The crushing weight of student loan debt is a reality for millions. Many grapple with the question: can early repayment offer a path to financial freedom? While completely eliminating interest might be unrealistic, strategic repayment can significantly reduce the overall cost and shorten the repayment timeline. This exploration delves into the various methods, financial strategies, and considerations involved in accelerating your student loan payoff.

This guide will equip you with the knowledge to navigate the complexities of early repayment, empowering you to make informed decisions aligned with your financial goals. We’ll examine different repayment plans, budgeting techniques, and income-boosting strategies, ultimately guiding you toward a more debt-free future.

Understanding Early Student Loan Repayment

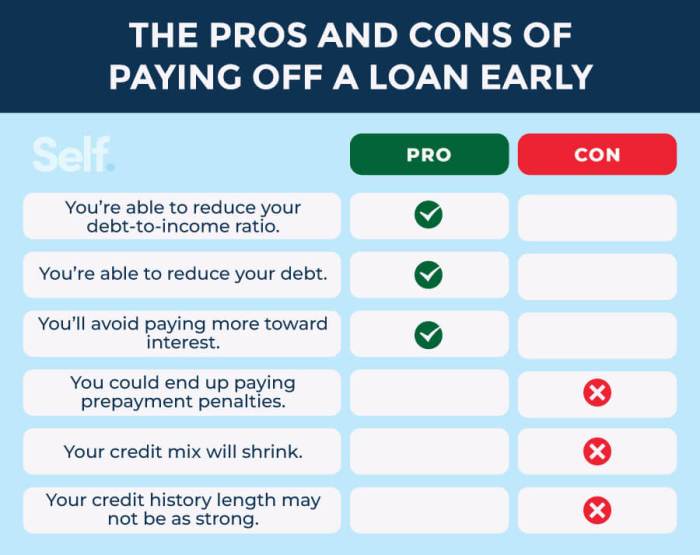

Paying off student loans early can significantly impact your financial future, offering substantial long-term benefits. However, it’s crucial to understand both the advantages and potential drawbacks before implementing an aggressive repayment strategy. Careful planning and consideration of your individual financial situation are key to making informed decisions.

Benefits of Early Student Loan Repayment

Accelerated repayment of student loans offers several key advantages. The most obvious is the reduction of total interest paid. Interest accrues over time, so the sooner you pay off your loans, the less you’ll spend on interest charges. This frees up more of your income for other financial goals, such as saving for a down payment on a house, investing, or paying off other debts. Furthermore, early repayment reduces the overall length of your loan repayment period, relieving the financial burden and providing a sense of accomplishment and improved financial well-being. Early repayment can also improve your credit score, as a lower debt-to-income ratio is viewed favorably by lenders.

Drawbacks of Aggressive Early Repayment Strategies

While early repayment offers significant benefits, aggressive strategies can have downsides. For instance, diverting too much money towards loan repayment could leave you with insufficient funds for emergencies or other essential expenses. This could force you to rely on high-interest credit cards or loans, potentially negating the savings from early loan repayment. Additionally, aggressively paying down student loans might delay other important financial goals, such as saving for retirement or investing in your education or career development. A balanced approach, carefully considering your overall financial picture, is therefore crucial.

Comparison of Repayment Plans and Their Impact on Early Payoff

Different repayment plans significantly affect the speed of early payoff. Standard repayment plans typically spread payments over a longer period, resulting in higher overall interest payments. Accelerated repayment plans, on the other hand, involve higher monthly payments but lead to faster loan payoff and lower interest costs. Income-driven repayment plans, while potentially lowering monthly payments, often extend the repayment period, increasing the total interest paid and delaying early payoff. The best plan depends on individual circumstances and financial priorities. For example, someone with a high income might benefit from an accelerated plan, while someone with a fluctuating income might find an income-driven plan more suitable.

Calculating Savings from Early Repayment

Calculating the savings from early repayment involves several steps. First, determine your current monthly payment and the remaining loan balance. Next, identify the interest rate on your loan. Then, using an online student loan amortization calculator (many free calculators are available online), input these values along with a hypothetical higher monthly payment reflecting your accelerated repayment plan. The calculator will then project the new payoff date and the total interest paid under this scenario. Finally, compare the total interest paid under your current plan to the total interest paid under the accelerated plan to determine the potential savings. For example, let’s say a loan with a $30,000 balance and a 6% interest rate has a standard repayment period of 10 years. An accelerated repayment plan might reduce the repayment period to 7 years, resulting in significant savings on interest.

Example Calculation: Total Interest Paid (Standard Plan) – Total Interest Paid (Accelerated Plan) = Savings from Early Repayment.

Methods for Early Repayment

Accelerating your student loan repayment can significantly reduce the total interest paid and shorten the loan’s lifespan. Several strategies can help you achieve this goal, each with its own set of advantages and disadvantages. Choosing the right approach depends on your financial situation, risk tolerance, and personal preferences.

Strategies for Accelerated Repayment

Several methods exist to expedite student loan repayment. Understanding these methods and their implications is crucial for effective debt management.

Lump-Sum Payments

Making lump-sum payments, whenever possible, is a highly effective way to reduce your principal balance quickly. This strategy significantly lowers the total interest accrued over the life of the loan. A windfall like a bonus, inheritance, or tax refund can be strategically allocated towards your student loans to make a substantial dent in your debt. The larger the lump sum, the more significant the impact on your repayment timeline.

Increased Monthly Payments

Increasing your regular monthly payment, even by a small amount, can accelerate your repayment significantly over time. This consistent extra payment consistently reduces your principal, leading to lower interest charges and faster payoff. Even an additional $50 or $100 per month can make a considerable difference in the long run. Careful budgeting and prioritizing loan repayment are key to implementing this strategy effectively.

Debt Snowball and Avalanche Methods

These methods prioritize different aspects of your debt. The debt snowball method focuses on paying off the smallest loan first, regardless of interest rate, to gain momentum and motivation. The debt avalanche method, conversely, prioritizes paying off the loan with the highest interest rate first, to minimize overall interest paid. Both methods require discipline and careful tracking of payments.

Sample Repayment Schedule

Let’s consider a $30,000 student loan with a 5% interest rate and a 10-year repayment term (120 months).

| Payment Strategy | Monthly Payment | Total Paid | Time to Payoff |

|————————–|—————–|————-|—————–|

| Standard Repayment | $304.14 | $36,497.02 | 120 months |

| +$100 extra monthly | $404.14 | $32,964.42 | 92 months |

| Lump Sum ($5,000 upfront)| $281.63 | $32,751.86 | 105 months |

| Lump Sum + $100 extra | $381.63 | $29,222.00 | 77 months |

Note: These calculations are simplified and do not account for potential changes in interest rates or fees.

Comparison of Repayment Methods

| Method | Advantages | Disadvantages | Example |

|---|---|---|---|

| Lump-Sum Payments | Significant principal reduction, substantial interest savings, faster payoff | Requires access to a large sum of money, may delay other financial goals | Paying off $5,000 of principal with a bonus |

| Increased Monthly Payments | Consistent progress, manageable increase in monthly budget, relatively simple to implement | Requires disciplined budgeting, may necessitate lifestyle adjustments | Increasing monthly payment by $100 |

| Debt Snowball | Psychological boost from early loan payoff, easier to maintain motivation | May take longer to pay off overall debt, higher total interest paid | Paying off smallest loan first, regardless of interest rate |

| Debt Avalanche | Minimizes total interest paid, fastest way to eliminate debt | May be demotivating initially, requires more complex calculations | Paying off highest interest loan first |

Visual Representation of Repayment Timelines

Imagine four lines representing the repayment timelines of the four methods. The standard repayment plan would be the longest line, stretching across the full 10 years. The line representing the “+$100 extra monthly” strategy would be shorter, reaching approximately 7.5 years. The line for the “Lump Sum ($5,000 upfront)” would be slightly shorter than the standard repayment, and the line for “Lump Sum + $100 extra” would be the shortest, representing a payoff time of around 6.5 years. The lengths of these lines visually demonstrate the impact of each repayment strategy on the overall time it takes to pay off the loan. The steeper the slope of the line, the faster the repayment.

Financial Strategies for Early Repayment

Paying off student loans early requires a proactive approach to your finances. This involves not only making extra payments but also strategically managing your income and expenses to maximize the amount you can allocate towards debt reduction. By implementing effective budgeting techniques and exploring avenues for increased income, you can significantly accelerate your repayment journey and achieve financial freedom sooner.

Effective Budgeting Techniques

Creating a detailed budget is crucial for identifying areas where you can cut back and redirect funds towards your student loans. Start by tracking your income and expenses for a month to understand your spending habits. Categorize your expenses (housing, transportation, food, entertainment, etc.) to pinpoint areas of overspending. Consider using budgeting apps or spreadsheets to simplify this process. Once you have a clear picture of your spending, identify non-essential expenses you can reduce or eliminate. For example, cutting back on dining out, subscription services, or entertainment can free up significant funds for extra loan payments. Prioritizing needs over wants is key to successful budgeting. A realistic approach to budgeting is essential; aim for gradual changes rather than drastic cuts that are difficult to maintain.

Strategies for Increasing Income

Increasing your income is another effective strategy for accelerating loan repayment. Explore opportunities for advancement within your current job, such as seeking a promotion or taking on additional responsibilities. Negotiating a higher salary can significantly boost your repayment capacity. If a salary increase isn’t immediately feasible, consider seeking a higher-paying job in your field or exploring a career change. Researching industry trends and acquiring new skills can enhance your job prospects and earning potential. Remember to factor in any potential costs associated with a job change, such as relocation expenses or training fees.

The Role of Side Hustles and Additional Income Streams

Side hustles and additional income streams offer a powerful way to accelerate loan repayment. The possibilities are vast and depend on your skills and interests. Examples include freelancing, tutoring, driving for a ride-sharing service, or selling handmade goods online. A part-time job can also provide a consistent source of extra income. The key is to choose a side hustle that aligns with your skills and schedule, ensuring it doesn’t negatively impact your primary job or well-being. Even a small amount of extra income each month can make a substantial difference in your loan repayment progress over time. For instance, earning an extra $500 per month could significantly reduce the overall loan repayment period.

Realistic Savings Goals and Their Impact

Setting realistic savings goals is essential for successfully paying off student loans early. Start by determining how much extra you can realistically contribute each month towards your loans. Then, calculate how long it will take to pay off your loans based on your current payment plan and your additional contributions. For example, if you have a $30,000 loan with a 5% interest rate and you can afford an extra $200 per month, you can use a loan amortization calculator to determine how much faster you can pay off your loan. This will provide a clear timeline and motivate you to stay on track. Regularly review and adjust your savings goals as your financial situation changes. Remember, consistency is key; even small, regular contributions add up over time. Celebrating milestones along the way can also help maintain motivation and momentum.

Assessing Your Financial Situation

Before diving headfirst into aggressively paying down your student loans, it’s crucial to take a comprehensive look at your overall financial health. A well-structured approach ensures you’re not sacrificing other essential financial needs in the pursuit of early loan repayment. Ignoring your broader financial picture could lead to unforeseen difficulties and ultimately hinder your progress.

Creating a personal budget and diligently tracking your expenses is the cornerstone of effective financial management. This provides a clear picture of your income and outflow, allowing you to identify areas where you can potentially save and reallocate funds towards your student loan repayment. Understanding your spending habits is vital for informed decision-making.

Budget Creation and Expense Tracking

Developing a personal budget involves listing all your monthly income sources and then categorizing your expenses. Common expense categories include housing, transportation, food, utilities, entertainment, and debt payments. Several budgeting methods exist, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), zero-based budgeting (allocating every dollar), or using budgeting apps that automate tracking. Consistent monitoring of your expenses against your budget is key to identifying areas for improvement and ensuring you stay on track. Regularly reviewing and adjusting your budget as your circumstances change is also essential.

High-Interest Debt vs. Student Loan Debt

High-interest debt, such as credit card debt, typically carries a significantly higher interest rate than most federal student loans. This means that the interest accrued on high-interest debt grows much faster, potentially snowballing into a larger overall debt burden. Prioritizing the repayment of high-interest debt before focusing solely on student loans can often be a more financially advantageous strategy, as it reduces the overall interest burden and frees up more funds for future savings and investments. For example, paying down a credit card with a 20% interest rate before a student loan with a 5% interest rate will save you more money in the long run.

Emergency Fund Assessment

An emergency fund is a crucial component of a robust financial plan. It acts as a safety net for unexpected expenses such as medical bills, car repairs, or job loss. Before aggressively repaying student loans, ensure you have a sufficient emergency fund, typically recommended to cover 3-6 months of living expenses. This safeguards you against unforeseen circumstances that could derail your repayment plan and force you to take on additional debt. Having an emergency fund in place provides financial security and allows you to focus on your student loan repayment without the added stress of potential financial emergencies.

Communication with Loan Servicers

Effective communication with your student loan servicer is crucial for successfully paying off your loans early. Understanding their processes and maintaining clear, concise communication can significantly streamline the repayment process and avoid potential misunderstandings. Open and proactive communication can help you navigate any challenges and ensure you’re on track to achieve your financial goals.

Contacting your loan servicer typically involves utilizing the contact information provided on their website or your loan documents. This often includes phone numbers, email addresses, and secure online messaging portals. When initiating contact, it’s helpful to have your loan details readily available, including your loan ID number and the specific questions you wish to address. Remember to be polite and professional in all your interactions.

Best Practices for Effective Communication

Effective communication with your loan servicer hinges on clarity, organization, and documentation. Keeping detailed records of all communication, including dates, times, and the outcome of each interaction, is highly recommended. This documentation can be invaluable if disputes or misunderstandings arise later.

When contacting your servicer, clearly state your purpose and provide all relevant information upfront. Avoid ambiguous language and ensure your requests are specific and easily understood. Follow up on any communication to confirm receipt and understanding. If you’re having trouble reaching someone, try different contact methods or consider escalating your concern to a supervisor.

Potential Communication Challenges and Solutions

Challenges in communicating with loan servicers can range from long wait times to difficulty understanding complex loan terms. Long hold times on the phone can be frustrating, but persistence is key. Consider calling during off-peak hours or utilizing their online messaging system. If you’re struggling to understand the information provided, don’t hesitate to ask for clarification or seek assistance from a financial advisor.

Inconsistent or inaccurate information from the servicer can also be a challenge. If you receive conflicting information, document the discrepancies and request written confirmation of the correct information. Keeping meticulous records of all your interactions will help resolve any confusion.

Examples of Questions to Ask Your Loan Servicer

Before contacting your loan servicer, prepare a list of specific questions. This will ensure you efficiently address all your concerns during the interaction. Asking well-defined questions will help you receive clear and accurate answers.

Examples of questions you might ask include: “What is the current payoff amount for my loan?”, “What are the specific steps involved in making an early lump-sum payment?”, “Are there any penalties for making extra payments?”, “What documentation do you require to process an early repayment?”, and “What is the process for updating my contact information?”

Outcome Summary

Successfully paying off student loans early requires a proactive approach combining financial discipline and strategic planning. By understanding the various repayment methods, implementing effective budgeting techniques, and maintaining open communication with your loan servicer, you can significantly accelerate your progress toward financial independence. Remember, while eliminating interest entirely may not be feasible, substantial savings and a shorter repayment period are achievable with the right strategy.

FAQ Explained

Can I make extra payments without penalty?

Generally, yes. However, check your loan agreement; some loans might have prepayment penalties, though these are uncommon with federal student loans.

Will early repayment affect my credit score?

Paying down debt generally improves your credit score. However, significant changes in your credit utilization might temporarily affect your score. The overall impact is usually positive in the long run.

What if I can’t afford extra payments every month?

Focus on consistent, increased payments when possible. Even small extra payments accumulate over time. Prioritize building an emergency fund before aggressively increasing loan payments.

What happens if I consolidate my loans?

Consolidation simplifies repayment by combining multiple loans into one, but it may alter your interest rate. Carefully compare the new rate to your current rates before consolidating.