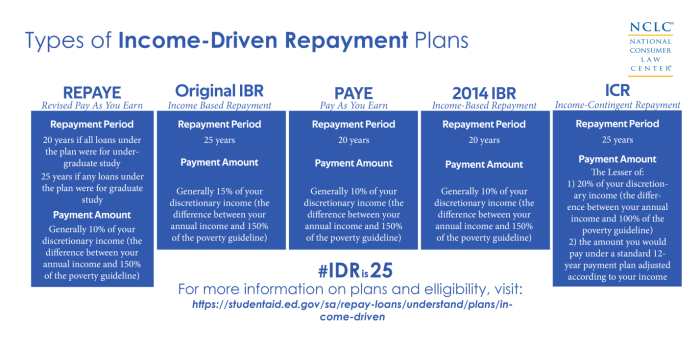

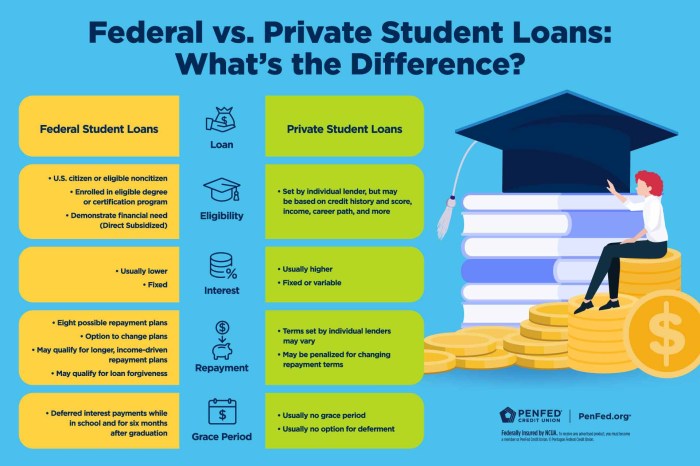

Navigating the complexities of student loan repayment can feel daunting, especially when grappling with the often-overlooked yet significant aspect: interest. This guide delves into the intricacies of interest paid on student loans, demystifying the calculations, factors influencing rates, and strategies for minimizing your overall cost. From understanding fixed versus variable rates to exploring various repayment plans and their impact on total interest, we aim to equip you with the knowledge needed to make informed financial decisions. We’ll examine the various types of student loans, highlighting the differences in interest accrual methods and how these differences translate into varying total interest Read More …