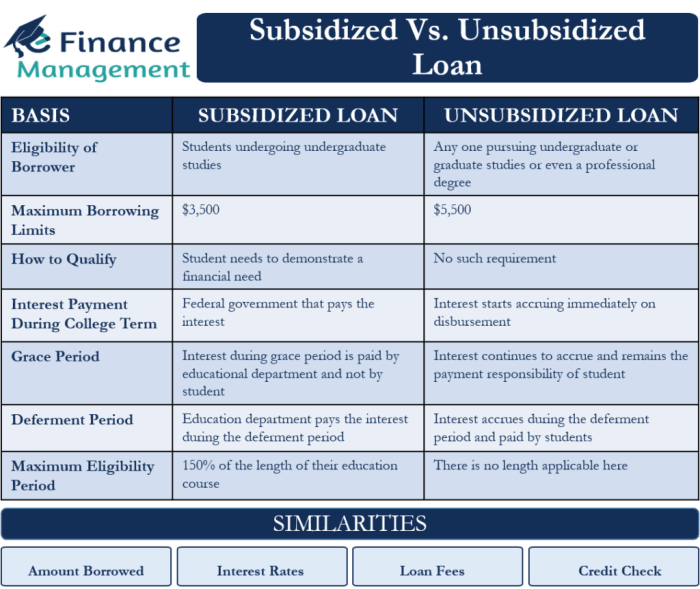

Securing student loans can be a pivotal step in pursuing higher education, yet the eligibility process often presents a maze of requirements and considerations. Understanding the intricacies of loan eligibility, from basic criteria to special circumstances, is crucial for prospective students. This guide navigates the complexities of federal and private student loans, illuminating the factors that influence your chances of approval and offering insights into maximizing your opportunities. We will explore the various aspects impacting eligibility, including academic performance, financial status, credit history, and unique situations such as military service or disability. By clarifying these key elements, we aim to Read More …