The crushing weight of student loan debt is a pervasive reality for millions, impacting not only finances but also mental well-being. This guide explores the multifaceted challenges of managing unpayable student loans, offering strategies for navigating this difficult situation. We delve into the emotional toll, financial strategies, legal ramifications, and societal implications of this widespread crisis, providing readers with a clear understanding of their options and resources.

From exploring the psychological effects of overwhelming debt to outlining practical steps for debt management and legal recourse, we aim to empower individuals facing this struggle. We will examine various repayment plans, explore the potential of forgiveness programs, and discuss the legal consequences of default. The goal is to provide a holistic view of this complex issue, offering support and guidance to those burdened by unpayable student loans.

The Emotional Impact of Student Loan Debt

The crushing weight of student loan debt extends far beyond the financial burden; it significantly impacts the mental and emotional well-being of individuals. The constant pressure of looming payments, coupled with the uncertainty of the future, creates a pervasive sense of anxiety and stress that can profoundly affect daily life. This stress is not simply a matter of inconvenience; it can lead to serious mental health challenges.

The psychological effects of being unable to pay student loans are multifaceted and can range from mild anxiety to severe depression. The inability to meet financial obligations triggers feelings of failure, shame, and hopelessness. This can lead to decreased self-esteem, difficulty concentrating, and problems with sleep. The constant worry about debt can also manifest as irritability, increased social isolation, and even physical symptoms like headaches and stomach problems.

Financial Stress and Mental Health

Financial stress related to student loan debt is a major contributor to poor mental health. Studies have shown a strong correlation between high levels of debt and increased rates of depression, anxiety, and even suicidal ideation. The relentless pressure to find ways to pay back loans, often while juggling other financial responsibilities, can create a sense of overwhelm and helplessness. This is particularly true for individuals who are unemployed or underemployed, or those facing unexpected life events like illness or job loss. The constant fear of defaulting on loans adds another layer of stress, impacting their ability to plan for the future and achieve personal goals. For example, a recent study by the American Psychological Association found that individuals with high levels of student loan debt reported significantly higher levels of stress and anxiety compared to their debt-free counterparts.

Coping Mechanisms for Insurmountable Student Loan Debt

Individuals facing insurmountable student loan debt often employ various coping mechanisms, some healthy and others less so. Healthy coping mechanisms include seeking professional help from therapists or financial advisors, connecting with support groups, and prioritizing self-care activities like exercise and mindfulness. Less healthy coping mechanisms, however, can include avoidance, denial, substance abuse, or unhealthy eating habits. These coping strategies, while providing temporary relief, often exacerbate the underlying problems in the long run and hinder the individual’s ability to address the financial challenges effectively. For instance, someone might avoid opening their mail to delay confronting the reality of their debt, which only makes the problem worse over time.

Available Support Systems

Several support systems are available to individuals struggling with student loan payments. These include non-profit credit counseling agencies that can provide guidance on debt management strategies and explore options like income-driven repayment plans or loan consolidation. Many universities also offer career services and financial literacy programs that can help graduates navigate their student loan debt. Additionally, mental health professionals can provide counseling and support to help individuals cope with the emotional and psychological toll of student loan debt. Government agencies, such as the Department of Education, also offer resources and information on repayment options and hardship programs. These resources can be invaluable in helping individuals find a sustainable path towards managing their student loan debt and improving their overall well-being.

Financial Strategies for Managing Unpayable Student Loans

Facing insurmountable student loan debt can be incredibly stressful, but several strategies can help manage the burden and potentially find a path towards financial stability. Understanding these options and proactively engaging with your lenders is crucial. This section Artikels various approaches to consider, emphasizing the importance of exploring all available avenues before resorting to drastic measures.

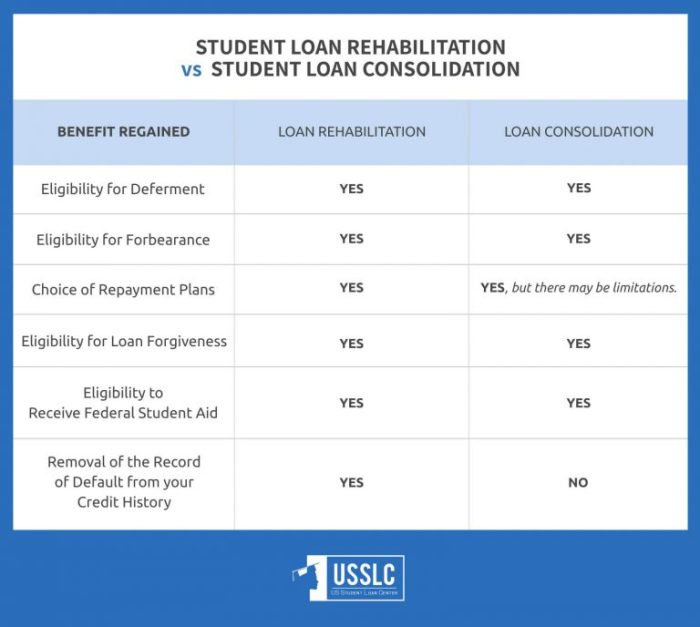

Debt Consolidation

Debt consolidation involves combining multiple student loans into a single loan with potentially more favorable terms, such as a lower interest rate or a longer repayment period. This can simplify repayment and potentially reduce monthly payments. However, it’s important to carefully compare the terms of the new loan to your existing loans to ensure that consolidation truly benefits your financial situation. A longer repayment period, while lowering monthly payments, may result in paying significantly more interest over the life of the loan. Consider using a reputable financial advisor to help assess whether debt consolidation is the right choice for your circumstances.

Debt Negotiation

Negotiating with your lenders directly is another avenue to explore. This may involve requesting a temporary forbearance (suspension of payments), a deferment (postponement of payments), or a modification of your repayment plan. Successful negotiation often requires presenting a compelling case demonstrating your financial hardship and proposing a realistic repayment plan. Documenting your income, expenses, and any unforeseen circumstances that have impacted your ability to repay your loans is essential. Be prepared for a potentially lengthy process that may involve multiple communications with your lenders.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie your monthly student loan payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility criteria vary depending on the plan, but generally involve demonstrating financial need. The application process usually involves submitting detailed financial information to your loan servicer. While IDR plans can significantly reduce monthly payments, it’s crucial to understand that they may extend the repayment period, leading to higher total interest payments over the life of the loan. The potential for loan forgiveness after a specified period of repayment (often 20 or 25 years) is a significant advantage of these plans.

Student Loan Forgiveness Programs

Several student loan forgiveness programs exist, often targeted at specific professions (like teachers or public service employees) or borrowers who meet certain income requirements. These programs can provide partial or complete loan forgiveness after a period of qualifying employment or repayment. Eligibility requirements are stringent, and the application process can be complex. It’s essential to thoroughly research the specific requirements of each program to determine eligibility and understand the implications before applying. Examples of these programs include the Public Service Loan Forgiveness (PSLF) program and certain state-sponsored forgiveness initiatives. These programs are subject to change, and careful monitoring of updates and guidelines is crucial.

Step-by-Step Guide for Contacting Lenders

1. Gather your information: Collect all relevant loan details, including loan numbers, balances, and contact information for your lenders. Compile documentation supporting your financial hardship, such as pay stubs, tax returns, and medical bills.

2. Contact your loan servicer: Identify the servicer responsible for your loans and contact them through their preferred communication channels (phone, mail, or online portal).

3. Clearly explain your situation: Articulate your financial difficulties and explain why you are unable to make your current loan payments. Be polite, professional, and concise in your communication.

4. Propose a solution: Suggest a realistic repayment plan or explore options like forbearance, deferment, or an IDR plan.

5. Document everything: Keep records of all communication with your lenders, including dates, times, and summaries of conversations.

6. Follow up: If you don’t receive a response within a reasonable timeframe, follow up with your lender to ensure your request is being processed.

Legal and Regulatory Aspects of Student Loan Default

Defaulting on student loans carries significant legal and financial ramifications. Understanding these consequences is crucial for borrowers facing repayment difficulties. Failure to meet repayment obligations triggers a chain of events that can severely impact a borrower’s creditworthiness and financial future.

Legal Consequences of Student Loan Default

Defaulting on federal student loans initiates a series of legal actions. The Department of Education (or its contracted collection agencies) will pursue various methods to recover the outstanding debt. These actions can include wage garnishment, tax refund offset, and even legal action to seize assets. The specific actions taken will depend on the amount of debt owed and the borrower’s financial situation. The consequences can be severe and long-lasting, impacting credit scores and future borrowing opportunities. State laws may also add additional consequences. For instance, some states may suspend professional licenses for borrowers in default.

Impact on Credit Scores and Future Borrowing

A student loan default has a devastating impact on credit scores. It significantly lowers credit scores, making it difficult to obtain credit in the future. This can affect the ability to secure mortgages, auto loans, credit cards, and even rent an apartment. The negative impact on credit scores can persist for years, even after the debt is repaid. Lenders view borrowers with a history of default as high-risk, leading to higher interest rates or outright denial of credit applications. For example, a default can result in a credit score drop of 100-200 points, making it significantly harder to qualify for favorable loan terms.

Wage Garnishment and Tax Refund Offset

Wage garnishment involves a portion of a borrower’s wages being directly deducted by their employer to repay the defaulted student loan debt. The amount garnished is typically capped by federal law, but it can still represent a substantial portion of income. Tax refund offset is another method used to recover defaulted loans. The government can intercept and seize a borrower’s federal tax refund to apply towards the outstanding debt. These actions are taken without prior warning or court intervention after the borrower is officially in default status. For instance, if a borrower owes $10,000 and their annual tax refund is $5,000, the entire refund may be seized to partially settle the debt.

Legal Protections Available to Borrowers

While the consequences of default are severe, some legal protections exist for borrowers facing financial hardship. These include income-driven repayment plans, which adjust monthly payments based on income and family size. Borrowers may also qualify for loan rehabilitation programs, which involve making a series of on-time payments to restore their loans to good standing. Additionally, borrowers may be able to pursue loan forgiveness programs based on their employment or specific circumstances, such as working in public service. However, eligibility criteria for these programs are stringent, and the application process can be complex. Each program has specific requirements and limitations. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan.

The Societal Impact of Student Loan Debt Crisis

The pervasive burden of student loan debt extends far beyond the individual borrower, significantly impacting the broader economy and social fabric. Its consequences ripple through various aspects of society, hindering economic growth, delaying major life milestones, and exacerbating existing inequalities. Understanding these societal ramifications is crucial for developing effective policy solutions.

The accumulation of student loan debt has demonstrable effects on the overall economy. A significant portion of disposable income is diverted towards loan repayments, leaving less for consumption and investment. This reduced consumer spending can stifle economic growth, while the debt burden can also discourage entrepreneurship, as individuals may be hesitant to take on the risks associated with starting a business when already grappling with substantial debt. This dampening effect on economic activity is particularly pronounced among younger generations, who are crucial drivers of innovation and economic dynamism.

Economic Impacts of Widespread Student Loan Debt

Widespread student loan debt negatively impacts economic growth through reduced consumer spending and investment. For example, a recent study by the Federal Reserve Bank of New York showed a correlation between high student loan debt and lower rates of homeownership and entrepreneurship among young adults. This reduction in economic activity translates to slower overall growth and potentially reduced tax revenue for the government. Moreover, the increased demand for debt counseling and related services, while creating some jobs, represents a misallocation of resources that could otherwise contribute to more productive sectors of the economy.

Impact of Student Loan Debt on Homeownership and Family Formation

Student loan debt significantly impacts major life milestones such as homeownership and family formation. The substantial monthly payments often make it difficult for borrowers to save for a down payment on a house or afford the associated costs of homeownership. Similarly, the financial strain of loan repayments can delay or prevent individuals from starting families, potentially contributing to lower birth rates and altering demographic trends. The pressure to repay loans can also force individuals to postpone other significant life decisions, such as pursuing further education or investing in their careers. This delay can have long-term consequences on career advancement and earning potential.

Potential Policy Solutions to Address the Student Loan Debt Crisis

Several policy solutions could effectively address the student loan debt crisis. These include targeted loan forgiveness programs for specific demographics or income brackets, income-driven repayment plans that adjust payments based on borrowers’ income, and increased funding for affordable higher education to reduce the need for extensive borrowing. Furthermore, stricter regulations on for-profit colleges and universities could help prevent the accumulation of excessive debt by students attending institutions with questionable value propositions. Finally, a comprehensive overhaul of the student loan system to streamline processes and enhance transparency could also contribute to a more sustainable and equitable system.

Comparison of Student Loan Debt Levels Across Different Demographics

Student loan debt levels vary significantly across different demographic groups. Studies consistently show that minority borrowers, particularly Black and Hispanic individuals, often carry higher levels of student loan debt than their white counterparts. This disparity is often linked to factors such as lower access to financial aid, higher attendance at for-profit institutions, and limited family wealth to support educational expenses. Similarly, women often accumulate more student loan debt than men, potentially due to factors like pursuing higher education in fields with lower earning potential or shouldering a greater share of household financial responsibilities. These disparities highlight the need for targeted policy interventions to address systemic inequities in access to higher education and financial resources.

Illustrative Examples of Personal Struggles with Student Loan Debt

The weight of student loan debt can be profoundly debilitating, impacting not only finances but also mental health and overall well-being. Understanding the diverse experiences of individuals struggling with unpayable loans is crucial for developing effective solutions and fostering empathy. This section presents a fictional case study and a narrative to illustrate the harsh realities faced by many borrowers.

A Fictional Case Study: The Impact of Unpayable Student Loans on Sarah Miller

The following table details the circumstances of Sarah Miller, a fictional individual whose story exemplifies the challenges faced by many burdened with student loan debt.

| Name | Age | Education Level | Debt Amount |

|---|---|---|---|

| Sarah Miller | 32 | Master’s Degree in Education | $120,000 |

Sarah Miller’s Journey: A Narrative of Financial and Emotional Struggle

Sarah, a dedicated educator, pursued a Master’s degree to advance her career and improve her earning potential. However, the high cost of tuition left her with a substantial debt burden of $120,000. Despite working diligently and maintaining a frugal lifestyle, she found herself struggling to make even the minimum monthly payments. The constant stress of looming debt affected her sleep, her relationships, and her overall mental health. She considered career changes, but the limited job market and the fear of accumulating further debt through retraining kept her trapped in a cycle of financial anxiety. The weight of her student loans overshadowed her professional achievements, leaving her feeling hopeless and defeated. She experienced significant emotional distress, leading to periods of isolation and difficulty focusing on her work. The constant pressure to find ways to manage her debt significantly impacted her personal life, limiting her ability to enjoy leisure activities or plan for her future. The weight of her debt felt insurmountable, leaving her feeling trapped and powerless.

Visual Representation of Overwhelming Student Loan Debt

Imagine a powerful visual: a lone figure, representing Sarah, hunched over, visibly strained, and almost crushed beneath a towering pile of papers. These papers, meticulously detailed and overflowing, symbolize the overwhelming volume of student loan documents, statements, and notices. The figure’s posture conveys a sense of defeat and despair, their shoulders slumped, head bowed low under the immense weight. The papers themselves are not simply neat stacks; they are chaotic, overflowing, and spilling onto the ground, visually representing the uncontrolled and overwhelming nature of the debt. The color palette would be muted and somber, emphasizing the bleakness of the situation. The lighting could be dim, further highlighting the feeling of oppression and hopelessness. The overall effect would be a striking image conveying the crushing weight of student loan debt and the emotional toll it takes on individuals. The visual would be a stark reminder of the human cost of the student loan crisis.

Last Point

Navigating the complexities of unpayable student loans requires a multifaceted approach, encompassing emotional resilience, strategic financial planning, and a thorough understanding of legal options. While the journey can be challenging, this guide has provided a framework for understanding the issues, accessing resources, and charting a path toward financial stability. Remember, seeking professional guidance from financial advisors and legal experts is crucial in navigating this complex landscape.

FAQ Compilation

What happens if I stop paying my student loans?

Failure to make payments will result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment, tax refund offset, and legal action.

Can I negotiate my student loan payments?

Yes, contacting your lender directly to discuss your financial situation and explore options like income-driven repayment plans or forbearance is possible. Be prepared to provide documentation supporting your circumstances.

What is an income-driven repayment plan?

These plans base your monthly payments on your income and family size, potentially lowering your payments and extending the repayment period.

Are there any resources available to help me manage my student loan debt?

Yes, numerous non-profit organizations and government agencies offer free counseling and resources to help manage student loan debt. The National Foundation for Credit Counseling (NFCC) is a good starting point.