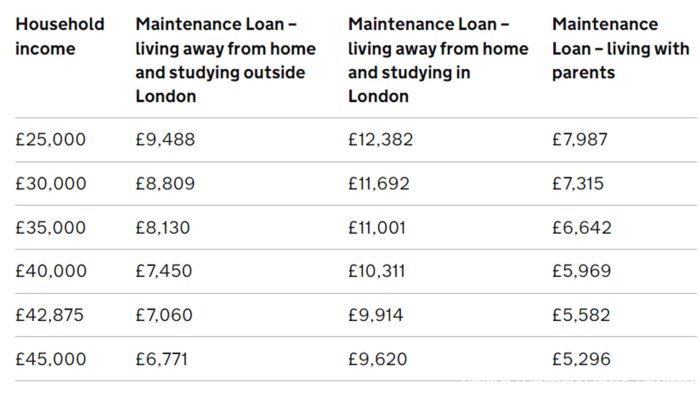

Navigating the complexities of higher education often involves grappling with the significant costs associated with tuition, books, and, importantly, living expenses. Many students find themselves wondering: can they utilize student loans to cover these everyday costs? This guide delves into the intricacies of securing student loans for living expenses, exploring various loan types, eligibility requirements, and potential risks, ultimately empowering you to make informed financial decisions. Understanding the financial landscape of higher education is crucial for successful planning. This guide will provide a clear and concise overview of the options available, allowing you to weigh the benefits and drawbacks of Read More …