The crushing weight of student loan debt is a reality for millions, often forcing difficult financial choices. One question frequently arises: can tapping into retirement savings, specifically a 401(k), provide a solution? While seemingly appealing, this decision carries significant financial implications, demanding a careful consideration of both short-term relief and long-term retirement security. This guide explores the complexities of using 401(k) funds to pay student loans, examining the regulations, alternatives, and potential consequences to help you make an informed decision.

Understanding the rules surrounding 401(k) withdrawals is paramount. Early withdrawals typically incur penalties and taxes, significantly reducing the amount you actually receive. Conversely, various student loan repayment plans offer different approaches to managing debt, each with its own advantages and disadvantages. Weighing the immediate benefits of debt reduction against the potential long-term costs of jeopardizing retirement savings is crucial before making a decision.

Understanding 401(k) Regulations

Before considering using your 401(k) to pay off student loans, it’s crucial to understand the regulations surrounding early withdrawals. These regulations are complex and vary slightly depending on the specific plan, so consulting your plan documents or a financial advisor is highly recommended. Generally, accessing your 401(k) before retirement age comes with significant financial consequences.

General Rules and Restrictions Governing 401(k) Withdrawals

Generally, you cannot access your 401(k) funds without penalty until you reach age 59 1/2. Exceptions exist, but they are limited and often come with substantial tax liabilities and penalties. The rules governing 401(k) withdrawals are designed to encourage long-term savings for retirement. Early withdrawals disrupt this plan and are therefore heavily discouraged. Accessing funds before retirement typically requires specific qualifying events.

Tax Implications of Early 401(k) Withdrawals

Early withdrawals from a 401(k) are subject to both income tax and a 10% early withdrawal penalty. This means that not only will you pay taxes on the amount withdrawn as if it were regular income, but you will also pay an additional 10% penalty. For example, if you withdraw $10,000 and your tax bracket is 22%, you would owe $2,200 in income tax plus $1,000 in penalties, leaving you with significantly less than the initial $10,000. This makes early withdrawals a very expensive option.

Legitimate Reasons for Early 401(k) Withdrawal

There are limited circumstances where you may be able to withdraw from your 401(k) before age 59 1/2 without incurring the 10% penalty. These include: death or disability; birth or adoption expenses; certain medical expenses; payments made directly to a domestic abuse victim; qualified higher education expenses (in limited circumstances); and unforeseeable emergency expenses. However, even in these situations, the withdrawn amount will still be subject to your regular income tax rate. The specific rules for each exception are complex and should be reviewed carefully.

Potential Penalties Associated with Early 401(k) Withdrawals

As previously mentioned, the primary penalty for early 401(k) withdrawal is the 10% early withdrawal penalty. However, additional penalties may apply depending on the specific circumstances and your plan’s rules. For instance, some plans may impose additional fees for early withdrawals. It is crucial to consult your plan documents to understand all potential penalties before making any withdrawal decisions. These penalties can significantly reduce the amount of money you actually receive.

Comparison of Withdrawal Options and Associated Penalties

| Withdrawal Type | Age Requirement | Income Tax | 10% Penalty |

|---|---|---|---|

| Early Withdrawal (Non-qualified) | Before 59 1/2 (generally) | Yes, at your ordinary income tax rate | Yes |

| Withdrawal for Qualified Expenses (e.g., Birth, Adoption, Medical) | Before 59 1/2 (with qualifying event) | Yes, at your ordinary income tax rate | No (but exceptions apply; verify your plan) |

| Hardship Withdrawal | Before 59 1/2 (with qualifying hardship) | Yes, at your ordinary income tax rate | May or may not apply depending on plan rules and hardship qualifications |

| Withdrawal at Age 59 1/2 or Later | 59 1/2 or older | Yes, at your ordinary income tax rate | No |

Student Loan Repayment Options

Navigating the complexities of federal student loan repayment can feel overwhelming. Understanding the various repayment plans available is crucial for effectively managing your debt and minimizing long-term financial strain. Choosing the right plan depends on your individual financial circumstances, income, and long-term goals.

Federal Student Loan Repayment Plan Types

Several repayment plans are available for federal student loans, each designed to cater to different financial situations. These plans offer varying monthly payment amounts, repayment periods, and ultimately, the total amount paid over the life of the loan. Careful consideration of these factors is essential for making an informed decision.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to income-driven plans.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This can provide initial relief but leads to significantly higher payments later in the repayment term.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans—including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR)—base monthly payments on your discretionary income and family size. They typically result in lower monthly payments and potentially loan forgiveness after 20 or 25 years, depending on the plan.

Comparison of Repayment Plan Benefits and Drawbacks

The choice between repayment plans involves weighing the advantages and disadvantages of each option. For example, while an extended repayment plan offers lower monthly payments, it significantly increases the total interest paid over the loan’s life. Conversely, income-driven repayment plans provide lower monthly payments but may extend the repayment period considerably and potentially lead to a larger total repayment amount.

| Repayment Plan | Benefit | Drawback |

|---|---|---|

| Standard | Fixed payments, predictable repayment schedule | Higher monthly payments |

| Graduated | Low initial payments | Substantially higher payments later |

| Extended | Lower monthly payments | Higher total interest paid |

| IDR Plans | Lower monthly payments based on income | Longer repayment periods, potential for higher total interest |

Applying for Income-Driven Repayment Plans

Applying for an IDR plan typically involves completing a federal student aid application (FAFSA) and providing documentation of your income and family size. The specific requirements and application process may vary depending on the chosen IDR plan and your loan servicer. It’s crucial to carefully review the requirements and deadlines to ensure a smooth application process. Many servicers offer online portals to simplify this process.

Implications of Loan Forgiveness Programs

Several loan forgiveness programs exist for federal student loans, primarily targeting borrowers in public service or those enrolled in IDR plans for extended periods. These programs can significantly reduce or eliminate student loan debt after meeting specific requirements. However, it’s important to note that these programs are subject to change and may have eligibility restrictions. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. The potential for loan forgiveness should be carefully considered when selecting a repayment plan, but it shouldn’t be the sole deciding factor.

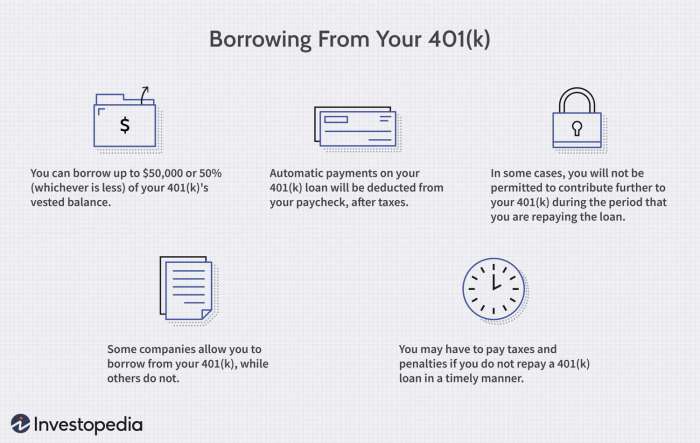

Comparing 401(k) Withdrawal to Other Debt Solutions

Using your 401(k) to pay off student loans is a drastic measure with significant long-term implications. Before considering this option, it’s crucial to weigh it against other, potentially less damaging, debt management strategies. Understanding the potential financial consequences is paramount to making an informed decision.

This section compares using 401(k) funds for student loan repayment with alternative debt consolidation methods, highlighting the potential long-term financial repercussions of early 401(k) withdrawal and its impact on retirement savings. A hypothetical scenario will illustrate the financial trade-offs involved.

Long-Term Financial Consequences of Early 401(k) Withdrawal

Withdrawing from your 401(k) before retirement incurs significant penalties, typically including a 10% early withdrawal penalty plus applicable income taxes. This substantially reduces the amount you receive, severely impacting your retirement nest egg. Furthermore, you lose out on years of potential investment growth, compounding the negative effect. The longer the money remains invested, the greater the potential for growth, leading to a substantially larger retirement fund. For example, a $20,000 withdrawal today could potentially grow to $100,000 or more by retirement age if left invested. Losing that potential growth severely limits your retirement options.

Impact of Early 401(k) Withdrawal on Retirement Savings

The impact on retirement savings can be devastating. Consider the effect of compound interest. Early withdrawal not only reduces the principal but also eliminates the potential for future growth on that withdrawn amount. This loss compounds over time, resulting in a significantly smaller retirement fund. For instance, a 30-year-old withdrawing $20,000 might lose out on $100,000 or more by retirement age, depending on investment returns. This could mean a lower standard of living in retirement or even the need to continue working longer than planned.

Comparison with Other Debt Consolidation Strategies

Several alternatives to 401(k) withdrawal exist for managing student loan debt. These include debt consolidation loans, which offer lower interest rates than some student loans; income-driven repayment plans, adjusting monthly payments based on income; and student loan refinancing, which can streamline payments and potentially lower interest rates. These options often offer more favorable terms than incurring the penalties associated with a 401(k) withdrawal.

Hypothetical Scenario Illustrating Financial Trade-offs

Let’s imagine Sarah, a 35-year-old with $50,000 in student loan debt and a $100,000 401(k). If she withdraws $50,000 from her 401(k), she’ll likely pay around $5,000 in penalties and taxes, leaving her with approximately $45,000. However, this leaves her with only $55,000 in her 401(k), significantly reducing her retirement savings. Alternatively, if she consolidates her loans with a lower interest rate and makes consistent payments, she might pay off the debt over 10-15 years with less overall cost and maintain her 401(k) for retirement. This scenario demonstrates the considerable financial trade-off between immediate debt relief and long-term financial security.

Alternative Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a multifaceted approach. While withdrawing from your 401(k) is generally not recommended, several viable alternatives exist to help you navigate your repayment journey. These strategies focus on optimizing your financial resources and exploring options tailored to your specific circumstances.

Student Loan Repayment Plans

Several federal student loan repayment plans offer varying payment amounts and durations, catering to diverse financial situations. These plans can significantly impact your monthly budget and overall repayment timeline. Income-Driven Repayment (IDR) plans, for instance, base your monthly payment on your income and family size, potentially lowering your immediate financial burden. Standard Repayment plans offer fixed monthly payments over a 10-year period. Understanding the nuances of each plan is crucial in selecting the most suitable option. The Federal Student Aid website (studentaid.gov) provides detailed information on available repayment plans and eligibility criteria.

Student Loan Refinancing Options

Refinancing your student loans with a private lender might lower your interest rate and monthly payments. This involves consolidating your existing loans into a new loan with a different lender, often resulting in more favorable terms. However, it’s crucial to compare offers from multiple lenders to secure the best possible rate and terms. Factors such as your credit score, loan amount, and repayment history significantly influence the interest rate you qualify for. Before refinancing, carefully assess the implications, including the potential loss of federal loan benefits, such as income-driven repayment plans or loan forgiveness programs. Credible sources like NerdWallet and Bankrate offer tools and resources to compare refinancing options.

Seeking Professional Financial Advice

A certified financial planner (CFP) can provide personalized guidance on debt management strategies. They can analyze your financial situation, create a customized repayment plan, and help you prioritize debt repayment while considering other financial goals, such as saving for retirement or purchasing a home. A CFP’s expertise can be invaluable in navigating complex financial situations and making informed decisions. The Financial Planning Association (FPA) website provides resources to locate certified financial planners in your area.

Creating a Realistic Budget for Debt Repayment

A well-structured budget is fundamental to effective debt management. Tracking your income and expenses allows you to identify areas for potential savings and allocate funds towards your student loan repayment. Consider using budgeting apps or spreadsheets to monitor your spending habits and adjust your budget as needed. Prioritizing essential expenses and reducing discretionary spending can free up additional funds for debt repayment. A realistic budget ensures that your repayment plan is sustainable and reduces the risk of defaulting on your loans. Many free online resources and budgeting templates are available to help you create a personalized budget.

Illustrative Scenarios

To further clarify the potential financial ramifications of using 401(k) funds to pay off student loans, let’s examine two contrasting scenarios: one involving a high-income earner and another focusing on a low-income earner. These examples highlight the complexities and potential long-term consequences of this decision.

High-Income Earner Scenario

Consider Sarah, a 35-year-old software engineer earning $200,000 annually. She has $100,000 in student loan debt and a $200,000 401(k) balance. If Sarah withdraws $100,000 from her 401(k) to pay off her student loans, she will incur immediate tax penalties and potentially an early withdrawal fee, depending on her plan’s specifics. Let’s assume a combined penalty of 25%, resulting in a net gain of only $75,000. The lost opportunity cost of forgoing potential investment growth on that $100,000 is substantial. Over 20 years, assuming a conservative 7% annual return, this lost growth could easily exceed $300,000. Furthermore, the tax burden on the withdrawn amount will reduce her current income, potentially impacting future tax brackets and retirement savings contributions. This scenario demonstrates that while immediate debt relief is achieved, the long-term financial consequences could be significantly more detrimental for a high-income earner due to their higher earning potential and greater capacity for future investment growth.

Low-Income Earner Scenario

Now, consider David, a 28-year-old teacher earning $45,000 annually. He has $50,000 in student loan debt and a $20,000 401(k) balance. He’s struggling to make ends meet and considers withdrawing his entire 401(k) to eliminate his student loan debt. Similar to Sarah, David would face tax penalties and potential early withdrawal fees, reducing his net gain. Let’s assume a 25% penalty again, leaving him with $15,000. While this significantly reduces his debt, it also depletes his retirement savings. The lost growth on this smaller amount is less dramatic than in Sarah’s case, but it still represents a significant loss for someone with limited income and a longer time horizon until retirement. The long-term impact is a severely reduced retirement nest egg, increasing the risk of financial hardship in his later years.

Visual Representation of Financial Impact

A visual representation would likely consist of two bar graphs, one for each scenario. Each graph would compare the initial 401(k) balance to the net amount remaining after the withdrawal and associated penalties. A second set of bars would illustrate the projected growth of the initial 401(k) balance over a 20-year period, compared to the growth of the reduced balance after the withdrawal. The difference in the projected growth would dramatically highlight the long-term financial consequences of the 401(k) withdrawal, particularly in Sarah’s case. The contrast between the two graphs would clearly demonstrate the significantly larger financial impact on the high-income earner due to the compounding effect of investment growth over time. Finally, a smaller chart could display the additional tax liability incurred in both scenarios, further emphasizing the overall cost of this decision.

Ultimate Conclusion

The decision of whether to use 401(k) funds to pay off student loans is deeply personal and hinges on individual circumstances. While the allure of immediate debt relief is strong, the long-term consequences for retirement savings can be substantial. Thoroughly exploring all available student loan repayment options, understanding the tax implications of early 401(k) withdrawals, and seeking professional financial advice are vital steps in navigating this complex financial dilemma. Prioritizing a comprehensive financial plan that balances present needs with future security is key to achieving long-term financial well-being.

Question & Answer Hub

What are the tax consequences of withdrawing from a 401(k) before age 59 1/2?

You’ll generally face a 10% early withdrawal penalty, plus you’ll owe income tax on the amount withdrawn.

Are there any exceptions to the early withdrawal penalties for 401(k)s?

Yes, there are exceptions such as substantial hardship, death or disability, or certain qualified domestic relations orders (QDROs).

Can I refinance my student loans to lower my monthly payments?

Yes, refinancing can potentially lower your interest rate and monthly payment, but it might impact your loan forgiveness eligibility.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially leading to loan forgiveness after a set period.