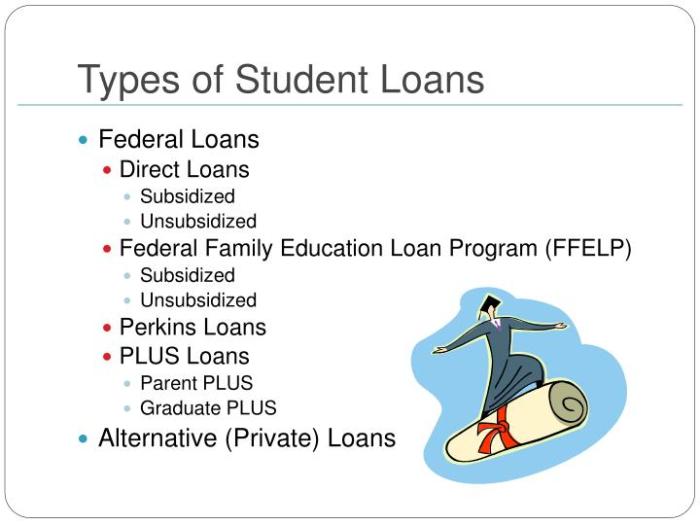

Financing a higher education can feel like navigating a complex maze, especially when considering the various options available. This guide provides a clear path through the intricacies of Colorado Technical University (CTU) student loans, equipping prospective and current students with the knowledge necessary to make informed decisions about their financial future. We’ll explore the different loan types, application processes, and effective debt management strategies, ensuring you’re well-prepared for the journey ahead. From understanding the eligibility criteria for federal and private loans to mastering the art of budgeting and repayment planning, we aim to demystify the world of student loan financing Read More …