The soaring cost of higher education leaves many graduates grappling with substantial student loan debt. Simultaneously, families diligently save for their children’s college education using 529 plans, powerful tax-advantaged savings vehicles. This naturally leads to a crucial question: can these funds, intended for tuition and related expenses, be used to alleviate the burden of student loan repayment? The answer, as we will explore, is nuanced, depending on various factors and interpretations of IRS regulations.

This guide delves into the intricacies of 529 plans and their permissible uses, specifically addressing the possibility of applying these funds towards student loan debt. We will examine the tax implications, potential benefits and drawbacks, and provide clear examples to illustrate the financial ramifications of such a decision. Understanding these complexities is vital for families seeking to maximize the value of their 529 investments and navigate the challenges of financing higher education.

Federal Regulations Regarding 529 Plan Withdrawals

Understanding the IRS rules governing 529 plan withdrawals is crucial for maximizing the tax advantages of these savings vehicles. Improper withdrawals can lead to significant tax penalties, negating the benefits of tax-deferred growth. This section will detail the regulations surrounding qualified and non-qualified withdrawals, providing clarity on what expenses are eligible and the consequences of non-compliance.

IRS Rules on 529 Plan Withdrawals for Education Expenses

The IRS allows tax-free withdrawals from 529 plans for qualified education expenses. These expenses are specifically defined and must be used to pay for the beneficiary’s education. The amount withdrawn is not taxed, and the earnings portion is also tax-free, provided the funds are used for qualified purposes. However, meticulous record-keeping is essential to substantiate these withdrawals in case of an IRS audit. Failing to maintain adequate documentation can result in penalties even if the funds were used for educational purposes.

Penalties for Non-Qualified Withdrawals from a 529 Plan

Non-qualified withdrawals from a 529 plan are subject to income tax on the earnings portion of the withdrawal, plus an additional 10% penalty. This penalty is in addition to any applicable state taxes. For example, if $10,000 is withdrawn, and $3,000 represents earnings, the taxpayer would owe income tax on the $3,000, plus a $300 penalty (10% of $3,000). Exceptions to this penalty exist in cases of death or disability of the beneficiary, but these require specific documentation and procedures. The 10% penalty is a significant deterrent against using 529 funds for non-educational purposes.

Examples of Qualified and Non-Qualified Education Expenses

Qualified education expenses include tuition, fees, books, supplies, and room and board for courses taken at eligible educational institutions. This encompasses both undergraduate and graduate programs, as well as certain vocational training programs. Examples of qualified expenses include tuition payments at a four-year university, fees for required courses, textbooks purchased for a semester, and room and board charges for on-campus housing. Conversely, non-qualified expenses include purchases unrelated to education, such as a new car, personal travel, or investments. Using 529 funds for a down payment on a house or a family vacation would constitute a non-qualified withdrawal, triggering the aforementioned penalties.

Flowchart Illustrating the 529 Plan Withdrawal Process

The following flowchart illustrates the process of withdrawing funds from a 529 plan for education expenses.

[Imagine a flowchart here. The flowchart would begin with “Need to Withdraw Funds?”. A “Yes” branch would lead to “Determine Qualified Education Expense?”. A “Yes” branch would lead to “Submit Withdrawal Request to Plan Provider”. A “No” branch would lead to “Understand Non-Qualified Withdrawal Penalties”. A “Yes” branch under “Submit Withdrawal Request” would lead to “Funds Disbursed”. A “No” branch would lead to “Resolve Issues with Plan Provider”. A “Yes” branch under “Understand Non-Qualified Withdrawal Penalties” would lead to “Proceed with Non-Qualified Withdrawal (Tax & Penalty Implications)”. A “No” branch would lead back to “Determine Qualified Education Expense?”.]

The flowchart visually represents the decision-making process involved in withdrawing funds, highlighting the importance of determining whether the expense is qualified before proceeding with the withdrawal request. Failure to correctly classify the expense can lead to significant financial repercussions.

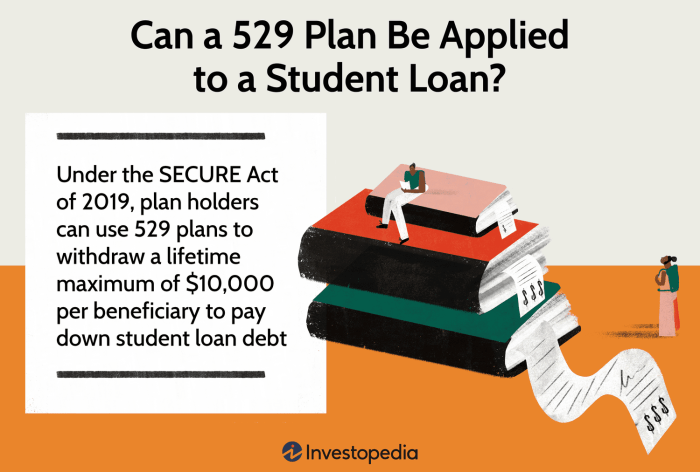

Student Loan Repayment and 529 Plans

The student loan debt crisis in the United States is a significant financial burden for millions of Americans. The sheer volume of outstanding debt and the complexities of repayment options contribute to widespread financial strain and impact long-term financial planning. Understanding the various student loan programs and the potential role of 529 plans in addressing this debt is crucial for informed financial decision-making.

Student loan programs vary significantly in their interest rates and repayment terms. This variation depends on the type of loan (federal or private), the borrower’s creditworthiness, and the specific loan program.

Federal Student Loan Programs and Interest Rates

Federal student loans generally offer lower interest rates than private loans and various repayment plans, including income-driven repayment options that adjust monthly payments based on income. For example, Direct Subsidized Loans for undergraduates typically have lower interest rates than Direct Unsubsidized Loans or Graduate PLUS Loans. The specific interest rates fluctuate annually and are set by the government. Repayment terms also vary, with standard repayment plans typically spanning 10 years, but income-driven repayment plans can extend the repayment period significantly, reducing monthly payments but increasing the total interest paid over the life of the loan.

Private Student Loan Programs and Interest Rates

Private student loans are offered by banks and other financial institutions and are often subject to variable interest rates. These rates are typically higher than federal loan rates and are often tied to market indices. Repayment terms for private loans are usually less flexible than those offered for federal loans. Borrowers with strong credit histories may secure lower interest rates, but those with less-than-perfect credit can face substantially higher rates.

Scenarios Where Using 529 Funds for Student Loan Repayment Might Be Advantageous

While 529 plans are primarily designed for qualified education expenses, there are limited scenarios where using 529 funds for student loan repayment might be beneficial. One such scenario involves a situation where the student has incurred unexpectedly high medical expenses that depleted savings intended for education. Using 529 funds to pay down high-interest private student loans could potentially result in significant savings on interest payments in the long run, especially if the interest rate on the loan significantly exceeds the potential investment returns from the 529 plan. Another scenario could involve a sudden job loss or unexpected financial hardship impacting the ability to make timely student loan payments. In these cases, using 529 funds could provide a short-term solution to avoid default and mitigate the potential damage to the borrower’s credit score. However, it’s crucial to carefully weigh the potential tax implications before making this decision.

Potential Drawbacks to Using 529 Funds for Student Loan Repayment

Using 529 funds for student loan repayment involves several potential drawbacks that require careful consideration.

- Tax Penalties: Withdrawing 529 funds for non-qualified education expenses typically incurs a 10% tax penalty on the earnings, plus regular income tax on the earnings portion of the withdrawal.

- Lost Investment Growth: Withdrawing funds prematurely prevents them from growing tax-deferred, potentially reducing the amount available for future education expenses.

- Limited Flexibility: 529 plans offer limited flexibility compared to other savings or investment vehicles.

- Potential for Better Investment Opportunities: The returns from the 529 plan may not always outperform the interest rate savings achieved by paying down high-interest debt.

Alternative Uses of 529 Plan Funds

While primarily designed for higher education expenses, 529 plans offer flexibility beyond traditional college tuition. Understanding these alternative uses and their tax implications is crucial for maximizing the benefits of your 529 plan. This section details permitted alternative uses, their consequences, and situations where utilizing 529 funds for non-traditional education expenses might be advantageous.

Permitted Alternative Uses of 529 Plan Funds

Beyond college tuition, 529 plan funds can be used for a range of qualified education expenses. These include, but are not limited to, K-12 tuition, fees, books, and supplies; certain apprenticeship programs; and even some expenses related to special needs education. The specific allowable expenses can vary slightly by state, so reviewing your plan’s specific rules is always recommended. However, the general principle is that the expenses must be directly related to the beneficiary’s education.

Tax Implications of Using 529 Funds for Alternative Purposes

The tax advantages of 529 plans are significant when used for qualified education expenses. Earnings grow tax-deferred, and withdrawals for qualified expenses are generally tax-free at the federal level. However, using 529 funds for non-qualified expenses results in a different outcome. The earnings portion of the withdrawal will be subject to both income tax and a 10% penalty. The original contributions are generally not taxed, but the penalty still applies. This underscores the importance of careful planning and understanding the potential tax consequences before using 529 funds for non-education purposes.

Examples of Justified Non-Traditional 529 Fund Usage

There are situations where using 529 funds for non-traditional education expenses can be a sound financial decision. For example, if a beneficiary decides to pursue a vocational training program after high school, 529 funds could cover tuition, fees, and related expenses. Similarly, if a child requires specialized tutoring or therapy due to a learning disability, 529 funds could be used to pay for these essential services. Finally, if a beneficiary attends a private K-12 school, the 529 plan can help cover tuition, textbooks, and other educational costs. These situations highlight the flexibility of 529 plans to adapt to various educational pathways.

Tax Consequences of Using 529 Funds

| Expense Type | Tax on Earnings | Penalty on Earnings | Tax on Contributions |

|---|---|---|---|

| Qualified Education Expenses | None | None | None |

| Non-Qualified Expenses | Yes (ordinary income tax rates) | Yes (10%) | Generally None |

Illustrative Scenarios

Understanding the financial implications of using 529 plan funds for student loan repayment requires careful consideration of individual circumstances. The tax advantages of 529 plans are significant, but they might not always outweigh the potential benefits of other repayment strategies. The following scenarios illustrate situations where using 529 funds for student loans could be either beneficial or detrimental.

Scenario: 529 Funds for Student Loans are Financially Beneficial

Imagine a family with a $20,000 balance in their 529 plan and a student facing $10,000 in federal student loans with a 6% interest rate. The student is graduating and beginning a high-paying job. The family has already exhausted other avenues for funding their child’s education, such as scholarships and grants. Using the $10,000 from the 529 plan to pay off the loan eliminates the 6% interest, saving them potentially hundreds or thousands of dollars over the life of the loan. The remaining $10,000 in the 529 plan could then be invested for future educational expenses or other financial goals. This strategy is particularly advantageous if the student’s income is high enough to eliminate the 10% tax penalty associated with non-qualified withdrawals. The savings on interest may exceed the penalty.

Scenario: 529 Funds for Student Loans are Financially Detrimental

Consider a different family with a $20,000 balance in their 529 plan and a student with $10,000 in low-interest federal student loans (e.g., subsidized loans at 2%). The student plans to pursue a career in public service and qualify for loan forgiveness programs. Using the 529 funds to pay off the loan in this instance would incur a 10% tax penalty on the withdrawn amount ($1000), forgoing the potential for loan forgiveness. Leaving the money in the 529 plan and investing it allows for tax-advantaged growth and potentially a greater return than the low interest rate on the loan. In this case, the tax penalty and lost potential for loan forgiveness would outweigh the benefits of immediate loan repayment.

Visual Representation of a Hypothetical Family’s Financial Situation

The illustration would depict two bar graphs side-by-side. The left graph represents the “Without 529 for Loans” scenario. It shows a large bar representing the student loan debt ($10,000), a smaller bar representing the remaining 529 plan balance ($20,000), and a separate, smaller bar representing accumulated interest on the student loan over time (e.g., $2,000). The right graph represents the “With 529 for Loans” scenario. It shows a significantly smaller bar representing the student loan debt (now $0), a smaller bar representing the remaining 529 plan balance ($10,000), a small bar for the 10% tax penalty incurred ($1,000), and a much smaller or absent bar representing accumulated interest (e.g., $0). Arrows could connect the bars to show the flow of funds and the impact of each decision. The total value (assets minus liabilities) at the end of each scenario would be clearly labelled, illustrating the net financial gain or loss in each case. A legend clearly identifying each bar would make the comparison readily apparent.

Closure

Ultimately, the decision of whether to use 529 plan funds for student loan repayment requires careful consideration of individual circumstances. While not explicitly permitted by the IRS, certain scenarios might justify such a use, though often at a financial cost. A thorough understanding of the tax implications, potential penalties, and available alternatives is paramount. This guide has provided a framework for making an informed decision, emphasizing the importance of consulting with a financial advisor before making any significant changes to your savings or debt repayment strategy.

Question & Answer Hub

Can I use 529 funds for graduate school loans?

Yes, provided the graduate program is considered a qualified education expense by the IRS.

What happens if I withdraw 529 funds for non-qualified expenses?

You will be subject to income tax on the earnings portion of the withdrawal, plus a 10% penalty.

Are there any exceptions to the 10% penalty for non-qualified withdrawals?

Yes, there are some exceptions, such as cases of disability or death. Consult the IRS guidelines for specifics.

Can I transfer 529 funds to another beneficiary?

Yes, you can change the beneficiary to another eligible family member.

Is it better to pay off student loans or contribute to a 529 plan?

This depends on individual circumstances, including the interest rate on your loans and your risk tolerance. Financial advice is recommended.