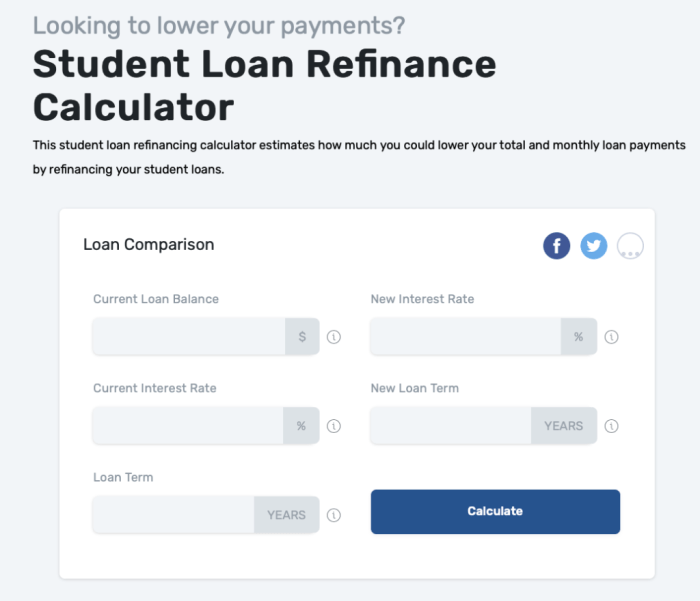

The crushing weight of student loan debt is a reality for millions. Many grapple with the question: can early repayment offer a path to financial freedom? While completely eliminating interest might be unrealistic, strategic repayment can significantly reduce the overall cost and shorten the repayment timeline. This exploration delves into the various methods, financial strategies, and considerations involved in accelerating your student loan payoff. This guide will equip you with the knowledge to navigate the complexities of early repayment, empowering you to make informed decisions aligned with your financial goals. We’ll examine different repayment plans, budgeting techniques, and income-boosting strategies, Read More …