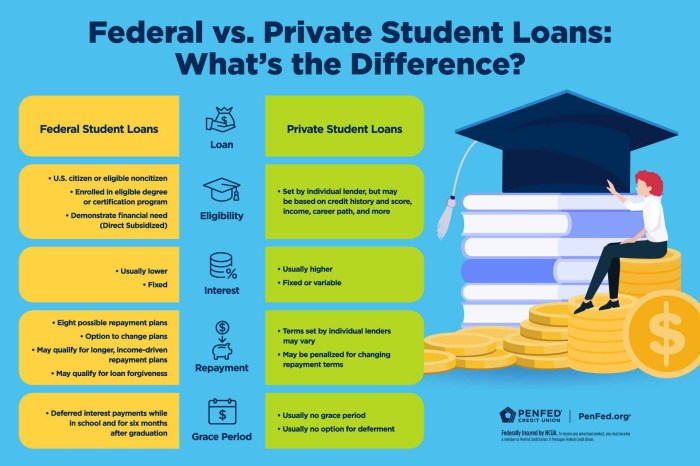

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available options and strategies is crucial for long-term financial well-being. This guide provides a clear and concise overview of various repayment plans, factors influencing repayment, and effective strategies to manage and ultimately eliminate student loan debt. We’ll explore the psychological impact of debt and Artikel steps for building a strong financial future after repayment. From understanding income-driven repayment plans versus standard plans to exploring government programs and resources, we aim to empower you with the knowledge needed to make informed decisions about your student loan repayment journey. Read More …