Navigating the complexities of student loan repayment can feel overwhelming, but proactive strategies like prepayment offer significant long-term financial and psychological advantages. This guide explores various prepayment methods, analyzes their impact on your credit score and budget, and clarifies the potential tax implications. Understanding these factors empowers you to make informed decisions and accelerate your journey to financial freedom. From lump-sum payments to refinancing options, we’ll delve into practical strategies to help you manage your debt effectively. We’ll also examine the often-overlooked psychological benefits of reducing your loan burden, demonstrating how prepayment can positively impact your overall well-being. Ultimately, this Read More …

Kategori: Personal Finance

Student Loan Interest Reddit A Deep Dive

Navigating the complex world of student loan debt is a significant challenge for many, and Reddit provides a unique platform for borrowers to share their experiences, strategies, and concerns. This analysis delves into the collective sentiment surrounding student loan interest on Reddit, examining the prevalent themes, repayment approaches, and the impact of government policies. We explore both the financial and emotional repercussions of high interest rates, offering insights into the diverse perspectives and challenges faced by those grappling with student loan debt. From discussions on federal versus private loan options and their associated interest rates to the psychological toll of Read More …

Student Loan Refinance Credit Union A Guide

Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential path to lower monthly payments and faster repayment. Credit unions, known for their member-focused approach, are emerging as a compelling alternative to traditional banks for student loan refinancing. This guide explores the benefits, processes, and considerations involved in refinancing your student loans through a credit union, empowering you to make informed decisions about your financial future. We’ll delve into the key differences between credit union and bank refinancing programs, examining interest rates, fees, eligibility criteria, and the application process. We’ll also analyze the various loan Read More …

Student Loan Planner Com A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming. Student loan planner websites offer a crucial resource, providing tools and information to help borrowers understand their debt, explore repayment options, and ultimately achieve financial freedom. These platforms vary significantly in features and user experience, however, making informed selection vital. This guide delves into the world of student loan planner websites, examining their functionality, data security practices, integration with other financial tools, and effective marketing strategies. We’ll explore the user experience, compare various platforms, and address common concerns regarding data privacy and security. The goal is to empower users to Read More …

Student Loan Group A Collaborative Approach

Navigating the complexities of student loan debt can be daunting, but the emergence of student loan groups offers a potential pathway to collective financial empowerment. These groups, formed around shared circumstances like loan type, school affiliation, or income level, leverage the power of collaboration to tackle the challenges of repayment. This exploration delves into the dynamics, strategies, legal considerations, and long-term impacts of participating in such a group, providing a comprehensive overview of this increasingly relevant financial strategy. From shared repayment strategies and collective bargaining to the psychological support networks these groups often provide, the benefits and drawbacks are multifaceted. Read More …

Student Loan Consolidation Reddit A Comprehensive Guide

Navigating the complex world of student loan debt can feel overwhelming, but Reddit offers a wealth of firsthand experiences and advice. This guide delves into the vibrant discussions surrounding student loan consolidation on Reddit, examining the common themes, concerns, and strategies shared by users. We’ll explore the various consolidation options, their potential benefits and drawbacks, and the crucial factors to consider before making such a significant financial decision. From federal and private loan consolidation programs to alternative debt management strategies, we’ll analyze the pros and cons based on real-world Reddit experiences. We’ll also address common pitfalls to avoid and offer Read More …

Student Loan Calculator NerdWallet A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming. Understanding your repayment options and their long-term financial implications is crucial for securing your future. NerdWallet’s student loan calculator offers a powerful tool to visualize different repayment scenarios, allowing you to make informed decisions about your debt. This guide explores its functionality, features, and the valuable insights it provides. From understanding the nuances of federal versus private loans to exploring the potential benefits of refinancing, the calculator empowers users to take control of their financial trajectory. We will delve into its features, demonstrating how it projects repayment schedules, assesses the Read More …

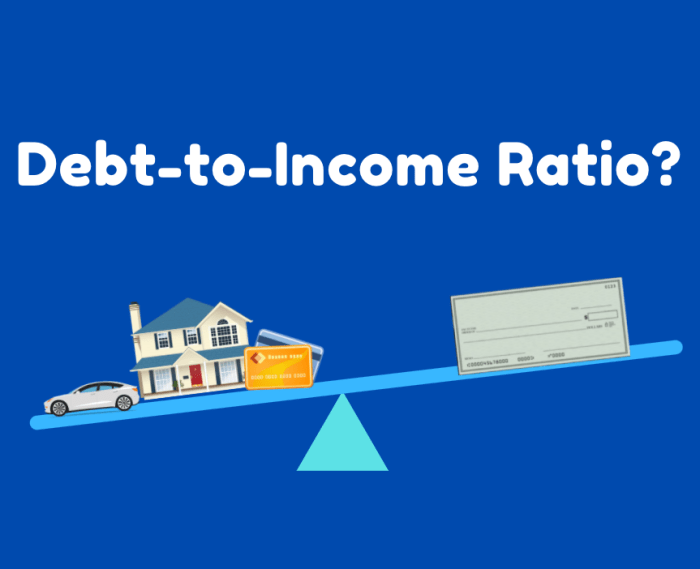

Student Loan Debt to Income Ratio A Comprehensive Guide

Navigating the complexities of student loan debt is a significant challenge for many. Understanding your student loan debt-to-income ratio (DTI) is crucial for making informed financial decisions. This ratio, a simple yet powerful indicator, reveals how much of your monthly income is dedicated to repaying student loans. A high DTI can significantly impact your ability to secure mortgages, save for retirement, and even obtain other loans. This guide delves into the intricacies of calculating and managing your student loan DTI, offering strategies for effective debt management and highlighting the long-term implications of your choices. We will explore the calculation of Read More …

Should I Pay Off Student Loans?

Navigating the complexities of student loan repayment can feel overwhelming. The decision of whether to prioritize paying off student loans or pursuing other financial goals requires careful consideration of various factors. This guide explores the multifaceted aspects of student loan debt management, helping you make informed decisions aligned with your individual financial circumstances and long-term aspirations. From understanding the nuances of federal versus private loans and their associated interest rates to crafting a personalized budget and exploring alternative investment opportunities, we delve into the practical strategies necessary for effective debt management. We also examine the long-term financial implications of different Read More …

Should I Pay All My Student Loans At Once?

The question of whether to pay off student loans in one lump sum is a significant financial decision impacting your short-term cash flow and long-term financial well-being. This decision requires careful consideration of your current financial situation, potential investment opportunities, and the specific terms of your student loans. Weighing the immediate financial strain against the long-term benefits of eliminating debt and interest payments is crucial for making an informed choice. This comprehensive guide explores the financial implications of both immediate and delayed repayment, providing a framework for assessing your personal circumstances and exploring alternative repayment strategies. We’ll examine the impact Read More …