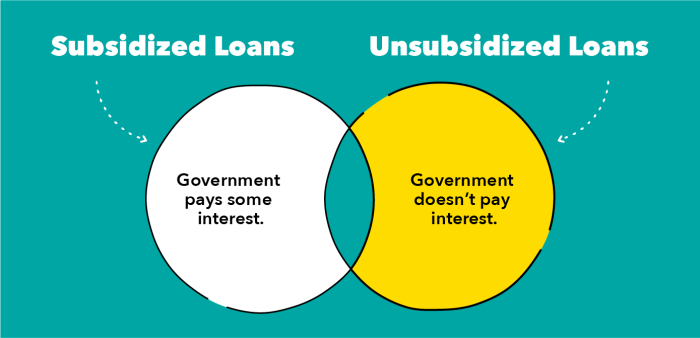

Funding graduate education is a significant undertaking, often requiring substantial financial planning. Subsidized loans offer a potential pathway, but understanding their intricacies is crucial for responsible borrowing. This guide delves into the world of subsidized graduate student loans, providing a clear overview of available programs, eligibility requirements, and effective repayment strategies to help you make informed decisions about your financial future. From exploring the differences between federal and private options to outlining the application process and potential challenges, we aim to equip you with the knowledge needed to navigate the complexities of graduate student financing. We’ll examine various repayment plans, Read More …