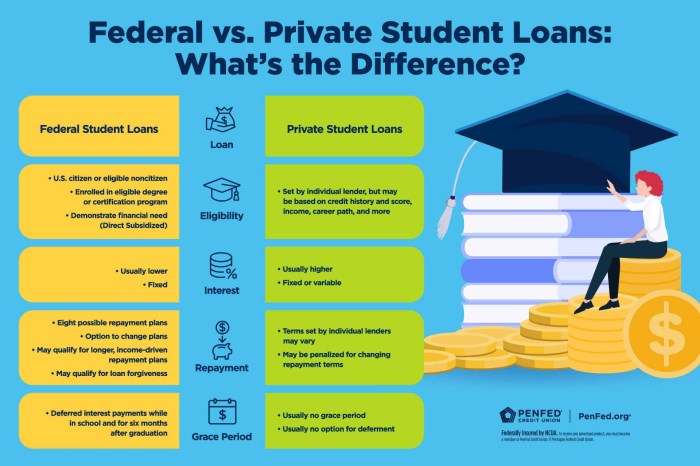

Securing a subsidized student loan can significantly ease the financial burden of higher education. Understanding the eligibility criteria, however, is crucial. This guide navigates the process of qualifying for these loans, explaining the requirements, the application process, and what to expect afterward. We’ll explore the intricacies of financial need assessment, the various loan types available, and the importance of maintaining satisfactory academic progress. By the end, you’ll have a clearer understanding of your chances of securing this valuable financial aid. From determining your dependency status and completing the FAFSA form to understanding repayment options and avoiding default, we aim to Read More …