long-term financial health. A financial advisor provides an objective perspective, helping you avoid emotional decision-making. They can also identify potential pitfalls and unforeseen consequences associated with various repayment options. This proactive approach can save you time, money, and significant stress in the long run. For instance, they might help you avoid strategies that could negatively impact your credit score or leave you with insufficient funds for emergencies.

Questions to Ask a Financial Advisor About Early Student Loan Repayment

Before engaging a financial advisor, it’s beneficial to prepare a list of questions tailored to your specific circumstances. Examples include clarifying the implications of different repayment strategies on your overall financial health, understanding the potential tax advantages or disadvantages of accelerated repayment, and assessing the feasibility of various repayment plans given your current financial situation and future income projections. Furthermore, you should inquire about the advisor’s experience with student loan repayment strategies and their fee structure. Finally, asking about their process for monitoring your progress and making adjustments as needed ensures ongoing support.

Resources for Finding Qualified Financial Advisors

Several reputable resources can assist in finding qualified financial advisors. The National Association of Personal Financial Advisors (NAPFA) offers a directory of fee-only advisors, ensuring transparency in their compensation. The Certified Financial Planner Board of Standards (CFP Board) provides a directory of certified financial planners, who have met rigorous education, examination, experience, and ethical requirements. Your employer’s human resources department may also offer resources or referrals to financial advisors. It’s crucial to verify credentials and check client reviews before engaging an advisor.

Closure

Successfully navigating early student loan repayment requires a proactive and informed approach. While the potential for significant savings and accelerated debt freedom is substantial, understanding the nuances of your loan agreements and aligning your strategy with your overall financial goals is critical. By carefully considering the information presented, including the potential benefits and drawbacks of early repayment, and seeking professional advice when needed, you can confidently chart a course toward a debt-free future. Remember, a well-defined financial plan, coupled with a realistic budget, is key to achieving your objectives.

Question Bank

What happens to my interest if I pay off my student loan early?

The interest accrued up to the point of early repayment will still be due. Early repayment simply reduces the principal balance and the overall amount of future interest you’ll accrue.

Can I make extra payments on my student loans without affecting my credit score?

Making extra payments generally won’t negatively impact your credit score. In fact, it can indirectly improve your score by reducing your debt-to-income ratio over time.

Will paying off my student loans early improve my credit score immediately?

While it won’t provide an immediate boost, consistently reducing your debt-to-income ratio through early loan payments will positively affect your credit score over the long term.

What if I can’t afford to make extra payments every month?

Even small, consistent extra payments can make a significant difference over time. Prioritize your budget and only make extra payments if you can comfortably afford them without compromising other essential financial obligations.