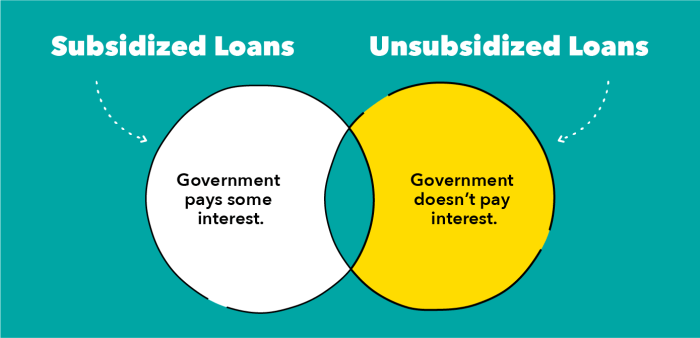

Navigating the complexities of student loan repayment can be daunting. Understanding your loan status and the potential consequences of default is crucial for maintaining your financial well-being. This guide provides a clear and concise path to determining if your student loan is in default, outlining the steps to take should you find yourself in this situation, and offering proactive strategies to prevent default altogether. We’ll explore both federal and private loans, highlighting key differences and resources available to borrowers. From understanding the definition of default and its ramifications to effectively communicating with your loan servicer and interpreting your loan documents, Read More …