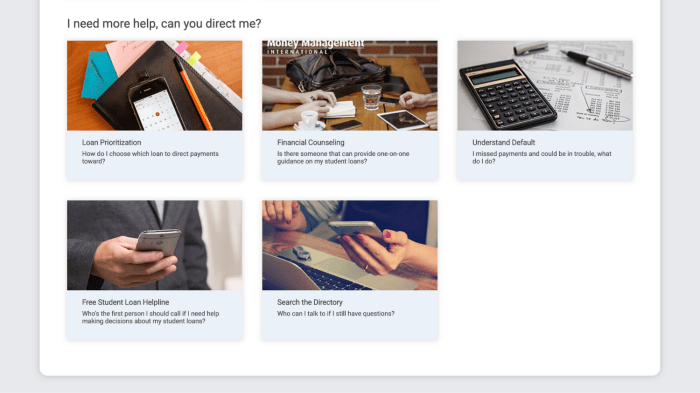

The crippling weight of student loan debt is a pervasive issue affecting millions, hindering financial stability and delaying major life milestones. This comprehensive guide delves into the current state of student loan debt in the United States, exploring its far-reaching economic and societal consequences. We will examine the various demographics disproportionately impacted, analyze historical trends, and dissect different loan types and their associated interest rates. Understanding this landscape is crucial to formulating effective solutions. Beyond simply outlining the problem, we will explore a range of proposed solutions, from loan forgiveness programs and income-driven repayment plans to interest rate reductions and Read More …