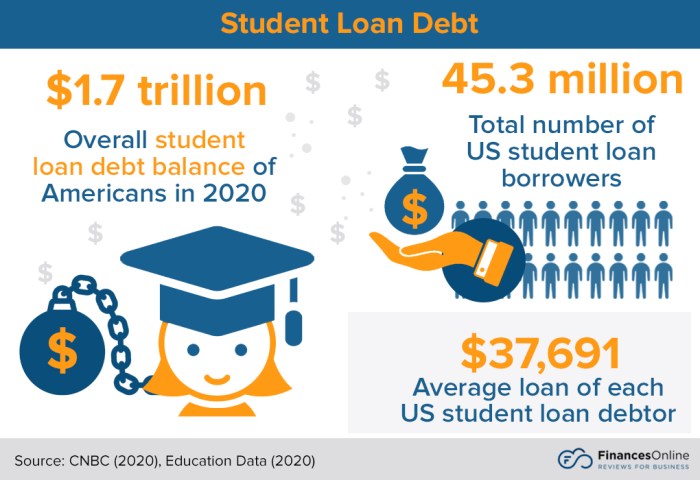

Navigating the financial landscape of higher education can be challenging. Unexpected expenses and the ever-present pressure to balance studies with work often leave students seeking immediate financial solutions. Instant loans, while offering quick access to funds, require careful consideration of their associated risks and responsibilities. This guide explores the various types of instant loans available to students, outlining the eligibility criteria, application processes, and potential pitfalls to help you make informed decisions. Understanding the nuances of different loan types – from payday loans with their high-interest rates to more manageable personal loans – is crucial. We’ll examine the advantages and Read More …