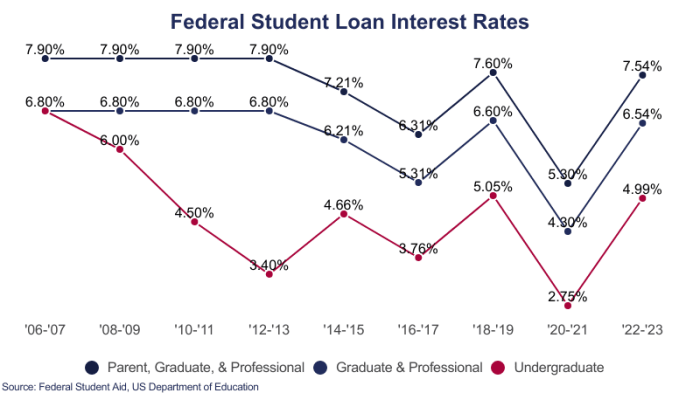

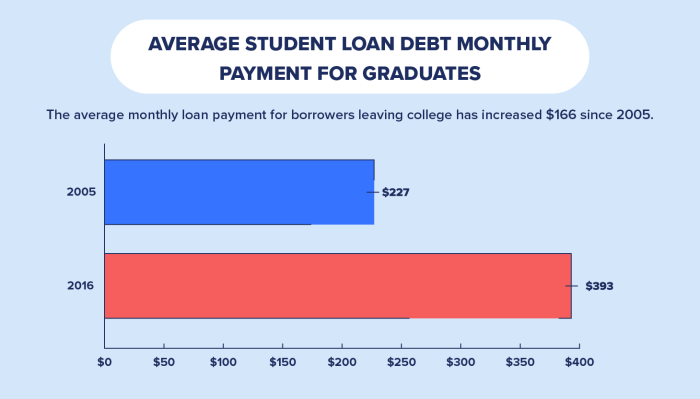

The flow of student loan interest from borrower to lender is a complex system impacting individuals, institutions, and the economy. Understanding this intricate financial ecosystem requires examining various perspectives – from the borrower grappling with repayment to the lender managing risk and profitability. This exploration delves into the mechanics of student loan interest, revealing the factors influencing rates, the strategies employed by lenders, and the broader economic consequences. This analysis will dissect the different types of student loan interest (fixed versus variable), exploring how interest capitalization impacts the total debt. We’ll examine the regulatory landscape governing lenders, considering their risk Read More …