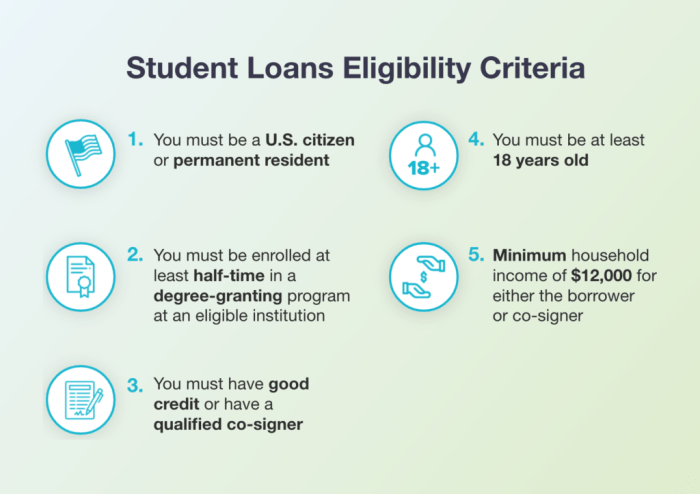

Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential path to lower monthly payments and faster debt repayment. Citizens Bank presents itself as a viable option for those seeking to streamline their student loan obligations. This exploration delves into the intricacies of Citizens Bank’s student loan refinance program, examining eligibility criteria, rates and fees, the application process, customer experiences, and comparisons with competing lenders. We aim to provide a comprehensive overview to help you determine if refinancing with Citizens Bank aligns with your financial goals. Understanding the nuances of refinancing is crucial. Factors such Read More …