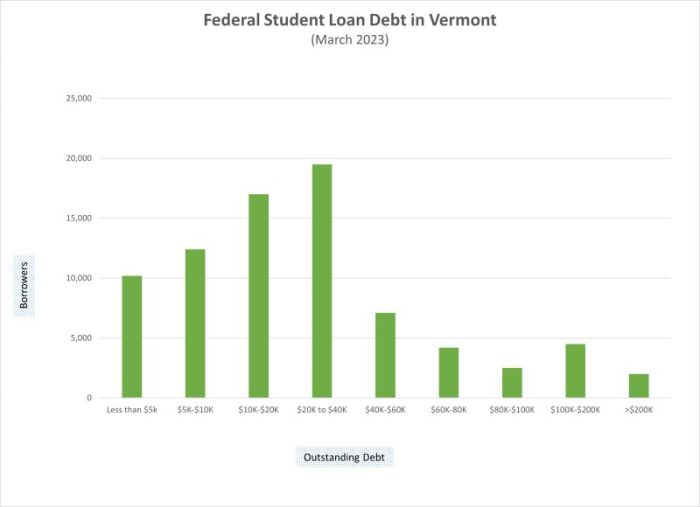

Securing a higher education is a significant investment, and understanding the landscape of student loan options is crucial for Vermont students. This guide delves into the intricacies of Vermont student loan programs, providing a clear overview of available options, eligibility requirements, and repayment strategies. We’ll explore both state-specific and federal loan programs, highlighting their unique benefits and drawbacks to help you make informed decisions about financing your education. From understanding eligibility criteria and interest rates to navigating loan forgiveness programs and managing debt effectively, this resource aims to empower Vermont students with the knowledge they need to successfully navigate the Read More …