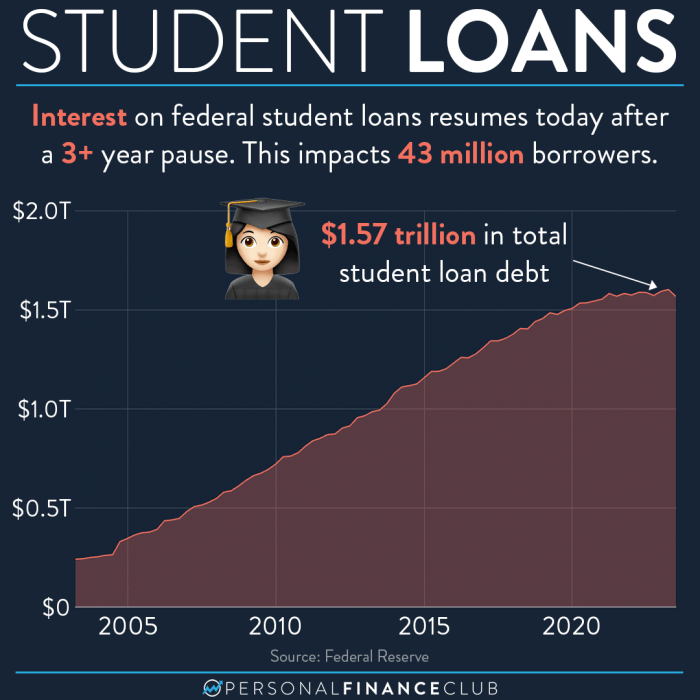

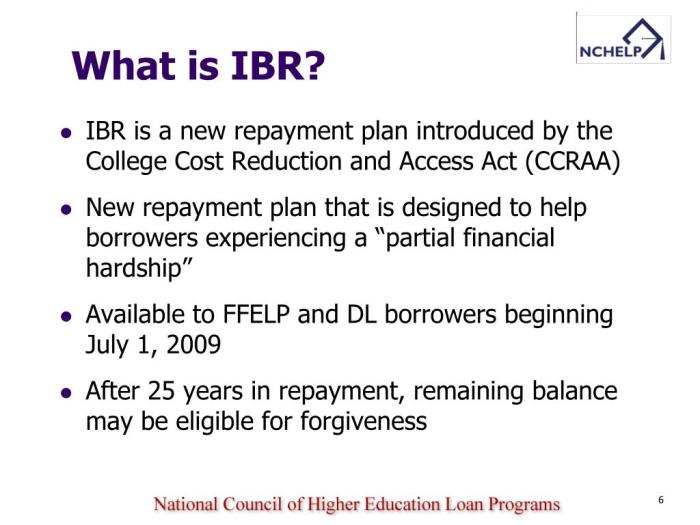

The promise of student loan forgiveness can feel like a distant dream for many borrowers. Navigating the complex web of eligibility requirements, application processes, and ever-shifting policies can be overwhelming. This guide aims to demystify the process, offering clarity on why your student loans might not be forgiven and providing actionable steps to increase your chances of success. Understanding the nuances of different loan forgiveness programs, from Income-Driven Repayment (IDR) plans to Public Service Loan Forgiveness (PSLF), is crucial. This includes knowing the specific eligibility criteria for each program, the required documentation, and the potential pitfalls that can lead to Read More …