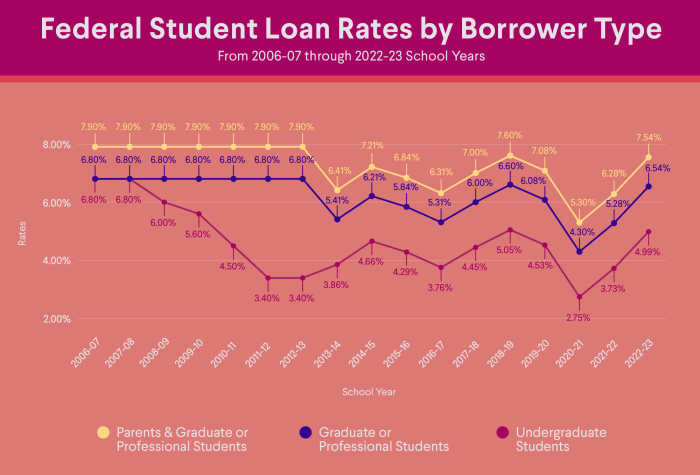

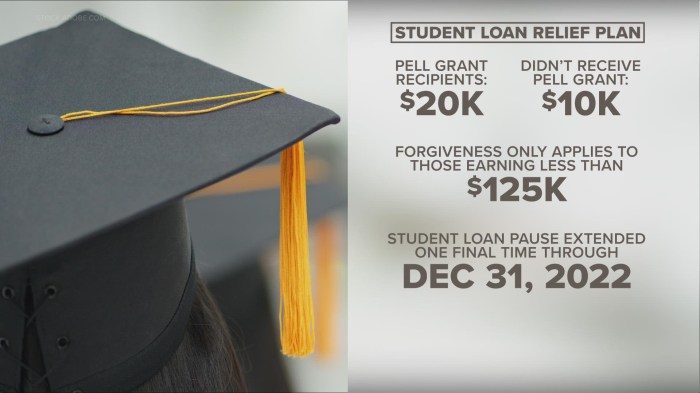

Navigating the complexities of financing a higher education can be daunting, particularly at a large institution like Texas State University. This guide provides a comprehensive overview of student loan options available to Texas State students, covering federal and private loans, repayment strategies, and crucial financial aid resources. Understanding the nuances of each loan type, from subsidized to unsubsidized federal loans and the various private lender offerings, is key to making informed decisions and avoiding future financial strain. We’ll explore the application processes, interest rates, repayment terms, and potential pitfalls to help you chart a course towards responsible debt management. Furthermore, Read More …