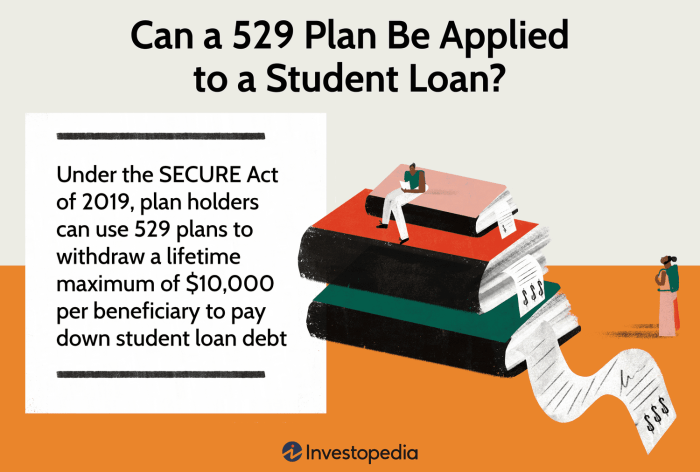

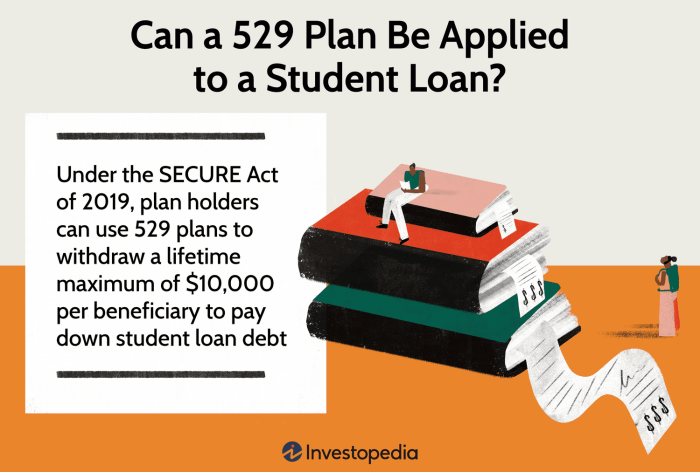

Navigating the complexities of higher education financing often leaves students and families grappling with substantial student loan debt. While 529 plans are designed for educational expenses, many wonder if they can be leveraged to alleviate the burden of student loan repayments. This guide delves into the intricacies of using 529 funds for non-qualified expenses like student loan payoff, exploring the potential benefits, drawbacks, and crucial legal and tax implications. We’ll examine the circumstances under which this strategy might be advantageous, and when alternative approaches might be more financially sound. Understanding the tax advantages of 529 plans, the various student loan Read More …