The crushing weight of student loan debt is a reality for millions, often overshadowing other crucial financial goals. Many find themselves exploring unconventional avenues for relief, and one question frequently arises: can tapping into retirement savings, specifically a 401(k), offer a viable solution? This guide delves into the complexities of using your 401(k) to pay off student loans, weighing the potential benefits against the significant long-term financial ramifications.

We’ll examine the intricate regulations surrounding early 401(k) withdrawals, the tax implications, and the various student loan repayment options available. Through detailed examples and comparisons, we aim to equip you with the knowledge necessary to make an informed decision that aligns with your individual financial circumstances and long-term objectives.

Understanding 401(k) Regulations

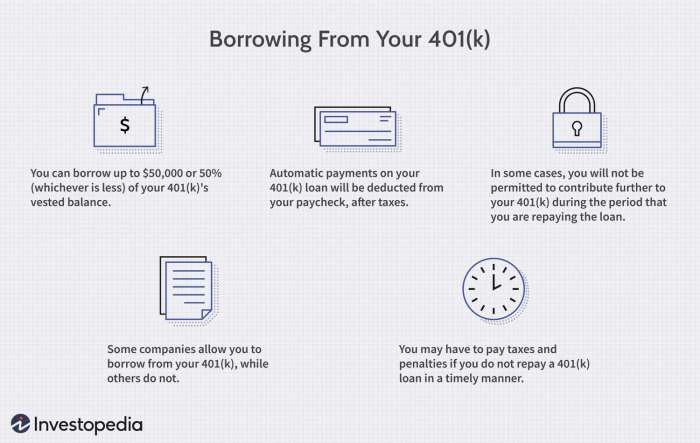

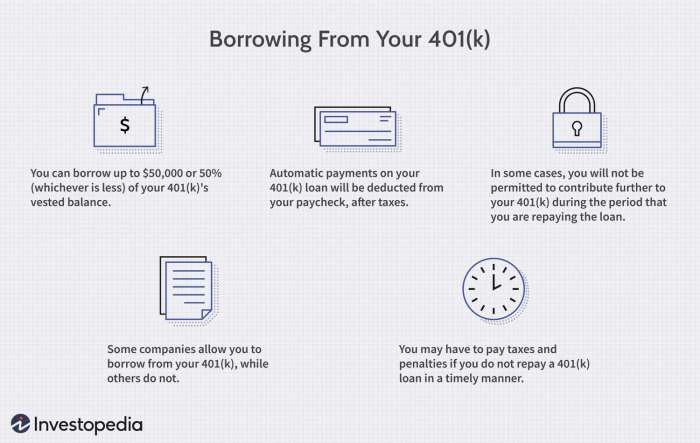

Accessing your 401(k) before retirement age is governed by specific regulations designed to encourage long-term savings. Understanding these rules is crucial before considering using your 401(k) to pay off student loans or for any other pre-retirement purpose. Penalties and tax implications can significantly impact your financial situation.

Rules Governing Early 401(k) Withdrawals

Generally, withdrawing funds from a 401(k) before age 59 1/2 incurs a 10% early withdrawal penalty, in addition to regular income taxes on the withdrawn amount. There are exceptions, however, and the specific rules can vary slightly depending on the plan’s governing documents. These exceptions provide some flexibility, but careful consideration is still required.

Tax Implications of Early 401(k) Withdrawals

Early withdrawals are taxed as ordinary income, meaning they are subject to your current marginal tax rate. This can result in a significantly higher tax burden compared to the lower tax rates typically associated with retirement withdrawals. For example, if you withdraw $10,000 and your marginal tax rate is 22%, you’ll owe $2,200 in federal income taxes, plus any applicable state taxes. This is in addition to the 10% early withdrawal penalty. The total tax and penalty burden on this $10,000 withdrawal would be $3,200, leaving you with only $6,800.

Situations Where Early Withdrawal Penalties Might Be Waived or Reduced

Several exceptions exist that allow for penalty-free or reduced-penalty withdrawals. These include cases of:

* Hardship: This generally refers to immediate and heavy financial needs such as medical expenses, preventing foreclosure, or avoiding eviction. The specific definition of “hardship” varies by plan.

* Death or Disability: If the account holder dies or becomes disabled, beneficiaries or the account holder may be able to withdraw funds without penalty.

* Domestic Abuse Victim: Funds can be withdrawn penalty-free if you are a victim of domestic abuse.

* Certain Qualified Higher Education Expenses: While not directly applicable to paying off existing student loans, some plans allow penalty-free withdrawals for qualified higher education expenses. This is usually limited to the account holder or their dependents.

Comparison of Early Withdrawal Penalties Across Different 401(k) Plans

While the 10% penalty is standard, the specific rules regarding hardship withdrawals and other exceptions can vary between plans. It’s crucial to consult your specific 401(k) plan documents for details. The following table provides a generalized comparison, but it is not exhaustive and should not be used as a substitute for reviewing your individual plan documents.

| Plan Type | Standard Early Withdrawal Penalty | Hardship Withdrawal Availability | Other Potential Exceptions |

|---|---|---|---|

| Traditional 401(k) | 10% + Income Tax | Often Available, but with strict requirements | Death, Disability, Domestic Abuse Victim |

| Roth 401(k) | 10% (contributions) + Income Tax (earnings), Exceptions may apply to contributions. | Often Available, but with strict requirements | Death, Disability, Domestic Abuse Victim |

Student Loan Repayment Options

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available options is crucial for long-term financial well-being. Choosing the right repayment plan depends on your individual financial situation, loan type, and long-term goals. This section Artikels various repayment plans and their associated benefits and drawbacks.

Standard Repayment Plan

The standard repayment plan is the default option for most federal student loans. It typically involves fixed monthly payments over a 10-year period. While straightforward, this plan may result in higher total interest payments compared to income-driven plans. However, it offers the benefit of a predictable payment schedule and a shorter repayment period.

Graduated Repayment Plan

Under a graduated repayment plan, monthly payments start low and gradually increase over time. This can be beneficial in the early stages of a career when income is typically lower. However, payments can become significantly higher later on, potentially causing financial strain. This plan also generally extends the repayment period, leading to higher overall interest costs.

Extended Repayment Plan

This plan stretches the repayment period to a maximum of 25 years for federal loans. Lower monthly payments are a key advantage, but the extended repayment period results in significantly higher interest paid over the life of the loan. This option is generally suitable for borrowers with lower incomes or those facing financial hardship.

Income-Driven Repayment Plans (IDR Plans)

IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), tie monthly payments to your income and family size. Payments are typically lower than under standard plans, making them attractive for borrowers with lower incomes. However, these plans usually extend the repayment period to 20 or 25 years, and any remaining loan balance after the repayment period may be forgiven (though this may be considered taxable income).

Interest Rates and Repayment Terms of Different Loan Types

Federal student loans generally have lower interest rates than private student loans. Subsidized federal loans do not accrue interest while the borrower is in school, during grace periods, or under certain deferment options. Unsubsidized loans accrue interest throughout. Private student loan interest rates are variable and depend on creditworthiness, the loan amount, and the lender. Repayment terms also vary depending on the lender and loan type, ranging from 5 to 25 years. A borrower with multiple loans may have different interest rates and repayment terms for each loan.

Long-Term Financial Implications of Repayment Strategies

Choosing a repayment plan significantly impacts long-term financial health. While lower monthly payments may seem appealing, extending the repayment period leads to increased interest payments, ultimately costing significantly more over the loan’s lifetime. Conversely, higher monthly payments under a standard repayment plan lead to a faster payoff, minimizing interest costs. Careful consideration of the trade-offs between monthly payment amounts and total interest paid is essential. For example, a borrower might choose an IDR plan to manage immediate financial stress, but needs to plan for potential tax implications from loan forgiveness.

Comparison of Student Loan Repayment Options

| Repayment Plan | Pros | Cons |

|---|---|---|

| Standard Repayment | Predictable payments, shortest repayment period | Higher monthly payments, potentially higher total interest |

| Graduated Repayment | Lower initial payments | Increasing payments over time, potentially higher total interest |

| Extended Repayment | Lowest monthly payments | Longest repayment period, significantly higher total interest |

| Income-Driven Repayment | Payments based on income, potentially lower monthly payments | Longer repayment period, potential tax implications from forgiveness |

Financial Implications of Using 401(k) for Student Loans

Withdrawing from your 401(k) to pay off student loans presents a significant financial decision with long-term consequences. While it might offer immediate relief from debt, it can severely impact your retirement savings and overall financial well-being. Understanding the potential drawbacks is crucial before considering this option.

The primary concern is the loss of potential investment growth. Money withdrawn from a 401(k) before retirement age typically incurs taxes and potential penalties, reducing the amount available to pay down your debt. More importantly, you lose out on the years of compounding growth that your contributions would have experienced had they remained invested.

Loss of Potential Investment Growth Due to Early Withdrawal

Let’s consider an example. Suppose you withdraw $20,000 from your 401(k) at age 30 to pay off student loans. Assume an average annual return of 7% (a reasonable assumption based on long-term historical market performance). If that $20,000 had remained invested until age 65, it would have grown to approximately $160,000 due to compounding interest. This calculation doesn’t even account for additional contributions you could have made during those years. The lost opportunity cost of this early withdrawal is substantial. This is a simplified example; actual returns will vary depending on market performance and investment choices.

Comparison of 401(k) Withdrawal versus Other Repayment Methods

Using a 401(k) to pay off student loans should be compared to other repayment options. Income-driven repayment plans, student loan refinancing, and exploring hardship deferments or forbearances are all alternatives that should be considered before depleting retirement savings. While these alternatives may not offer immediate relief, they generally offer better long-term financial outcomes.

Calculating the Total Cost of Using a 401(k) for Student Loan Repayment

A step-by-step guide to calculating the total cost involves several factors.

1. Determine the withdrawal amount: Calculate the exact amount you need to withdraw from your 401(k) to fully or partially pay off your student loans.

2. Calculate taxes and penalties: Federal income tax will be applied to the withdrawn amount, and you may face an additional 10% early withdrawal penalty if you are under age 59 1/2. Your state may also impose additional taxes.

3. Calculate the lost investment growth: Estimate the potential growth of the withdrawn amount had it remained invested in your 401(k) until retirement. Use a reasonable average annual return rate based on historical market data and consider compounding interest.

4. Calculate the total cost: Sum the withdrawal amount, taxes, penalties, and the lost investment growth. This total represents the true cost of using your 401(k) to pay off your student loans. This figure will significantly exceed the initial loan balance.

The total cost of using a 401(k) for student loan repayment is significantly higher than the loan principal due to taxes, penalties, and the loss of potential investment growth.

Alternative Strategies for Student Loan Repayment

Navigating student loan debt can be challenging, but exploring alternative repayment strategies can significantly impact your financial well-being. Understanding the various options available and their implications is crucial for developing a personalized repayment plan. This section Artikels several alternatives to standard repayment plans, detailing their advantages, disadvantages, eligibility criteria, and application processes.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can result in lower monthly payments, particularly during periods of lower income. However, it often extends the repayment period, leading to higher overall interest payments.

- Advantages: Lower monthly payments, potentially affordable during periods of low income.

- Disadvantages: Longer repayment period, potentially higher total interest paid, may lead to a larger tax bill later.

- Eligibility: Generally available to federal student loan borrowers. Specific eligibility requirements vary by plan.

- Application Process: Applications are typically made online through the student loan servicer’s website. You’ll need to provide income and family size information.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can lead to lower monthly payments and faster repayment. However, it might lose federal protections, such as income-driven repayment options.

- Advantages: Potentially lower interest rates, lower monthly payments, faster repayment.

- Disadvantages: Loss of federal student loan benefits, potential for higher fees, credit check required.

- Eligibility: Good to excellent credit score is typically required. Income and debt-to-income ratio are also considered.

- Application Process: Involves applying online through a private lender. You will need to provide financial information and credit history.

Student Loan Consolidation

Consolidation combines multiple federal student loans into a single loan. This simplifies repayment by reducing the number of payments and potentially lowering your monthly payment. However, it may not reduce your interest rate.

- Advantages: Simplifies repayment, potentially lower monthly payment (depending on the repayment plan chosen).

- Disadvantages: May not lower your interest rate, potentially longer repayment period.

- Eligibility: Available to borrowers with multiple federal student loans.

- Application Process: Apply online through the Federal Student Aid website (studentaid.gov).

Deferment and Forbearance

Deferment and forbearance temporarily postpone your student loan payments. Deferment is usually granted due to specific circumstances, such as unemployment or enrollment in school. Forbearance is granted when you are experiencing financial hardship. However, interest may still accrue during these periods, increasing the total amount owed.

- Advantages: Provides temporary relief from payments during financial hardship.

- Disadvantages: Interest may continue to accrue, increasing the total loan amount.

- Eligibility: Eligibility requirements vary depending on the type of loan and the reason for the request.

- Application Process: Applications are typically made through your loan servicer.

Steps to Exploring and Applying for Alternative Student Loan Repayment Options

Before applying for any alternative repayment option, it’s crucial to understand your financial situation and loan details.

- Gather all your student loan information, including loan balances, interest rates, and servicers.

- Assess your current financial situation, including income, expenses, and debt.

- Research different repayment options and compare their advantages and disadvantages.

- Check your eligibility for each option.

- Complete the application process for your chosen option.

- Monitor your loan account regularly to ensure payments are being made correctly.

Illustrative Scenarios

To better understand the implications of using a 401(k) to pay off student loans, let’s examine two contrasting scenarios, one where this strategy proves beneficial and another where it’s detrimental. These scenarios are simplified for illustrative purposes and do not encompass all potential variables. Real-world situations are far more complex.

Scenario 1: Financially Beneficial Use of 401(k) for Student Loan Repayment

This scenario focuses on an individual facing exceptionally high-interest student loan debt and limited income growth prospects. Let’s imagine Sarah, a recent graduate with $100,000 in student loans at a 7% interest rate. She has a modest 401(k) balance of $10,000 and anticipates slow salary increases in her chosen field. By using a portion of her 401(k) to pay off a significant chunk of her high-interest loans, she substantially reduces the overall interest burden she will pay over the life of her loans. This allows her to potentially save significantly more money in the long run, despite the tax penalties associated with early 401(k) withdrawal. The reduced monthly payments also free up cash flow for other financial priorities, such as building an emergency fund or investing in other less risky ventures.

Financial Breakdown: Scenario 1

The following table illustrates the potential long-term savings. Note that these figures are estimations and do not account for potential market fluctuations. The tax penalty for early withdrawal is assumed to be 10% plus any applicable income tax.

| Item | Without 401(k) Withdrawal | With $10,000 401(k) Withdrawal |

|---|---|---|

| Initial Loan Balance | $100,000 | $90,000 |

| Interest Rate | 7% | 7% |

| Estimated Total Interest Paid (over 10 years) | $47,000 (estimated) | $37,000 (estimated) |

| Total Repayment | $147,000 | $127,000 |

| 401(k) Withdrawal Penalty (10% + Taxes) | – | $2,000 (estimated) |

| Net Savings | – | $8,000 (estimated) |

Scenario 2: Financially Detrimental Use of 401(k) for Student Loan Repayment

Conversely, consider Mark, a high-earning individual with $50,000 in student loans at a 4% interest rate and a substantial 401(k) balance of $100,000. Mark is in a high tax bracket and anticipates significant income growth. Using his 401(k) to pay off his relatively low-interest loans would incur substantial tax penalties, significantly diminishing the long-term benefits of his 401(k) growth. The potential return on investment in the 401(k) over the long term significantly outweighs the relatively small savings on interest from paying off the student loan debt.

Financial Breakdown: Scenario 2

This scenario highlights the potential loss from an unwise 401(k) withdrawal. Again, these are estimations and do not include market fluctuations.

| Item | Without 401(k) Withdrawal | With $50,000 401(k) Withdrawal |

|---|---|---|

| Initial Loan Balance | $50,000 | $0 |

| Interest Rate | 4% | – |

| Estimated Total Interest Paid (over 10 years) | $10,000 (estimated) | $0 |

| Total Repayment | $60,000 | $0 |

| 401(k) Withdrawal Penalty (10% + Taxes) | – | $15,000 (estimated) |

| Net Loss | – | $15,000 (estimated) – potential loss of future 401k growth |

Final Wrap-Up

Ultimately, the decision of whether to use your 401(k) to pay off student loans is deeply personal and hinges on a careful assessment of your unique financial situation. While the allure of immediate debt relief is undeniable, the potential sacrifice of long-term retirement security demands careful consideration. By thoroughly understanding the associated costs, penalties, and alternative repayment strategies, you can navigate this complex decision with greater confidence and clarity, ensuring a financially sound future.

FAQ Insights

Can I withdraw only a portion of my 401(k) to pay off student loans?

Yes, you can typically withdraw a portion of your 401(k), but remember that early withdrawal penalties and taxes will apply to the entire amount withdrawn, not just the portion used for student loans.

What are the tax implications of using my 401(k) for student loan repayment?

You’ll generally face income tax on the withdrawn amount, plus a 10% early withdrawal penalty unless you qualify for an exception (e.g., hardship).

Are there any situations where I can avoid the early withdrawal penalty?

Some 401(k) plans may offer exceptions for hardship withdrawals, but the requirements are strict and vary by plan. Consult your plan documents or provider.

What if I have both federal and private student loans? Which should I prioritize?

Prioritize loans with the highest interest rates first, regardless of whether they are federal or private. This will minimize your overall interest payments.